Inflation remained unchanged at 3.8 per cent in September, meaning the state pension will rise by 4.8 per cent in line with July’s earnings growth figure under the triple lock.

In April 2026, the state pension will get bumped up by the July earnings growth figure of 4.8 per cent.

Therefore the full ‘new’ state pension should increase from £230.25 per week to £241.30 per week.

While the ‘old’ state pension should increase from £176.45 per week to £184.90 per week.

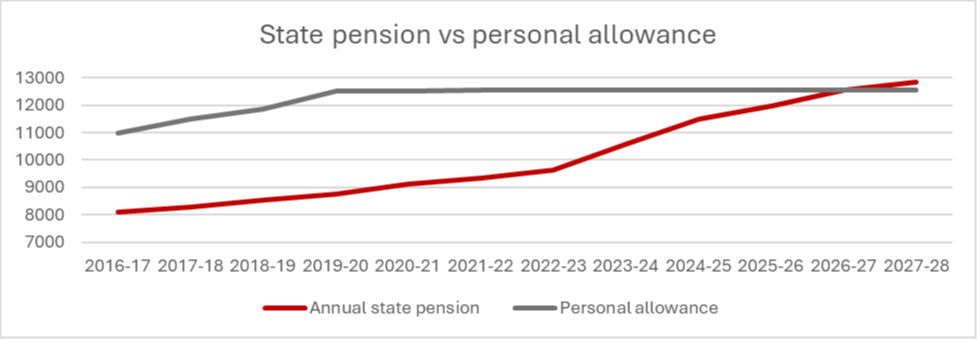

Currently the personal allowance is frozen at £12,570 with AJ Bell estimating the state pension will exceed this by 2027-28, if it remains frozen.

Graph showing the gradual growth of state pension against the personal allowance© AJ Bell

Rachel Vahey, head of public policy at AJ Bell, warned the government could come under mounting pressure to address the sustainability of the triple lock.

The government previously committed to keeping the triple lock.

She said: “Removing the freeze on the personal allowance would come at significant cost to the Treasury at a time when the chancellor’s fiscal headroom is already strained at best.

“While an overhaul of the triple lock would come with huge political risk before the next general election.”

Andrew Tully, technical services director at Nucleus, said the increase to state pension means many more will pay income tax given the ongoing freeze to the personal allowance.

“While the headline state pension increases by the triple lock, other parts of the state pension such as SERPS/S2P, the graduated pension, protected payments, and benefits for deferring, will go up by CPI which may be lower than earnings,” he explained.

“The government has announced a review of the state pension age which will consider if and when state pension age moves to 68 and beyond.

“However rather than focus solely on state pension age, we need to consider the future of our state pension system as a whole.

“As well as state pension ages, this wider debate should consider a suitable level of state benefit, the future of the triple lock, differing life expectancy across the UK, and support for those below state pension age who aren’t able to work.”

alina.khan@ft.com