The US added just 22,000 jobs in August, raising fears that the labour market is stalling and intensifying pressure on the Federal Reserve to slash borrowing costs this month.

Friday’s figure from the Bureau of Labor Statistics was far below the upwardly revised 79,000 jobs added in July and the 75,000 expected by analysts polled by Bloomberg.

June’s figure was revised down to a job loss of 13,000, the first time the economy has shed positions since the coronavirus pandemic in 2020.

“The labour market’s starting to freeze,” said Diane Swonk at KPMG.

“It’s never good to see red ink and that was the first red ink we’ve seen since December 2020 at the height of the Delta wave [of coronavirus] when the economy almost went into a double-dip recession.”

The report will deal a blow to President Donald Trump, who has touted his tax cuts and tariffs as a boon to the world’s biggest economy. Employment in tariff-exposed sectors has been hit hard by the trade turmoil.

The president has sharply criticised the Fed and its chair Jay Powell for not cutting rates this year, insisting high borrowing costs are hurting consumers and businesses.

“Jerome ‘Too Late’ Powell should have lowered rates long ago,” Trump posted on his Truth Social platform following the report. “As usual, he’s ‘Too Late!’”

US Treasuries surged in price after the payroll figures were released, as investors ratcheted up bets that the Fed will soon begin cutting rates again after 1 percentage point of reductions in 2024

“The Fed will be justified in moving to cut policy rates and we wouldn’t be surprised if they chose to move more aggressively from here,” said BlackRock chief investment officer Rick Rieder, an outside contender to replace Powell as Fed chair later this year.

The two-year yield, which is sensitive to rate expectations, tumbled after the release but recovered later in the the session, ending at 3.52 per cent.

Stocks fell, with the blue-chip S&P 500 closing 0.3 per cent lower. The Russell 2000 small-cap index, often seen as a bellwether for the US economy, jumped after the release but then retreated. It finished the day up 0.5 per cent.

Dec Mullarkey, managing director at SLC Capital Management, said: “Equity markets seem to be more concerned about the deterioration in the labour markets and the potential that the Fed is behind the curve, than they are excited about rate cuts.”

Andrew Hollenhorst, chief economist at Citigroup, said a rate cut was now “all but locked in” at the next meeting of the Fed’s policy-setting committee on September 16-17.

Gennadiy Goldberg, head of US rates strategy at TD Securities, said: “The data shows that the labour market is moderating quite significantly, probably more than the Fed was expecting at the start of the year.”

Traders are betting there is about a 10 per cent chance of an extra-large half-percentage point cut at the Fed meeting later this month. Before the jobs data, futures markets were pricing in a quarter-point move.

Steve Englander, global head of G10 currency research at Standard Chartered, said the number meant a bumper half-percentage point interest rate cut would now be a “serious consideration” for the Fed.

Even without a jumbo rate cut in September, futures markets imply investors are still anticipating 0.75 percentage points in total reductions this calendar year. The market implies a 75 per cent chance for another quarter point percentage reduction in October, up from just 52 per cent before the jobs data, and 90 per cent for a follow-on cut in December.

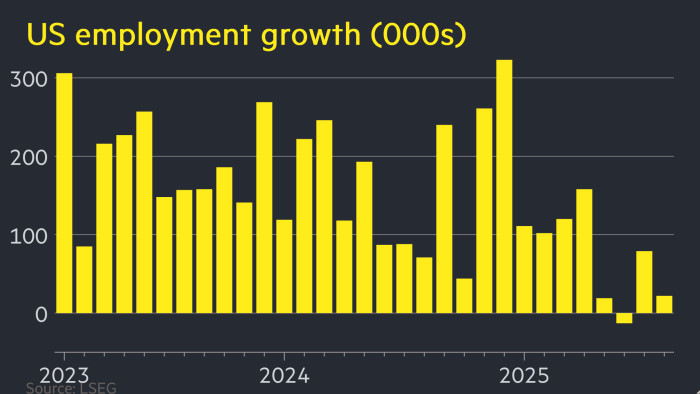

In a sign of the scale of the slowdown, US job growth has dropped to an average of 27,000 in May to August, compared with 123,000 in the first four months of the year.

The August figure was dragged down by job losses in wholesale trade, manufacturing and energy and mining sectors — industries that are exposed to the president’s levies.

“Trade-exposed sectors were obvious victims in this morning’s payrolls report,” said Carrie Freestone, an economist at Royal Bank of Canada.

Federal government payrolls also continued to slide, shedding another 15,000 jobs to leave the sector down by 97,000 since January as the White House slims down government agencies.

Job growth in healthcare, the sector that had been driving gains in recent months, also slipped to its weakest level since January 2022. Overall, the jobless rate increased to 4.3 per cent in August from 4.2 per cent the previous month.

Powell signalled last month the central bank would probably cut rates in September as policymakers grew more concerned about the risk that elevated borrowing costs are restraining the jobs market.

Friday’s jobs report is the first from the BLS since Trump sacked its commissioner, Erika McEntarfer, last month following a gloomy data release that he claimed was “rigged” against him. Veteran BLS official William Wiatrowski has been standing in as commissioner since McEntarfer was fired.

Trump has nominated EJ Antoni, a loyalist from the rightwing Heritage Foundation, to take over the BLS on a permanent basis, but he must still be confirmed by the Senate.