Graham Thalben Ball, better known as Johnny Ball, is a stand-up comedian, television presenter and writer, known for popularising maths. Ball, 87, began his stand-up career in Liverpool in the 1960s and later moved into TV, where he was a regular fixture on children’s programmes through the 1970s and 1980s, including Play School, Think of a Number, and Johnny Ball Reveals All. Ball has four children, including the television and radio presenter Zoe Ball from his first marriage. He lives with his wife, Diane, in Buckinghamshire. His autobiography, My Previous Life in Comedy, was published earlier this year and part two, Stories that Must be Told!, will be released in March 2026.

Definitely not a spender. I’m very lucky. We’re comfortably off and don’t require anything at all, because we have saved. Me and my wife, Di, are a partnership. We have six grandchildren and we help with their education and other support, which is a lovely thing to do, and we do that comfortably. When Di bought me an expensive watch for Christmas, I said, “You’re trying to get me mugged.”

What was your first job?

It was with the De Havilland Aircraft Company when I was 16. I’d failed at school, but done very well in maths, so I joined them and I single-handedly did the costs for a Blackburn Beverley propeller, which was 1,400 parts. I listed them all in pencil and worked out the cost to De Havilland for every single part and added it up.

Johnny Ball with his daughter Zoe

ALAMY

They paid based on time, so everybody was given a job and if they did a 100-minute job in half the time, they got a 100 per cent bonus and went home with about £10. Then they changed it and said let’s just give them the money and give them time to do things, and within six months it was taking three times as long because there was no bonus. It nearly wrecked the company.

After that, I went into the RAF for three years. That was my university and I learnt so much and had a wonderful time. I was in radar identification and worked with boffins on tracking guided missiles and things like that. But I was always determined to go to Butlin’s as a red coat. I did three years and from there I started comedy in Liverpool and was a stand-up for 17 years.

Have you ever been hard up?

That first winter in Liverpool was the poorest I ever was. I had to get a job in an office, which was almost Dickensian. I had to use a fountain pen to copy from one ledger to another and got £8, less stoppages, £7, less my digs, £3.50, less my cigarettes, £2, less hire purchase on my drums … I am absolutely on zero. I haven’t even got on the bus yet.

That’s when I met the Beatles. I told them there was no money in rock’n’roll — two years later they took off. Once I turned pro as a stand-up, I was never poor again.

The Beatles ignored Johnny Ball’s advice

GETTY

What has been your most lucrative work?

Because I’d been writing comedy, I understood how to write scripts. You’ve got to write a joke or something of interest in every line. I wrote 20 series of programmes. Writing, as well as presenting on television, was wonderful.

I finished television in 1993, and the corporate world, seeing that I could explain things, beat a path to my door. I worked for the National Grid for seven years, three years for BAE Systems, two years for British Gas, and for the Engineering Council. I wrote five educational stage musicals for the government and for engineering; the brochures that told you how the grid works were written by me.

• Geoff Norcott: My first gig paid £40. Last year I made more than Keir Starmer

A firm selling boilers asked me to help so we wrote the commercials and their business increased 1,000 per cent in 12 months — they went from selling 500 boilers a year to 5,000. It was all fantastic; the corporate industry is essential — it’s what creates the wealth of the country, so I helped in every way I could.

I worked for the government. In about 2000 I ran stands at conferences explaining how maths can be so much more exciting, and then I worked for Michael Gove when he was minister for education and did tours encouraging people to do engineering.

And all that is when I was really earning and it was comfortable from then on. Shows like Tales of Maths and Legends in 2000, it was only £5 a ticket but we averaged 3,500 kids a day. We got £2 a ticket, so I was getting £7,000 a day, three days a week. And I had actors in the [Millennium] Dome doing another show. So 2000 was the time I paid off my mortgage.

Do you own a property?

We bought a terribly run-down four-bedroom house in 1978. We paid £50,000 and the neighbours sniggered. It had been rented out for about ten years and was an absolute wreck.

But we’ve done two extensions and doubled its size — I fitted the kitchen and did the stairs and landing — and now it’s six bedrooms and is our paradise. Paying off the mortgage was great. My accountant went mad, he said: “No! I claim against that.”

• Ian Botham: ‘As a young cricketer I lived off ham sandwiches in a squat’

We’ve never had a holiday home. When we go on holiday, we always stay in hotels because if you’ve got an apartment abroad, the first thing you have to do is go to the supermarket. Horrible. But we don’t even feel the need to holiday any more because we’ve been everywhere. We’ve had some lovely trips.

Do you invest in shares?

Very much so. When I moved to London I met the bank manager and he said it was the best thing to do with my money. My annuity kicked in when I was 69 and I got a rate of 14.5 per cent. You can’t get anywhere near that today — it only took seven years to get all the money back.

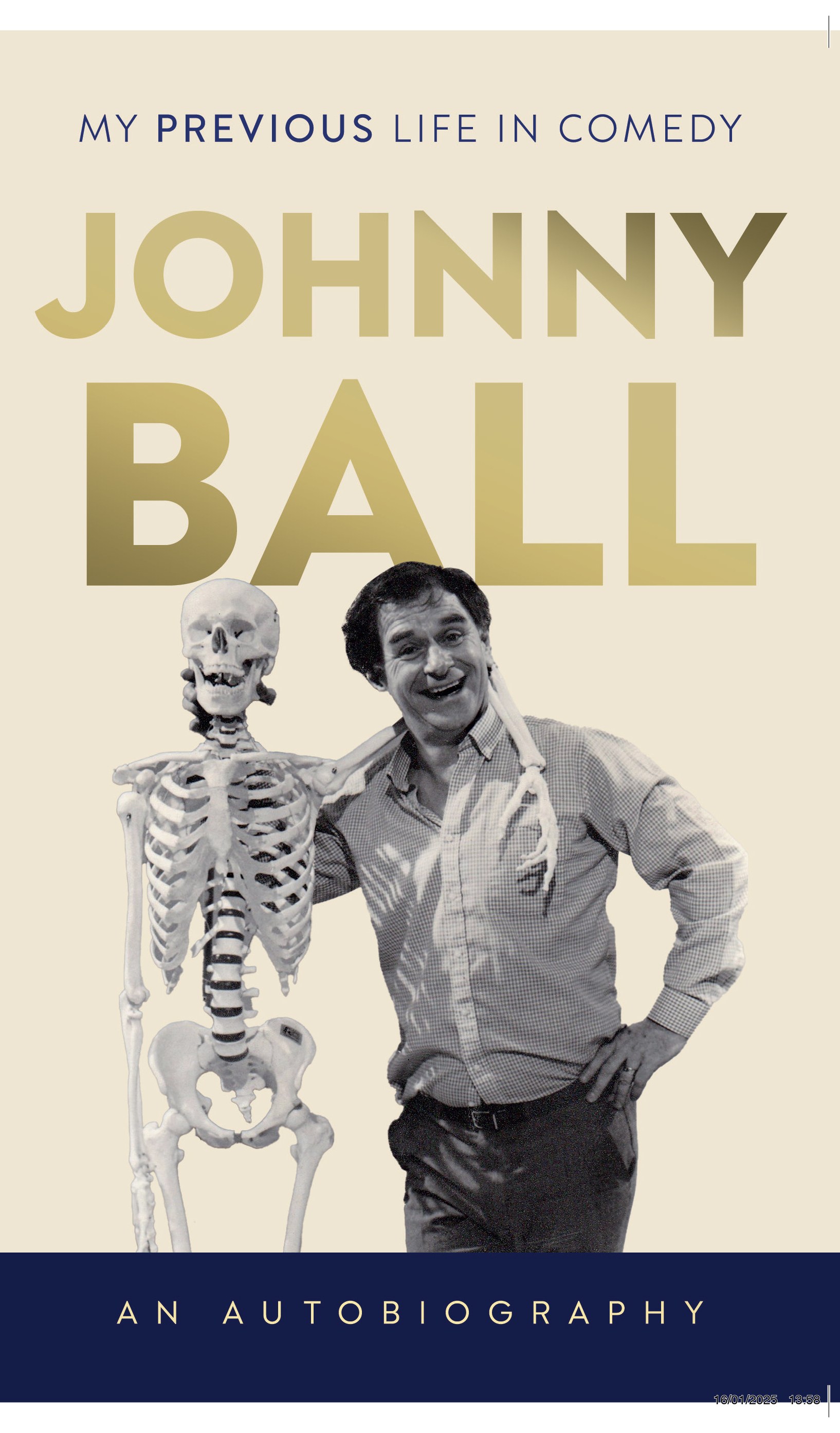

Johnny Ball published his autobiography this year

I have had financial advisers, sometimes thrust upon me and sometimes voluntarily, but I eventually sacked everyone because I found I could do it better myself. I love the maths of investing; it’s wonderful to watch the fluctuations and see the record of what they’ve done in past years, and hopefully you’re always in one fund that’s growing.

I follow the greatest investor in the world, Warren Buffett. Bitcoin? I may be wrong, but I wouldn’t touch it with a barge pole.

What’s better for retirement — property or pension?

It’s a no-brainer. People who go for property, you can only realise property when you sell it. It’s a big lump standing there and a big lump when you sell it. With pensions, you’re flexible.

• Angela Griffin: We moved to the country and hated it. Moving back cost us £500k

I had a self-invested personal pension and every time you put in £1,000, the government gives you £400, which is brilliant. So all the way through my working for the corporates, I was putting a lot of money away and the government was giving me 40 per cent. Now when I draw the money out, I have to pay 40 per cent tax, but that’s absolutely fair because that’s how it started.

Are you better off than your parents?

Yes. My parents were absolutely lovely but we never had any money. We moved to Bolton from Bristol and they opened up a shop so they would be self-employed, but they didn’t understand that the shop had been closed for years because it was in a terrible situation between two main roads where there was no passing trade.

They lost everything they borrowed and we were very, very poor. When I went to grammar school I was the only one in a grey jacket because my mum found one much cheaper than the blue jacket with the badge.

My dad would have been a wonderful comedian, but he never got a decent break. He never owned a car. He was just naturally funny all the time and his influence made me want to be a comedian by the time I was 11.

How much did you earn last year?

I get royalties from maths books, but my earnings are very low and spasmodic. I do a lot of charity work and speaking at schools or organisations, often free or for expenses, because I love doing it. My pension, our investments and savings provide everything we need pretty well.

What is your money weakness?

Two pints a night. Because my wife once said, when you’ve had two pints, you’re lovely but she can tell when I’ve had two and a half because I argue with the television. And when I’ve had three, I stand up and argue with the television.

• Carol Decker: A glass of wine in my local is £21 — ridiculous!

The sad thing is now that the kids can’t afford to go to the pubs. It’s the atmosphere of being with people and being relaxed and enjoying it, and the pressure they’re under today makes it almost impossible. I think Wetherspoons is a godsend; it’s cheap and full of young people.

What is the most extravagant thing you’ve ever bought?

I once bought from a showroom a brand new Rover 2000 with the money in my wallet — about £1,400.

Cars can be an awful disappointment though. I bought a five-series diesel BMW and was told it was the cleanest car on the planet. Three years later I’m told it’s polluting the atmosphere.

Do you support any charities?

Yes. I do an educational maths project for the NSPCC every year. I’m fronting an initiative for Remember a Charity to encourage people to leave a gift to charities in their will. I’m 87 now and you have to think about these things as you get older.

What is the most important lesson you’ve learnt about money?

If you get the maths right, life is wonderful. Work hard, but love the work you do.

To find out more about how you can leave a gift to charity in your will, visit rememberacharity.org.uk