Di-n-octyl Sulfide Market Size and Share Forecast Outlook 2025 to 2035

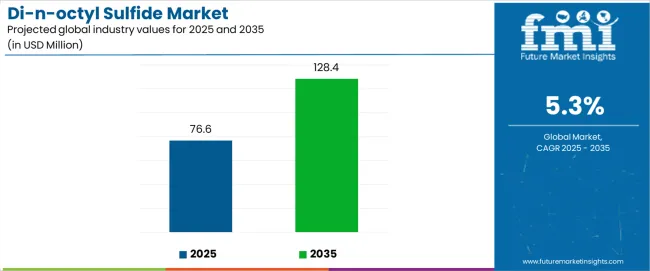

The global di-n-octyl sulfide market, valued at USD 76.6 million in 2025, is projected to reach USD 128.4 million by 2035, expanding at a CAGR of 5.3% and adding USD 51.8 million in absolute value over the forecast horizon. A year-on-year (YoY) analysis highlights a steady and incremental growth pattern, consistent with its role as a niche yet essential chemical intermediate. From 2025 to 2026, the di-n-octyl sulfide market is expected to cross the USD 80 million threshold, marking the beginning of a growth cycle powered by pharmaceutical and specialty chemical applications. By 2027, as demand strengthens in high-purity synthesis for catalytic processes and industrial formulations, YoY expansion is expected to consolidate around the 5% mark. This moderate pace indicates stability rather than sharp volatility, suggesting that consumption is linked more to ongoing structural trends in advanced materials and synthesis techniques than to cyclical fluctuations.

Moving into the 2028–2030 period, the di-n-octyl sulfide market is anticipated to accelerate marginally, reaching approximately USD 100 million by the end of the decade. YoY growth during these years is expected to stabilize in the 5.3% to 5.5% range, reinforced by the broader adoption of sulfur-based intermediates in pharmaceutical manufacturing and chemical R&D initiatives. Increasing reliance on di-n-octyl sulfide in precision applications contributes to predictable demand, with industrial processing facilities incorporating these compounds into upgraded formulations. The turn of the decade signals a significant milestone, as growth during this stage represents close to 45% of the decade’s absolute market expansion, demonstrating how early momentum creates the base for long-term scale.

Between 2031 and 2035, the YoY trajectory continues its steady climb, with the di-n-octyl sulfide market expected to add roughly USD 28.4 million in the latter half of the period. Growth rates hover around the CAGR average, ensuring a consistent climb toward the USD 128.4 million mark by 2035. This phase is marked by wider adoption in high-value synthesis, increased penetration into specialty chemical markets, and enhanced regulatory approvals that validate its use in pharmaceutical-grade applications. Efficiency gains in production processes also allow suppliers to maintain competitive pricing, supporting broader accessibility across regions. The YoY expansion in this period underscores the resilience of the market, as it maintains demand despite possible macroeconomic pressures or shifts in raw material costs.

Quick Stats for Di-n-octyl Sulfide Market

di-n-octyl Sulfide Market Value (2025): USD 76.6 million

di-n-octyl Sulfide Market Forecast Value (2035): USD 128.4 million

di-n-octyl Sulfide Market Forecast CAGR: 5.30%

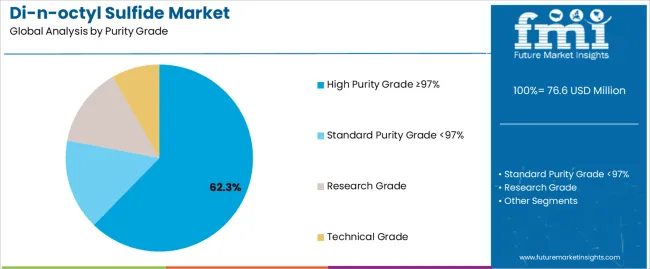

Leading Product Category in Di-n-octyl Sulfide Market: High Purity Grade ≥97% (62.3%)

Key Growth Regions in Di-n-octyl Sulfide Market: Asia Pacific, North America, Europe

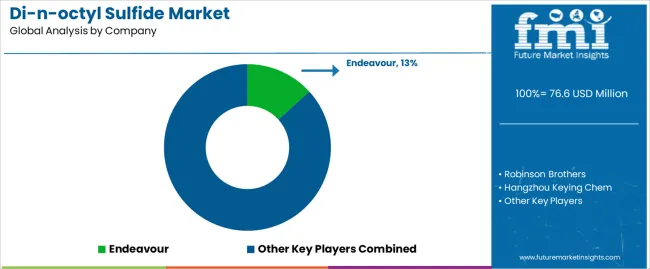

Key Players in Di-n-octyl Sulfide Market: Endeavour, Robinson Brothers, Hangzhou Keying Chem

Between 2025 and 2030, the Di-n-octyl sulfide market is projected to expand from USD 76.6 million to USD 98.7 million, resulting in a value increase of USD 22.1 million, which represents 42.7% of the total forecast growth for the decade. This phase of development will be shaped by increasing demand for pharmaceutical intermediates, rising chemical processing activity enabling advanced synthesis techniques, and growing availability of high-purity chemical compounds across research laboratories and industrial manufacturing facilities.

Between 2030 and 2035, the di-n-octyl sulfide market is forecast to grow from USD 98.7 million to USD 128.4 million, adding another USD 29.7 million, which constitutes 57.3% of the overall ten-year expansion. This period is expected to be characterized by the advancement of specialized synthesis processes, the integration of quality control systems for chemical purity verification, and the development of premium chemical grades across diverse pharmaceutical applications. The growing emphasis on process optimization and chemical waste reduction will drive demand for advanced chemical varieties with enhanced purity characteristics, improved stability profiles, and superior performance attributes.

Between 2020 and 2024, the Di-n-octyl sulfide market experienced steady growth, driven by increasing pharmaceutical research activity and growing recognition of sulfur compounds’ effectiveness in delivering consistent chemical synthesis outcomes across medicinal chemistry and industrial processing applications. The di-n-octyl sulfide market developed as chemical manufacturers recognized the potential for specialized sulfur compounds to deliver operational efficiency while meeting modern requirements for chemical purity and high-quality synthesis operations. Technological advancement in chemical purification and synthesis design began emphasizing the critical importance of maintaining chemical consistency while enhancing process reliability and improving material utilization rates.

di-n-octyl Sulfide Market Key Takeaways

Metric

Value

Estimated Value in (2025E)

USD 76.6 million

Forecast Value in (2035F)

USD 128.4 million

Forecast CAGR (2025 to 2035)

5.30%

From 2030 to 2035, the di-n-octyl sulfide market is forecast to grow from USD 98.7 million to USD 128.4 million, adding another USD 29.7 million, which constitutes 57.3% of the overall ten-year expansion. This period is expected to be characterized by the advancement of digital quality monitoring systems, the integration of automated purification processes for manufacturing efficiency, and the development of specialized chemical grades for enhanced synthesis applications. The growing emphasis on chemical traceability and operational precision will drive demand for premium varieties with enhanced analytical credentials, improved compatibility options, and superior functionality characteristics.

Between 2020 and 2024, the Di-n-octyl sulfide market experienced robust growth, driven by increasing awareness of chemical synthesis benefits and growing recognition of sulfur compounds’ effectiveness in supporting efficient research operations across pharmaceutical laboratories and specialty chemical manufacturing services. The di-n-octyl sulfide market developed as users recognized the potential for specialized chemicals to deliver productivity advantages while meeting modern requirements for consistent synthesis quality and reliable process performance. Technological advancement in chemical manufacturing processes and quality assurance systems began emphasizing the critical importance of maintaining purity standards while extending chemical shelf life and improving customer satisfaction across diverse synthesis applications.

Why is the Di-n-octyl Sulfide Market Growing?

Market expansion is being supported by the increasing global demand for specialized chemical intermediates and the corresponding shift toward high-performance sulfur compounds that can provide superior operational characteristics while meeting user requirements for chemical purity and cost-effective synthesis processes. Modern pharmaceutical researchers are increasingly focused on incorporating chemical systems that can enhance synthesis efficiency while satisfying demands for consistent, precisely controlled reaction outcomes and optimized material consumption practices. Di-n-octyl sulfide’s proven ability to deliver synthesis efficiency, process reliability, and diverse application possibilities makes it an essential component for pharmaceutical researchers and quality-conscious chemical professionals.

The growing emphasis on precision synthesis and process optimization is driving demand for high-performance chemical systems that can support distinctive synthesis outcomes and comprehensive process protection across pharmaceutical research, industrial processing, and specialty chemical applications. User preference for chemicals that combine functional excellence with operational flexibility is creating opportunities for innovative implementations in both traditional and emerging synthesis applications. The rising influence of automated synthesis processes and advanced chemical technologies is also contributing to increased adoption of specialized chemicals that can provide authentic performance benefits and reliable operational characteristics.

Segmental Analysis

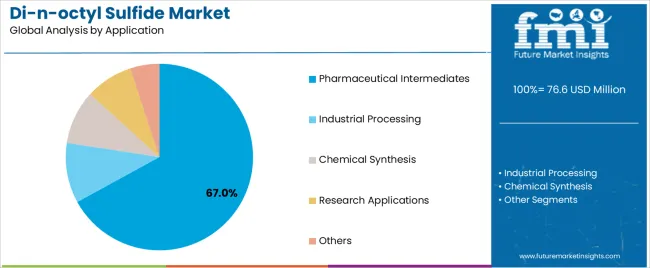

The di-n-octyl sulfide market is segmented by purity grade, application, synthesis method, end-user industry, and region. By purity grade, the di-n-octyl sulfide market is divided into high purity grade ≥97%, standard purity grade <97%, research grade, and technical grade. Based on application, the di-n-octyl sulfide market is categorized into pharmaceutical intermediates, industrial processing, chemical synthesis, research applications, and others. By synthesis method, the di-n-octyl sulfide market includes direct synthesis, catalytic synthesis, and modified synthesis processes. By end-user industry, the di-n-octyl sulfide market encompasses pharmaceutical companies, chemical manufacturers, research institutions, and specialty chemical producers. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and other regions.

By Purity Grade, the High Purity Grade ≥97% Segment Accounts for 62.3% Market Share

The high purity grade ≥97% segment is projected to account for 62.3% of the Di-n-octyl sulfide market in 2025, reaffirming its position as the leading purity category. Pharmaceutical researchers and chemical professionals increasingly utilize high purity grade chemicals for their superior quality characteristics, established reliability standards, and essential functionality in diverse synthesis applications across multiple project types. High purity grade chemicals’ proven performance characteristics and established cost-effectiveness directly address user requirements for reliable synthesis operations and optimal chemical precision in pharmaceutical applications.

This purity segment forms the foundation of modern chemical synthesis performance patterns, as it represents the chemical category with the greatest operational impact potential and established compatibility across multiple synthesis systems. Business investments in advanced purification technology and quality optimization continue to strengthen adoption among quality-conscious researchers. With users prioritizing synthesis consistency and chemical reliability, high purity grade chemicals align with both productivity objectives and quality requirements, making them the central component of comprehensive synthesis strategies.

By Application, Pharmaceutical Segment Shows Strong Market Dominance

Pharmaceutical applications are projected to represent 67.0% of the Di-n-octyl sulfide market in 2025, underscoring their critical role as the primary application for quality-focused researchers seeking superior synthesis efficiency benefits and enhanced research completion credentials. Pharmaceutical researchers and chemical professionals prefer pharmaceutical applications for their established research volumes, proven market demand, and ability to maintain exceptional synthesis quality while supporting versatile chemical requirements during diverse research projects. Positioned as essential applications for performance-conscious researchers, pharmaceutical offerings provide both operational excellence and competitive positioning advantages.

The segment is supported by continuous improvement in synthesis technology and the widespread availability of established research standards that enable quality assurance and premium positioning at the pharmaceutical level. Pharmaceutical companies are optimizing chemical selections to support research differentiation and competitive development strategies. As synthesis technology continues to advance and researchers seek efficient synthesis methods, pharmaceutical applications will continue to drive market growth while supporting business development and research satisfaction strategies.

What are the Drivers, Restraints, and Key Trends of the Di-n-octyl Sulfide Market?

The Di-n-octyl sulfide market is advancing rapidly due to increasing chemical synthesis consciousness and growing need for precision chemical solutions that emphasize superior performance outcomes across pharmaceutical segments and industrial applications. The di-n-octyl sulfide market faces challenges, including competition from alternative chemical intermediates, synthesis process complexities, and chemical cost pressures affecting operational economics. Innovation in analytical monitoring integration and advanced purification methods continues to influence market development and expansion patterns.

Expansion of Pharmaceutical and Research Applications

The growing adoption of Di-n-octyl sulfide in pharmaceutical research and chemical development is enabling researchers to develop synthesis strategies that provide distinctive efficiency benefits while commanding competitive positioning and enhanced research completion characteristics. Pharmaceutical applications provide superior synthesis consistency while allowing more sophisticated quality control features across various research categories. Users are increasingly recognizing the operational advantages of chemical positioning for premium synthesis outcomes and efficiency-conscious research integration.

Integration of Digital Monitoring and Quality Control Systems

Modern Di-n-octyl sulfide manufacturers are incorporating advanced analytical technologies, digital purity control systems, and automated quality tracking to enhance operational precision, improve chemical stability, and meet commercial demands for intelligent chemical solutions. These systems improve operational effectiveness while enabling new applications, including predictive quality programs and performance optimization protocols. Advanced monitoring integration also allows researchers to support productivity leadership positioning and quality assurance beyond traditional synthesis operations.

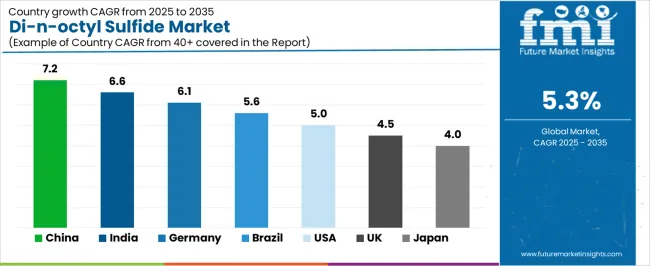

Analysis of the Di-n-octyl Sulfide Market by Key Country

Country

CAGR (2025-2035)

China

7.2%

India

6.6%

Germany

6.1%

Brazil

5.6%

USA

5.0%

UK

4.5%

Japan

4.0%

The Di-n-octyl sulfide market is experiencing robust growth globally, with China leading at a 7.2% CAGR through 2035, driven by the expanding pharmaceutical industry, growing chemical manufacturing requirements, and increasing adoption of specialized synthesis systems. India follows at 6.6%, supported by rising research development, expanding chemical sector, and growing acceptance of efficient synthesis solutions. Germany shows growth at 6.1%, emphasizing established chemical capabilities and comprehensive synthesis technology development. Brazil records 5.6%, focusing on pharmaceutical expansion and chemical processing growth. The USA demonstrates 5.0% growth, prioritizing advanced synthesis technologies and process optimization.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

China Leads Global Market Growth with Chemical Industry Expansion

Revenue from Di-n-octyl sulfide consumption and sales in China is projected to exhibit exceptional growth with a CAGR of 7.2% through 2035, driven by the country’s rapidly expanding pharmaceutical sector, favorable government policies toward chemical development, and initiatives promoting advanced synthesis technologies across major industrial regions. China’s position as a leading chemical manufacturing hub and increasing focus on specialized chemical systems are creating substantial demand for high-quality Di-n-octyl sulfide in both domestic and export markets. Major pharmaceutical companies and chemical manufacturers are establishing comprehensive synthesis capabilities to serve growing demand and emerging market opportunities.

Established chemical manufacturing culture and expanding pharmaceutical practices are driving demand for Di-n-octyl sulfide across research projects, industrial facilities, and comprehensive synthesis systems throughout Chinese pharmaceutical markets.

Strong manufacturing infrastructure and technology adoption initiatives are supporting the rapid adoption of premium Di-n-octyl sulfide among quality-conscious researchers seeking to meet evolving performance standards and efficiency requirements.

India Demonstrates Strong Market Potential with Pharmaceutical Focus

Revenue from Di-n-octyl sulfide products in India is expanding at a CAGR of 6.6%, supported by rising pharmaceutical investment, growing chemical development, and expanding research capabilities. The country’s developing pharmaceutical sector and increasing commercial investment in advanced synthesis technologies are driving demand for Di-n-octyl sulfide across both traditional and modern synthesis applications. International chemical companies and domestic distributors are establishing comprehensive operational networks to address growing market demand for quality chemicals and efficient synthesis solutions.

Rising pharmaceutical investment and expanding research activity are creating opportunities for Di-n-octyl sulfide adoption across manufacturing operations, modern research projects, and chemical companies throughout major Indian pharmaceutical regions.

Growing pharmaceutical development initiatives and synthesis technology advancement are driving the adoption of chemical products and services among domestic researchers seeking to enhance their operational capabilities and meet increasing efficiency demand.

Germany Maintains Market Leadership with Technical Excellence

Revenue from Di-n-octyl sulfide products in Germany is projected to grow at a CAGR of 6.1% through 2035, supported by the country’s mature chemical sector, established synthesis standards, and leadership in chemical technology. Germany’s sophisticated pharmaceutical infrastructure and strong support for advanced synthesis systems are creating steady demand for both traditional and innovative chemical varieties. Leading chemical manufacturers and specialty distributors are establishing comprehensive operational strategies to serve both domestic markets and growing export opportunities.

Advanced chemical capabilities and established pharmaceutical markets are driving demand for premium Di-n-octyl sulfide across pharmaceutical facilities, specialty researchers, and comprehensive chemical companies seeking superior functionality profiles and technical innovation.

Strong technical excellence culture and commercial leadership are supporting the adoption of innovative chemicals among users prioritizing chemical reliability and operational efficiency in synthesis applications.

Brazil Strengthens Position with Pharmaceutical Growth

Revenue from Di-n-octyl sulfide products in Brazil is projected to grow at a CAGR of 5.6% through 2035, driven by the country’s emphasis on pharmaceutical expansion, chemical development, and growing research capabilities. Brazilian researchers and pharmaceutical companies consistently seek commercial-grade chemicals that enhance synthesis efficiency and support operational excellence for both traditional and modern synthesis applications. The country’s position as a Latin American pharmaceutical leader continues to drive innovation in specialized chemical applications and commercial synthesis standards.

Expanding pharmaceutical culture and growing chemical markets are driving demand for commercial Di-n-octyl sulfide across research facilities, synthesis providers, and pharmaceutical-focused outlets seeking superior performance and distinctive synthesis profiles.

Increasing focus on synthesis efficiency and commercial chemical systems is supporting the adoption of specialty chemical varieties among researchers and distributors seeking authentic Brazilian pharmaceutical products in regional markets with established quality expertise.

USA Anchors Growth with Technology Integration

Revenue from Di-n-octyl sulfide products in the USA is projected to grow at a CAGR of 5.0% through 2035, supported by the country’s emphasis on synthesis technology advancement, process optimization, and advanced automation integration requiring efficient chemical solutions. American researchers and pharmaceutical users prioritize performance reliability and operational precision, making specialized chemicals essential components for both traditional and modern synthesis applications. The country’s comprehensive technology leadership and advancing synthesis patterns support continued market expansion.

Advanced technology capabilities and growing precision synthesis are driving demand for Di-n-octyl sulfide across specialty applications, modern pharmaceutical formats, and technology-integrated synthesis programs serving domestic markets with increasing functionality requirements.

Strong focus on operational optimization and performance excellence is encouraging researchers and distributors to adopt chemical solutions that support efficiency objectives and meet American quality standards for synthesis applications.

UK Maintains Steady Growth with Quality Focus

Revenue from Di-n-octyl sulfide products in the UK is projected to grow at a CAGR of 4.5% through 2035, supported by established synthesis standards, mature pharmaceutical markets, and emphasis on chemical reliability across commercial and research sectors. British researchers and chemical professionals prioritize quality performance and operational consistency, creating steady demand for premium chemical solutions. The country’s comprehensive market maturity and established synthesis practices support continued development in specialized applications.

Established pharmaceutical markets and mature chemical industry are driving demand for quality Di-n-octyl sulfide across research projects, synthesis operations, and professional chemical companies throughout British pharmaceutical regions.

Strong emphasis on quality standards and operational reliability is supporting the adoption of premium chemical varieties among researchers seeking proven performance and established quality credentials in synthesis applications.

Japan Demonstrates Precision-Focused Growth

Revenue from Di-n-octyl sulfide products in Japan is projected to grow at a CAGR of 4.0% through 2035, supported by the country’s emphasis on precision manufacturing, quality excellence, and advanced technology integration requiring efficient chemical solutions. Japanese businesses and pharmaceutical users prioritize technical performance and manufacturing precision, making specialized chemicals essential components for both traditional and modern synthesis applications. The country’s comprehensive quality leadership and advancing synthesis patterns support continued market expansion.

Advanced manufacturing technology capabilities and growing precision synthesis applications are driving demand for Di-n-octyl sulfide across specialty pharmaceutical applications, modern research formats, and technology-integrated synthesis programs serving domestic markets with increasing quality requirements.

Strong focus on technical precision and manufacturing excellence is encouraging businesses and distributors to adopt chemical solutions that support quality objectives and meet Japanese precision standards for synthesis applications.

Europe Market Split by Country

The Europe Di-n-octyl sulfide market is projected to grow from USD 19.2 million in 2025 to USD 31.8 million by 2035, recording a CAGR of 5.1% over the forecast period. Germany leads the region with a 31.8% share in 2025, moderating slightly to 31.5% by 2035, supported by its strong chemical base and demand for premium, technically advanced synthesis chemical compounds. The United Kingdom follows with 23.4% in 2025, easing to 23.0% by 2035, driven by a mature pharmaceutical market and emphasis on chemical reliability and performance optimization. France accounts for 17.2% in 2025, rising to 17.6% by 2035, reflecting steady adoption of automated synthesis solutions and operational efficiency enhancement. Italy holds 13.6% in 2025, expanding to 14.2% by 2035 as pharmaceutical research and specialty synthesis applications grow. Spain contributes 7.3% in 2025, growing to 7.6% by 2035, supported by expanding pharmaceutical sector and process modernization. The Nordic countries rise from 4.2% in 2025 to 4.5% by 2035 on the back of strong technology adoption and advanced synthesis methodologies. BENELUX remains at 2.5% share across both 2025 and 2035, reflecting mature, efficiency-focused pharmaceutical markets.

Competitive Landscape of the Di-n-octyl Sulfide Market

The Di-n-octyl sulfide market is characterized by competition among established chemical manufacturers, specialized synthesis producers, and integrated pharmaceutical solution companies. Companies are investing in precision manufacturing technologies, advanced purification systems, product innovation capabilities, and comprehensive distribution networks to deliver consistent, high-quality, and reliable Di-n-octyl sulfide systems. Innovation in purity enhancement, compatibility optimization, and application-specific product development is central to strengthening market position and customer satisfaction.

Endeavour leads the di-n-octyl sulfide market with a strong focus on chemical synthesis innovation and comprehensive Di-n-octyl sulfide solutions, offering commercial chemical systems with emphasis on manufacturing excellence and technological heritage. Robinson Brothers provides specialized synthesis chemicals with a focus on pharmaceutical market applications and performance engineering networks. Hangzhou Keying Chem delivers integrated chemical solutions with a focus on research positioning and operational efficiency.

Global Di-n-octyl Sulfide Market — Stakeholder Contribution Framework

The success of Di-n-octyl sulfide in meeting commercial synthesis demands, research-driven efficiency requirements, and performance integration will not only enhance synthesis quality outcomes but also strengthen global chemical manufacturing capabilities. It will consolidate emerging regions’ positions as hubs for efficient chemical production and align advanced economies with commercial synthesis systems. This calls for a concerted effort by all stakeholders — governments, industry bodies, manufacturers, distributors, and investors. Each can be a crucial enabler in preparing the di-n-octyl sulfide market for its next phase of growth.

How Governments Could Spur Local Production and Adoption?

Targeted Incentives: Introduce manufacturing modernization subsidies for companies adopting advanced Di-n-octyl sulfide production technologies in chemical manufacturing and pharmaceutical regions, and production-linked incentives for facilities producing chemicals for domestic consumption and export markets.

Trade Agreements: Accelerate export growth through bilateral and multilateral agreements that classify Di-n-octyl sulfide under “precision chemical intermediates,” easing cross-border regulatory approvals and technical certifications.

Facilitate Innovation: Establish Centers of Excellence for synthesis technology innovation and chemical engineering. Fund R&D into efficient manufacturing systems, purification optimization, and quality-standard integration for commercial synthesis operations.

How Industry Bodies Could Support Market Development?

Foster Connectivity: Constitute a global Di-n-octyl sulfide consortium linking chemical manufacturers, pharmaceutical suppliers, researchers, and policymakers to align production targets with quality and performance commitments.

Promote Exports: Work with export councils to brand Di-n-octyl sulfide as premium, technically engineered chemical solutions. Facilitate trade fairs to connect chemical innovators with global buyers in pharmaceutical, research, and industrial sectors.

Upskilling Programs: Develop curricula on advanced chemical manufacturing, purification selection, quality control processes, and performance optimization to prepare manufacturers and operators for premium market opportunities.

How Distributors and Chemical Industry Players Could Strengthen the Ecosystem?

Drive Integration: Bundle Di-n-octyl sulfide with performance-focused marketing and efficiency messaging systems. Position precision chemicals as part of holistic “synthesis optimization solutions.”

Forge Partnerships: Collaborate with chemical manufacturers and technology providers for joint R&D on chemical applications, performance enhancement initiatives, and global quality assurance for premium markets.

How Manufacturers Could Navigate the Shift?

Capture Premium Markets: Leverage government incentives and rising efficiency demand to offer Di-n-octyl sulfide into growth markets where alternative chemicals face performance and reliability challenges.

Invest in Technology: Partner with technology providers to advance efficient manufacturing workflows, commercial-grade quality, and advanced production practices.

Build Capabilities: Train technical staff and quality specialists to demonstrate Di-n-octyl sulfide’s performance advantages, repositioning commercial relationships toward long-term supply partnerships.

Key Players in the Di-n-octyl Sulfide Market

Endeavour

Robinson Brothers

Hangzhou Keying Chem

Arkema Group

Chevron Phillips Chemical

Tokyo Chemical Industry

sigma-Aldrich (Merck KGaA)

TCI Chemicals

Alfa Aesar (Thermo Fisher Scientific)

Acros Organics

Fisher Scientific

Oakwood Products

Matrix Scientific

ChemBridge Corporation

AK Scientific

Scope of the Report

Items

Values

Quantitative Units (2025)

USD 76.6 Million

Purity Grade

High Purity Grade ≥97%, Standard Purity Grade <97%, Research Grade, Technical Grade

Application

Pharmaceutical Intermediates, Industrial Processing, Chemical Synthesis, Research Applications, Others

Synthesis Method

Direct Synthesis, Catalytic Synthesis, Modified Synthesis Processes

End-User Industry

Pharmaceutical Companies, Chemical Manufacturers, Research Institutions, Specialty Chemical Producers

Regions Covered

North America, Europe, Asia Pacific, Latin America, Middle East & Africa, Other Regions

Countries Covered

China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries

Key Companies Profiled

Endeavour, Robinson Brothers, Hangzhou Keying Chem, and other leading Di-n-octyl sulfide companies

Additional Attributes

Dollar sales by purity grade, application, synthesis method, end-user industry, and region; regional demand trends, competitive landscape, technological advancements in chemical engineering, precision manufacturing initiatives, purification enhancement programs, and premium product development strategies

di-n-octyl Sulfide Market by Segments Purity Grade:

High Purity Grade ≥97%

Standard Purity Grade <97%

Research Grade

Technical Grade

Application:

Pharmaceutical Intermediates

Industrial Processing

Chemical Synthesis

Research Applications

Others

Synthesis Method:

Direct Synthesis

Catalytic Synthesis

Modified Synthesis Processes

End-User Industry:

Pharmaceutical Companies

Chemical Manufacturers

Research Institutions

Specialty Chemical Producers

Region:

North America

United States

Canada

Mexico

Europe

Germany

United Kingdom

France

Italy

Spain

Nordic Countries

BENELUX

Rest of Europe

Asia Pacific

China

India

Japan

South Korea

Australia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

Kingdom of Saudi Arabia

United Arab Emirates

South Africa

Rest of Middle East & Africa

Other Regions

Oceania

Central Asia

Other Markets

Frequently Asked Questions

How big is the Di-n-octyl sulfide market in 2025?

The global Di-n-octyl sulfide market is estimated to be valued at USD 76.6 million in 2025.

What will be the size of Di-n-octyl sulfide market in 2035?

The market size for the Di-n-octyl sulfide market is projected to reach USD 128.4 million by 2035.

How much will be the Di-n-octyl sulfide market growth between 2025 and 2035?

The Di-n-octyl sulfide market is expected to grow at a 5.3% CAGR between 2025 and 2035.

What are the key product types in the Di-n-octyl sulfide market?

The key product types in Di-n-octyl sulfide market are high purity grade ≥97% , standard purity grade <97%, research grade and technical grade.

Which application segment to contribute significant share in the Di-n-octyl sulfide market in 2025?

In terms of application, pharmaceutical intermediates segment to command 67.0% share in the Di-n-octyl sulfide market in 2025.