The state pension triple lock should be ditched in favour of the ‘smoothed earnings link’ used in Australia, according to the Institute of Fiscal Studies think tank.

This would means setting a target level for the state pension as a percentage of median wages, then using either average earnings growth or inflation to increase it each year.

At present the triple lock pledge means the state pension should increase every year by the highest of inflation, average earnings growth or 2.5 per cent.

But the IFS says this is costly, difficult to forecast over the long term, and disproportionately beneficial to better off people who tend to live longer.

The full headline state pension is currently worth around £12,000 a year and next April’s increase is expected to be confirmed at more than £12,500 – only just shy of the income tax threshold of £12,570.

The IFS notes that a rise of 4.8 per cent in line with average earnings growth will increase the weekly rate by £11 to £241 a week – higher than it would be without the triple lock.

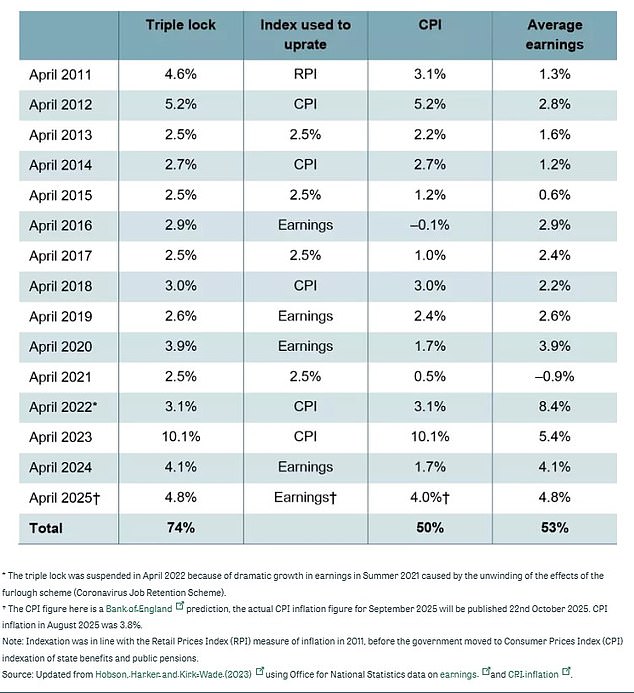

‘Since the introduction of the triple lock in 2011, the value of the state pension has risen much faster than either average earnings or prices,’ it says.

Triple lock: The pensions pledge is now costing the Government £12bn extra a year

How has state pension increased under triple lock?

‘At £241 per week, a full new state pension is expected to be £30 per week (14 per cent) higher than it would have been under average earnings indexation since 2011,’ says the IFS.

If adds that the triple lock is now costing the Government £12billion extra a year.

The triple lock was introduced by David Cameron’s Conservative Government to ensure pensioners receive a decent rise in income every year, and despite criticism of the cost in some quarters it is widely popular.

The main parties promised to stick with the policy at the last election as they sought support of older voters, and the Labour Government has repeated its intention to honour it for the whole of this parliament.

Historic: Here’s how the triple lock has boosted state pension payments since April 2011

Should we switch to a ‘smoothed earnings link’ like in Australia?

Under this system, the Government would set a target level for the new state pension, which would be a share of median (meaning the midpoint figure, not average) full-time earnings.

When the state pension was at the target level and earnings were growing in real terms, it would be uprated in line with average earnings growth.

But if inflation was above average earnings growth, this figure would be used instead until real earnings recovered to its target level as a percentage of average earning.

This IFS says: ‘Together these features of the smoothed earnings link would mean that the state pension both keeps up with growing standards of living in the long run, while providing inflation protection in times of economic turmoil.

‘This would provide greater predictability for both pensioners and policymakers.

‘While the government has committed to keeping the triple lock this parliament, a sensible approach would be to move away from the triple lock after the next election.’

Why does the IFS think triple lock should be replaced?

The influential think-tank makes the following arguments.

– The state pension age is under review, and if it rises the delay will affect poorer people who on average have a lower life expectancy.

– Therefore using further increases to the state pension age to rein in the cost while keeping the triple lock will tend to favour the better off.

– The generosity of the triple lock has a substantial and growing impact on public finances, though spending will continue to increase anyway due to the ageing population.

– Because the triple lock increases the state pension based on the maximum of three figures, two of which are potentially volatile over time, forecasting state pension spending in the future becomes more difficult.

– The Office for Budget Responsibility estimates that spending on the state pension will rise by around £80billion in today’s terms by the 2070s, over half of which would be due to the triple lock – but this depends on the volatility of the economic environment.

Share or comment on this article:

Britain should copy Australia to reform ‘costly’ state pension triple lock, says the IFS