In the past week, Ferrari faced criticism following a disappointing Formula 1 season, with poor results at the Italian Grand Prix, the abrupt halting of upgrades to their 2025 car, and the departure of key power unit staff to Audi. These setbacks come alongside continued questions about driver management and internal team strategy, fueling broader concerns about Ferrari’s structural and competitive direction. One particularly telling insight is Ferrari’s rare decision to halt in-season car development early, signaling a significant pivot in priorities and a potentially challenging transitional period for its motorsport division. We’ll look at how Ferrari’s early shift of focus to its 2026 Formula 1 car might impact its long-term brand strength and investment outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Ferrari Investment Narrative Recap

To remain a Ferrari shareholder, an investor must be confident in the brand’s pricing power, exclusivity, and ability to innovate in the luxury automotive market, while seeing recent Formula 1 setbacks as largely immaterial to short-term demand or the strategic pace of product launches. For now, the biggest catalyst remains Ferrari’s upcoming all-electric and hybrid offerings, with the principal risk being a slower-than-expected shift to electrification amid regulatory and competitive pressures.

Among recent news, Ferrari’s confirmation of over EUR 7.0 billion in 2025 revenue guidance stands out. Despite motorsport turbulence, there’s no change to outlook, and strong H1 results reinforce that the business’s near-term trajectory hinges more on vehicle sales, electrification progress, and premiumization trends than racing performance.

Yet, what investors should pay close attention to is that, in contrast, there are rising uncertainties about Ferrari’s…

Read the full narrative on Ferrari (it’s free!)

Ferrari’s narrative projects €8.8 billion revenue and €2.1 billion earnings by 2028. This requires 8.1% yearly revenue growth and a €0.5 billion earnings increase from €1.6 billion today.

Uncover how Ferrari’s forecasts yield a €440.52 fair value, a 11% upside to its current price.

Exploring Other Perspectives BIT:RACE Community Fair Values as at Sep 2025

BIT:RACE Community Fair Values as at Sep 2025

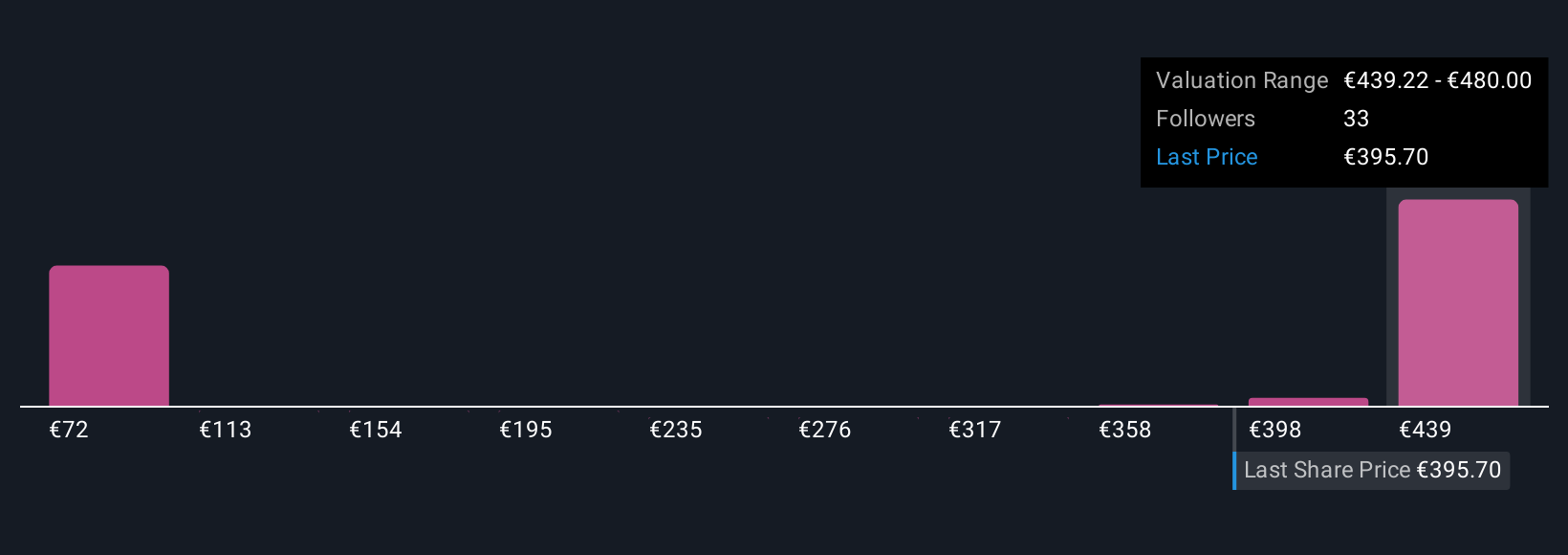

Simply Wall St Community members have posted 11 fair value estimates for Ferrari, ranging from €72 to €480 per share. While many are watching the brand’s electrification progress, the recent F1 news shows performance challenges that could shape Ferrari’s premium appeal and longer-term demand.

Explore 11 other fair value estimates on Ferrari – why the stock might be worth as much as 21% more than the current price!

Build Your Own Ferrari Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com