Report Overview

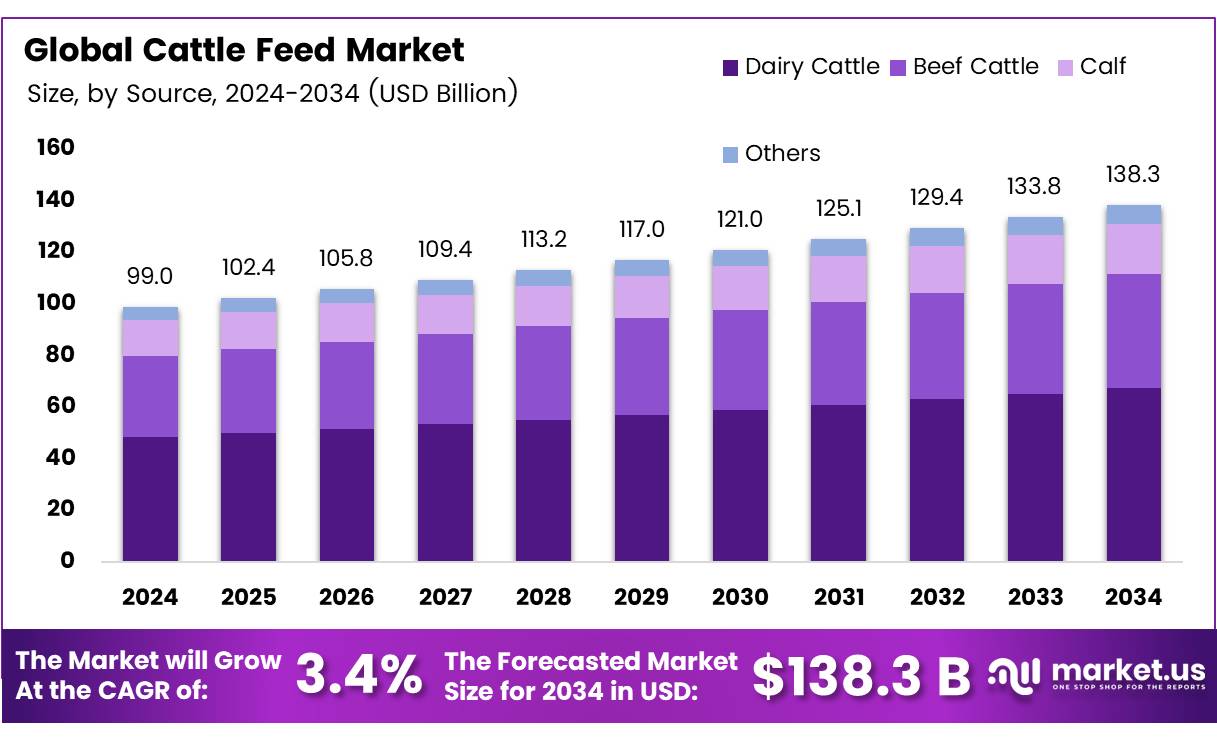

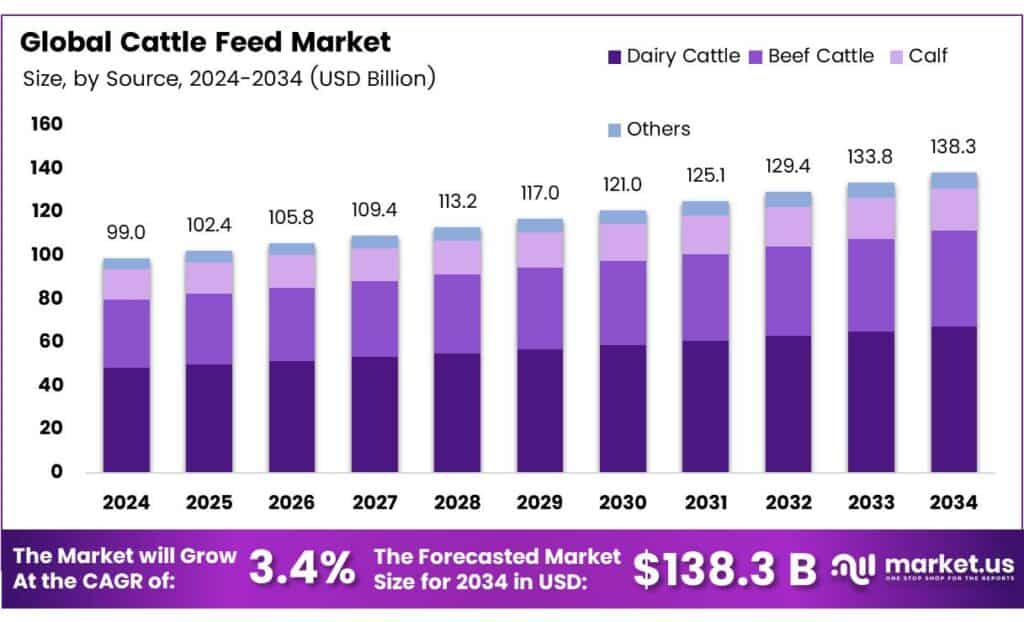

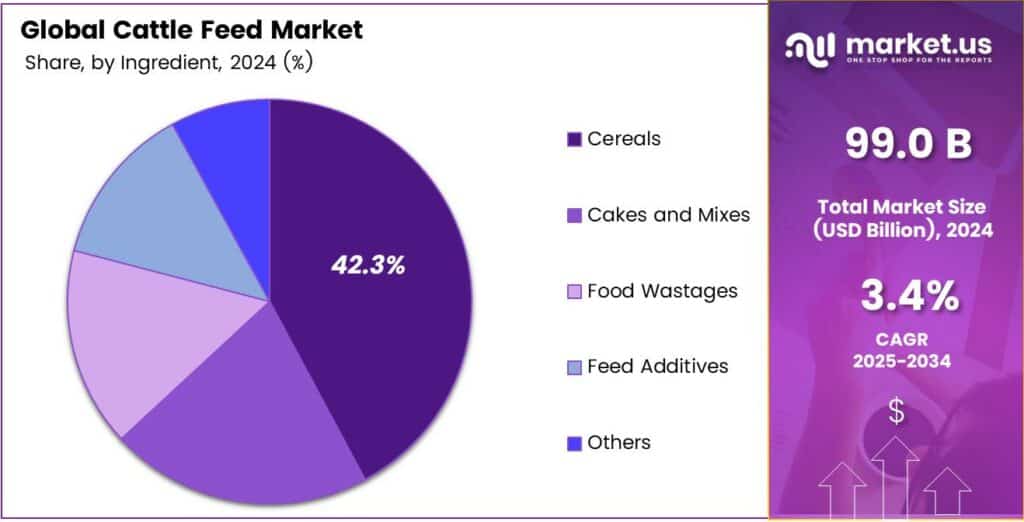

The Global Cattle Feed Market size is expected to be worth around USD 138.3 Billion by 2034, from USD 99.0 Billion in 2024, growing at a CAGR of 3.4% during the forecast period from 2025 to 2034.

Cattle feed plays a central role in livestock management, directly influencing milk production, meat quality, and overall herd health. With rising global demand for dairy and beef, the cattle feed sector continues to expand as farmers seek nutrient-rich, cost-efficient formulations to enhance productivity. The market is strongly driven by rising livestock populations, particularly in emerging economies.

Maize is widely used in cattle feeding due to its high metabolisable energy value and low fibre content. It contains about 8–13% crude protein and has a total digestible nutrient (TDN) value of nearly 85%. Farm animals are usually fed crushed maize, while flaked maize alters the rumen fermentation pattern by reducing the acetic acid to propionic acid ratio, which in turn lowers the butterfat content in milk.

Oats (Avena sativa) are another important cereal feed, notable for having the highest crude fibre content of 12–16% along with 7–15% crude protein. Although deficient in amino acids such as methionine, histidine, and tryptophan, oats are rich in glutamic acid. They are generally fed in crushed or bruised form. Barley (Hordeum vulgare), widely used for fattening animals in the UK, contains 6–14% crude protein and high fibre but has low lysine and less than 2% oil.

Feeding dairy cows requires careful balance since feed accounts for nearly 60% of milk production costs. Nutrient requirements must meet both maintenance and milk production needs. During lactation, rations are adjusted based on stage, with green fodder and concentrates supplied in varying amounts. High-yielding cows benefit from challenge feeding, where concentrate levels are gradually increased before and after calving to support peak milk production.

Feeding practices such as mixing roughages and concentrates, or adopting complete feed systems, ensure optimum rumen fermentation, prevent acidosis, and improve overall efficiency. Minerals such as calcium and phosphorus play a critical role in skeletal development, enzyme activity, and metabolic reactions. Deficiencies lead to rickets, osteomalacia, reduced fertility, and conditions such as milk fever. Proper supplementation with bone meal, limestone, or green forages ensures balanced mineral intake and healthy herd performance.

Key Takeaways

The Global Cattle Feed Market is expected to reach USD 138.3 billion by 2034 from USD 99.0 billion in 2024, with a CAGR of 3.4%.

Dairy cattle segment led in 2024, holding a 48.7% share due to high demand for nutrient-rich feed for milk production.

Cereals dominated in 2024 with a 42.3% share, valued for their high carbohydrate content and digestibility.

Offline channels held an 83.4% share in 2024, driven by local distributors and agricultural cooperatives.

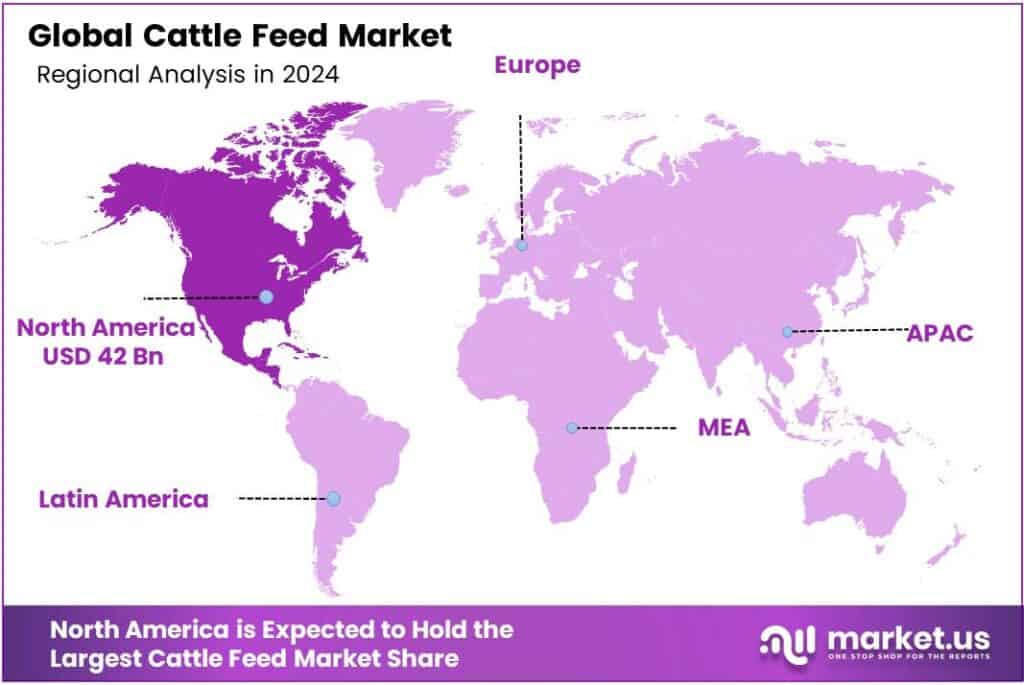

North America accounted for 42.5% of market revenue in 2024 (USD 42 billion), led by the U.S. and Canada’s beef and dairy sectors.

Analyst Viewpoint

The Cattle Feed Industry presents a compelling investment landscape, driven by the growing global demand for meat and dairy. With populations rising and incomes increasing in regions like Asia-Pacific and Latin America, the need for high-quality cattle feed to support livestock production is surging. Opportunities lie in sustainable feed solutions, such as plant-based or insect-derived proteins, which align with consumer preferences for eco-friendly and ethically sourced products.

Innovations like precision feeding systems and feed additives that boost animal health and reduce environmental impact are also attracting investor interest. Advancements in feed formulations that cut methane emissions or enhance nutrient absorption are gaining traction, offering a chance to tap into both profitability and sustainability.

The capital-intensive nature of the industry, with high upfront costs for feed production and R&D, means investors need to be strategic and patient for returns. Despite the potential, risks cannot be ignored. Volatile raw material prices, especially for grains like corn and soy, can squeeze profit margins, as these inputs are heavily influenced by weather and global supply chains.

By Animal Type

Dairy Cattle Leads with 48.7% Share

In 2024, Dairy Cattle held a dominant market position, capturing more than a 48.7% share of the global cattle feed market. This dominance reflects the high demand for quality feed to sustain milk production, as dairy herds require nutrient-rich diets for optimal yield and animal health.

The segment’s strength also comes from rising consumption of milk and dairy products, particularly in developing nations where demand continues to climb. This trend is expected to remain steady as farmers increasingly adopt formulated feed blends to improve milk productivity and herd efficiency.

Dairy cattle feed is also benefiting from government programs that support balanced nutrition for livestock to strengthen food security. With its large base of dairy farmers worldwide, the segment will continue to account for the largest portion of the cattle feed market, highlighting its critical role in the global food chain.

By Ingredient

Cereals Dominate with 42.3% Share

In 2024, Cereals held a dominant market position, capturing more than a 42.3% share of the cattle feed market. Their leadership comes from being the primary source of energy for cattle, providing high levels of carbohydrates and easy digestibility.

Farmers widely rely on maize, barley, wheat, and sorghum to meet the daily energy needs of their herds, ensuring healthy growth and consistent productivity. The demand for cereal-based feed is expected to remain strong as both dairy and beef producers continue to prioritize cost-effective and energy-dense feed options.

Cereals also benefit from wide availability across regions, making them a dependable ingredient in feed formulations. Their role in improving cattle health and supporting high milk and meat output will keep cereals at the center of cattle feed use, solidifying their market leadership in the coming years.

By Distribution Channel

Offline Channels Lead with 83.4% Share

In 2024, Offline held a dominant market position, capturing more than an 83.4% share of the cattle feed market. This dominance is driven by the strong presence of local distributors, retail shops, and agricultural cooperatives that farmers rely on for bulk purchases and immediate supply.

Many cattle owners prefer offline buying as it allows direct interaction with sellers, easier access to credit, and the ability to inspect product quality before purchase. Offline sales are expected to maintain their strength, especially in rural and semi-urban regions where digital infrastructure and online adoption remain limited.

The trust factor associated with long-standing supplier relationships and the convenience of local availability will continue to keep offline channels at the forefront. While online sales may slowly gain ground, the offline segment will remain the primary mode of cattle feed distribution, supporting the everyday needs of farmers.

Key Market Segments

By Animal Type

Dairy Cattle

Beef Cattle

Calf

Others

By Ingredient

Cereals

Cakes and Mixes

Food Wastages

Feed Additives

Others

By Distribution Channel

Drivers

Rising Global Demand for Milk and Meat Products

One of the major driving factors for the cattle feed market is the rising global demand for milk and meat products. As populations grow and incomes rise, people are consuming more animal-based protein, which directly increases the need for nutritious and balanced cattle feed.

The Food and Agriculture Organization (FAO), world milk production reached about 930 million tonnes in 2023, with India alone contributing over 231million tonnes, making it the largest producer globally. This growth in milk output is closely tied to the rising demand for dairy feed that can sustain high-yielding dairy cattle.

The United States Department of Agriculture (USDA) estimated global beef production at 59.2 million tonnes in 2024, with strong demand from regions such as Asia and Latin America. As more meat is consumed, cattle farmers are under pressure to maintain higher productivity and better animal health, which is only possible through nutrient-rich feed.

Restraints

Impact of Climate Change on Feed Crop Availability

A major restraint for the cattle feed market is the growing impact of climate change on the availability of key feed crops like maize, soybeans, and barley. Cattle feed depends heavily on these crops for energy and protein, but rising temperatures, erratic rainfall, and frequent droughts are making their supply uncertain.

The Food and Agriculture Organization (FAO) estimates that over 30% of global agricultural losses between 2008 and 2018 were linked to climate-related disasters, with cereals and oilseeds among the most affected crops. The United States Department of Agriculture (USDA) reported that severe drought conditions reduced maize yields in key producing states, lowering overall supply.

Global maize output in 2023–24 stood at 1.2 billion tonnes, but climate-related disruptions forced several regions to rely more on imports, creating further price instability. Similar issues have been reported in South America, where soybean production, vital for protein meals in cattle feed, suffered from droughts and floods.

Opportunity

Rising Global Livestock Population Driving Feed Demand

One major growth factor for the cattle feed market is the steady rise in the global livestock population. As more people rely on dairy and meat for daily nutrition, the need to maintain larger and healthier cattle herds is pushing demand for high-quality feed.

According to the Food and Agriculture Organization (FAO), the world’s cattle population reached 1.53 billion heads, showing a gradual increase over the past decade. Dairy farming, in particular, has seen remarkable expansion. Asia contributes the largest share, mainly from India and China.

To sustain this output, farmers are adopting nutritionally balanced feed that boosts milk yield and maintains cattle health. In countries like India, which alone produced 231 million tonnes of milk in 2022–23, government programs such as the Rashtriya Gokul Mission and National Livestock Mission are actively promoting improved feed practices to support smallholder farmers.

Trends

Adoption of Sustainable and Alternative Feed Ingredients

An emerging factor in the cattle feed market is the growing focus on sustainable and alternative feed ingredients. Traditional feed sources like maize and soybeans are becoming more expensive and vulnerable to climate change, pushing farmers and feed manufacturers to explore innovative options.

The Food and Agriculture Organization (FAO), the livestock sector contributes nearly 14.5% of total global greenhouse gas emissions, with feed production and processing accounting for a major share. One area gaining attention is the use of crop residues and by-products from the food industry.

The European Food Safety Authority (EFSA) has already approved certain insect proteins for use in animal feed, marking a significant step toward future adoption. Governments are also promoting these alternatives. India’s National Livestock Mission is encouraging the use of locally available and unconventional feed resources to reduce dependency on expensive imports.

Regional Analysis

North America leads with a 42.5% share and a USD 42.0 billion market value.

North America remains the anchor of the global cattle feed market, accounting for an estimated 42.5% revenue share, USD 42.0 billion, underpinned by its extensive beef and dairy value chains and high adoption of nutritionally balanced compound feeds. The U.S., with its large fed-cattle sector and concentrated feedlot infrastructure across the Plains, drives the bulk of demand, while Canada contributes steadily through dairy-intensive provinces and expanding value-added beef programs.

Feed formulations remain corn–soymeal centric, complemented by distillers’ dried grains (DDGS) from the region’s robust ethanol industry and by increasing inclusion of forage enhancers and functional additives. Adoption of vitamin mineral premixes, rumen-protected amino acids, probiotics/yeast cultures, and mold inhibitors is rising as producers target better feed conversion and milk solids, alongside compliance with stringent feed safety frameworks.

FSMA in the U.S. and feed regulations overseen by CFIA in Canada. Weather-related forage tightness and cyclical cattle herd rebuilding continue to elevate the role of total mixed rations and precision feed management, supporting demand for pelleted and textured concentrates in both cow-calf and finishing systems.

Sustainability priorities lower enteric emissions, improved manure nutrient utilization, and lifecycle footprint reporting demanded by retailers and processors, are accelerating trials of methane-mitigating feed strategies and digital ration optimization. North America is well-positioned to retain its leadership in premium and performance-oriented cattle feed, even as producers navigate input cost volatility and evolving antibiotic stewardship expectations.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

ADM Animal Nutrition leverages its global grain processing network to provide high-quality, nutrient-rich cattle feed solutions. Their focus on research-driven formulations enhances animal health and productivity. With a strong emphasis on sustainability, ADM integrates innovative technologies to reduce environmental impact. Their extensive distribution network ensures reliable supply to farmers worldwide, solidifying their position as a key industry leader committed to advancing livestock nutrition through science and efficiency.

Alltech specializes in natural, yeast-based additives and innovative nutritional solutions that improve cattle gut health and feed efficiency. Their strong research foundation emphasizes reducing antibiotic use and enhancing sustainability. By leveraging cutting-edge technologies like nutrigenomics, Alltech helps producers optimize animal performance and profitability. Their global presence and educational initiatives support farmers in achieving higher standards of animal welfare and operational excellence.

Cargill, Incorporated, is a major player offering a comprehensive portfolio of cattle feed products, including premixes, supplements, and complete nutritional systems. Their focus on digital solutions and supply chain efficiency helps farmers improve productivity and sustainability. With a commitment to reducing carbon footprints and enhancing traceability, Cargill invests heavily in research and innovation to address evolving challenges in livestock farming, ensuring quality and reliability across markets.

Top Key Players in the Market

ADM Animal Nutrition

Alltech

Cargill, Incorporated

Charoen Pokphand Foods PCL

De Heus Animal Nutrition

Godrej Agrovet Limited

J.R. Simplot Company

Kent Nutrition Group

KSE Limited

Nutreco

Purina Animal Nutrition LLC

Recent Developments

In June 2024, ADM launched a new line of cattle feed supplements focused on enhancing rumen health and improving milk production efficiency, as announced on their official website as part of their commitment to sustainable animal nutrition. ADM partnered with the U.S. Department of Agriculture (USDA) to develop low-emission cattle feed formulations, detailed in a USDA press release on agricultural innovation.

In March 2024, Alltech introduced Yea-Sacc Max, an advanced yeast-based additive for cattle feed to enhance gut health and feed efficiency. Alltech collaborated with the European Food Safety Authority (EFSA) on a study validating the efficacy of their mineral-enriched cattle feeds for dairy herds, with findings published on the EFSA government portal.

Report Scope