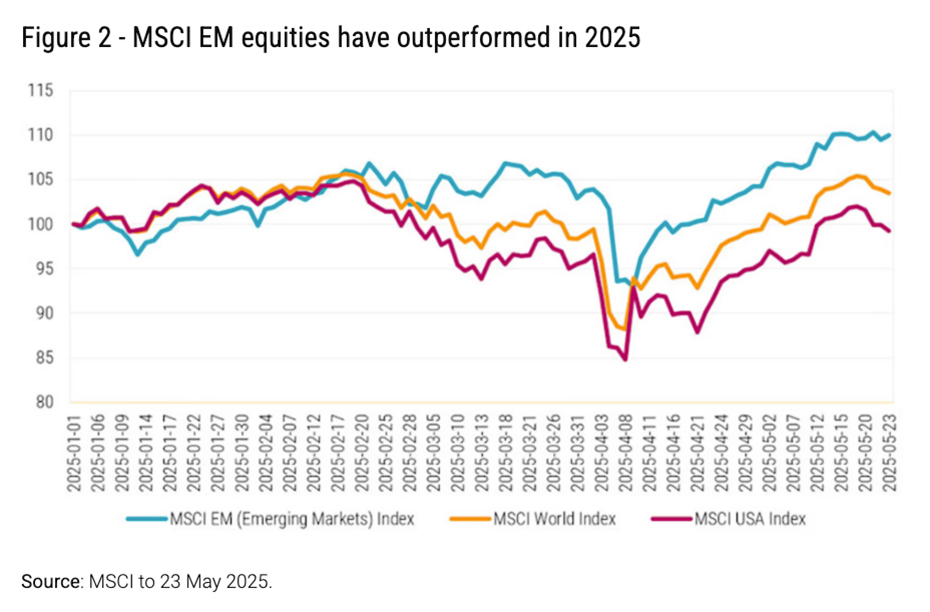

Emerging market equities and debt have bested their developed market counterparts this year, as structural shifts have tilted in these regions’ favor.

These countries, on the whole, have seen lower inflation, enjoyed appreciating currencies, and benefitted from both a weaker dollar and their domestic interest rate easing cycles, which began well more than a year before those in many developed markets.

The MSCI Emerging Markets Index, which tracks large- and mid-cap stock performance across 24 emerging markets’ countries, is up 29.80% year to date, as of the end of September. The S&P 500, meanwhile, rose about 14.65% during the same period, and the STOXX Europe 600 rose about 11.9%.

“EM has been outperforming this year—finally, right? Because it’s been a very long winter,” says Guilherme Riveiro do Valle, a founding partner of and a portfolio manager at ABS Global Investments who notes that since 2009, the EM trade has not been a good one—until now.

Want the latest institutional investment industry news and insights? Sign up for CIO newsletters.

“Most of the money has been concentrated in developed markets, especially in the U.S.,” do Valle says. “And for a good reason, right? I think the main reason that happened is because you had [quantitative easing], you had very loose monetary policies across the U.S., Europe, Japan, providing a lot of liquidity. That same thing did not happen across most emerging markets, not because they didn’t want to do it, but because they could not do it.”

Asset manager Robeco, in a June report, noted that emerging markets are now in a cyclically strong position—these markets having recovered from post-COVID defaults, something which Robeco noted is still a challenge in developed market credit.

In the fixed-income markets, EM corporates have also outperformed U.S. high-yield and global investment grade credit, according to Robeco. Eastspring Investments also noted in a report that EM hard currency yields have remained higher than their historical averages, while offering more attractive yields to other global fixed-income segments—the manager also predicted EM spreads will remain relatively stable, as this sector has a more resilient economic outlook.

The report also noted that EM equities, even with their outperformance, are relatively cheap—trading at 14 times forward earnings—roughly 30% cheaper than developed market equities and 42% cheaper than U.S. equities.

“In aggregate, you see emerging markets still trading around or below 15 times earnings, with the same type of growth in earnings you see in the U.S.,” do Valle says. “You still see very attractive valuations when you compare to countries like the U.S. … The same type of growth, in some cases higher growth than the U.S., with a much lower valuation.”

As investors are increasingly diversifying globally, emerging markets present themselves as an under-appreciated opportunity.

“With growing discussion around the end of prolonged dollar strength and the beginning of a weaker [dollar] cycle, we see a potential for a significant boost to EM assets,” says Hayley Tran, managing principal in and head of equities research at Meketa Investment Group. “EM equities have historically offered both diversification and the opportunity for enhanced potential returns.”

Fixed Income

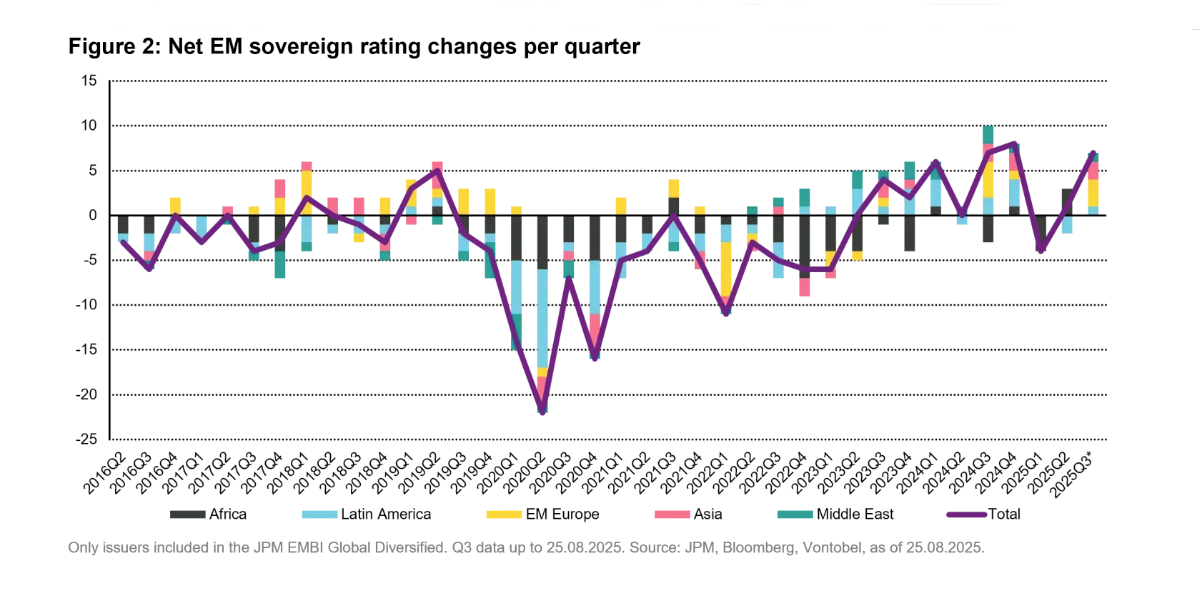

Emerging markets’ fixed income is also having a resurgence—especially both hard and local currency, as well as investment grade corporates—in part due to rising commodities prices, AND EM ratings upgrades, an increase in inflows into the asset class as well as a decline in the value of the dollar, notes Vontobel strategist and portfolio manager Carlos de Sousa.

Mark McKeown, managing principal in and head of fixed income research at Meketa, notes that many emerging market debt investors are investing based on the theme of a weaker dollar—something that bodes well for emerging markets and non-dollar assets.

Rising commodities prices are also providing tailwinds for emerging markets, as these countries are generally large producers of commodities.

“For fixed income … it’s not about growth; it’s about ability to repay debts,” de Sousa says, “In this particular instance, having lower levels of industrialization, having more exports to commodities, is a plus.”

At least eight emerging market countries have seen their credit ratings upgraded in 2025, de Sousa notes, while at the same time, developed market sovereigns are experiencing more downgrades than usual.

“This is a very rare development,” says de Sousa. “Over the last decade—almost every single year, and in fact, almost every single quarter—[emerging markets] had more rating downgrades for almost an entire decade, basically, since commodity prices declined very sharply during the second half of 2014. … Since the second half of 2023, we see the opposite.”

Vontobel, in a September paper, noted that in the prior three months, EM sovereigns had seen “11 upgrades and two downgrades, the highest net upgrades in more than a decade.”

De Sousa also notes that allocators have increased their investments in EM fixed income this year, after years of outflows. “Starting this year, especially since May, we have had quite a sustained flow into the asset class,” de Sousa says.

EM investment grade companies are exceeding the returns of U.S. corporates, according to Vontobel. The former returned an annualized 3.3%, greater than 3.1% for U.S. investment grade corporate debt, while EM IG had lower annualized volatility—4.1% vs. 6.7% for the U.S., over the past decade

Ella Hoxa, head of fixed income at BNY’s Newton Investments, notes that there are many troubled spots in developed markets, such as the U.S., due to high deficits—and these countries’ currencies are also weakening.

“The only area where this problem is not prevalent is in a lot of emerging markets, which are seeing the opposite effect, where you have very high real rates and inflation is falling, and you have central banks that are now engaging with a positive dynamic of appreciating currencies,” Hoxha says.

McKeown notes that inflation is moderating across emerging markets, which indicates the potential for further rate cuts ahead. EM countries had already begun their interest rate cutting cycles before the U.S. and other developed countries did so.

“Additionally, [emerging market debt] managers note that fundamentals in EMD are strong such that overall real yields are at 20-year historical highs, and spreads are compelling vs. U.S. high-yield bonds,” McKeown says.

Navigating EM Risks

Emerging markets have long been perceived as riskier—due to political instability, volatility and—in some cases—weaker corporate governance.

“Even though they’re still perceived as being riskier, if you look at the performance of emerging market investment grade, it is a very similar performance to developed market [investment grade]: slightly higher in total returns [and lower volatility], depending on which sub asset class,” de Sousa says.

Uncertainty about U.S. trade policy, as well as mounting geopolitical risks and higher expected U.S. deficits, have increased risk in the developed markets, McKeown says. That could drive investors to demand higher yields from U.S. fixed income.

“Meanwhile fiscal discipline in emerging markets and the ability to ease policy via rate cuts in EM countries may keep EM debt supported, especially if we continue to see default rates drifting down in [emerging markets debt] and credit ratings upgrades,” McKeown says.

Tran notes that currency dynamics have historically been a major driver of emerging markets returns, and that for U.S.-based investors, the dollar has historically had a major effect on EM performance.

“Maybe the type of risk they used to see perceived as emerging market type of risk, like the government intervening and changing the rules of the game—probably now you can make an argument that probably that risk exists in the U.S. as well,” do Valle says.

Diversification

Another potential reason to invest in emerging markets is the opportunity to diversify and not be too dependent on any single economy.

“The benefit of emerging markets is that you have almost 80 countries in which you can invest, and you can always have a diversified portfolio,” de Sousa says. “When you invest in developed markets, you have way fewer countries and you have lots of higher concentrations.”

Additionally, do Valle notes that emerging markets are not a homogenous block: “Each [country] is a different story; each one is subject to a different political cycle, economic cycle, different companies, different sectors, different themes. When you’re investing in the broad emerging markets, you have also a very diversified set of countries that, in aggregate, I think, have been managed in a very prudent manner.”

Robeco, in a report, highlighted the diverse investment universe of EM. For example, India and the nearby Association of Southeast Asian Nations are benefiting from strong domestic demand and digitalization—while Latin America, a more cyclical region, has exposure to commodities and has attractive real yields.

Allocating to EM

Asset owners are warming up to the idea of increasing their investments in EM, according to analysts and consultants. Do Valle notes that while institutional investors are increasingly considering EM investments, allocators now are more “rejigging” their EM investments, usually replacing one manager with another, rather than increasing their exposures.

“After many years of pullback by U.S. institutional investors, we are seeing increased flows and interest in [emerging market debt], driven by a view of a weakening U.S. dollar for the first time in many years,” Mckeown says, noting that U.S. institutional clients are exploring local currency emerging markets debt for the first time in years, as opposed to hard currency emerging markets debt.

McKeown notes that when looking at EM fixed income, many institutional investors prefer to invest with active managers and blended strategies that allow them to invest across various fixed-income products.

“A blended strategy that includes sovereign and corporate debt issued in U.S. dollars, euros and local currency offers the investment manager opportunities to mitigate country, credit and currency risks through naïve hedging across countries and issuers,” McKeown says.

Emerging market allocations are often considered in the context of the entire portfolio and typically calibrated to overall risk-return goals, Tran says: “Active strategies can introduce additional volatility, which may be an important factor in sizing decisions. Ongoing rebalancing can help to maintain alignment with established targets.”

Tran notes that in Meketa’s view, emerging markets are typically not a tactical bet, but a building block for achieving durable, long-term investment outcomes.

EM assets are not major components of institutional allocator portfolios—with many of the portfolios that do report such investments holding positions that represent single-digit portions allocated to emerging market equity and fixed income.

“For a great part of the last 15 years—this long winter in emerging markets from 2005 onwards—many consultants were recommending an overweight allocation to emerging markets, which was not a profitable one; if you look in hindsight, it was not a very good decision,” do Valle says. “So I think many asset owners are still a little bit wary of that.”

An August white paper from State Street noted that the share of high yield/EMD increased to 2.5% of investment portfolios in 2023 from 1.4% in 2020. State Street noted “the gap in expected returns between HY/ EMD and public equities narrowing, the two asset classes are competing for capital, although the relatively small size of the HY/EMD market sets a natural limit to this competition.”

Still, there is more interest building in emerging markets, says Dan Morgan, a multi-asset analyst at Ninety One UK Ltd. “I think that it takes a little bit longer for clients to get comfortable with moving into emerging markets, but I think that seems to be the stage we’re moving into now.”

Related Stories:

Voya Fixed-Income CIO Tips Treasury Duration, Emerging Market Assets as Offsets

Investors Eye Emerging Markets for Some Relative Quiet

Emerging Market Bonds, on a Roll, Should Do Even Better, Says Ned Davis

Tags: Emerging Markets, Equities, Fixed-Income