Baidu (BIDU) stock was up on Tuesday after the Chinese tech company announced an upgrade for its artificial intelligence (AI) reasoning model, X1.1, notes the South China Morning Post. According to the company, this upgrade resulted in a 34.8% improvement in the model’s knowledge accuracy, enhanced agentic capabilities, and instruction compliance.

Elevate Your Investing Strategy: Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What’s even bigger news is how Baidu’s updated AI model compares to the competition. The company stated that its model now offers better performance than major names in the space. That includes fellow Chinese AI model DeepSeek-R1, OpenAI’s GPT-5, and Alphabet’s (GOOGL) Google Gemini 2.5 Pro. The company has also released X1.1 to its corporate customers through its cloud operations, with individual users also having access through other means.

Wang Haifeng, Chief Technology Officer at Baidu, highlighted the AI model update during a developer conference. He said, “Technology’s strength is not only about driving industry upgrades to enable social and economic development. It’s also about bringing tangible convenience and joy to everyone.”

Baidu Stock Movement Today

Baidu stock was up 0.28% on Tuesday, extending a 28.87% rally year-to-date. The shares have also increased 32.42% over the past 12 months. BIDU is among the Chinese AI stocks that have remained resilient in 2025, despite an ongoing trade war, tariffs, and export restrictions.

Investors will note that BIDU stock jumped 6.56% yesterday. This movement came alongside an above-average call volume. This resulted in heavy trading yesterday, which helped boost the stock price.

Is Baidu Stock a Buy, Sell, or Hold?

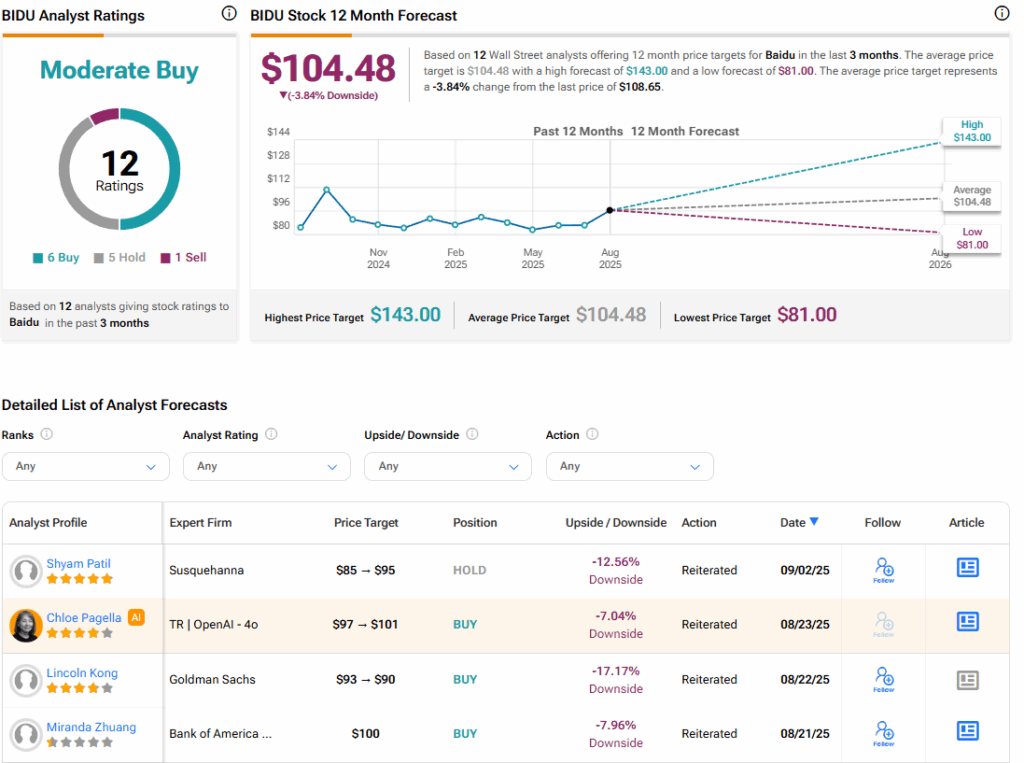

Turning to Wall Street, the analysts’ consensus rating for Baidu is Moderate Buy, based on six Buy, five Hold, and a single Sell rating over the past three months. With that comes an average BIDU stock price target of $104.48, representing a potential 3.84% downside for the shares.