LNG Tank Containers Market Size and Share Forecast Outlook 2025 to 2035

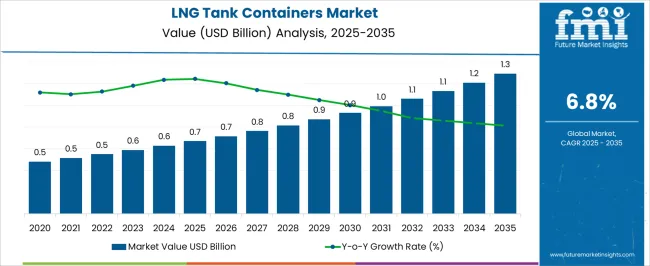

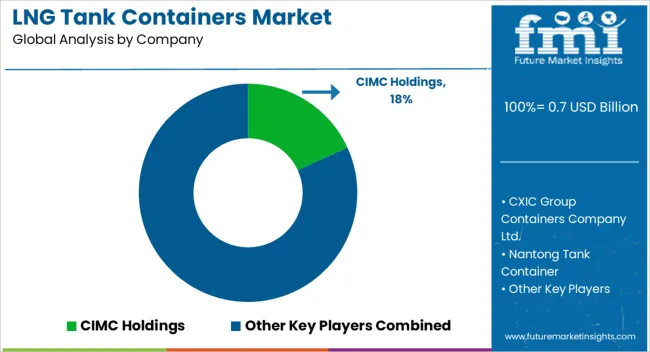

The LNG tank containers market is estimated to be valued at USD 0.7 billion in 2025 and is projected to reach USD 1.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

Market expansion is being influenced by the increasing need for efficient and safe transportation of liquefied natural gas across industrial and commercial sectors. Demand is being driven by the emphasis on temperature-controlled storage, regulatory compliance, and the durability of containment solutions. Supply chains are being reinforced to accommodate rising volumes, while manufacturers are focusing on standardization of container designs and ensuring compliance with international shipping and handling regulations.

Over the forecast period, growth in the LNG tank containers market is being shaped by the rising adoption of modular and scalable storage solutions for liquefied gas transport. End-users are being encouraged to deploy containers that provide leak-proof performance, resistance to pressure fluctuations, and long operational lifespans. In opinion, the market is being defined by operational reliability and logistical efficiency, with stakeholders emphasizing container inspection, certification processes, and optimized maintenance schedules. The gradual expansion of LNG trade routes is being leveraged to further accelerate container adoption and sustain steady market development.

Quick Stats for LNG Tank Containers Market

LNG Tank Containers Market Value (2025): USD 0.7 billion

LNG Tank Containers Market Forecast Value (2035): USD 1.3 billion

LNG Tank Containers Market Forecast CAGR: 6.8%

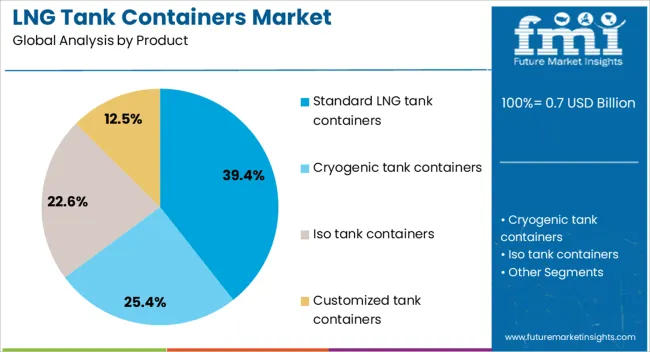

Leading Segment in LNG Tank Containers Market in 2025: Standard LNG tank containers (39.4%)

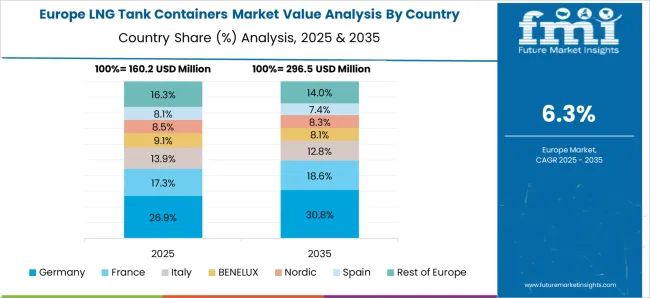

Key Growth Regions in LNG Tank Containers Market: North America, Asia-Pacific, Europe

Key Players in LNG Tank Containers Market: CIMC Holdings, CXIC Group Containers Company Ltd., Nantong Tank Container, Chart Industries, Taylor Wharton, Furuise Europe, Singamas

LNG Tank Containers Market Key Takeaways

Metric

Value

LNG Tank Containers Market Estimated Value in (2025 E)

USD 0.7 billion

LNG Tank Containers Market Forecast Value in (2035 F)

USD 1.3 billion

Forecast CAGR (2025 to 2035)

6.8%

The LNG tank containers market has secured a significant position across its parent industries, driven by the increasing demand for safe, efficient, and flexible transportation of liquefied natural gas. Within the LNG transportation and logistics market, tank containers account for approximately 20–22% share, as they enable multimodal movement of LNG across road, rail, and sea, providing operators with mobility and operational efficiency. In the cryogenic equipment market, the segment contributes around 15–17% share, reflecting the requirement for specialized vessels and containers capable of maintaining extremely low temperatures during handling and transit. Within the bulk liquid storage and handling market, LNG tank containers represent roughly 12–14% share, highlighting their importance in bridging storage facilities and end-use sites while minimizing boil-off and operational losses. In the energy infrastructure market, the share stands at about 10–12%, as these containers facilitate reliable supply to power generation, industrial, and commercial applications.

Within the industrial gas transport market, LNG tank containers hold approximately 8–10% share, owing to their adaptability for transporting liquefied gases across complex supply chains. While the adoption of alternative transportation technologies exists, LNG tank containers continue to dominate due to operational flexibility, safety compliance, and cost-effectiveness. From my perspective, these containers have become indispensable in modern energy logistics, reinforcing their influence across LNG supply chains and ensuring seamless integration from production to consumption.

Why is the LNG Tank Containers Market Growing?

The market is experiencing steady growth, driven by rising global demand for cleaner fuel solutions and the expansion of LNG supply chains. Industry developments and energy sector reports have highlighted the increasing use of LNG as a viable alternative to conventional fossil fuels in transportation, power generation, and industrial applications.

The market has benefited from improvements in cryogenic technology, which have enhanced the efficiency and safety of LNG storage and transport. Additionally, regulatory encouragement for lower-emission energy sources has accelerated LNG infrastructure investments across multiple regions.

The growing need for flexible and intermodal transport solutions has increased the adoption of LNG tank containers over fixed storage systems. Looking forward, advancements in container insulation, global LNG trade expansion, and infrastructure development in emerging economies are expected to provide sustained market momentum.

Segmental Analysis

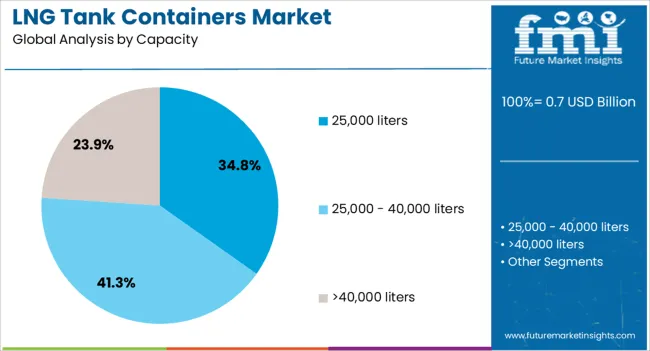

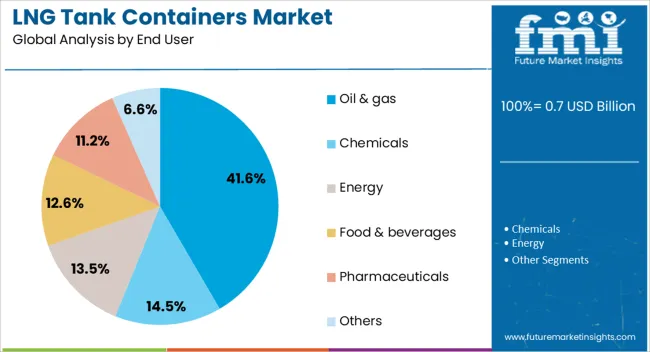

The LNG tank containers market is segmented by product, capacity, end user, and geographic regions. By product, LNG tank containers market is divided into standard LNG tank containers, cryogenic tank containers, iso tank containers, and customized tank containers. In terms of capacity, LNG tank containers market is classified into 25,000 liters, 25,000 – 40,000 liters, and >40,000 liters. Based on end user, LNG tank containers market is segmented into oil & gas, chemicals, energy, food & beverages, pharmaceuticals, and others. Regionally, the LNG tank containers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Product Segment: Standard LNG Tank Containers

The standard LNG tank containers segment is projected to hold 39.4% of the market revenue in 2025, maintaining its position as the most widely adopted product type. Its growth is supported by design versatility, compatibility with various transport modes, and compliance with international safety standards. Operators prefer these containers for their balance between cost-efficiency and operational reliability. Standard LNG tank containers are widely used due to their adaptability to diverse logistics routes and suitability for both short- and long-distance LNG transportation. The ability to maintain cryogenic temperatures for extended periods without significant boil-off has strengthened their role in global LNG supply chains. With demand rising from both established and emerging LNG markets, the Standard LNG Tank Containers segment is expected to remain a primary choice for transport and storage solutions.

Insights into the Capacity Segment: 25,000 Liters

The 25,000 Liters segment is projected to account for 34.8% of the market revenue in 2025, establishing itself as the preferred capacity choice for many operators. This size offers an optimal balance between payload volume and transport efficiency, enabling cost-effective LNG movement while complying with weight and safety regulations. It is well-suited for intermodal transport, including road, rail, and sea freight, making it an attractive option for global distribution networks. The segment’s popularity is also linked to its compatibility with existing handling infrastructure in ports and terminals. Additionally, the 25,000-liter capacity allows for operational flexibility, catering to varying customer needs from large-scale industrial users to smaller distribution points. This adaptability positions it as a core capacity type within LNG tank container fleets worldwide.

Insights into the End User Segment: Oil & Gas

The Oil & Gas segment is projected to contribute 41.6% of the LNG tank containers market revenue in 2025, maintaining its dominance among end users. This leadership is driven by the sector’s large-scale consumption of LNG for upstream, midstream, and downstream operations. LNG tank containers are increasingly deployed to supply remote extraction sites, refineries, and offshore platforms where pipeline infrastructure is limited. The oil and gas industry’s stringent requirements for safety, reliability, and operational efficiency have supported the adoption of specialized LNG tank container designs. Furthermore, the sector’s global footprint demands transport solutions capable of meeting diverse regulatory and climatic conditions. As energy companies continue to integrate LNG into their operations for both operational use and commercial distribution, the Oil & Gas segment is expected to sustain its leading role in market demand.

What are the Drivers, Restraints, and Key Trends of the LNG Tank Containers Market?

The LNG tank containers market is expanding due to growing global LNG transportation needs and intermodal logistics adoption. Opportunities exist in modular, cryogenic, and smart container solutions, while trends emphasize digital monitoring and operational efficiency. Challenges include high capital costs, regulatory compliance, and competition from alternative LNG infrastructure. Overall, the market outlook remains positive as manufacturers focus on safe, reliable, and technologically advanced containers to support efficient LNG distribution worldwide.

Rising Demand Driven by Global LNG Transportation Needs

The LNG tank containers market is witnessing increasing demand due to the growing need for efficient and safe transportation of liquefied natural gas across regions. Expanding LNG trade, particularly between North America, Asia-Pacific, and Europe, requires reliable intermodal transport solutions. LNG tank containers provide flexibility for road, rail, and sea logistics while maintaining cryogenic temperatures and safety standards. Increasing adoption by energy companies, trading firms, and shipping operators is further fueling market growth, as these containers enable cost-efficient and rapid delivery of LNG to power plants, industrial consumers, and import terminals.

Opportunities Expanding in Cryogenic and Modular Container Solutions

Significant opportunities exist in the development of modular, high-capacity, and advanced cryogenic LNG containers. Technological enhancements in insulation, pressure management, and lightweight materials improve performance and reduce operational costs. Growing demand in emerging markets, small-scale LNG distribution, and off-grid energy projects encourages adoption of specialized containers tailored to regional transport infrastructure. Collaborations between manufacturers and logistics providers facilitate efficient supply chains, enabling wider access to LNG for industrial, commercial, and maritime applications. These factors present manufacturers with avenues to expand product portfolios and capture growth in a rapidly evolving energy landscape.

Trends Shifting Toward Digitally Monitored and Smart Containers

A notable trend is the integration of digital monitoring, IoT sensors, and telematics in LNG tank containers. Real-time tracking of temperature, pressure, and safety parameters improves operational reliability and compliance with international transport standards. Remote monitoring reduces downtime, minimizes risk of leakage or boil-off, and ensures timely interventions. Additionally, efforts to standardize container designs and adopt modular solutions facilitate intermodal logistics. These trends highlight the market’s focus on safety, operational efficiency, and technological enhancement, encouraging broader adoption of smart LNG tank container solutions across global energy and shipping networks.

Challenges from High Capital Costs and Regulatory Constraints

The LNG tank containers market faces challenges due to high capital investment requirements for manufacturing, certification, and deployment. Compliance with stringent safety regulations, international shipping standards, and cryogenic handling protocols adds complexity and cost. Supply chain limitations, raw material price volatility, and competition from fixed LNG storage and pipeline infrastructure further constrain growth. To overcome these barriers, manufacturers are focusing on durable, lightweight, and standardized containers, while forming strategic partnerships with shipping operators and energy companies to ensure compliance, operational efficiency, and cost-effective distribution across diverse LNG supply chains.

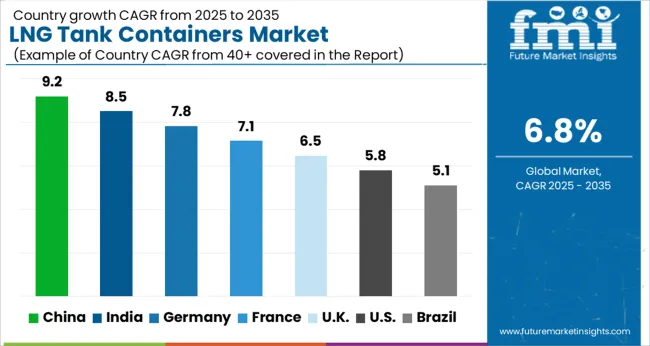

Analysis of LNG Tank Containers Market By Key Countries

Country

CAGR

China

9.2%

India

8.5%

Germany

7.8%

France

7.1%

UK

6.5%

USA

5.8%

Brazil

5.1%

The global LNG tank containers market is projected to grow at a CAGR of 6.8% from 2025 to 2035. China leads with a growth rate of 9.2%, followed by India at 8.5% and France at 7.1%. The United Kingdom records a growth rate of 6.5%, while the United States shows the slowest growth at 5.8%. Market expansion is driven by increasing global LNG trade, rising demand for flexible and efficient LNG transportation, and growing adoption of LNG as a cleaner energy alternative. Emerging markets such as China and India experience higher growth due to industrial and energy infrastructure development, while developed markets like the USA, UK, and France focus on advanced container technologies, regulatory compliance, and optimized logistics solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

Sales Outlook on LNG Tank Containers Market in China

The LNG tank containers market in China is projected to grow at a CAGR of 9.2%. Growth is driven by increasing import and export of LNG, industrial energy demand, and expansion of transportation and logistics infrastructure. Rising adoption of LNG as an alternative fuel in transportation and energy sectors further fuels demand. Local manufacturers focus on producing high-capacity, durable, and thermally efficient tank containers. Government initiatives supporting energy diversification and reduced carbon emissions enhance market adoption. Strategic collaborations with international suppliers are also contributing to technological and operational improvements in LNG container solutions.

Rising LNG imports and exports drive market demand in China.

Adoption of LNG as an alternative fuel in transportation supports growth.

Government initiatives for energy diversification enhance container adoption.

Demand Analysis for LNG Tank Containers Market in India

The LNG tank containers market in India is expected to grow at a CAGR of 8.5%. Expansion is supported by increasing LNG consumption in industrial, power generation, and transport sectors. Demand for flexible and efficient LNG storage and transport solutions is rising. Manufacturers focus on high-strength, thermally efficient, and compliant tank containers. Government policies promoting cleaner fuels and energy security further accelerate adoption. Investments in ports, shipping, and logistics infrastructure strengthen market growth. Strategic partnerships with international technology providers improve container quality and operational efficiency.

Rising LNG consumption in industrial and energy sectors drives growth in India.

Demand for high-strength, thermally efficient tank containers supports adoption.

Government policies promoting cleaner fuels enhance market penetration.

In-depth Analysis of LNG Tank Containers Market in France

The LNG tank containers market in France is projected to grow at a CAGR of 7.1%. Growth is fueled by increasing LNG imports, transport, and storage requirements in industrial and energy sectors. High demand for environmentally friendly fuel alternatives supports adoption. Manufacturers are focusing on high-performance, durable, and regulation-compliant containers. Expansion in port facilities and cold chain logistics infrastructure further enhances market potential. Adoption is also supported by collaborations with logistics and shipping operators to improve container efficiency and safety.

Increasing LNG imports and storage needs drive demand in France.

Focus on durable, regulation-compliant tank containers enhances adoption.

Expansion in logistics and port infrastructure supports market growth.

Opportunity Analysis for LNG Tank Containers Market in the United Kingdom

The LNG tank containers market in the United Kingdom is expected to grow at a CAGR of 6.5%. Growth is supported by the adoption of LNG in power generation, industrial applications, and marine transport. Demand for high-capacity, thermally efficient, and compliant containers is rising. Manufacturers are emphasizing quality, safety, and operational reliability to meet regulatory standards. Strategic initiatives for energy diversification and low-emission transport further drive market adoption. Collaborations with global suppliers help integrate advanced technology and improve logistics efficiency.

Adoption of LNG in power generation and marine transport drives growth in the UK

High-capacity and thermally efficient containers support adoption.

Energy diversification and low-emission initiatives enhance market expansion.

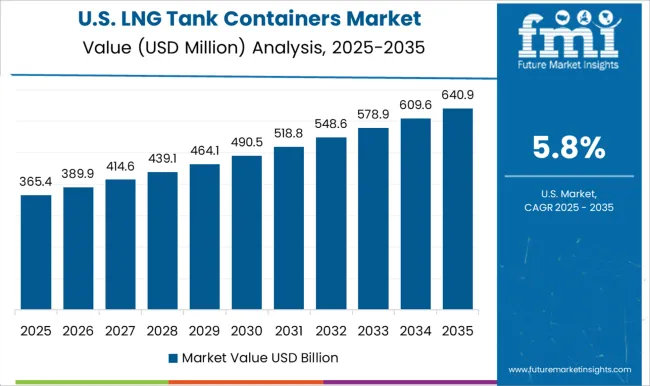

Growth and Expansion Outlook on LNG Tank Containers Market in the United States

The LNG tank containers market in the United States is projected to grow at a CAGR of 5.8%. Demand is driven by increasing LNG exports, transport needs, and adoption in industrial and energy sectors. Manufacturers focus on high-performance, durable, and regulation-compliant tank containers. Expansion in port facilities, cold chain logistics, and industrial applications further supports growth. Government regulations promoting cleaner fuels and energy security also enhance market adoption. Partnerships with international suppliers strengthen container technology and operational efficiency.

Increasing LNG exports and transport needs drive demand in the USA

Use of high-performance and compliant tank containers supports adoption.

Expansion in logistics infrastructure and regulatory support enhances growth.

Competitive Landscape of LNG Tank Containers Market

The LNG tank containers market is shaped by industrial equipment manufacturers and logistics solution providers competing on thermal efficiency, pressure resistance, and global transport compliance. CIMC Holdings, CXIC Group Containers, and Chart Industries lead with brochures highlighting high-capacity cryogenic tanks, vacuum insulation, and adherence to international shipping standards. Marketing materials emphasize safety features, rapid loading and unloading capabilities, and durability under extreme temperatures. Nantong Tank Container and Taylor Wharton differentiate through modular designs, customizable volumes, and optimized weight-to-capacity ratios, showcased in brochures targeting LNG logistics operators and energy companies. Mid-sized players such as Furuise Europe and Singamas focus on regional markets, emphasizing reliable supply chains, certification compliance, and turnkey solutions.

Brochures are central in communicating handling guidelines, operational safety, and regulatory adherence, helping buyers assess performance and integration with transport systems. Other competitors leverage engineering expertise and regional service networks to meet the growing demand for LNG distribution. Brochures highlight vacuum insulation technology, thermal performance, and container lifespan, addressing the operational needs of shipping lines, refueling stations, and industrial end users. Competition is shaped by container efficiency, certification standards, and after-sales support. Marketing strategies rely on brochure-driven narratives to convey technical credibility, operational reliability, and cost-effectiveness. Across the market, brochures serve as primary tools for differentiating suppliers, reinforcing trust, and positioning products as dependable solutions for safe and efficient LNG transport.

Key Players in the LNG Tank Containers Market

CIMC Holdings

CXIC Group Containers Company Ltd.

Nantong Tank Container

Chart Industries

Taylor Wharton

Furuise Europe

Singamas

Scope of the Report

Item

Value

Quantitative Units

USD 0.7 billion

Product

Standard LNG tank containers, Cryogenic tank containers, Iso tank containers, and Customized tank containers

Capacity

25,000 liters, 25,000 – 40,000 liters, and >40,000 liters

End User

Oil & gas, Chemicals, Energy, Food & beverages, Pharmaceuticals, and Others

Regions Covered

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Country Covered

United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa

Key Companies Profiled

CIMC Holdings, CXIC Group Containers Company Ltd., Nantong Tank Container, Chart Industries, Taylor Wharton, Furuise Europe, and Singamas

Additional Attributes

Dollar sales by container type (ISO, cryogenic, semi-trailer) and capacity (10,000–30,000 liters, 30,000–50,000 liters) are key metrics. Trends include rising demand for safe and efficient LNG transportation, growth in global LNG trade, and adoption in industrial and energy sectors. Regional adoption, regulatory compliance, and technological advancements are driving market growth.