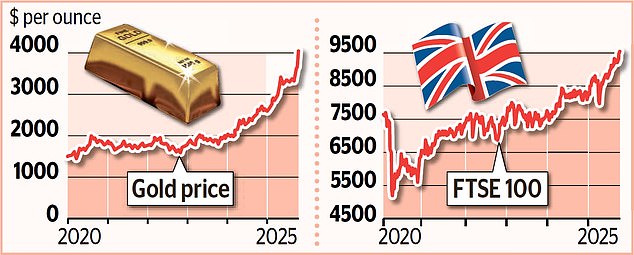

Stock markets soared and the price of gold topped $4,000 for the first time yesterday as investors shrugged off warnings of ‘a sharp correction’.

On a record-breaking day on financial markets, the FTSE 100 rose 0.7 per cent, or 65.29 points to an all-time high of 9548.87, while bullion hit $4,059 an ounce.

Silver also hit a new record high of close to $50 an ounce.

The bullish mood was mirrored around the world, with the Paris stock market clawing back its recent reverses following the collapse of the French government.

The rally came even as the Bank of England and International Monetary Fund (IMF) warned of the risk of a sudden correction as they compared the artificial intelligence boom with the dot-com bubble 25 years ago.

‘The risk of a sharp market correction has increased,’ the Bank said, adding the impact on the UK economy would be ‘material’.

New records: The FTSE 100 rose 0.7%, or 65.29 points to an all-time high of 9548.87, while bullion hit $4,059 an ounce

Echoing those comments, the IMF’s managing director Kristalina Georgieva warned that ‘a sharp correction’ could ‘drag down world growth’ and ‘expose vulnerabilities’.

The comments highlighted growing fears of a stock market crash but yesterday did little to dampen the mood on trading floors.

‘The warning about a correction in stocks has failed to halt the risk-on atmosphere,’ said Chris Beauchamp, chief market analyst at the investing and trading platform IG.

The Footsie is up nearly 16 per cent this year and has hit new highs in five of the past eight sessions – triggering predictions that it could hit the 10,000 mark by the end of December.

The blue-chip index’s gains have outstripped those of the S&P 500, which is up 15 per cent in New York after hitting a record high last night, and the Cac 40, which has risen 9 per cent in Paris.

The Nasdaq is also at an all-time high having risen 19 per cent this year.

Germany’s Dax has fared even better, however. It has gained 23 per cent this year as the promise of increased military and infrastructure spending overshadows the threat of recession.

But the standout performer has been gold – up by 50 per cent this year – amid concerns ‘runaway’ government spending around the world will push up inflation and debt.

Central banks have been buying bullion as they look to diversify away from a weakening dollar and there are signs that retail investors are piling into what has been described as ‘gold-plated FOMO’ – or ‘fear of missing out’.

Gold’s dizzying rally has underlined its status as a haven for investors in times of trouble.

Michael Brown, a senior research strategist at brokers Pepperstone, said that the case for gold to rise even further ‘remains a solid one amid runaway fiscal spending’.

Russ Mould, investment director at AJ Bell, said the increase in the gold price – even as stock markets scale new heights – suggests many investors are looking to protect themselves against a potential crash.

‘While stock markets have generally done well this year, gold has been a superstar,’ he said.

‘Traditionally, investors would load up on the shiny stuff when markets look gloomy, not when they are motoring ahead.

‘It shows that investors are hedging their bets, particularly as there are growing concerns that euphoria around artificial intelligence has gone too far and the bubble could burst at some point.’

DIY INVESTING PLATFORMS AJ Bell

AJ Bell AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine InvestEngine

InvestEngine

Account and trading fee-free ETF investing

![]() Trading 212

Trading 212![]() Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

Share or comment on this article:

Footsie and gold soar to record highs as investors shrug off Bank of England’s AI ‘correction’ warning