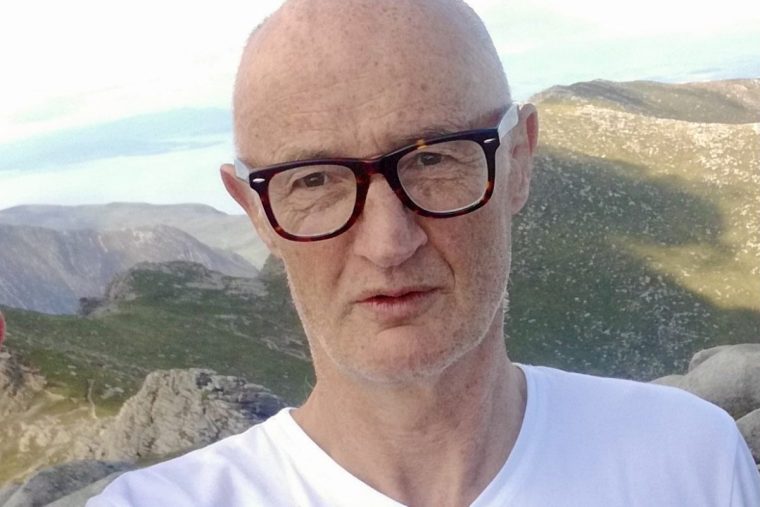

Paul Kelsey is among thousands of retirees whose private pensions do not keep up with the cost of living due to a ‘loophole’ in the law

Retired Britons living “under the cosh” of soaring bills are urging the Government to take action after their private pensions were frozen.

Paul Kelsey, a 73-year-old who lives in Wales, is worried about how he and his wife will pay bills in the future because his private pension cannot keep up with cost of living increases.

Mr Kelsey, who worked for a firm bought out by computer giant Hewlett-Packard, wants the Government to change the law so that the company raises pension payments in line with inflation.

“Pensioners like me are under cosh with cost of living increases,” he told The i Paper. “Prices have gone up so much.

New FeatureIn ShortQuick Stories. Same trusted journalism.

“It’s a tremendous worry that this pension won’t keep up with what’s ahead,” Mr Kelsey added.

“The value [of the pension] will get worse and worse over time. I worry about coping with the impact of bigger bills in the future.”

It comes as Chancellor Rachel Reeves considers whether she can raise any money from pensioners at her Budget on 26 November.

A reduction to the 25 per cent tax-free lump sum on pensions, and a cut to the higher rates of pension tax relief, have been mooted.

‘Loophole’ stopping private pension rise

A law passed in the mid-1990s by the then-Conservative Government – which required all companies to raise pensions with inflation – left out defined benefit (DB) pensions accrued before 1997.

This type of workplace pension gives retirees an income based on their salary and how long they have been part of the scheme for.

Most UK companies voluntarily increase payments annually, regardless of the law. However, a small group of multinationals have used the pre-1997 “loophole” in the law to avoid annual rises.

Mr Kelsey and other campaigners are urging the Labour Government to “fix” the legislation so they get inflation-linked pension increases in future.

The former computer expert worked for a company called Digital Equipment Corporation (DEC) for 17 years until 1996. Hewlett-Packard Enterprise later took over the firm and inherited its pension scheme.

Mr Kelsey now gets around £1,100 a month from his Hewlett-Packard Enterprise pension, along with £800 a month from his state pension.

The 73-year-old estimates that if his private pension had kept pace with inflation, it would be worth almost twice as much by now – around £2,000 a month – making life much easier.

‘We’ve had to cut back visits to family’

“The frozen pension has already had a severe financial impact,” said Mr Kelsley.

“We can’t do everything we wanted to do. We don’t go on holiday. We’ve had to cut back on visits to family in other parts of the country.

“We can’t be as generous with the grandchildren as we’d like to be. We’ve had to cut back on eating out, we don’t do that much. We’ve had to go into savings to pay some energy bills.

“It seems to me grossly unfair treatment,” he added.

“I want the Government to say, ‘This isn’t on’. It wouldn’t cost the Government anything to fix this. We just want to stop the rot, so these companies have to give increases in future.”

‘I’m angry as hell on behalf of pensioners’

Retirees in the Hewlett-Packard Pension Association (HPPA) campaign group are aware of several other multinationals companies – including drug giant Pfizer – who also avoid increasing their pre-1997 pensions each year.

Just over 50,000 people in the UK who have pensions with these companies are affected by the issue – including the 5,500 people with a pre-1997 Hewlett-Packard Enterprise pension, according to campaigners.

David McIlroy, a former DEC employee who lives in Scotland, gets around £630 a month from his Hewlett-Packard Enterprise pension. The 71-year-old also gets £980 a month from his state pension, and has some savings.

“I’m enraged by the way these companies are behaving,” said Mr McIlroy. “In practical terms, it [the private pension] has been frozen for decades.”

David McIlroy has seen his Hewlett-Packard Enterprise pension frozen for years

David McIlroy has seen his Hewlett-Packard Enterprise pension frozen for years

“I’m fortunate enough to be relatively okay, financially. But I’m angry as hell on behalf of all the other pensioners, some of whom are already struggling to keep up with the cost of living.”

Hewlett-Packard Enterprise had increased the pension only three times – by 1 per cent in 2004 and 2008, and by 3 per cent in 2022 – in the past two decades, according to Patricia Kennedy, co-chair of the HPPA campaign group.

Some pensioners are struggling to pay bills or find money to care for loved ones, while some have had to sell homes and downsize, Mr Kennedy said.

MPs pushing for change in the law

The campaign has won support from a cross-party group of MPs. Senior Conservative Sir Roger Gale previously told The i Paper he was working with others on an amendment to the Government’s Pension Schemes Bill to fix the pre-1997 “loophole”.

Labour MP Dame Nia Griffith said it was “shocking” that some major multinationals “have used a loophole in previous legislation to avoid index-linking the pensions of former pre-1997 employees”.

“So together with other MPs, I am looking at trying to get a clause into the Pensions Schemes Bill, which is currently going through Parliament, which would close this loophole and make these companies restore index-linking from now on.”

A Hewlett-Packard Enterprise spokesperson said the company was “committed to satisfying all of its responsibilities”.

They added: “The decision on whether to grant discretionary increases to relevant pensioners is given careful consideration and is made based on a number of factors. It is reviewed on an annual basis.”

Pfizer declined to comment. The Government declined to say whether it will consider the amendment being worked on by MPs.

A Department for Work and Pensions spokesperson said companies and pension trustees “are ultimately responsible for whether or not discretionary increases are paid”.

They said the issue of raising private pensions in line with inflation was “a balance between providing members with some protection against inflation and not increasing schemes’ costs beyond what they can afford”.

Your next read