Rachel Reeves will have to break Labour’s manifesto pledge not to increase taxes on “working people” or scrap the state pension triple lock to relieve pressure on the public finances, the IMF has said.

In a report published on Friday, the international financial body said that the UK would need to take “difficult decisions” to address “new expenditure pressures and rebuild fiscal buffers”.

It said that an alternative to raising VAT, income tax, or national insurance, or scrapping the triple lock, would be charging wealthier people to use the NHS.

It comes at a time as the Chancellor is contemplating what taxes she will have to put up in this autumn’s Budget to repair a hole in the public finances caused by lower than expected growth and U-turns over winter fuel and welfare cuts.

It follows similar warnings from the Institute for Fiscal Studies, which warned in March that the Chancellor may have to raise taxes in the autumn, while the Office for Budget Responsibility (OBR) said earlier this month that the triple lock was set to cost three times more than expected by the end of the decade.

Labour’s 2024 general election manifesto included a commitment to “not increase taxes on working people”, which the document defined as not increasing “National Insurance, the basic, higher, or additional rates of Income Tax, or VAT”.

Reeves subsequently announced an increase to employer National Insurance contributions in last October’s Budget, but argued that as this applied to employers and not employees, it was consistent with the manifesto pledge.

However, in the IMF’s annual report on the UK economy, the institution warned that an “uncertain global environment” and Reeves’s decision to give herself “limited” headroom against her fiscal rules on borrowing meant the rules “could easily be breached if growth disappoints or interest rate shocks materialise”.

The Chancellor’s rules are to fund day-to-day spending from taxation and not borrowing, but her headroom – essentially money she can draw into – is just £9.9bn.

Warning of unpalatable choices

While the report generally praised the Government’s fiscal plans and growth agenda, it said Reeves might have to make some unpalatable choices to stay within her rules, which require public spending to be balanced with tax revenue over a five-year horizon and for debt to fall as a proportion of GDP in the last year of the parliament.

The IMF said: “Unless the authorities revisit their commitment not to increase taxes on ‘working people,’ further spending prioritisation will be required, to align better the scope of public services with available resources.

“The authorities have already embarked on this process through recent reforms to incapacity and disability benefits, but other avenues for savings need to be considered.

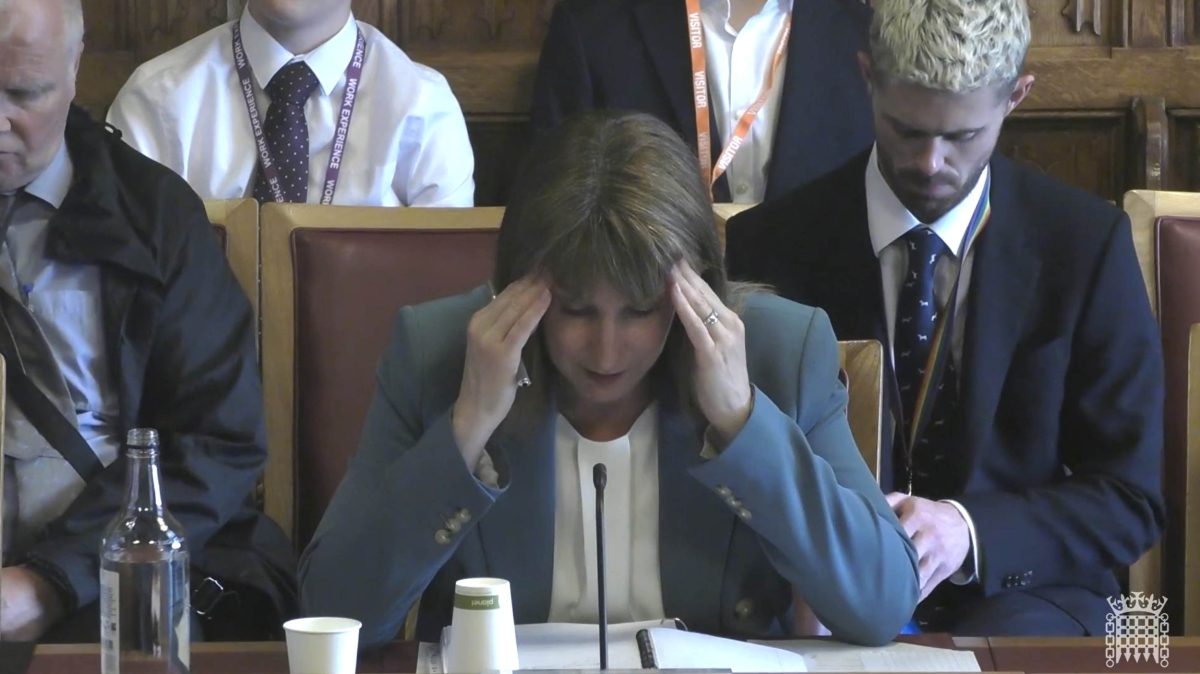

Rachel Reeves meets with staff and apprentices during a visit to Rolls Royce at Inchinnan, Renfrewshire on Friday (Photo: Jane Barlow/PA Wire)

Rachel Reeves meets with staff and apprentices during a visit to Rolls Royce at Inchinnan, Renfrewshire on Friday (Photo: Jane Barlow/PA Wire)

“In particular, the triple lock could be replaced with a policy of indexing the state pension to the cost of living, as recommended in previous [IMF] reports.

“Access to public services could also depend more on an individual’s capacity to pay, with charges levied on higher-income users, such as copayments for health services, while shielding the vulnerable. There may also be scope to expand means testing of benefits.”

The triple lock ensures the state pension rises each year with the highest of inflation, average earnings growth or 2.5 per cent.

Inflation link to pensions would mean less cash

If the state pension were tied to inflation only, as it was before the triple lock, it would likely become considerably less generous over time.

Calculating what an inflation link would mean for pensions going forward is difficult, as it would depend on what happened to earnings growth and inflation over the coming years.

But if an inflation link had been in place since 2016 instead of the triple lock, the full new state pension would be around £209 per week, rather than the £230 per week it is currently.

Sir Steve Webb, the former MP who was pensions minister when the triple lock was designed in 2011, said the policy of linking the state pension to inflation “resulted in the value of the state pension slumping relative to what people earn – which is the problem the triple lock was designed to fix.”

However, with some Labour MPs already privately arguing that the triple lock is unsustainable, the IMF’s intervention will raise further doubts about its long-term feasibility.

Tax rises ahead

The fact that Reeves is preparing to put up taxes again this autumn is partly a result of the fact that she only gave herself £9.9bn of fiscal headroom, making her plans vulnerable to relatively small economic fluctuations.

The IMF suggested that the Government could move to a system where its public finances are checked by the Office for Budget Responsibility just once a year, as opposed to the current practice of twice.

But it said the best way for Reeves to avoid “overly frequent” policy changes would be to give herself “higher buffers” when it comes to her headroom – potentially spelling even bigger tax rises in the Budget.

Responding to the IMF, Reeves said: “Today’s IMF report confirms that the choices we’ve taken have ensured Britain’s economic recovery is underway, and that our plans will tackle the deep-rooted economic challenges that we inherited in the face of global headwinds.

“There’s more to do, and that’s why we’re slashing unnecessary red tape and unblocking investment to let British businesses thrive and put more money in working people’s pockets.”