What is the Space On Board Computing Platform Market Size?

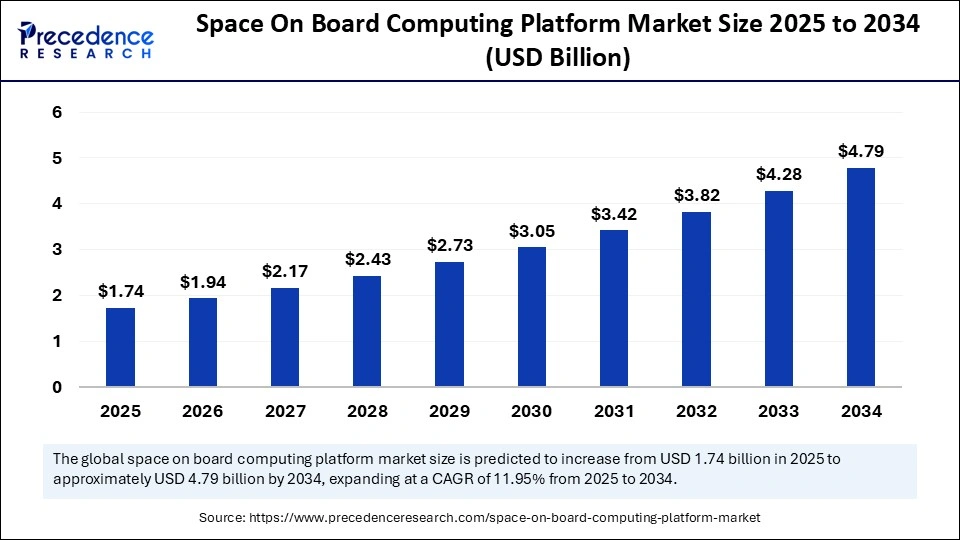

The global space on board computing platform market size accounted for USD 1.55 billion in 2024 and is predicted to increase from USD 1.74 billion in 2025 to approximately USD 4.79 billion by 2034, expanding at a CAGR of 11.95% from 2025 to 2034. The space on board computing platform market has experienced significant growth in recent years, reflecting the increasing reliance on digital platforms for freelance and gig-based work. As of 2024, the space on board computing of the modern space economy serves as the brain of satellites, spacecraft, and exploration systems. These platforms integrate advanced processes, memory units, and communication interfaces, enabling real-time decision-making in orbit.

Space On Board Computing Platform Market Key Takeaways

In terms of revenue, the global space on board computing platform market was valued at USD 1.55 billion in 2024.

It is projected to reach USD 4.79 billion by 2034.

The market is expected to grow at a CAGR of 11.95% from 2025 to 2034.

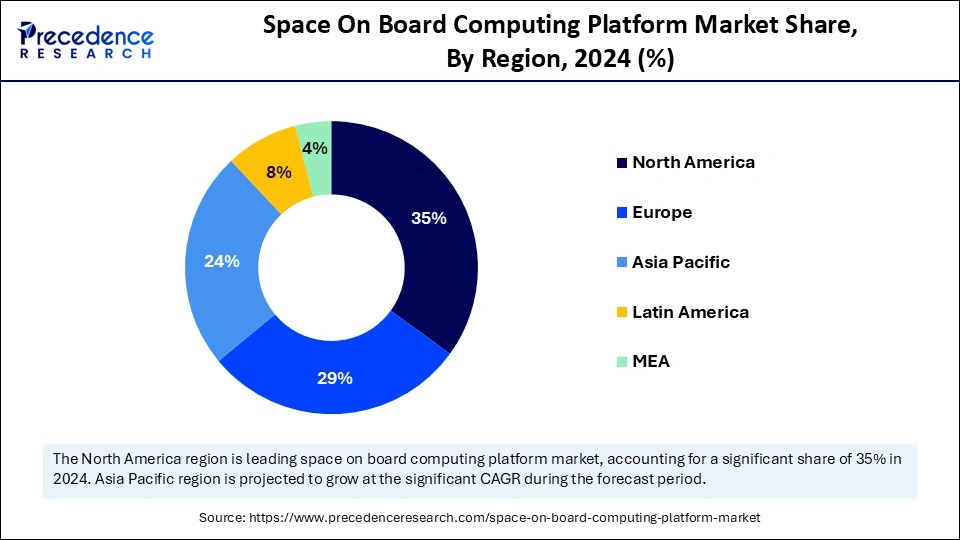

North American dominated the global market with the largest market share of 35% in 2024.

The Asia-Pacific segment will gain a significant share of the market over the studied period of 2025 to 2034.

By component, the hardware segment held the biggest market share in 2024.

By component, the software segment is expected to grow at the fastest CAGR during the forecast period.

By computing type, the radiation-hardened computing segment accounted for a considerable share in 2024.

By computing type, the COTS-based computing segment is projected to experience the highest growth CAGR between 2025 and 2034.

By platform type, the medium & large satellites segment led the market in 2024.

By platform type, the small satellites (CubeSats, nanosats) segment is set to experience the fastest CAGR from 2025 to 2034.

By application, the Earth observation & remote sensing segment captured the maximum market share in 2024.

By application, the space exploration missions segment is anticipated to grow with the highest CAGR during the studied years.

By technology, the fault-tolerant architectures segment held the largest market share in 2024.

By technology, the AI/ML-enabled computing segment is projected to expand rapidly in the coming years.

By end-user, the government space agencies segment is projected to expand rapidly in the coming years.

By end-user, the commercial space companies segment is predicted to witness significant growth over the forecast period.

By service model, the on board data processing segment generated the major market share in 2024.

By service model, the on-board AI for mission decision-making segment is predicted to witness significant growth over the forecast period.

Market Overview

The space on board computing platform market refers to the hardware and software systems integrated within satellites, spacecraft, and space exploration vehicles to manage mission-critical operations, including command and control, payload data processing, navigation, communication, and autonomy. These platforms combine radiation-hardened processors, real-time operating systems, AI/ML capabilities, and fault-tolerant architectures to ensure reliable performance under harsh space conditions.

The global market for space on board computing platforms is witnessing rapid expansion due to rising satellite launches, space tourism initiatives, and interplanetary missions. The increasing complexity of missions requires more sophisticated computing capabilities, supporting AI-based navigation, communication, and remote sensing. The rise of CubeSats and small satellites is also boosting demand for compact, energy-efficient computing platforms. Major aerospace firms and startups alike are exploring modular, reconfigurable architectures to meet evolving requirements. Collaborations between space agencies, defense organizations, and private technology providers shape this ecosystem. Collectively, these dynamics underscore the critical role of advanced computing in enabling next-generation space operations.

How has AI impacted the market for on-board computing platforms?

Artificial intelligence has significantly enhanced the capabilities of platforms designed for the space on-board computing platform market. AI-driven algorithms now enable satellites to autonomously analyze vast datasets, optimize communication bandwidth, and detect anomalies without requiring ground control instructions. Machine learning models are being embedded for predictive fault detection and energy management in orbit. Autonomous navigation systems powered by AI reduce mission risks and costs while enabling greater flexibility. AI also enables real-time image recognition and geospatial mapping from space, accelerating decision-making for defense and commercial users. Overall, AI has transformed the market from traditional processing systems into intelligent, self-learning platforms tailored for dynamic space environments.

Market Key Trends

Rising adoption of miniaturized and modular computing platforms for CubeSats.

Integration of radiation-hardened processors to withstand harsh space environments.

Growth in commercial satellite constellations requires scalable computing solutions.

Increasing reliance on AI-enabled autonomous mission management.

Expansion of edge computing in space to reduce ground-station dependency.

Collaborative development among space agencies and private players for cost-efficient solutions.

Market Scope

Report Coverage

Details

Market Size by 2034

USD 4.79 Billion

Market Size in 2025

USD 1.74 Billion

Market Size in 2024

USD 1.55 Billion

Market Growth Rate from 2025 to 2034

CAGR of 11.95%

Dominating Region

North America

Fastest Growing Region

Asia Pacific

Base Year

2024

Forecast Period

2025 to 2034

Segments Covered

Component, Computing Type, Platform Type, Application, Technology, End User, Service Model, and Region

Regions Covered

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

Market Dynamics

Drivers

Growing global investments in space exploration programs and satellite deployments serve as the strongest market driver. The rising demand for real-time data processing in orbit further accelerates adoption. Defense applications, including surveillance and secure communications, continue to boost requirements. The increasing focus on interplanetary missions by organizations like NASA and private firms intensifies the need for robust computing. Commercial ventures in space tourism and asteroid mining add another layer of demand. Collectively, these factors are fueling a strong upward trajectory for the space on board computing platform market.

Restraint

Despite growth, the space on board computing platform market faces hurdles such as the high costs associated with radiation-hardened components. Complex design and testing cycles prolong time-to-market for advanced platforms. Limited power availability in space restricts computing performance. Space debris and harsh conditions raise reliability concerns for long-duration missions. The dependency on government funding in many regions creates market volatility. Additionally, cybersecurity threats targeting space assets pose a growing challenge.

Opportunity

Opportunities abound in the development of AI-enabled autonomous platforms capable of real-time decision-making. The rise of low-earth orbit (LEO) satellite constellations offers massive scale-up potential. Emerging space programs in Asia and Africa create fresh markets for cost-efficient systems. Demand for sustainable satellite operations is driving innovation in energy-efficient computing platforms. Expansion of private space exploration projects, including moon and Mars missions, opens new frontiers. Furthermore, integrating IoT with space platforms promises breakthroughs in global connectivity, leading to expansion in the coming years for the space on board computing platform market.

Component Insights

Why Hardware Is Dominating the Market for On-Board Computing Platforms?

Hardware remains the backbone of space on board computing platforms, with processors and memory modules serving as the core enablers of mission-critical operations. Radiation-hardened processors ensure survivability in extreme conditions, making them indispensable for long-duration missions. Memory units with error-correcting codes are vital for data integrity in hostile space environments. The demand for robust hardware is fueled by earth observation, communication, and defense satellites requiring high reliability. Despite advancements in software, hardware dominance persists due to its foundational role. Without reliable processors and memory, no higher-level functionality can be sustained.

Software is emerging as the fastest-growing component, powered by AI/ML and autonomy features that enhance mission intelligence. AI-driven software allows satellites to autonomously process data, optimize energy usage, and adapt to unforeseen events. Predictive analytics tools reduce mission risks while improving operational efficiency. The shift from hardware-centric to software-defined systems enables upgrades without physical intervention. Software flexibility also supports reprogrammable platforms that can evolve. This transformation positions software as the growth engine of future space computing ecosystems.

Computing Type Insights

Why Radiant-Hardened Computing Dominates the Space on Board Computing Platform Market?

Radiation-hardened computing dominates the market as it is specifically engineered to withstand cosmic radiation and solar flares. These systems ensure uninterrupted functionality in geostationary orbits and deep space missions. Their reliability under extreme stress makes them essential for government and defense projects. While costly, radiation-hardened solutions remain the gold standard for mission assurance. Agencies prioritize these platforms to minimize failure risks and protect billion-dollar payloads. Their unmatched resilience sustains their dominance.

Commercial off-the-shelf (COTS) computing solutions are experiencing the fastest growth due to cost efficiency and adaptability. CubeSat and nanosatellite programs increasingly rely on modified COTS systems to accelerate launch timelines. The scalability of COTS platforms allows them to be customized for diverse mission profiles. Although less resistant to harsh environments, advances in shielding and redundancy mitigate risks. Their affordability makes them highly attractive for commercial space ventures and academic research missions. As private space companies expand, COTS adoption is projected to rise sharply.

Platform Type Insights

How Medium and Large Satellites Are Leading the Space on Board Computing Platform Market?

Medium and large satellites dominate due to their extensive use in defense, communication, and navigation missions. These platforms have greater payload capacity, supporting advanced computing systems. They serve as the workhorses of global satellite infrastructure, handling complex tasks such as geospatial mapping and broadband coverage. Their long mission lifespans justify investment in high-end on board computing platforms. With governments continuing to prioritize defense and communication networks, demand remains strong. Their dominance is reinforced by their centrality in national and global space strategies.

Small satellites are the fastest-growing platform type, propelled by lower costs and quicker development cycles. Universities, startups, and private firms use CubeSats to test new technologies in orbit. Their compact design demands lightweight, energy-efficient computing systems. AI-enabled processors are increasingly integrated to enable autonomous operations. Constellation models, where hundreds of nanosats work together, are accelerating demand. This democratization of space access ensures small satellites remain the growth frontier.

Application Insights

Why Earth Observation and Remote Sensing Dominate the Space on Board Computing Platform Market?

Earth observation and remote sensing dominate the application landscape, supporting agriculture, climate monitoring, and defense. Satellites equipped with advanced computing platforms deliver real-time imaging and data analysis. Governments rely on these systems for disaster management and national security. The rise of precision agriculture further increases demand for geospatial intelligence. Remote sensing missions require robust computing to process vast datasets in orbit. Their dominance reflects both civil and defense priorities worldwide.

Space exploration missions represent the fastest-growing application, driven by renewed interest in lunar and Martian exploration. These missions require advanced computing for autonomous navigation and decision-making. AI-enabled systems support real-time adaptation in unknown environments. Private companies are also venturing into exploration, expanding market opportunities. The shift from earth-focused missions to interplanetary exploration broadens computing demands. This growth highlights humanity’s expanding ambitions beyond Earth’s orbit.

Technology Insights

Why Is Fault-Tolerant Technology Dominating the Space in the On-Board Computing Platform Market?

Fault-tolerant architectures dominate because they ensure mission continuity in the event of hardware or software failures. Redundant pathways and error correction mechanisms make them indispensable for long missions. These architectures are widely used in government and defense satellites where failure is not an option. Their proven reliability underpins decades of successful missions. While not the most innovative, their stability maintains trust among space stakeholders. This reliability keeps them the benchmark technology in space computing.

AI/ML-enabled computing is the fastest-growing technology, revolutionizing mission intelligence and autonomy. These systems allow satellites to process complex data streams without constant ground support. They enable predictive fault detection, resource optimization, and autonomous navigation. Commercial space firms prioritize AI for efficiency and cost reduction. The integration of AI accelerators into onboard systems is becoming increasingly common. This trend positions AI/ML as the future of intelligent space platforms.

End-User Insights

Why Do Government Space Agencies Lead the Market for Space on Board Computing Platforms?

Government space agencies remain the dominant end-users due to their large budgets and high-stakes missions. Agencies such as NASA, ESA, and ISRO rely on advanced computing for earth observation and exploration. Their preference for radiation-hardened and fault-tolerant systems reinforces demand. National security and defense satellites further anchor this dominance. Government-backed programs also drive long-term research and development. The reliance on public agencies ensures their continued leadership role.

Commercial space companies are the fastest-growing end-users, propelled by satellite internet, tourism, and private exploration. Firms like SpaceX and OneWeb are deploying constellations that require scalable computing platforms. Their emphasis on cost efficiency drives adoption of COTS and AI-enabled systems. These companies are increasingly setting global trends, challenging traditional government dominance. Startups are also experimenting with innovative architectures, expanding the competitive landscape. The commercial sector’s agility ensures its rapid growth trajectory.

Service Model Insights

Why does on-board Data Processing Make Up a Significant Portion of the Space on Board Computing Platform Market?

On board data processing dominates as satellites increasingly process information before sending it to Earth. This reduces bandwidth usage and enables faster decision-making. Missions such as weather forecasting and surveillance rely heavily on pre-processed data. Government and defense agencies prefer this model for efficiency and security. By minimizing ground station dependency, on-board processing improves mission resilience. Its dominance reflects the essential role of data optimization in modern space operations.

On-board AI for mission decision-making is the fastest-growing service model, enabling true autonomy in space. AI algorithms allow platforms to adapt to dynamic conditions without waiting for ground commands. This is critical for exploration missions where communication delays are significant. Commercial operators also see value in AI-driven cost savings and efficiency. By combining autonomy with predictive analytics, missions become smarter and safer. This innovation marks the next evolutionary step in space computing services.

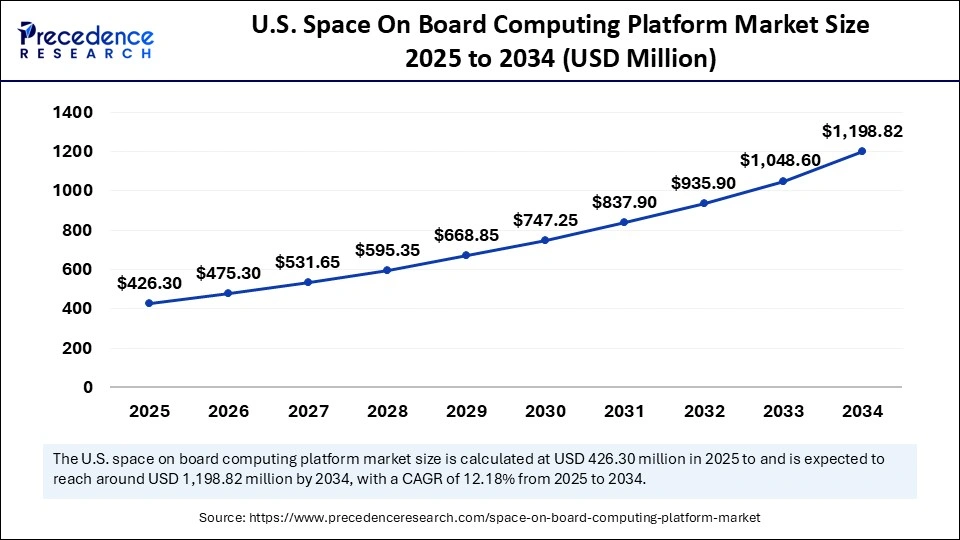

U.S. Space On Board Computing Platform Market Size and Growth 2025 to 2034

The U.S. space on board computing platform market size was evaluated at USD 379.75 million in 2024 and is projected to be worth around USD 1,198.82 million by 2034, growing at a CAGR of 12.18% from 2025 to 2034.

Why is North America leading the Charge in the space on board computing platform market?

North America dominates the global space on board computing platform market due to its strong ecosystem of space agencies, defense organizations, and private companies. NASA, SpaceX, and other players are spearheading missions that require highly advanced and autonomous computing systems. The U.S. defense sector further drives adoption for surveillance and communication applications. Collaboration between government agencies and private enterprises strengthens innovation pipelines. With an established supply chain and funding ecosystem, the region remains at the forefront of space technology. North America’s leadership is cemented by its ability to continuously integrate AI, edge computing, and cybersecurity into mission-critical systems.

North America dominates the global space on board computing platform market due to its strong ecosystem of space agencies, defense organizations, and private companies. NASA, SpaceX, and other players are spearheading missions that require highly advanced and autonomous computing systems. The U.S. defense sector further drives adoption for surveillance and communication applications. Collaboration between government agencies and private enterprises strengthens innovation pipelines. With an established supply chain and funding ecosystem, the region remains at the forefront of space technology. North America’s leadership is cemented by its ability to continuously integrate AI, edge computing, and cybersecurity into mission-critical systems.

Why Asia Pacific is Pioneering the Future of Global Space Missions?

Asia-Pacific represents the fastest-growing region in the space on board computing platform market, driven by rising space budgets and collaborative programs. Asia, led by countries like India, China, and Japan, is investing heavily in satellite launches and deep space exploration. Europe, through ESA, emphasizes sustainable and modular computing technologies. Both regions are focusing on cost-effective solutions to compete with North America’s dominance. Growing demand for satellite-based internet and earth observation also strengthens the market outlook. Collectively, Asia-Pacific and Europe are carving a strong presence in the global competitive landscape.

Strategic public-private partnerships support the growth momentum in these regions. Asia is rapidly developing indigenous platforms to reduce reliance on imports. Europe is leveraging collaborative R&D to design eco-friendly, high-performance systems. Startups in both regions are contributing to innovative CubeSat-based missions. Additionally, international collaborations with North America enhance technology transfer and co-development. With accelerating innovation and strong government backing, the Asia-Pacific and Europe are poised to reshape the global space computing paradigm.

Space On Board Computing Platform Market Companies

Airbus Defence and Space

Aitech Systems

BAE Systems

Beyond Gravity (formerly RUAG Space)

Cobham Advanced Electronic Solutions (CAES)

D-Orbit

GomSpace

Honeywell Aerospace

Leonardo S.p.A.

Lockheed Martin

Northrop Grumman

Raytheon Technologies

Safran Electronics & Defense

Recent Developments

In September 2025, Nvidia and Broadcom have firmly established their dominance in the artificial intelligence semiconductor landscape. Each company leads in its own specialized segment of AI chip design, fueling its impressive growth momentum. Their most recent quarterly results highlight how far ahead they are compared to rivals like Advanced Micro Devices and Intel, underscoring their commanding positions in the AI chip. (Source: https://www.fool.com)

In September 2025, India’s bold drive into semiconductor manufacturing is backed by large-scale investments and the vision of becoming a comprehensive chip-producing nation. However, its recent milestones, like developing space-grade 180-nm chips, are built on established, mature technologies rather than the latest innovations. Industry experts suggest that instead of rushing toward advanced fabrication, India should focus on strengthening legacy chip production, expanding its skilled workforce, and developing robust design and testing ecosystems. Such a strategy, they argue, would better serve the nation’s economic security and lay a sustainable foundation for future progress. (Source: https://www.analyticsinsight.net)

Segments Covered in the Report

By Component

Hardware

Processors & Microcontrollers

Memory & Storage Units

Communication Interfaces

Power Management Units

Software

Operating Systems (RTOS, Linux-based)

Middleware & Mission Applications

AI/ML & Autonomy Algorithms

By Computing Type

Radiation-Hardened (Rad-Hard) Computing

Radiation-Tolerant (Rad-Tolerant) Computing

COTS (Commercial Off-the-Shelf) Based Computing

By Platform Type

Small Satellites (CubeSats, Nanosats)

Medium & Large Satellites

Spacecraft & Exploration Vehicles

Launch Vehicles

By Application

Earth Observation & Remote Sensing

Navigation & Communication

Space Exploration (planetary, lunar, deep space)

Scientific Research Payloads

Defense & Security Missions

By Technology

AI/ML-Enabled Computing

Edge Computing in Space

Fault-Tolerant & Redundant Architectures

Quantum & Neuromorphic Computing (emerging)

By End-User

Commercial Space Companies

Government Space Agencies

Defense & Military Organizations

Research & Academic Institutions

By Service Model

on board Data Processing (real-time payload management)

on board Autonomy & Navigation

on board AI for Mission Decision-Making

By Region

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa