The first time around, the debt seemed to creep up on me (Picture: Katie N Brand Photography)

Staring at the figure in my debt dashboard, I burst into tears.

£45,000.

It was January 2023, and I’d just been forced to close my business after it became a casualty of the pandemic. And this debt was my responsibility to repay.

The worst part was that I had been here before. About 10 years earlier, I had just become debt-free after I racked up £40,000 aged 24 and managed to claw my way out of it by the age of 30.

Now, here I was again. I felt like a total failure and the shame was all consuming.

The first time around, the debt seemed to creep up on me, partly due to my undiagnosed ADHD.

Impulsive spending on clothes, bags, shoes and booze, combined with an inability to face the growing problem, meant it built up over three years, mostly on credit cards, overdrafts and loans.

After my diagnosis, I understood why managing money (and life) had always been a struggle (Picture: Katie N Brand Photography)

I convinced myself I’d sort it out later when I was earning more money. But later never came and I stuck my head in the sand and ignored the letters.

To view this video please enable JavaScript, and consider upgrading to a web

browser that

supports HTML5

video

When I eventually told my mum, she suggested I go to Citizens’ Advice. They gave me two options: file for bankruptcy or pay it off.

Bankruptcy felt too shameful at the time, so I chose the latter.

I started setting micro-goals, like paying off £100 in a week, and celebrated every tiny win, by congratulating myself out loud and giving myself a pat on the back, or going hardcore on yellow sticker shopping to see what weird and wonderful things I could find at the cheapest price.

I lived by the 50/40/10 rule, where I spent 50% of my income on my rent, bills and everyday living expenses, I spent 40% on paying off my debts, and 10% on everything else.

So i thought i would re introduce myself to you all, I havent told my story here for quite a while, and I now write for the press fairly regularly, i have my own money community on facebook which is about to get even more exciting in app form, with loads of discounts, offers and tips for you all to try. Being in debt is lonely, but being part of a money community that supports and helps makes you feel less alone. I wish i had that support when i didnt know where to turn. I help people to tell their debt stories on my podcast Mad About Money, i am starting season two very soon! I love helping people to save money, i share tips and tricks and little things that i do to save money, make money, find discounts and get support. So this is my back story. 40k of debt cleared on my own, but it doesnt have to be that way. Give me a follow for more info on my new app coming soon! #madaboutmoney #moneysavingtipsuk #madaboutmoneyapp #madaboutmoneypodcast #moneytalk #debtsupport #debtcommunity #moneysavingcommunity #moneysavingtipsuk #costoflivingcrisis #costoflivingsupport #benefitsuk #moneystory #fyp

♬ original sound – Maddy Alexander-Grout

Meanwhile, I cancelled subscriptions, bought clothes from charity shops, stopped eating out, and found free or cheap ways to socialise – like going for walks in the park, or visiting museums.

During this period, too, my house burned down. Thankfully I was OK, and had house insurance, and I put this £15,000 towards paying off my debts too.

It wasn’t easy but, these changes, combined with saving every spare penny I could from my £1,500 a month salary, meant that, in just under six years, I was out of debt.

And for a long time after that, I lived a happy, financially sound, life.

I still saved and remained sensible with my money, I even started my TikTok channel, MadAboutMoneyOfficial, to help others.

I create separate pots for everything (Picture: Katie N Brand Photography)

Most importantly, I started a discount card business, which helped people to save when they shopped locally. I worked with shops directly to negotiate money off for members, starting off with a physical card before moving to an app.

For three years it was going really well – and then the pandemic hit.

My business collapsed – it simply wasn’t viable when people couldn’t leave the house – but instead of cutting my losses early, I clung on, convinced I could save it.

Before I knew it, the debts started stacking up again and by December 2022 I was back in £45,000 of personal debt and I had to close the business.

This nearly broke me, only, this time, I had knowledge to fall back on.

To view this video please enable JavaScript, and consider upgrading to a web

browser that

supports HTML5

video

Paying off debt is hard, but focussing on the small dopamine hits along the way really helps. I recommend tackling the smallest debts first, because watching them disappear gives you a boost and helps build momentum.

One of the best tools I found was using online pots in my Starling bank account (most banks offer something similar now).

I create separate pots for everything – debts, bills, holidays, treats, even a ‘massage fund’ – which helps me think carefully about what I was spending and stops me dipping into money that’s earmarked for something important.

I worked out the money I had coming in and I worked out the bills I had to pay and whatever was left I split depending on the level of importance to me, meaning massages got the lion’s share of ‘non-essential’ money.

I share tips like this on my Tikok account, and the response has been incredible (Picture: Katie N Brand Photography)

Find out more about Maddy

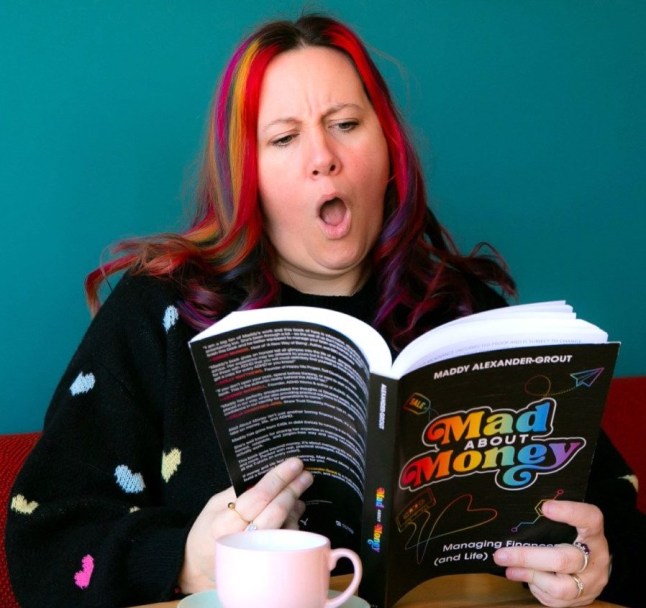

Maddy Alexander Grout’s book Mad About Money is out now and available online and at all good bookstores. You can find out more about Maddy at: maddyalexandergrout.com

While all this was going on, I was also having investigations into my suspected ADHD. I eventually got a formal diagnosis in January 2024, which was both a relief and an eye-opener.

For the first time, I understood why managing money (and life) had always been a struggle. Starting or finishing tasks is a challenge, as is losing track of time, spending money to soothe emotions, feeling overwhelmed by choices and shame around finances.

It explained why I’d forget bills, waste money on food I forgot to eat, or could nip out for milk and come home with a flat-screen TV.

Having a formal diagnosis and being on medication has allowed me to learn more about and understand my brain and what works best for it.

Now, whenever I want to buy something, I ask myself whether I need it or if I just want it. Or I’ll leave it in my online cart for up to 48 hours and if I still want it after that, I can buy it without guilt.

I share tips like this on my TikTok account, and the response has been incredible. People, especially those with ADHD or hidden money struggles, tell me they finally feel seen, and it makes me so proud.

Two and a half years on from closing my business, I’m pleased to say I’m almost debt-free again.

I have learnt the hard way that it’s hard for people with ADHD to have a good relationship with money, but I hope my story reminds people they’re not alone, and they’re not ‘bad’ with money – they just need tools that work for them.

Do you have a story you’d like to share? Get in touch by emailing jess.austin@metro.co.uk.

Share your views in the comments below.

Arrow

MORE: I blamed sex pain on recent birth – it was a dangerous symptom

Arrow

MORE: My date was going well until my braces got stuck… down there

Arrow

MORE: I uncovered my husband’s dirty secret while he was in a coma

Have you ever faced financial struggles like this? Share your story in the comments!

The Slice

Your free newsletter guide to the best London has on offer, from drinks deals to restaurant reviews.