Company Logo

The UK alternative lending market is primed for growth, driven by regulatory changes, BNPL’s expansion, open banking’s evolution, and SME partnerships. Opportunities lie in regulatory compliance for BNPL, integrating open banking in credit strategies, strengthening retailer-lender alliances, and leveraging data reforms.

United Kingdom Alternative Lending Market

United Kingdom Alternative Lending Market

Dublin, Jan. 05, 2026 (GLOBE NEWSWIRE) — The “United Kingdom Alternative Lending Market Size & Forecast by Value and Volume Across 100+ KPIs by Type of Lending, End-User Segments, Loan Purpose, Finance Models, Distribution Channels, and Payment Instruments – Databook Q4 2025 Update” has been added to ResearchAndMarkets.com’s offering.

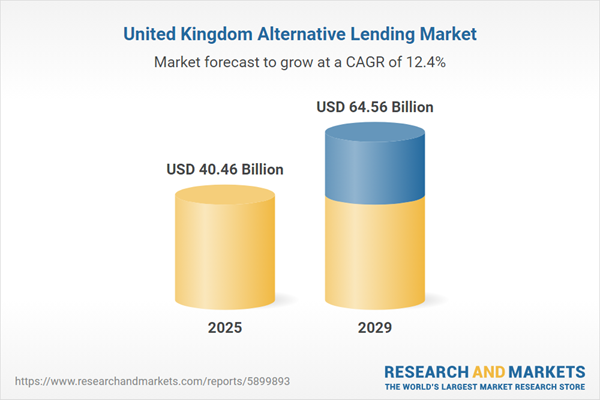

Alternative lending sector in the United Kingdom is forecasted to experience a 14.3% annual growth, with market value projected to reach USD 40.46 billion by 2025. Currently on an upward trend with a CAGR of 15.2% from 2020-2024, the market is expected to grow at a 12.4% CAGR through to 2029, ultimately expanding from USD 35.39 billion in 2024 to approximately USD 64.56 billion by 2029.

Key Trends & Drivers: The UK’s alternative lending market is advancing into a more mature phase, driven by regulatory changes and technological advancements. The Buy Now, Pay Later (BNPL) sector is undergoing a significant transition under full FCA oversight, thereby broadening its risk profile. Open banking is evolving from a payment utility to a foundational component of credit infrastructure. Embedded lending is consolidating around major retailers, with Small and Medium Enterprises (SMEs) growing through strategic partnerships.

Regulatory reforms around data and credit information promise to improve underwriting processes and enhance financial inclusion, crucial for lenders relying on compliance, data agility, and strategic alignments.

Competitive Landscape: The UK’s alternative lending sector is moderately fragmented yet rapidly maturing. While fintech lenders and challenger banks compete with legacy financial institutions, the focus is on differentiated underwriting and strategic distribution. The competitive environment is seeing consolidation, with well-capitalized players and those with embedded partnerships pulling ahead. Regulation is expected to filter market players, raising the bar for consumer protection and governance.

SME lending is shifting towards hybrid bank-fintech models, and BNPL providers are under pressure, potentially leading to market exits. Product diversification in areas such as cards, invoice finance, and integrated payments, alongside vertical specialization (e.g., healthcare), will drive competitive differentiation.

Strategic Movements: Key players such as Funding Circle have expanded their offerings, introducing business credit cards and strengthening partnerships. Iwoca is making strides into B2B trade credit. In the BNPL segment, Klarna is realigning its balance sheet strategy, while Zilch continues to scale with a focus on consumer and merchant-led models.

Regulatory Changes: By July 2026, Deferred Payment Credit (BNPL) will fall under full FCA regulation, demanding affordability checks and enhanced consumer disclosures. There are consultations on bringing merchant-funded BNPL into the scope of regulatory oversight.

Report Overview: This report provides a comprehensive analysis of the UK alternative lending industry, covering a wide array of key performance indicators (KPIs) and offering a granular view across lending segments. Important segmentation includes loan types and purposes, distribution channels, and borrower demographics, providing insights into market size, structure, and credit dynamics. The newly formed data-rights and credit information governance aim to streamline standardization in data flows, thereby optimizing lending solutions.

Backed by industry best practices and proprietary analytics, the report delivers evidence-based insights into market opportunities, enabling strategic decisions for stakeholders across the lending ecosystem.

Key Attributes:

Report Attribute

Details

No. of Pages

200

Forecast Period

2025 – 2029

Estimated Market Value (USD) in 2025

$40.46 Billion

Forecasted Market Value (USD) by 2029

$64.56 Billion

Compound Annual Growth Rate

12.4%

Regions Covered

United Kingdom

Key Topics Covered:

United Kingdom Economic Indicators

United Kingdom Broader Market Enablers & Digital Infrastructure

United Kingdom Overall Lending Industry Attractiveness

United Kingdom Overall Lending Market Size and Forecast by Type of Lending

United Kingdom Overall Lending Market Size and Forecast by End-User

United Kingdom Retail Lending Market Size and Forecast by Loan Purpose / Use Case

United Kingdom SME/MSME Lending Market Size and Forecast by Loan Purpose / Use Case

United Kingdom Overall Lending Market Size and Forecast by Distribution Channel

United Kingdom Alternative Lending Industry Attractiveness

United Kingdom Alternative Lending Market Size and Forecast by End-User

United Kingdom Alternative Lending Market Size and Forecast by Finance Models

United Kingdom Alternative Lending Market Size and Forecast by Finance Models and End-User Segments

United Kingdom Alternative Lending Market Size and Forecast by Loan Purpose / Use Case – Retail (Consumer Lending)

United Kingdom Alternative Lending Market Size and Forecast by Loan Purpose / Use Case – SME/MSME (SME/MSME Lending)

United Kingdom Alternative Lending Market Size and Forecast by Payment Instrument

United Kingdom Alternative Lending by Finance Models across Payment Instruments

United Kingdom Alternative Lending Analysis by Consumer Demographics & Behavior

For more information about this report visit https://www.researchandmarkets.com/r/du5u65

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900