Russia’s state rail monopoly registered its steepest freight decline in 16 years in 2025, a drop that Ukraine’s Center for Countering Disinformation said underscored mounting strain across key sectors of the Russian economy, according to the Center’s statement on January 14.

The agency stated that freight-rail volumes are an important indicator of the real state of the economy at a time when Russia’s official statistics can manipulate macroeconomic indicators, and Russian Railways has seen these volumes fall steadily for a fourth consecutive year since the start of the full-scale invasion of Ukraine.

Every article pushes back against disinformation. Your support keeps our team in the field.

The agency specified that grain shipments fell by more than 12%, construction materials by more than 10%, and timber by almost 6%, while the steepest declines were recorded in industrial raw materials and ferrous metals, down 16% and 17.7% respectively.

Freight rail volumes matter because they capture the flow of heavy, “real economy” goods—such as metals, raw materials, construction inputs, fuel, and agricultural cargo—that underpin industrial production, construction, and exports, making changes in rail loadings a practical barometer of underlying demand when headline macro data are contested.

Read more

CategoryLatest newsArmored Trains in 2025? Russia Slaps AI “Eyes” on a Relic of Past Wars

Dec 15, 2025 15:02

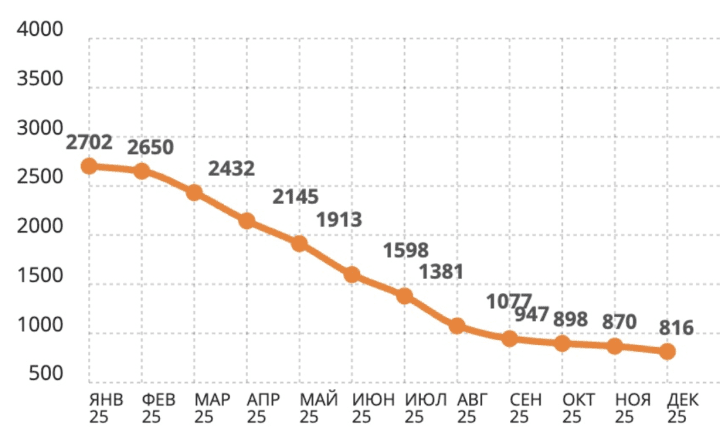

To illustrate the scale of the downturn, open-source analysts often point to the RailEX index, which tracks average Russian market rates for commercially leasing a standard open-top rail gondola car.

The Railroad Index chart shows the daily rate index for providing an open-top rail gondola car for a technical run across the “1520 space,” over the past 12 months. (Source: RAILROAD INDEX/Facebook)

By the end of 2025, the index had fallen by more than threefold, signaling a sharp drop in demand for rail capacity and weaker freight activity across the network.

Earlier, it was reported that Russia’s broader war strain is showing up across industry, including pressure on Russian Railways tied to shortages and staffing gaps alongside rising financial stress.

-f223fd1ef983f71b86a8d8f52216a8b2.jpg)

Support our frontline reporters

We report from the front lines to show the reality of war. Your support helps us stay there and tell the stories that matter.

Related articles