Experts say partners hesitate to approve large loans before new govt takes office

TBS Report

30 November, 2025, 06:15 pm

Last modified: 01 December, 2025, 01:55 am

Infographic: TBS

“>

Infographic: TBS

Bangladesh spent almost the same amount, disbursed by development partners in the first four months of the current fiscal year, to repay foreign loans during the same period, shows the latest report from the Economic Relations Division (ERD).

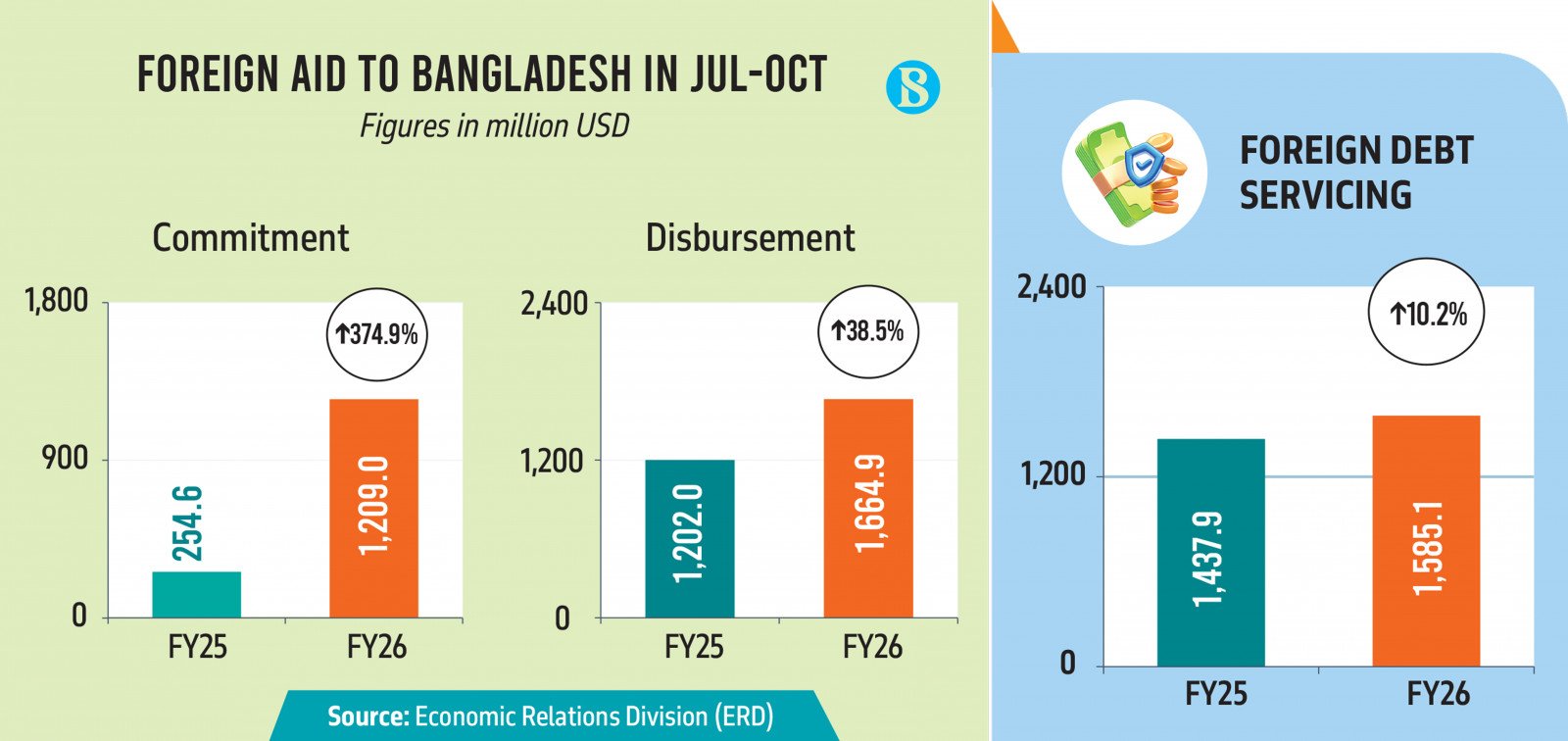

According to the report released today (30 November), development partners disbursed $1.66 billion from July to October, while Bangladesh repaid $1.585 billion in principal and interest on various loans.

At the same time, the country secured $1.2 billion in new foreign aid commitments or signed new loan agreements with development partners.

ERD data showed that commitments of foreign assistance rose by 375% compared with the same period last year, while actual loan disbursements increased by 38.51%. Repayments of principal and interest also grew by 10.23% during this period.

Keep updated, follow The Business Standard’s Google news channel

By contrast, in July-October of the previous fiscal, commitments stood at only $254.57 million, while disbursements amounted to $1.20 billion. During the same period, Bangladesh repaid $1.437 billion in principal and interest.

ERD officials said both disbursements and commitments were lower last year because development activities were largely stalled in July-October 2024 due to the mass uprising.

Besides, they said Bangladesh has taken several large foreign loans in the past, and as the grace periods for many projects end, principal repayments have started, contributing to a steady increase in foreign loan repayments

Polls impact on new commitments

Zahid Hussain, former lead economist at the World Bank’s Dhaka office, said the approach of national elections reduces the likelihood of new commitments for major development projects, including budget support and high-value loans.

He explained that uncertainties exist on both sides: ministries face reduced capacity to prepare and submit proposals amid election duties, while development partners hesitate to approve large loans before a new government takes office.

“Development partners, such as the World Bank and ADB, also see pre-election periods as risky,” he said. “They question whether a new administration will assume project ownership, making them cautious about approving large loans in advance.”

Positive signs despite challenges

Masrur Reaz, chairman and CEO of Policy Exchange, said the first four months of the current fiscal year show positive change compared with last year.

This year, he said, the government is in a comparatively stronger position regarding fiscal management, foreign loans, and development spending.

“Clearer policies and fiscal frameworks have created more confidence,” he said.

However, he noted that many development partners are still waiting for election results. “Once a stable, elected government is in place, they will engage with new policymakers to approve projects and expand commitments.”

Disbursement, repayment breakdown

According to ERD, Bangladesh repaid $1.02 billion in principal during July-October 2025, up from $895.58 million in the same period last year. Interest payments totalled $560.87 million, compared with $542.32 million in FY25.

The highest disbursement of $581.74 million came from the ADB, while the World Bank contributed $12.44 million in new commitments during this period.

Russia led disbursements with $407.78 million, largely used for the Rooppur Nuclear Power Project. The World Bank followed with $405.24 million, the ADB $248.81 million, China $194 million, India $84.85 million, and Japan $80.09 million.