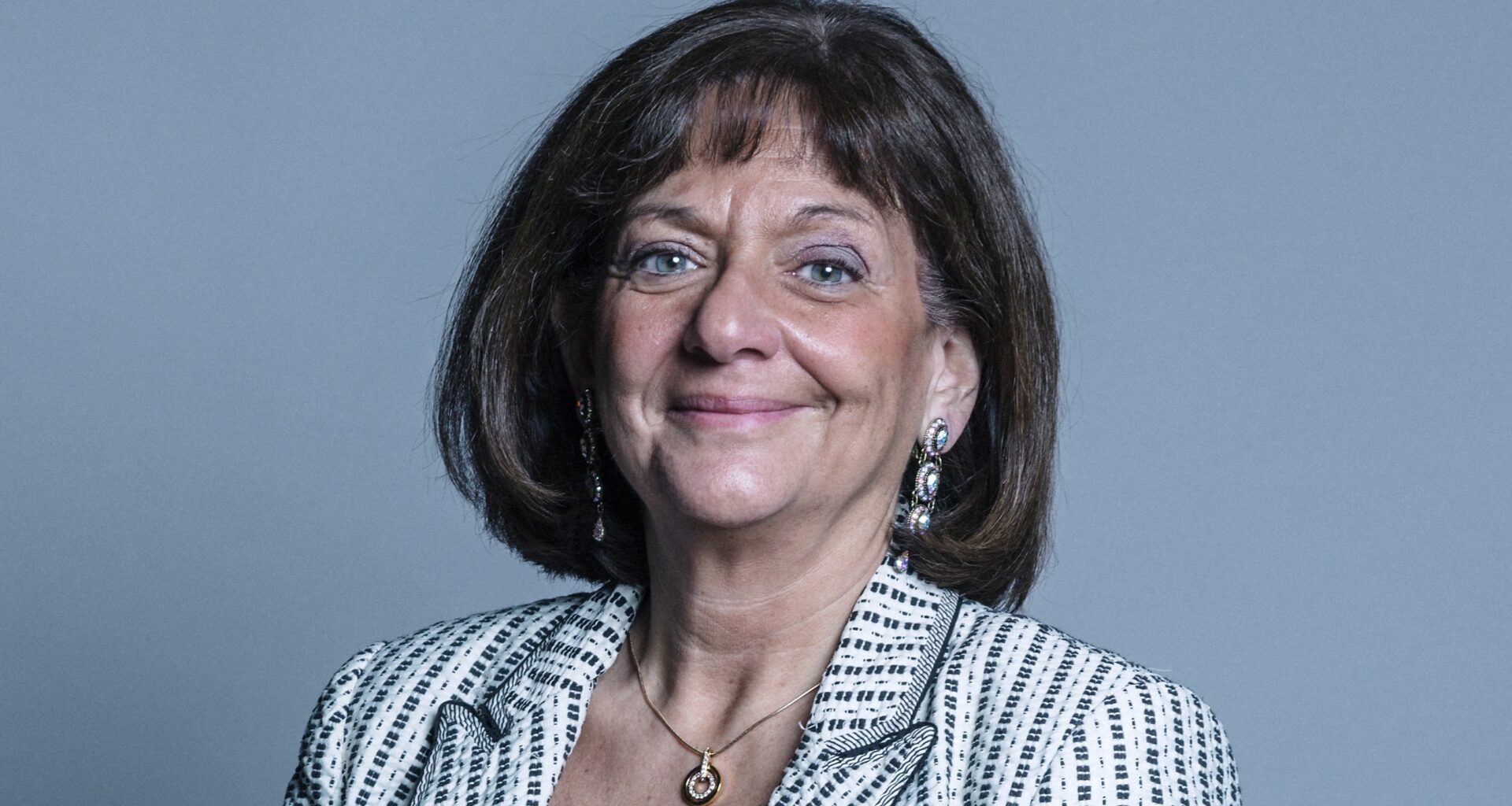

Government changes to inheritance tax could “damage the future of pensions in the country”, Baroness Ros Altmann has warned.

From 2027, most unused pension funds and death benefits would be included in the value of a person’s estate for inheritance tax.

But Altmann said these plans “could kill off modern pensions”.

She said imposing retrospective taxation could deter people from setting money aside for the long-term.

In a blog post, she wrote: “I have been warning that this policy will damage the future of pensions in this country.”

It comes after Altmann asked the government to “rethink their plans” for the future of pensions in a House of Lords Finance Bill sub-committee.

‘IHT and pensions is like oil and water, they don’t mix’

In her post, published last week, Altmann claimed it is “impossible” for unpaid executors of wills or personal representatives to find all past pensions and identify beneficiaries within six months,

She said: “The burden of this is being placed mostly on PRs, who will be liable to pay any inheritance tax due within six months, but will not have money from the pension funds to pay it from and will have to deal with all this at a time when they are grieving their lost loved one.”

Altmann believes the changes will harm “ordinary families” rather than close a loophole used by wealthy families.

She said a simpler way to reform the system would be with a flat-rate levy on unused pensions, which could be paid out of the pension fund by the provider and could apply to all pensions, regardless of the IHT position of the estate.

“There have not been enough warnings about this coming catastrophe,” added Altmann

“It’s not too late to avoid this disaster – I do hope the government will listen to reason.”

tara.o’connor@ft.com

What’s your view?

Have your say in the comments section below or email us: ftadviser.newsdesk@ft.com