PropTech, short for property technology, is transforming how we buy, rent, and manage places to live, work and use. It covers a broad range of innovations across Property Search, Management, Smart Buildings, Fintech and Real Estate, Construction, Marketing, and Tenant Experience. From smart sensors in buildings to digital mortgage tools and data-driven marketing, PropTech is making the real estate world more connected, transparent, and efficient.

Last week, we explored how PropTech startups are reshaping property discovery and booking experiences across Europe. This week, we turn our attention to the intersection of Fintech and Real Estate, where technology is redefining how properties are financed, invested in, and traded. From tokenised ownership and rent-to-own models to AI-powered asset management and blockchain-backed investment platforms, these companies are transforming how money moves through property.

In this article, we highlight ten exciting European startups founded between 2022 and today that are leading the way in real estate finance, offering smarter, more inclusive, and more transparent ways to invest, own, and manage assets in the digital age.

Based in Amsterdam, Anyone.com is on a mission to enable anyone to own a home. Founded in 2023, the company offers an inclusive platform that helps people enter the housing market through innovative ownership models and financial flexibility. Its goal is to make homeownership more accessible for individuals who are often excluded from traditional lending or mortgage systems.

By combining technology with tailored financial solutions, Anyone.com is reshaping how people approach buying property. Its model promotes transparency and inclusivity, supporting a new generation of homeowners in overcoming financial barriers. To date, they have raised €5 million.

Based in München, einwert is reimagining real estate valuation through a hybrid, ESG-compliant approach. Founded in 2022, the company blends digital tools with human expertise to create a comprehensive and transparent appraisal experience. Its platform helps financial institutions, investors, and asset managers understand property values with precision while integrating sustainability criteria into their assessments.

Einwert’s technology-driven model streamlines valuation workflows and ensures consistent, data-backed results. By modernising how valuations are performed and reported, the company is helping set new standards in property analytics and green compliance. To date, they have raised €6 million.

Based in London, Factored provides rent-backed financing solutions that help renters unlock capital and landlords improve liquidity. Founded in 2023, the company uses technology to assess rental payment histories and offer flexible financial products tied to ongoing tenancies. Its approach supports both sides of the rental market by turning rent flows into usable, short-term financing opportunities.

By connecting rental income with innovative funding models, Factored bridges the gap between property management and financial access. The company’s platform enhances transparency and reduces friction for property owners, investors, and tenants. To date, they have raised €24 million.

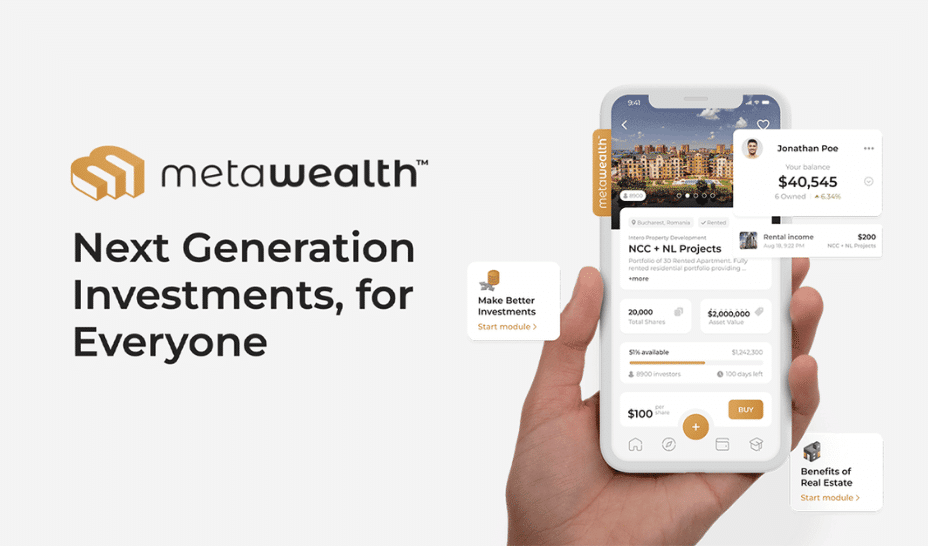

Based in Dublin, MetaWealth offers a modern investment platform that tokenises real estate properties, giving investors access to income-generating assets. Founded in 2022, it allows users to buy digital shares in global properties and earn passive income through tokenised ownership. The model combines transparency, accessibility, and blockchain security.

MetaWealth’s platform bridges traditional real estate with decentralised finance, making property ownership more flexible and liquid. Its innovative approach enables investors to diversify portfolios and participate in markets once reserved for institutions. To date, they have raised €2 million.

Based in Limassol, MHV Group is a hospitality and real estate investment company focused on risk-adjusted and value-appreciating assets. Founded in 2022, the group manages a portfolio of properties across key destinations, combining investment expertise with operational excellence. Its strategy prioritises sustainable growth and stable returns through a balance of hospitality and property ventures.

MHV Group’s integrated approach connects capital, development, and management under one framework. By leveraging deep industry experience and data-driven analysis, the company continues to expand its portfolio while delivering long-term value to investors. To date, they have raised €20 million.

Based in Stockholm, Navian develops AI-driven tools that enhance the predictability and profitability of real estate projects. Founded in 2022, the company’s platform supports developers and investors with automated financial modelling, risk assessment, and project management capabilities. Its mission is to make property investment more data-driven and accessible.

By merging technological innovation with financial insight, Navian bridges the gap between property development and investment. Its solutions enable users to evaluate projects efficiently, optimise capital allocation, and maximise returns. To date, they have raised €2.3 million.

Based in Paris, Nopillo provides automated tools that simplify and optimise real estate tax declarations and investment returns. Founded in 2022, the company helps property owners and investors manage financial obligations more effectively through digital automation. Its solution reduces complexity and ensures compliance, allowing users to focus on profitability.

By integrating technology into tax management, Nopillo enables more efficient reporting and clearer financial oversight. The platform’s user-friendly design and automation capabilities streamline property-related accounting for both individuals and businesses. To date, they have raised €4 million.

Based in Zürich, Optiml helps real estate asset managers plan investments and renovations that balance profitability with sustainability. Founded in 2022, the company offers AI-powered asset and portfolio workflows that allow users to understand current performance, assess future potential, and make data-backed investment decisions. Its technology helps optimise renovation planning and portfolio strategy while ensuring compliance with evolving regulations.

By combining sustainability data with financial modelling, Optiml empowers professionals to make realistic decisions that drive both performance and environmental progress. Its platform simplifies collaboration across teams, transforming complex climate and financial goals into actionable insights. To date, they have raised €3.8 million.

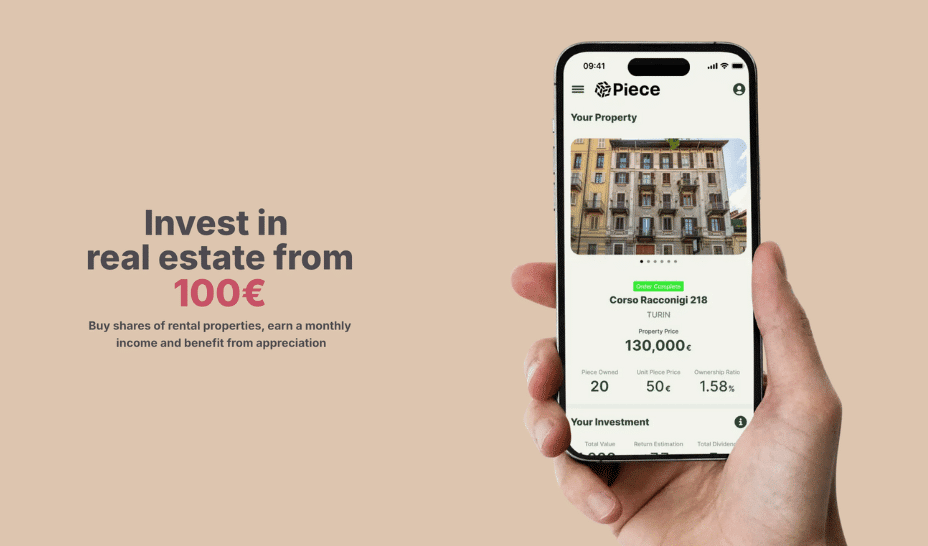

Based in Lugano, Piece is a digital investment platform that makes income-producing real estate accessible to individual investors. Founded in 2023, it enables users to buy fractional shares in properties, diversifying portfolios while reducing capital requirements. Its transparent model offers a simple and secure entry point into institutional-quality real estate.

Piece’s technology bridges fintech and property, offering seamless onboarding, asset tracking, and performance monitoring. By lowering barriers to investment, the company is democratising access to real estate ownership across Europe. To date, they have raised €2.7 million.

Based in Paris, Skarlett gives senior citizens access to their home equity by converting real estate value into liquid assets. Founded in 2023, the company helps older homeowners improve their purchasing power without leaving their homes, providing financial independence and stability in retirement.

Skarlett’s model focuses on unlocking the wealth tied up in property while maintaining long-term security for its clients. By combining social purpose with financial innovation, the company is redefining how older generations can benefit from the value of their homes. To date, they have raised €12 million.