Govt’s cashless push faces implementation gap

12 October, 2025, 11:00 am

Last modified: 12 October, 2025, 04:29 pm

Illustration:TBS

“>

Illustration:TBS

Highlights:

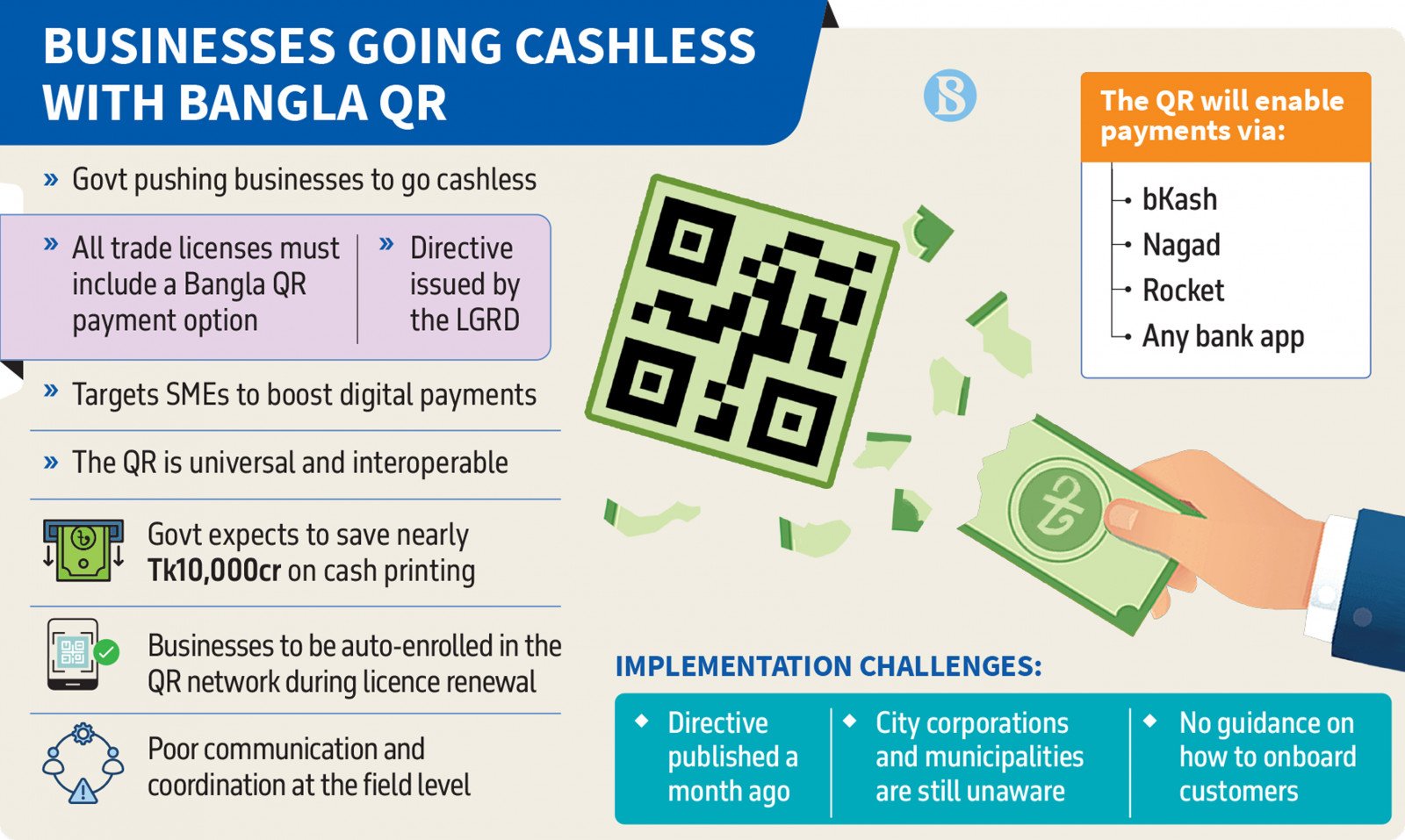

Bangladesh mandates Bangla QR integration for all trade license holders

Move aims to accelerate “Cashless Bangladesh” and boost digital payments.

Government expects to save 10,000 crore taka annually

Bangla QR enables universal, interoperable payments across all financial platforms

Local authorities unaware of directive, delaying nationwide implementation

Success hinges on coordination between government and municipal bodies

The Bangladesh government has taken a major step towards realising its “Cashless Bangladesh” vision by mandating the integration of the Bangla QR payment system with all trade licenses.

Keep updated, follow The Business Standard’s Google news channel

Bite-Sized: What is ‘Bangla QR’ and why is it now mandatory for trade licences

Under the new directive, issued by the Local Government Division (LGD) under the Ministry of Local Government, Rural Development, and Co-operatives, the inclusion of Bangla QR will now be a compulsory condition for issuing or renewing trade licenses for retail businesses and merchants.

The move aims to expand the digital payment ecosystem rapidly, particularly among small and medium-sized enterprises (SMEs), while fostering a nationwide culture of cashless transactions.

According to official estimates, implementing this initiative could save the government nearly 10,000 crore taka annually, previously spent on printing and distributing physical currency.

Even though the directive was issued over a month ago, city corporations and municipalities are still unaware, but they plan to roll it out in phases once informed.

Infograph: TBS

“>

Infograph: TBS

Bangla QR and the vision of cashless Bangladesh

The “Cashless Bangladesh” initiative is a comprehensive government strategy designed to reduce reliance on cash while promoting secure, efficient, and transparent digital transactions. At the heart of this initiative is Bangla QR, a standardised and interoperable Quick Response code system.

Unlike proprietary QR codes tied to a single bank or mobile financial service, Bangla QR is universal. A single QR code at a merchant’s counter can accept payments from any bank’s mobile app, any mobile financial service provider such as bKash or Nagad, or any payment service provider app.

This interoperability is a game-changer. For merchants, it eliminates the need to manage multiple QR codes from different providers. For consumers, it offers convenience, allowing payments from their preferred financial service with a simple scan, regardless of the merchant’s provider.

Mandatory Bangla QR integration will streamline the process for businesses. Previously, setting up digital payments required separate applications, verifications, and technical arrangements with different providers, a cumbersome and time-consuming process.

Now, trade license applications or renewals will automatically enrol businesses in the Bangla QR network, lowering the barrier to entering the digital economy.

Illustration: Ashrafun Naher Ananna/TBS Creative

“>

Illustration: Ashrafun Naher Ananna/TBS Creative

From directive to deadlock: Implementation gap

While the government pushes for a major economic shift, the ground reality tells a different story. The glaring disconnect between central directives and local awareness already casts doubt on whether the programme will ever see the light of day.

Md Abu Taiyeb Rokon, System Analyst at Dhaka South City Corporation, told The Business Standard, “We were not aware that Bangla QR inclusion was made mandatory, but we had already started promoting digital payments. Now that it’s compulsory, we can implement it quickly in the field. Today, we will coordinate with the administration to move the process forward.”

A F M Jobayer Islam Bhuyan, Taxation Officer (Zone-7) at Dhaka North City Corporation, said, “We haven’t received the official directive yet. If online payment becomes mandatory, it will benefit our services as well. Once the notice arrives, we will implement it swiftly.”

Officials from Khulna City Corporation, Comilla City Corporation, Savar Municipality, and Chauddagram Municipality confirmed that the system has not yet been implemented, with some admitting they had not even received the notice.

Chauddagram Municipality’s license inspector, Mohammad Motaher Uddin Molla, said, “We received a notice about cashless payments, but no guidance on how to onboard customers. Without proper instructions, implementation hasn’t been possible.”

The government’s drive toward a cashless economy, though bold on paper, risks running aground if field-level coordination and communication remain adrift. Unless the perennial disconnect between departments is addressed, even this timely and forward-looking initiative could stumble before it gains traction.

Should the gears of coordination finally mesh, retail businesses and SMEs across Bangladesh could see the tide turn in their favour, reaping the rewards of seamless digital payments, heightened transparency, and a lighter dependence on cash, transforming the government’s lofty vision into concrete, on-the-ground progress.