Is your paycheque keeping up with your life?

That’s the question Yahoo News Canada asked readers this week after Statistics Canada recently reported an increase in wages nationwide. The report comes as Canadians grapple with rising grocery prices, expensive housing and growing financial pressures. We wanted to know: Does the pay hike feel enough?

The response was loud and clear as hundreds of Canadians weighed in from across the country, revealing just how wide the gap feels between what people earn and what it costs to simply live.

Is $120K a year enough for your household to live comfortably?

Two of the most-voted on polls of the week quizzed Yahoo Canada readers on if they felt their current wages were enough to keep up with the rising cost of living in the country and whether a $120,000 yearly salary would suffice.

About 75 per cent of responders to the former say their “income lags behind” with only 11 per cent finding their salaries have “grown in line” with the higher living costs. This aligns with the broader Canadian sentiment on the issue found in recent surveys that revealed cost of living has been a top concern for Canadians over the last few years as they worry if their wages would keep up with inflation.

The second poll remains highly contested with 34 per cent of respondents saying $120K/year is “barely” enough for their household to live comfortably, against 37 per cent who feel they need “way more.” Out of the remaining votes, 24 per cent said they find a $120K/year salary to be enough to live comfortably.

From ‘I’m stagnant and stuck’ to ‘all plans have been put on hold’: Canadians feel the sting of soaring household economic pressure

Tapping deeper into the Canadian sentiment, Yahoo News Canada asked readers to share how their 2025 financial planning had been impacted by the spike in cost of living.

A consistent theme underlying much of the feedback was a deep sense of financial strain — a lack of disposable income that left many with an inability to enjoy simple pleasures such as vacationing, regular outings or even saving for retirement.

“All plans have been put on hold,” said a Yahoo polls participant from Edmonton, Alta.

“No vacations, and no activities for my kids,” said a British Columbia resident.

“I’ve begun cancelling services and stopped spending in the local economy,” said a third.

I’m stagnant and stuck, no matter how much I save I can’t get ahead of the continuous rising cost of living. Housing costs are unsustainable and society is failing as a result of greed.

Yahoo polls participantWhat’s your biggest monthly expense right now?

Housing, mortgage, rent and food were consistently listed as the biggest monthly expenses for majority of Canadians taking part in the Yahoo poll.

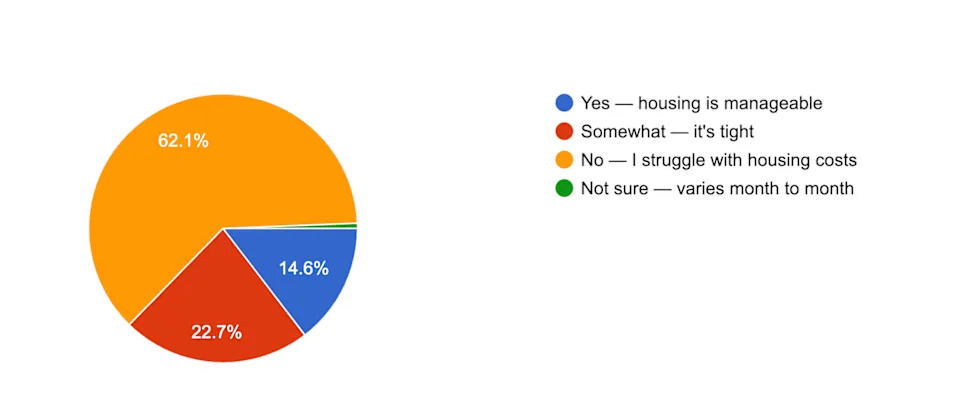

More than 60 per cent feel their current income does not allow them to afford housing in their city without financial strain. Only 14.6 per cent find housing to be “manageable” with their current pay.

John from Toronto does not necessarily struggle with housing costs but agrees that the situation is somewhat tight: “Financial planning has been difficult.”

Canadians weigh in on if their current incomes are enough to afford housing in their respective cities.

This mirrors national housing stress indicators that specifically show renters and low-income income households feeling acute negative impact.

On higher cost of living impacting their financial planning, a majority of responders said they cut discretionary spending and delayed big plans — in line with the ongoing financial strain felt across Canada despite cooling inflation.

What does a ‘comfortable income’ look like to you in your province or city — and why?

With feedback coming in from different regions across Canada, like Alberta, British Columbia, Ontario, Saskatchewan and New Brunswick, the responses ranged widely with about 40 per cent votes backing a salary of more than $200K/year to be a ‘comfortable income’ in current economy.

40 per cent said more than $200K annually

16 per cent said $100K–$150K

14 per cent said $150K–$200K

10 per cent placed it under $100K

Bottomline on what Canadians feel:

Wages are rising, but not as fast as the cost of living

Housing remains the most pressing strain

Many believe real comfort requires six-figure incomes

Costs are reshaping financial planning: Whether it’s aggressive savings, delaying big purchases, or cutting extras — Canadians are adapting.

If you enjoy participating in Yahoo polls and making your voice heard, we’d love to hear from you for upcoming polls. Stay tuned!

Poll results on weekends!

Joy Joshi is a senior editor and writer at Yahoo News Canada.