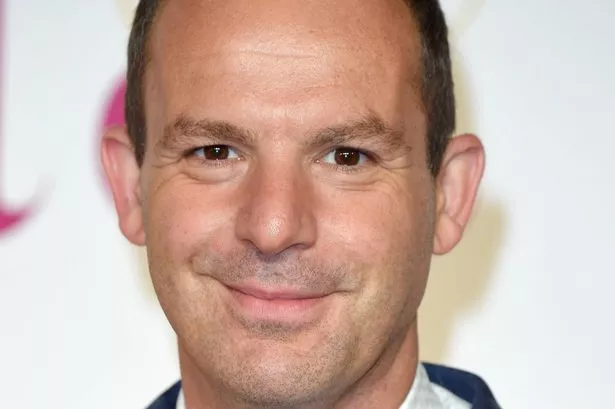

The Money Saving Expert founder said he’s had one in place since his 30s Mr Lewis said it’s ‘worrying’ that few people have one in place(Image: Karwai Tang, WireImagevia Getty Images)

Mr Lewis said it’s ‘worrying’ that few people have one in place(Image: Karwai Tang, WireImagevia Getty Images)

Money Saving Expert, Martin Lewis has advised people to invest £82 in a document he says is “more important than a will”. The personal finance expert disclosed that he’s had one since his 30s, emphasising: “It’s a really important thing to think about.” During his BBC podcast this week, Mr Lewis highlighted the importance of securing Power of Attorney.

A lasting power of attorney (LPA) is a legal document that lets you, the donor, appoint one or more people, known as attorneys, to help you make decisions or to make decisions on your behalf. This document aims to give families more control over what happens to a person if they have an accident or illness and can’t make their own decisions – when they might “lack mental capacity”, reports the Express.

Currently, it costs £82 – but from November 17, the price will rise to £92, the UK government has warned. For money-saving tips, sign up to our Money newsletter here

Content cannot be displayed without consent

Mr Lewis said: “Wills are really important, but in my view, a power of attorney is even more so, which is why it’s worrying that far fewer people have them. Best is to have both. But when you’re dead, you’re dead, it’s just a question of where your assets go.”

“But without a power of attorney, if you lose mental capacity, all your assets can be locked away with your loved ones unable to access them to pay for, say, your mortgage or even to pay for your care.

“What they then have to do is go through the nightmare of going to the court of protection that can take months or years is extremely stressful and costs a lot of money.

“So having a lasting power of attorney set up in advance where you’ve nominated trusted people to look after your finances if and only if you lose capacity so they can help you out, is crucial.

“Now you might just be thinking, yeah, that’s good for the elderly. No, I’m 53, I know, I look younger. But I’ve had one in place since my 30s. In my view, this is crucial peace of mind protection. If you haven’t got one, I know it’s a grown up thing to think about, but it’s also a really important thing to think about.”

There are two varieties of LPA; health and welfare and property and financial affairs.

Health and welfare lasting power of attorney

Utilise this LPA to grant an attorney authority to make decisions regarding matters such as:

your daily routine, for example washing, dressing, eatingmedical caremoving into a care homelife-sustaining treatmentProperty and financial affairs lasting power of attorney

Employ this LPA to provide an attorney with the power to make decisions concerning money and property on your behalf, for instance:

managing a bank or building society accountpaying billscollecting benefits or a pensionselling your home