Network API Market Summary

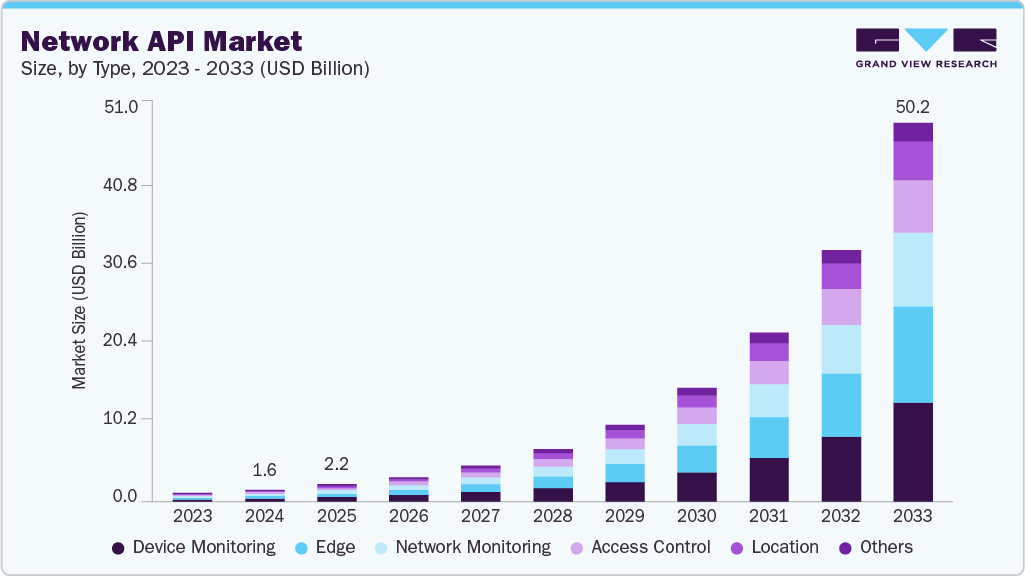

The global network API market size was estimated at USD 1.55 billion in 2024 and is projected to reach USD 50.23 billion by 2033, growing at a CAGR of 47.6% from 2025 to 2033. The market growth is primarily driven by rising adoption of IoT and connected devices, increasing demand for low-latency edge computing, growth in secure API integration for enterprise systems, and expansion of location-based and autonomous vehicle applications..

Key Market Trends & Insights

North America dominated the global network API market with the largest revenue share of 33.8% in 2024.

The network API market in the U.S. accounted for the largest market revenue share in North America in 2024.

By type, the device monitoring segment led the market with the largest revenue share of 24.9% in 2024.

By application, the business IT solution segment led the market with the largest revenue share of 25.0% in 2024.

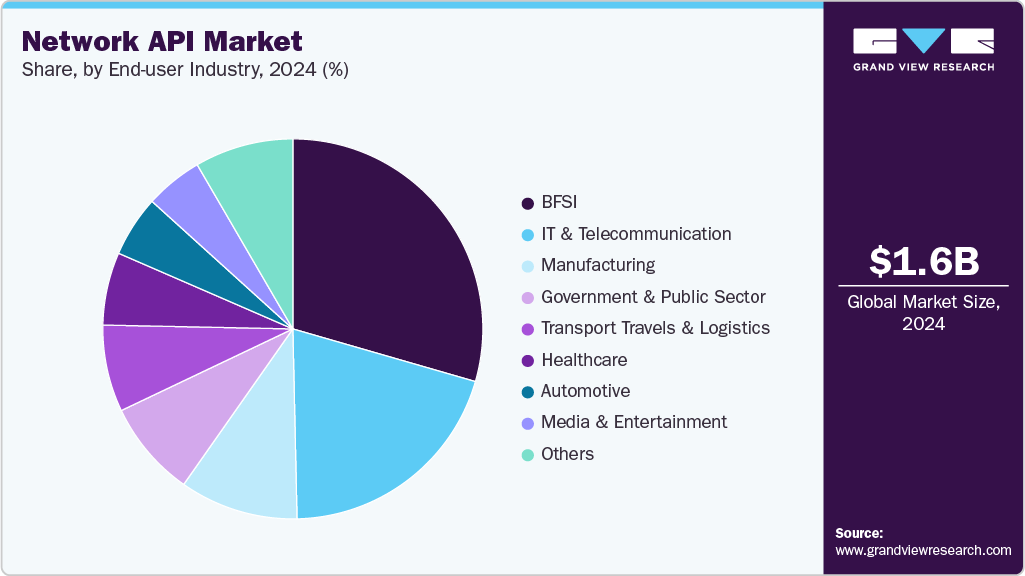

By end use, the IT & telecommunication segment is expected to grow at the fastest CAGR of 50.4% from 2025 to 2033.

Market Size & Forecast

2024 Market Size: USD 1.55 Billion

2033 Projected Market Size: USD 50.23 Billion

CAGR (2025-2033): 47.6%

North America: Largest market in 2024

Asia Pacific: Fastest market in 2024

The growing adoption of edge computing is driving demand for APIs optimized for low-latency, decentralized environments. Network APIs are now being designed to enable real-time data processing closer to users and devices, enhancing responsiveness for IoT, AR/VR, and autonomous systems. By distributing API workloads across edge nodes, operators can improve efficiency and reduce backhaul congestion. This also opens opportunities for localized services and dynamic orchestration of network functions. As enterprises pursue faster digital transformation, edge-ready APIs will be critical to achieving seamless performance and scalability.

Enterprises are increasingly operating in hybrid and multi-cloud environments, creating a need for unified API governance frameworks. Centralized management solutions now integrate security, compliance, and lifecycle control across diverse cloud infrastructures. This helps ensure consistent performance and data protection standards regardless of where APIs are deployed. By adopting unified governance, organizations can reduce complexity, streamline version control, and improve visibility across distributed systems. The trend reflects a strategic move toward greater agility and reliability in enterprise-grade API ecosystems.

The demand for network APIs is rapidly increasing as businesses across sectors seek more programmable, secure, and intelligent connectivity solutions. Enterprises are leveraging these APIs to access telecom capabilities such as identity verification, location intelligence, and quality-of-service management, enabling more efficient and personalized digital experiences. The surge in 5G adoption, IoT device connectivity, and AI integration is further amplifying the need for real-time, low-latency communication between applications and networks. Network APIs are becoming a strategic bridge between telecom operators and enterprise innovation, allowing for seamless integration of network functions into business workflows. As digital transformation accelerates, the growing reliance on the network API industry is redefining how organizations innovate, monetize, and scale connectivity-driven services globally.

Type Insights

The device monitoring segment led the market with the largest revenue share of 24.9% in 2024, owing to the increasing adoption of connected devices across enterprises. Growing demand for real-time monitoring and analytics has driven organizations to implement advanced device monitoring solutions for improved operational efficiency. The rise of IoT and smart infrastructure has further boosted the need for continuous device status tracking and performance management. In addition, regulatory compliance and security requirements are pushing companies to deploy robust monitoring systems to ensure data integrity and minimize downtime. As a result, the segment continues to attract significant investments and remains a key growth driver in the network API industry.

The edge segment is anticipated to grow at the fastest CAGR during the forecast period, driven by the need for low-latency processing and real-time data analytics at the network edge. Enterprises are increasingly adopting edge computing solutions to manage the massive data generated by IoT devices, minimizing reliance on centralized cloud systems. The expansion of 5G networks has further accelerated the use of edge APIs, enabling faster and more reliable communication for applications such as autonomous vehicles and industrial automation. Moreover, the need for enhanced security and privacy is encouraging organizations to process sensitive data locally rather than sending it to the cloud. As a result, the edge segment is expected to experience the fastest growth as businesses prioritize efficiency, speed, and scalable network solutions.

Application Insights

The business IT solutions segment accounted for the largest market revenue share in 2024, driven by enterprises’ increasing focus on digital transformation and IT modernization. Organizations are leveraging APIs to integrate diverse IT systems, enhance workflow automation, and improve operational efficiency. The rise of cloud adoption and hybrid IT environments has further accelerated the need for scalable and flexible API solutions that connect on-premises and cloud-based systems seamlessly. In addition, businesses are prioritizing data-driven decision-making, which requires robust IT solutions to enable real-time analytics and reporting. Overall, the segment continues to expand as companies invest in technology to streamline operations and remain competitive in a rapidly evolving digital landscape.

The IoT segment is anticipated to grow at the fastest CAGR during the forecast period, driven by the rapid proliferation of connected devices across industries such as manufacturing, healthcare, and smart cities. Organizations are increasingly deploying IoT solutions to enable real-time monitoring, automation, and predictive analytics, enhancing operational efficiency and decision-making. The expansion of 5G networks and improved connectivity infrastructure has further accelerated IoT adoption, allowing seamless data exchange between devices and systems. In addition, the need for scalable and secure API integrations to manage large volumes of IoT data is fueling market growth. As a result, the IoT segment is expected to maintain strong momentum as businesses continue to embrace connected ecosystems and intelligent operations.

End Use Insights

The BFSI segment accounted for the largest market revenue share in 2024, driven by the rapid digitalization of financial services and the need for secure, real-time data exchange across banking ecosystems. Financial institutions are increasingly using APIs to enable open banking, streamline payment processing, and enhance customer experience through personalized digital services. The integration of AI and analytics with network APIs is further helping banks improve fraud detection, credit scoring, and transaction monitoring. In addition, regulatory initiatives promoting transparency and interoperability, such as PSD2 and open finance frameworks, are accelerating API adoption in the sector. As a result, the BFSI segment continues to lead in API-driven innovation, driving greater efficiency, compliance, and customer trust.

The IT & telecommunication segment is anticipated to grow at the fastest CAGR during the forecast period, fueled by the rapid deployment of 5G networks and the increasing need for seamless connectivity and automation. Telecom operators are leveraging APIs to expose network capabilities, such as location, identity, and quality of service, to developers and enterprises for building advanced applications. The integration of AI, edge computing, and cloud-native architectures is further enhancing the efficiency and flexibility of network operations. Moreover, APIs enable communication service providers (CSPs) to monetize network services through open ecosystems and partnerships. As a result, the segment is witnessing strong growth, positioning itself as a key driver in the evolution toward programmable and intelligent networks.

Regional Insights

North America dominated the global network API market with the largest revenue share of 33.8% in 2024, primarily driven by strong adoption of 5G, cloud-native architectures, and enterprise API monetization initiatives by major telecom operators. Leading providers such as AT&T, Verizon, and T-Mobile are investing heavily in open API ecosystems aligned with the GSMA Open Gateway framework. The region’s mature developer community and integration with hyperscalers like AWS, Google Cloud, and Microsoft Azure are accelerating innovation and interoperability. In addition, high enterprise demand for APIs enabling edge computing, identity, and fraud prevention continues to strengthen North America’s market leadership.

U.S. Network API Market Trends

The network API market in the U.S. accounted for the largest market revenue share of 66.9% in North America in 2024, driven by API-first enterprise strategies, edge computing, and 5G adoption, which enable real-time, low-latency applications like autonomous vehicles and industrial IoT. Security and privacy-enhanced APIs are becoming critical as operators integrate encryption, identity verification, and compliance features to protect sensitive data. In addition, AI-powered APIs and unified management platforms automate network operations, traffic management, and lifecycle governance, accelerating innovation and monetization across industries.

Europe Network API Market Trends

The network API market in Europe is expected to grow at a significant CAGR of 43.5% from 2025 to 2033, owing to the region’s rapid digital infrastructure modernization and active participation in cross-operator standardization initiatives. European operators such as Vodafone, Telefónica, and Deutsche Telekom are leading efforts to harmonize network APIs through regional collaborations. The focus on secure connectivity, data sovereignty, and interoperable API frameworks is fostering strong adoption among financial, government, and industrial sectors. Furthermore, regulatory support for open digital ecosystems under the EU’s Digital Markets Act is helping drive the region’s API-driven innovation agenda.

Asia Pacific Network API Market Trends

The network API market in the Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2033. The demand is driven by large-scale 5G rollouts, growing IoT ecosystems, and increasing investment in smart cities across China, Japan, South Korea, and India. Telecom operators in the region are rapidly deploying programmable network APIs to support edge computing, real-time analytics, and industrial automation. Government-backed initiatives promoting digital transformation and AI integration are further propelling the regional market forward. The combination of vast mobile user bases and strong enterprise digitization is positioning the Asia Pacific as the next major hub for network API innovation.

Key Network API Companies Insights

Some of the key companies in the network API industry include Ericsson, Nokia, Cisco, Microsoft, AT&T, T-Mobile, Orange, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

Ericsson is a global leader in telecom infrastructure and network solutions, actively driving the adoption of Network APIs. The company has launched joint ventures, such as Aduna, to provide standardized APIs to telecom operators worldwide. Ericsson’s APIs enable developers and enterprises to build programmable and automated network services, improving efficiency and innovation. By focusing on 5G and next-generation network deployments, Ericsson remains at the forefront of the Network API industry.

Cisco provides enterprise-grade networking solutions, with a strong focus on network programmability through APIs. Its Network APIs enables businesses to automate operations, monitor network performance, and integrate advanced digital services. Cisco supports developers and operators with tools that simplify API deployment and management across complex networks. By combining hardware, software, and cloud solutions, Cisco drives significant adoption of Network APIs in enterprise and telecom environments.

Key Network API Companies:

The following are the leading companies in the network API market. These companies collectively hold the largest market share and dictate industry trends.

Ericsson

Nokia

Cisco

Microsoft

AT&T

T-Mobile

Orange

Deutsche Telekom

Vodafone

Telefonica

Recent Developments

In October 2025, Proximus Global launched Konera, a unified network API platform aimed at enterprises and developers worldwide. The platform consolidates APIs from various mobile operators, offering capabilities such as identity verification, fraud prevention, and enhanced user experiences, aligned with the GSMA CAMARA framework. Through its subsidiaries BICS and TeleSign, Proximus seeks to expand global collaboration and help operators monetize their network assets more efficiently.

In September 2025, Aduna entered a strategic partnership with Maxis in Malaysia to strengthen its global network API ecosystem. The collaboration enables Malaysian developers and enterprises to access standardized APIs such as Number Verification, SIM Swap, KYC Match, and Location Verification, leveraging Maxis’s network capabilities. This initiative aims to accelerate digital innovation, enhance security and fraud prevention, and streamline the deployment of next-generation services across industries.

In February 2025, Deutsche Telekom’s T Wholesale partnered with Nokia to launch a commercial agreement focused on advancing the network API industry. The collaboration introduces SIM Swap and Number Verification APIs through Nokia’s “Network as Code” platform, allowing developers to build secure, authentication-based applications. This initiative aims to help operators unlock new revenue streams by monetizing network capabilities and simplifying developer access to core network functions.

In February 2025, Aduna, a joint venture led by Ericsson and major telecom operators, partnered with Sinch to expand global opportunities in the network API ecosystem. The partnership integrates Sinch’s verification services, including Number Verify and SIM Swap APIs, into Aduna’s standardized CAMARA-based platform. This collaboration aims to simplify developer access, enhance digital trust and security, and accelerate innovation across communication services worldwide.

Network API Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.23 billion

Revenue forecast in 2033

USD 50.23 billion

Growth rate

CAGR of 47.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 – 2033

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segment scope

Type, application, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Ericsson; Nokia; Cisco; Microsoft; AT&T; T-Mobile; Orange; Deutsche Telekom; Vodafone; Telefonica

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Network API Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global network API market based on the type, application, end use, and region.

Type Outlook (Revenue, USD Million, 2021 – 2033)

Device Monitoring

Edge

Access Control

Location

Network Monitoring

Others

Application Outlook (Revenue, USD Million, 2021 – 2033)

End Use Outlook (Revenue, USD Million, 2021 – 2033)

Regional Outlook (Revenue, USD Million, 2021 – 2033)