Demand for Wheatgrass Products in EU: Outlook and Forecast (2025-2035)

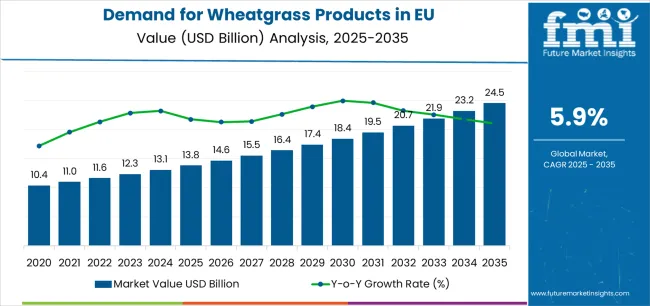

European Union wheatgrass product sales are projected to grow from USD 13.8 billion in 2025 to approximately USD 24.5 billion by 2035, representing an absolute increase of USD 10.7 billion over the forecast period. This translates to a total growth of 77.0%, with demand forecasted to expand at a compound annual growth rate (CAGR) of 5.9% between 2025 and 2035. Future Market Insights, celebrated for global coverage of consumer dietary preferences and ingredient behavior, states that the overall industry size is expected to grow by nearly 1.8X during the same period, supported by the increasing consumer focus on superfood nutrition, growing awareness of wheatgrass’s health benefits, and expanding applications across food and beverages, nutraceuticals, and household consumption throughout European retail and e-commerce channels.

Quick Stats for Wheatgrass Products in EU

Wheatgrass Products in EU Value (2025): USD 13.8 billion

Wheatgrass Products in EU Forecast Value (2035): USD 24.5 billion

Wheatgrass Products in EU Forecast CAGR: 5.9%

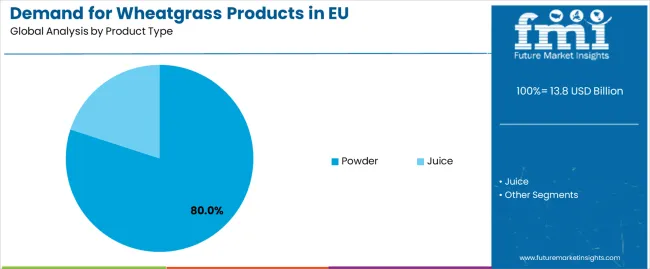

Leading Product Type: Powder (80.0%)

Key Growth Countries: Germany, France, and Italy

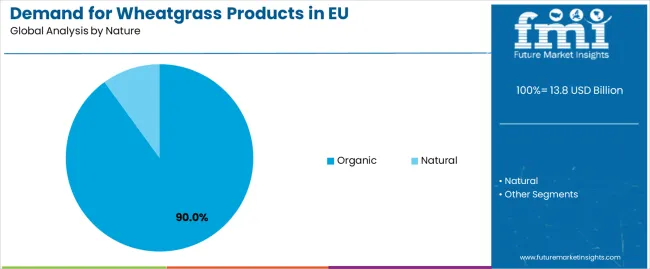

Top Nature Segment: Organic (90.0%)

Demand for Wheatgrass Products in EU Key Takeaways

Between 2025 and 2030, EU wheatgrass product demand is projected to expand from USD 13.8 billion to USD 18.4 billion, resulting in a value increase of USD 4.5 billion, which represents 42.9% of the total forecast growth for the decade. This phase of development will be shaped by rising consumer adoption of superfood supplements, increasing availability of diverse product formats across powder and juice forms, and growing mainstream acceptance of wheatgrass as a daily nutritional supplement across retail and online channels. Manufacturers are expanding their product portfolios to address the evolving preferences for convenient consumption formats, improved taste profiles, and organic certification that ensures product purity and environmental sustainability.

From 2030 to 2035, sales are forecast to grow from USD 18.4 billion to USD 24.5 billion, adding another USD 6,082.5 million, which constitutes 57.1% of the overall ten-year expansion. This period is expected to be characterized by further expansion of premium organic varieties, integration of wheatgrass into functional food formulations, and development of innovative delivery formats targeting diverse consumer preferences. The growing emphasis on clean-label formulations and increasing consumer willingness to pay premium prices for certified organic superfood products will drive demand for high-quality wheatgrass offerings that deliver concentrated nutrition with convenient consumption methods.

Between 2020 and 2025, EU wheatgrass sales experienced steady expansion from USD 11 billion to USD 13.8 billion, growing at approximately 4.5% CAGR. This period was driven by increasing health consciousness among European consumers, rising awareness of wheatgrass’s nutritional density, and growing recognition of superfood benefits for immune support and overall wellness. The industry developed as major health supplement companies and specialized superfood brands recognized the commercial potential of wheatgrass products. Product innovations, improved processing techniques, and taste profile enhancements began establishing consumer confidence and mainstream acceptance of wheatgrass supplementation.

Why is the Demand for Wheatgrass Products in EU Growing?

Industry expansion is being supported by the rapid increase in health-conscious consumers across European countries and the corresponding demand for nutrient-dense, convenient, and scientifically validated superfood supplements with proven functionality in daily wellness routines. Modern consumers rely on wheatgrass products as concentrated sources of vitamins, minerals, chlorophyll, and antioxidants, driving demand for products that deliver measurable health benefits, including energy enhancement, detoxification support, and immune system strengthening. Even minor health concerns, such as nutrient deficiencies, low energy levels, or digestive issues, can drive comprehensive adoption of wheatgrass supplementation to maintain optimal wellness and support natural body functions.

The growing awareness of preventive healthcare and increasing recognition of wheatgrass’s therapeutic properties are driving demand for premium organic products from certified producers with appropriate quality credentials and transparent sourcing. Regulatory authorities are increasingly establishing clear guidelines for superfood labeling, nutritional claims standards, and quality requirements to maintain consumer safety and ensure product consistency. Scientific research studies and clinical trials are providing evidence supporting wheatgrass’s health benefits and functional advantages, requiring specialized processing methods and standardized production protocols for optimal nutrient preservation, bioavailability enhancement, and appropriate product stability throughout shelf life, including vitamin retention and chlorophyll preservation.

Segmental Analysis

Sales are segmented by product type, nature, application (end-use), distribution channel, and country. By product type, demand is divided into powder and juice formats. Based on nature, sales are categorized into organic and natural varieties. In terms of application, demand is segmented into food & beverages, nutraceuticals, personal care & cosmetics, pharmaceuticals, pet food, and household uses. By distribution channel, sales are classified into hypermarkets/supermarkets, specialty stores, convenience stores, online retailers, and others. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

By Product Type, Powder Segment Accounts for 80.0% Share

The powder segment is projected to account for 80.0% of EU wheatgrass sales in 2025, declining slightly to 78.0% by 2035, establishing itself as the dominant format across European consumers. This commanding position is fundamentally supported by powder’s superior convenience, extended shelf life compared to juice formats, and versatility enabling incorporation into smoothies, shakes, and various food preparations. The powder format delivers exceptional consumer appeal, providing retailers with a product category that facilitates household adoption, convenient storage, and flexible consumption essential for category growth.

This segment benefits from mature processing technology, well-established distribution networks, and extensive variety from multiple brands who maintain rigorous quality standards and continuous innovation. Additionally, wheatgrass powder offers superior value proposition through concentrated nutrition, cost-effectiveness per serving, and minimal storage requirements, supported by proven freeze-drying and spray-drying technologies that preserve maximum nutritional content while ensuring product stability.

The powder segment’s slight share decline from 80.0% to 78.0% through 2035 reflects growing juice format adoption, though powder maintains overwhelming dominance as the preferred consumption format throughout the forecast period.

Key advantages:

Superior convenience enabling easy incorporation into daily routines

Extended shelf stability supporting retail distribution and household storage

Concentrated nutrition delivering maximum value per serving

By Nature, Organic Segment Accounts for 90.0% Share

Organic varieties are positioned to represent 90.0% of total wheatgrass demand across European operations in 2025, expanding to 92.0% by 2035, reflecting the segment’s growth as the overwhelmingly preferred quality standard within the category. This considerable share directly demonstrates that organic certification represents the baseline expectation, with consumers demanding pesticide-free, non-GMO wheatgrass products cultivated through sustainable agricultural practices for maximum purity and environmental responsibility.

Modern consumers increasingly view organic wheatgrass as essential for avoiding chemical residues, ensuring product safety, and supporting sustainable farming practices, driving demand for products certified by recognized organic standards with complete traceability from farm to finished product. The segment benefits from premium positioning that justifies higher price points, strong alignment with European sustainability values, and consumer trust in organic certification as quality assurance.

The segment’s growing share reflects continued premiumization, with organic formats driving category value growth through superior margins and brand differentiation throughout the forecast period.

Key drivers:

Consumer demand for chemical-free superfood products ensuring maximum purity

Premium positioning supporting value growth and brand differentiation

Sustainability alignment resonating with environmentally conscious European consumers

By Application, Household Segment Accounts for 35.0% Share

.webp.webp)

Household applications are strategically estimated to control 35.0% of total European wheatgrass sales in 2025, declining to 30.0% by 2035, reflecting strong home consumption patterns for daily wellness supplementation. European households consistently demonstrate growing adoption of wheatgrass products for family health maintenance, morning nutrition routines, and preventive wellness practices across all demographic segments.

The segment provides essential consumption occasions through daily supplementation rituals, family wellness programs, and home-based health optimization supporting consistent product usage. The household segment particularly benefits from bulk purchasing patterns, subscription service adoption, and loyalty-driven repeat purchases that establish wheatgrass as essential household staples for health-conscious families.

The segment’s declining share through 2035 reflects diversification into commercial applications, though household consumption maintains the largest single segment position throughout the forecast period.

Success factors:

Daily ritual integration establishing consistent consumption patterns

Family wellness adoption driving household penetration and volume growth

Subscription models supporting predictable demand and customer retention

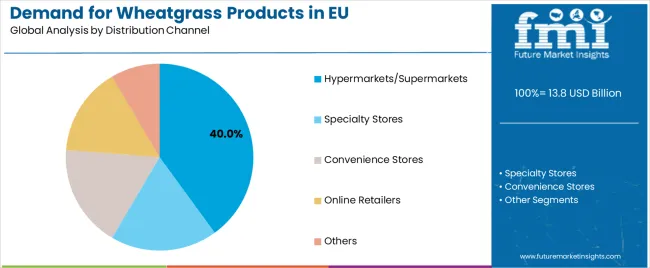

By Distribution Channel, Online Retailers Account for 40.0% Share

Online retail channels are strategically positioned to contribute 40.0% of total European sales in 2025, expanding dramatically to 50.0% by 2035, representing the critical importance of e-commerce for driving category accessibility and consumer education. European consumers consistently demonstrate growing preference for online purchasing that delivers convenience, price comparison capabilities, and access to premium international brands across specialized health platforms and mainstream e-commerce sites.

The segment provides essential advantages through comprehensive product selection, detailed nutritional information, customer reviews supporting purchase decisions, and subscription services enabling automatic replenishment. Major European e-commerce platforms, including Amazon, specialized health retailers, and direct-to-consumer brand websites, systematically expand wheatgrass selections, often featuring exclusive products, bulk purchasing options, and educational content that drives informed consumption.

The segment’s expanding share from 40.0% to 50.0% reflects fundamental channel shift toward digital commerce, with online becoming the dominant channel as younger demographics drive category growth throughout the forecast period.

Digital advantages:

Comprehensive selection enabling access to global premium brands

Information availability supporting educated purchase decisions

Subscription convenience driving customer lifetime value

What are the Drivers, Restraints, and Key Trends?

EU wheatgrass sales are advancing steadily due to increasing health consciousness, growing superfood awareness, and rising demand for preventive wellness solutions. The industry faces challenges, including taste barriers for new consumers unfamiliar with wheatgrass’s distinctive grassy flavor, premium pricing that limits mass market adoption, and quality variability concerns regarding nutritional consistency across different brands and production batches. Continued innovation in taste masking technologies and processing standardization remains central to industry development.

Expansion of Functional Food Integration

The rapidly accelerating integration of wheatgrass into functional food products is fundamentally transforming consumption from standalone supplementation to incorporated nutrition, enabling mainstream adoption through familiar food formats previously limited to traditional powder consumption. Advanced formulation platforms featuring wheatgrass in energy bars, breakfast cereals, smoothie mixes, and ready-to-drink beverages allow manufacturers to deliver superfood nutrition without taste compromise, creating accessible entry points for consumers hesitant about pure wheatgrass consumption. These product innovations prove particularly transformative for convenience-seeking consumers, including busy professionals, active families, and younger demographics, where familiar formats prove essential for category trial.

Major food manufacturers invest heavily in wheatgrass ingredient partnerships, taste optimization research, and product development for functional formulations, recognizing that integrated products represent breakthrough solutions for adoption barriers limiting category expansion. Manufacturers collaborate with flavor houses, food technologists, and nutritionists to develop scalable formulations that incorporate meaningful wheatgrass content while maintaining product appeal and sensory acceptability supporting mainstream positioning.

Growth of Premium Organic Certification

Modern wheatgrass producers systematically pursue premium organic certifications, including EU Organic, Demeter biodynamic standards, and specialized quality verifications that deliver transparency, traceability, and quality assurance exceeding basic organic requirements. Strategic certification positioning enables manufacturers to command premium pricing where certification directly determines purchasing behavior among discerning European consumers. These certification improvements prove essential for premium retail positioning, as quality-focused consumers demand verification beyond basic organic standards, including soil quality testing, heavy metal screening, and microbiological purity validation.

Companies implement extensive quality management systems, third-party certification programs, and blockchain traceability initiatives targeting supply chain transparency, including farm-level documentation, processing verification, and batch-specific testing results. Manufacturers leverage certification positioning in marketing communications, on-pack quality indicators featuring multiple certification logos, and educational messaging positioning certified wheatgrass as superior nutritional investments.

Innovation in Delivery Formats and Convenience Solutions

European consumers increasingly demand innovative wheatgrass delivery formats featuring convenient single-serve sachets, effervescent tablets, and liquid concentrates that eliminate preparation requirements while maintaining nutritional integrity. This format innovation trend enables manufacturers to expand consumption occasions through on-the-go convenience, travel-friendly packaging, and instant preparation supporting busy lifestyle integration. Format innovation proves particularly important for younger demographics where convenience determines category engagement and usage frequency.

The development of sophisticated processing technologies, including microencapsulation, freeze-drying optimization, and liquid standardization expands manufacturers’ abilities to create shelf-stable products delivering consistent dosing without refrigeration requirements. Brands collaborate with packaging specialists, preservation experts, and consumer researchers to develop formats balancing convenience with efficacy, supporting premium positioning and usage compliance while maintaining nutritional potency across extended shelf life.

Analyzing Demand for Wheatgrass Products in EU by Key Countries

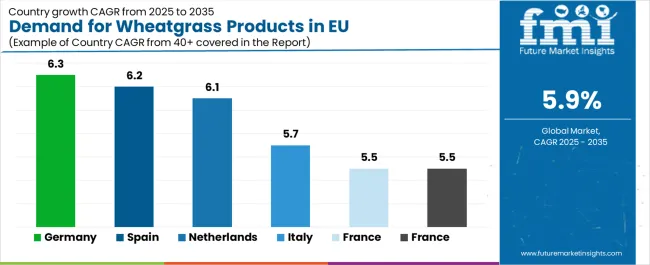

Country

CAGR % (2025–2035)

Germany

6.3%

France

5.5%

Italy

5.7%

Spain

6.2%

Netherlands

6.1%

Rest of Europe (EU)

5.5%

EU wheatgrass sales demonstrate synchronized growth across major European economies, with all markets expanding at 5.9% CAGR through 2035, driven by unified health consciousness trends and harmonized regulatory frameworks. Germany leads with USD 4,149.6 million in 2025, growing to USD 7,345.8 million by 2035. France maintains USD 2,766.4 million expanding to USD 4,897.2 million. Italy shows USD 1,936.5 million reaching USD 3,428.0 million. Spain records USD 1,383.2 million growing to USD 2,448.6 million. Netherlands demonstrates USD 829.9 million expanding to USD 1,469.2 million. Rest of Europe maintains USD 2,766.4 million reaching USD 4,897.2 million. Overall, sales show coordinated regional development reflecting EU-wide wellness trends toward superfood adoption and wheatgrass supplementation.

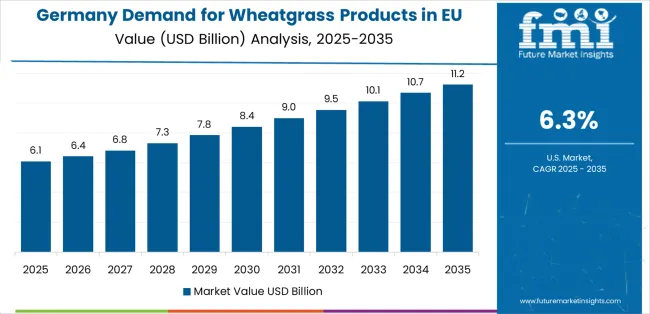

Germany Leads European Sales with Established Wellness Culture

Germany remains the largest European market for wheatgrass products, projected to reach USD 7,345.8 million by 2035, sustaining a dominant 30% share across the EU. The market expands at a 6.3% CAGR over 2025–2035, driven by an exceptionally strong wellness culture, naturopathic traditions, and widespread consumer commitment to preventive health. Germany’s premium organic retail infrastructure — with major players such as DM, Rossmann, Reformhaus, Alnatura, and Bio Company — dedicates substantial shelf space to wheatgrass and superfood supplements. High disposable income, trust in organic quality, and consumer familiarity with supplementation underpin consistent growth and adoption across all demographics.

Major retailers, including DM, Rossmann, Reformhaus, and specialized organic chains such as Alnatura and Bio Company, systematically expand wheatgrass selections, often dedicating significant shelf space to superfood supplements and positioning them prominently to encourage trial. German demand benefits from high disposable income supporting premium organic products, established naturopathic traditions embracing natural supplementation, and sophisticated consumer understanding of nutritional supplements that naturally supports wheatgrass adoption across mainstream demographics.

Growth drivers:

Established wellness culture normalizing daily supplementation practices

Strong organic retail presence with specialized chains driving premium availability

Health-conscious consumers prioritizing preventive nutrition and superfood benefits

France Demonstrates Strong Growth with Premium Positioning

France demonstrates steady expansion, reaching USD 4,897.2 million by 2035 at a 5.5% CAGR. The market is shaped by premium positioning, where consumers value purity, authenticity, and organic certification. National retailers such as Carrefour Bio, Naturalia, Biocoop, and La Vie Claire strengthen availability, while pharmacy distribution channels add credibility through healthcare professional endorsements. Urban consumers, especially younger demographics, are increasingly adopting global wellness trends, blending them with French expectations for quality and trust. France’s wheatgrass demand reflects its broader preference for premium, certified organic wellness solutions that align with lifestyle and dietary sophistication.

Major retailers, including Carrefour Bio, Naturalia, Biocoop, and La Vie Claire, establish comprehensive wheatgrass ranges serving continuously growing demand for superfood nutrition. French sales particularly benefit from pharmacy distribution channels where wheatgrass gains credibility through healthcare professional recommendations, supporting premium positioning and consumer trust. The market shows strong growth potential as younger urban demographics embrace global wellness trends while maintaining French quality expectations.

Success factors:

Premium quality focus aligning with French consumer expectations

Pharmacy channel credibility supporting professional recommendation

Urban wellness adoption driving superfood category growth

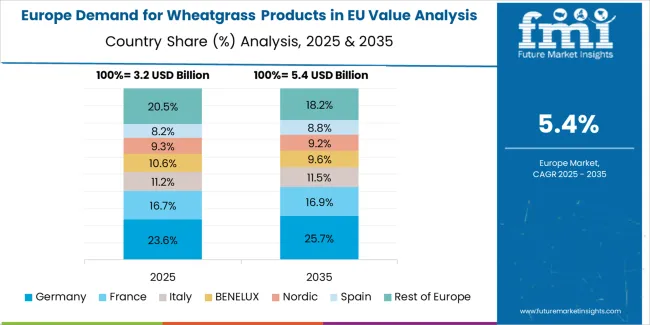

Europe Market Split by Country

EU wheatgrass sales are projected to grow from USD 13.8 billion in 2025 to USD 24.5 billion by 2035, registering a CAGR of 5.9% over the forecast period. All major markets demonstrate uniform growth at 5.9% CAGR, reflecting synchronized category development across European economies supported by common health trends, regulatory harmonization, and cross-border distribution networks.

Germany maintains the largest share at 30.0% in 2025, driven by established health supplement culture and strong organic market development. France follows with 20.0% share, while Italy represents 14.0%, Spain accounts for 10.0%, Netherlands holds 6.0%, and Rest of Europe comprises 20.0% of total EU demand.

Italy Maintains Above-Average Growth with Urban Health Focus

Revenue from wheatgrass products in Italy is growing at a robust CAGR of 5.7% to reach USD 3.4 billion by 2035, fundamentally driven by increasing health consciousness, progressive urban consumer segments, and rapid modernization of Italian dietary patterns incorporating superfood supplements. Italy’s traditionally Mediterranean diet is increasingly accommodating functional supplements as consumers recognize concentrated nutrition benefits beyond traditional food sources.

Major retailers, including Esselunga, NaturaSì, Conad, and Carrefour Italia, strategically invest in wheatgrass category expansion with dedicated health supplement sections addressing growing wellness interest. Italian sales particularly benefit from younger demographic adoption in Milan, Rome, and Turin, where urban professionals drive premium organic demand. The market demonstrates above-average growth potential as wellness trends accelerate across broader population segments.

Development factors:

Urban wellness acceleration driving faster category adoption

Younger demographics embracing international superfood trends

Premium organic positioning supporting value growth

Spain Shows Strong Expansion with Rapid Market Development

Demand for wheatgrass products in Spain is projected to grow at an impressive CAGR of 6.2%, reaching USD 2,548.6 million by 2035, substantially supported by rapidly evolving health consciousness among Spanish consumers and accelerating adoption of functional nutrition. Spanish consumer transformation toward preventive health positions wheatgrass as aligned with dietary modernization and wellness lifestyle adoption.

Major retailers, including Mercadona, Carrefour España, and specialized health stores like Herbolario Navarro, systematically expand wheatgrass offerings with growing shelf prominence. Spain’s dynamic growth reflects catching-up effects as the market transitions from early adoption to mainstream acceptance. The pharmacy channel shows particular promise, with increasing parafarmacias offering premium superfood supplements to health-conscious consumers.

Growth accelerators:

Rapid health consciousness evolution driving category discovery

Retail expansion supporting improved product accessibility

Catching-up growth from lower penetration base

Netherlands Leads Growth with Innovation Excellence

Demand for wheatgrass products in the Netherlands is expanding at a leading CAGR of 6.1% to reach USD 1,569.2 million by 2035, fundamentally driven by exceptionally progressive wellness culture, leadership in sustainable nutrition adoption, and sophisticated consumer base embracing nutritional innovation. Dutch consumers demonstrate particularly high receptivity to scientific health messaging and willingness to invest in premium wellness products.

Netherlands sales significantly benefit from advanced retail sophistication, with Albert Heijn’s extensive wellness sections, specialized stores like Holland & Barrett, and innovative startups testing cutting-edge superfood formats. The country serves as European innovation hub where successful product launches expand across broader markets. Small market size enables rapid penetration growth, while high per-capita spending supports premium positioning.

Innovation catalysts:

Innovation leadership positioning Netherlands as trend-setting market

Sophisticated consumers driving premium product adoption

High wellness investment supporting category value growth

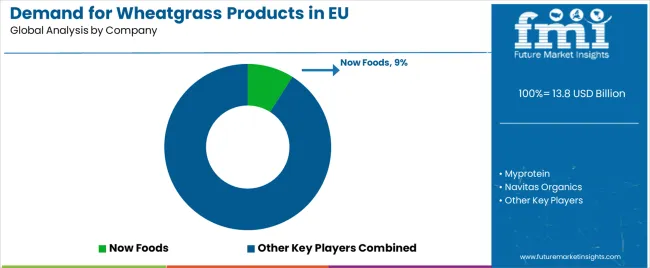

Competitive Landscape

EU wheatgrass sales are defined by competition among specialized superfood brands, health supplement companies, and organic food producers. Companies are investing in organic certification, processing technology optimization, quality standardization, and supply chain integration to deliver premium, consistent, and traceable wheatgrass solutions. Strategic partnerships with organic farms, distribution expansion initiatives, and marketing campaigns emphasizing scientific validation and quality superiority are central to strengthening competitive position.

Major participants include Now Foods with an estimated 9.0% share, leveraging its broad European distribution network, extensive supplement expertise, and established retail presence across health stores and pharmacies. Now Foods benefits from comprehensive product portfolio enabling cross-selling, technical quality capabilities, and ability to deliver consistent supply supporting retail confidence and consumer trust.

Myprotein holds approximately 6.0% share, emphasizing sports nutrition positioning, e-commerce distribution strength, and younger demographic appeal through digital marketing. Myprotein’s success in positioning wheatgrass as sports recovery and performance nutrition creates differentiated positioning and consumer loyalty, supported by influencer partnerships and subscription models.

Navitas Organics accounts for roughly 5.0% share through its premium organic positioning, superfood specialization, and strong e-commerce presence across European markets. The company benefits from authenticity credentials, sustainable sourcing stories, and comprehensive organic portfolio helping consumers discover wheatgrass within broader superfood adoption.

Girmes Wheatgrass represents approximately 3.5% share, supporting growth through German production capabilities, local cultivation advantages, and quality positioning as European-grown wheatgrass. Girmes leverages proximity benefits, freshness claims, and reduced carbon footprint, attracting environmentally conscious consumers seeking locally sourced superfoods.

Amazing Grass holds roughly 3.0% share through direct-to-consumer strength, retail partnerships, and brand recognition from North American success expanding into Europe. The company emphasizes taste innovation, convenient formats, and lifestyle marketing resonating with mainstream consumers seeking accessible superfood nutrition.

Other companies collectively hold 73.5% share, reflecting the fragmented nature of European wheatgrass sales, where numerous specialized brands, regional producers, private-label suppliers, and emerging startups serve specific consumer preferences, local markets, and niche applications. This competitive environment provides opportunities for differentiation through cultivation methods, processing innovations, certification standards, and targeted positioning resonating with diverse European consumer segments.

Key Players

Now Foods

Myprotein

Navitas Organics

Girmes Wheatgrass

Amazing Grass

Pukka Herbs

Naturya

Starwest Botanicals

Green Foods Corporation

Terrasoul Superfoods

Others

Scope of the Report

Item

Value

Quantitative Units

USD 24.5 billion

Product Type

Powder, Juice

Nature

Organic, Natural

Application (End-Use)

Food & Beverages, Nutraceuticals, Personal Care & Cosmetics, Pharmaceuticals, Pet Food, Household

Distribution Channel

Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Online Retailers, Others

Countries Covered

Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe

Key Companies Profiled

Now Foods, Myprotein, Navitas Organics, Girmes Wheatgrass, Amazing Grass

Additional Attributes

Dollar sales by product type, nature, application, and distribution channel; regional demand trends across major European economies; competitive landscape analysis with specialized superfood brands and supplement companies; consumer preferences for organic certification and quality standards; integration with functional food development and delivery format innovation; innovations in processing technology and taste optimization; adoption across retail and e-commerce channels; regulatory framework analysis for superfood labeling and nutritional claims; supply chain strategies including organic farming partnerships; and penetration analysis for mainstream and health-conscious European consumers.