The consumer champion addressed the issue of State Pension and tax with Chancellor Rachel Reeves to help people understand the announcement in the Budget.

During the post-Budget special episode of The Martin Lewis Money Show Live, Chancellor Rachel Reeves confirmed that people whose sole income is the State Pension will not pay any income tax on it for the duration of the current parliamentary term.

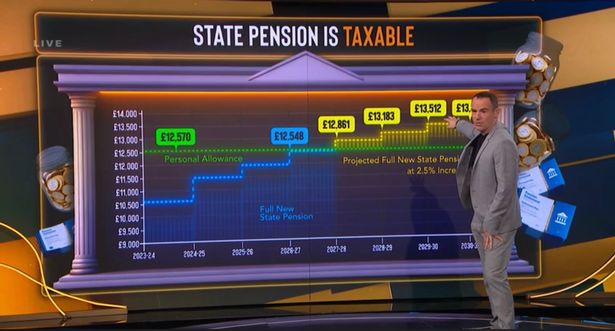

The Labour Government has also pledged to honour the Triple Lock during this parliament which means the full New State Pension is on track to exceed the Personal Allowance threshold of £12,570 in April 2027. The Chancellor also announced during the Budget that the freeze on the Personal Allowance will be extended until April 2031.

During this week’s show, the consumer champion explained to ITV viewers that the State Pension uprating will be worth £12,548 for the 2026/27 financial year, just £22 under the Personal Allowance. This means anyone with any additional income over that amount will pay tax next year.

READ MORE: WASPI announces new DWP compensation reconsideration due before end of FebruaryREAD MORE: DWP confirms New and Basic State Pension weekly payment rates from April

However, it’s important to understand that any additional income will either come off automatically though the PAYE system or Self Assessment, which wouldn’t need to be paid until the following year.

Martin showed a graph with the projected rises to full, New State Pension payments under the Triple Lock.

Under the Triple Lock the New and Basic State Pensions increase each year in-line with whichever is the highest between the average annual earnings growth from May to July (4.8%), CPI inflation rate in the year to September (3.8%), or 2.5 per cent.

Screenshot(Image: ITV)

Screenshot(Image: ITV)

Additional State Pension elements and deferred State Pensions rise each year with the September CPI figure (3.8%).

The increase for next year will see those on the full New State Pension receive £241.30 per week, while those on the maximum Basic State Pension would receive £184.90 per week.

However, the financial guru’s graph showed a steady annual rise under the 2.5 per cent measure, which calculated the minimum amount that it would rise each year. By 2030, the full New State Pension would be worth £13,850 – some £1,280 over the Personal Allowance threshold of £12,570.

Martin warned that the projections show that by the 2027/28 financial year, the full New State Pension will be “about £300 more than the tax allowance”.

Martin went on to say that his biggest concern was the admin involved for older people who need to complete a Self Assessment form.

He then played an extended version of his interview with the Chancellor addressing State Pension and tax, highlighting one concerned viewer whose father is 80 and has dementia, asking if he will need to fill in a self Assessment form.

Ms Reeves explained that nobody on the full New State Pension – with no other income – will pay tax. She said the ‘crossover’ is likely to happen in 2027 when the Personal Allowance will be exceeded but added “we are working on a solution, as we speak, to ensure that we’re not going after tiny amounts of money”.

When pressed by Martin on whether older people will need to pay the tax, she said “in this parliament they won’t have to pay the tax, further out I won’t be able to make any commitment on that but we are looking at a simple workaround at the moment”.

Martin also asked whether someone who only get an additional income of £50 per month, which would take thor total annual income over the threshold would pay tax.

The Chancellor said this is taxable and can only commit to no tax burden on anyone whose sole income is the full New State Pension.

You can watch the full interview with Chancellor Rachel Reeves on the Money Saving Expert website.

New State Pension payment rates 2026/27

Full New State Pension

Weekly: £241.30 (from £230.25)Four-weekly pay period: £965.20Annual amount: £12,547

Full Basic State Pension

Weekly: £184.90 (from £176.45)Four-weekly pay period: £739.60Annual amount: £9,614State Pension and tax

Guidance on GOV.UK states: “You pay tax if your total annual income adds up to more than your Personal Allowance. Find out about your Personal Allowance and Income Tax rates.

Your total income could include:

the State Pension you get – Basic or New State PensionAdditional State Pensiona private pension (workplace or personal) – you can take some of this tax-freeearnings from employment or self-employmentany taxable benefits you getany other income, such as money from investments, property or savingsCheck if you have to pay tax on your pension

Before you can check, you will need to know:

if you have a State Pension or a private pensionhow much State Pension and private pension income you will get this tax year (April 6 to April 5)the amount of any other taxable income you’ll get this tax year (for example, from employment or state benefits)

You cannot use this tool if you get:

any foreign incomeMarriage AllowanceBlind Person’s Allowance

Use this online tool at GOV.UK to check if you have to pay tax on your pension. The full guide to tax when you get a pension can be found on GOV.UK here.

Get the latest Record Money news

Get the latest Record Money news

Join the conversation on our Money Saving Scotland Facebook group for money-saving tips, the latest State Pension and benefits news, energy bill advice and cost of living updates.

Sign up to our Record Money newsletter and get the top stories sent to your inbox daily from Monday to Friday with a special cost of living edition every Thursday – sign up here.

You can also follow us on X (formerly Twitter) @Recordmoney_ for regular updates throughout the day or get money news alerts on your phone by joining our Daily Record Money WhatsApp community.