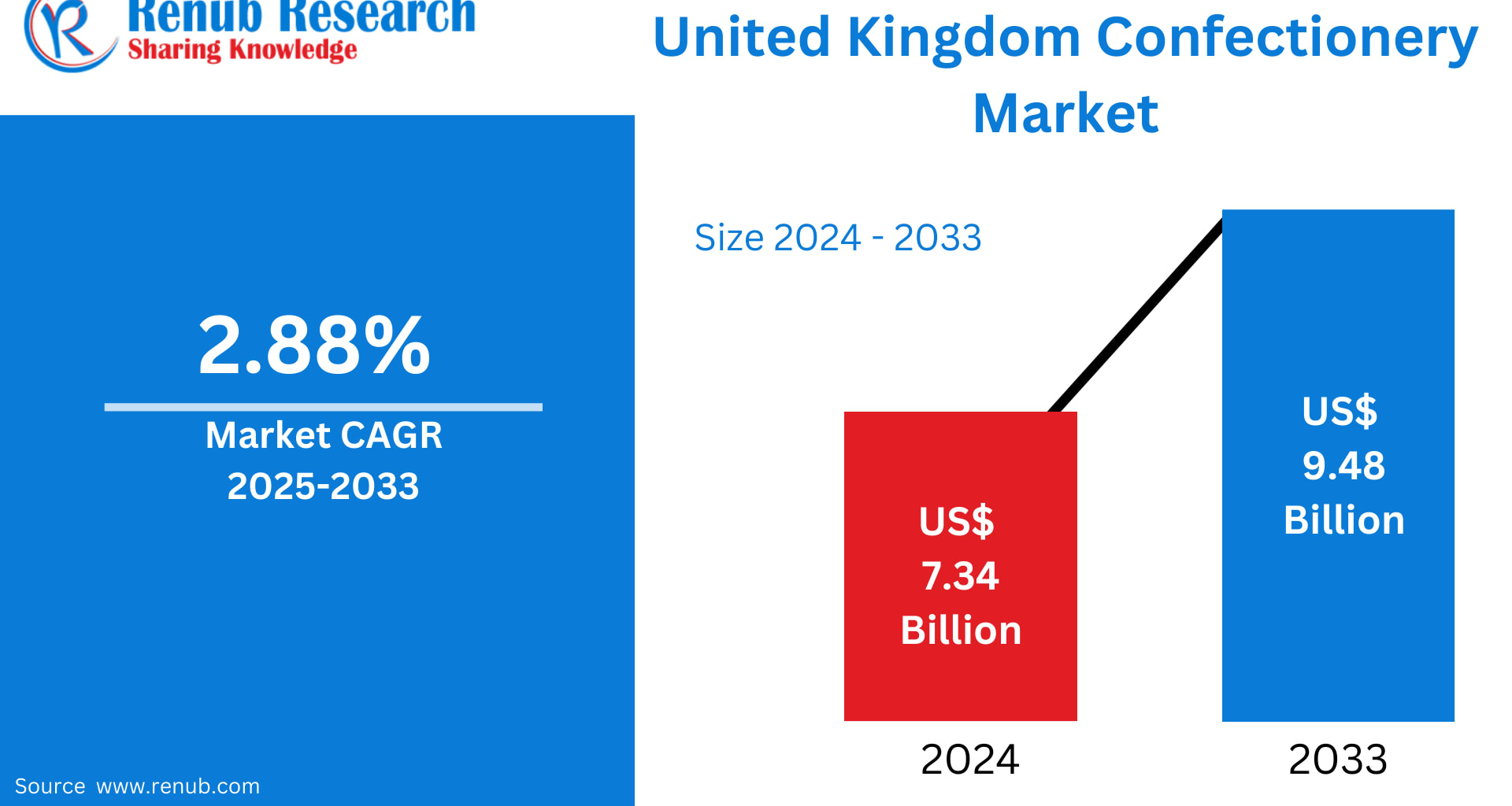

The United Kingdom Confectionery Market is experiencing a steady yet transformational rise, shaped by cultural traditions, evolving consumer preferences, and accelerating retail innovation. According to Renub Research, the United Kingdom Confectionery Market is expected to reach US$ 9.48 billion by 2033, rising from US$ 7.34 billion in 2024, growing at a CAGR of 2.88% during 2025–2033. This development reflects not only Britain’s sustained appetite for sweets but also the strategic adaptations of manufacturers and retailers to modern-day consumer expectations.

As food technology, ingredient innovation, and the push for healthier lifestyles continue to redefine the market, the UK stands as one of Europe’s most dynamic confectionery hubs—balancing indulgence with responsibility, tradition with innovation.

United Kingdom Confectionery Industry Overview

The UK confectionery industry remains one of the most vibrant segments within the broader food and beverage sector. Encompassing chocolate, sugar confectionery, and gum, the market caters to deeply rooted British traditions where chocolates and sweets are embedded in both cultural rituals and everyday life. Seasonal peaks—particularly around Christmas, Easter, and Valentine’s Day—underscore confectionery’s enduring role as a symbol of celebration, gifting, and nostalgia.

In recent years, the market landscape has shifted dramatically due to evolving customer preferences and retail strategies. Convenience stores, for instance, have become a dominant retail force. With over 48,590 convenience outlets across the UK in 2022, accessibility to confectionery has never been stronger. Major retailers are aggressively expanding. Aldi announced its plan to open 100 new UK stores by 2025, while Lidl GB aims to reach 1,100 outlets by the end of 2025, reaffirming the sector’s commitment to strengthening physical retail presence.

At the same time, digital transformation is reshaping how confectionery is purchased and consumed. In 2023, 82% of UK citizens made at least one online purchase, supported by an impressive 97.8% internet penetration and 66.11 million active internet users. Subscription services, curated sweet boxes, and tailored recommendations are now mainstream, pushing confectionery brands—legacy and emerging—to enhance their digital footprints.

Perhaps the most notable shift is towards health-focused confectionery. With 67% of consumers preferring milk chocolate, 22% dark chocolate, and 11% white chocolate, brands are innovating to meet both indulgence and wellness needs. This shift is further influenced by rising health concerns, with 4.3 million people in the UK diagnosed with diabetes in 2023, prompting manufacturers to introduce reduced-sugar, no-sugar, and functional alternatives.

Key Growth Drivers of the UK Confectionery Market

1. Strong Cultural Affinity and Seasonal Consumption

The UK has an unrivaled cultural connection to confectionery. Whether it’s a holiday gathering, office chocolate box, or simple moment of indulgence, sweets hold emotional value in British life. Seasonal periods remain blockbuster opportunities for brands—especially Christmas and Easter, which consistently drive soaring chocolate sales.

These occasions fuel demand for:

Festive assortments

Limited-edition packaging

Themed confectionery products

Gift-ready premium chocolate collections

Confectionery in the UK thrives as both an impulse buy and a symbolic gift. This dual utility makes it a high-frequency purchase category with reliable year-round demand. Seasonal traditions ensure that confectionery remains a central part of celebrations, reinforcing its position as a stable and culturally embedded market segment.

2. Premiumization and Ethical Sourcing Trends

In recent years, UK consumers have demonstrated an increasing desire for premium chocolates, artisanal sweets, and gourmet confectionery. This shift is driven by:

Higher disposable incomes

Curiosity about global flavors

Demand for transparency in sourcing

Growing interest in sustainable and ethical production

Brands promoting fair-trade cocoa, sustainable farming, and eco-conscious packaging have built strong loyalty among modern consumers. Premium chocolates—once reserved for special occasions—are now part of regular self-care and gifting trends.

Ethical sourcing is no longer a niche concern; it is a mainstream expectation. Consumers are willing to pay more for products that align with their values, boosting margins for companies that invest in sustainability.

3. Innovation in Health-Oriented Confectionery

Health consciousness among UK consumers is reshaping product development and marketing strategies. Traditional sugary treats are increasingly accompanied by a broad range of alternatives, including:

Sugar-free and reduced-calorie confectionery

Vegan and plant-based chocolates

Protein-infused or vitamin-enriched sweets

Clean-label offerings

Government regulations aimed at reducing sugar consumption—such as advertising restrictions and nutritional labeling—have forced manufacturers to reformulate and innovate without compromising taste.

This shift is giving rise to a new market subsegment: functional confectionery, appealing to consumers who seek indulgence with added health benefits.

Challenges in the United Kingdom Confectionery Market

1. Raw Material Price Volatility

Cocoa, sugar, and dairy prices continue to fluctuate due to global supply constraints, climate impacts, and geopolitical issues. This creates uncertainty for confectionery manufacturers, especially small and mid-sized businesses that struggle to hedge procurement risks.

Key challenges include:

Rising costs of ethical and sustainably sourced ingredients

Pressure to maintain affordability amid inflation

Difficulty passing cost increases to price-sensitive consumers

As price volatility increases, strategic planning and supply chain resilience remain crucial.

2. Regulatory and Health-Related Pressures

The UK’s push toward healthier eating has put confectionery brands under significant scrutiny. Regulations include:

Sugar reduction targets

Calorie labeling requirements

Restrictions on advertising sugary products to minors

These mandates require major investment in reformulation, packaging, and marketing. Brands must strike a delicate balance between reducing sugar and maintaining the flavors that define their identity. Non-compliance risks reputational damage and legal issues, making regulatory adaptation essential for long-term success.

Regional Market Overview

The UK’s confectionery consumption patterns vary across regions due to differences in demographics, cultural preferences, and retail landscapes.

London

London remains the epicenter of confectionery innovation and consumption. Its multicultural population fuels demand for both traditional treats and international flavors. High disposable income and health-focused lifestyles encourage strong purchasing of premium, vegan, and ethically sourced confectionery.

London’s retail ecosystem—including specialty chocolate boutiques, upscale markets, and robust e-commerce adoption—positions it as a key trendsetter for the entire UK market.

Scotland

Scotland’s confectionery market blends strong affinity for traditional sweets with rising interest in healthier alternatives. Local brands leverage regional identity, heritage flavors, and artisanal craftsmanship to maintain customer loyalty. Tourism boosts demand for giftable confectionery products, while e-commerce expansion widens access to diverse offerings.

West Midlands

Known for its industrial heritage and thriving urban centers, the West Midlands exhibits significant demand for both mainstream and premium confectionery. Affordability remains a primary factor, though health-oriented products are gaining popularity. A strong presence of local manufacturers and distribution networks supports growth across all segments.

Yorkshire and the Humber

As home to several historic confectionery manufacturers, Yorkshire and the Humber has a deep-rooted connection to sweets and chocolates. Traditional favorites maintain steady demand, while a younger, digitally savvy demographic creates opportunities for innovative, low-sugar, and plant-based products. Seasonal sales peaks and regional brand loyalty reinforce the area’s market importance.

Market Segmentations

By Type

Chocolate

Sugar Confectionery

Cookies

Ice Cream

By Distribution Channel

Supermarkets & Hypermarkets

Convenience Stores

Pharmaceuticals & Drug Stores

Specialty Stores

Online Channels

Others

By Region

London

South East

North West

East of England

South West

Scotland

West Midlands

Yorkshire and the Humber

East Midlands

Others

Key Companies Covered

August Storck KG

Chocoladefabriken Lindt & Sprüngli AG

Ferrero International SA

General Mills Inc.

HARIBO Holding GmbH & Co. KG

Kellogg Company

Lotte Corporation

Mars Incorporated

Company overviews, key personnel insights, recent developments, SWOT analyses, and revenue analysis form essential components of competitive benchmarking within the UK confectionery landscape.

Final Thoughts

The United Kingdom confectionery market is poised for steady growth through 2033, driven by the interplay of tradition, innovation, and evolving consumer values. While economic and regulatory pressures create hurdles, the sector’s ability to reinvent itself—through premiumization, healthier offerings, and digital expansion—positions it for resilience and long-term success.

As Britain continues to redefine indulgence in a modern context, confectionery remains one of the most beloved and culturally significant components of its food industry. The coming decade promises a sweet blend of nostalgia, creativity, and sustainable progress.