Greater Toronto real estate woes continue with no end in sight. December saw new home prices fall further, shedding up to 25% from peak according to BILD GTA data. Unfortunately, even with the drop, the market remains far from reach for end-users. As a result, the month ended 2025 as the worst year in more than 4 decades of data, heading into 2026 with more downward pricing pressure.

Toronto New Home Prices Down 25.4%, But Remain Out of Reach

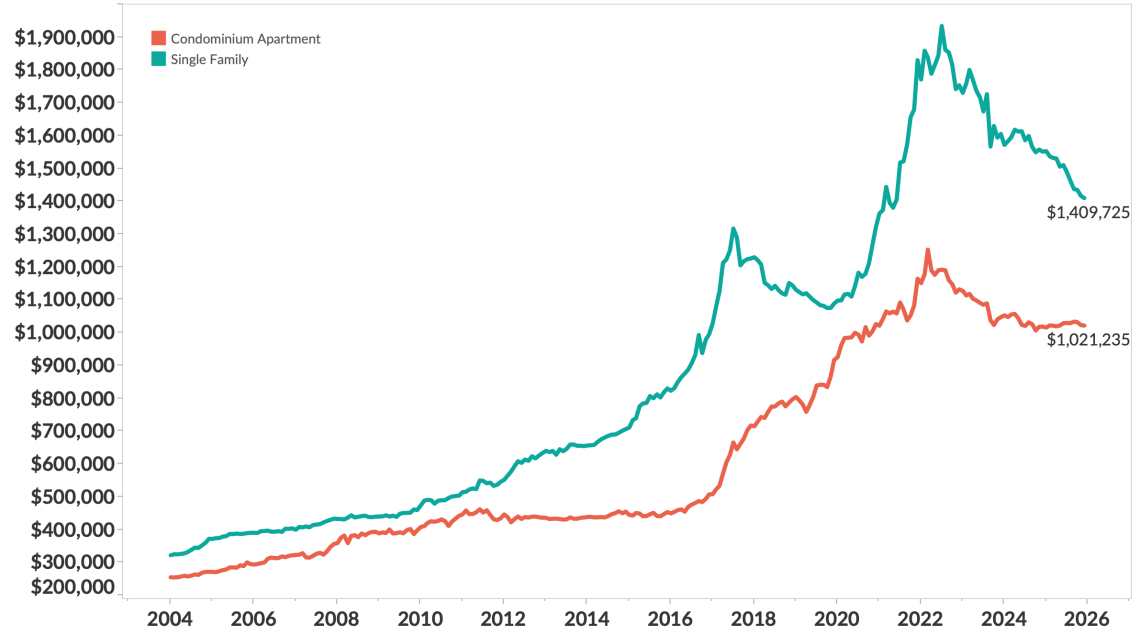

The Benchmark Price of A New Home Across Greater Toronto.

Source: Altus Group; BILD GTA.

Greater Toronto new home prices continue to slide lower. The benchmark asking price of a single-family home fell 0.5% (-$6.9k) to $1.41 million in December. This represents a 9.1% (-$141.5k) decline since last year, with prices now 25.4% (-$479k) from the record high reached in 2022. Those declines only bring prices back to 2021 levels, emphasizing the exuberance. After falling a quarter, prices still retain gains from the low-rate-fueled investor boom.

Condo apartment prices have held up better, but are showing signs of weakening. The price of a new condo fell 0.2% (-$1.7k) to $1.02 million in December. That leaves them essentially flat at 0.3% (+$3.1k) higher than a year before, but 18.1% (-$226.0k) below the record high. Shedding a fifth sounds like a lot, but prices are still where they were in 2024. Sales confirm that most buyers don’t exactly see this as a screaming deal they need to jump on.

Toronto New Home Sales Just Had The Worst Year On Record

Greater Toronto New Home Sales: December.

Source: BILD GTA; Altus Group; Better Dwelling.

Toronto real estate developers had an alarmingly slow month, even for December. Only 240 new homes sold last month, down 24% from a year earlier. It marked the weakest December in 30 years of monthly data available, with a revealing breakdown. Condo sales represented 87 of the homes sold (-42% y/y), failing to match the 153 single-family homes. Despite being much more affordable, the oversaturated condo market struggles to find buyers.

Last month also marked the end of 2025, with just 5,314 units sold in the whole year. That makes it the weakest year for Greater Toronto developers since at least 1981, when data tracking began. It’s now worse than the 1990s real estate crash, yet remarkably, prices remain out of reach for end-users.

Toronto New Home Inventory Slips, Still 2nd highest In 9 Years

Greater Toronto New Home Inventory.

Source: BILD GTA; Altus Group; Better Dwelling.

The biblically-sized disconnect between builders and end-users has resulted in a healthy amount of supply. Inventory ended the year with 20.8k new homes for sale, down 4.3% from last year. Even with the relatively small drop, inventory still had the second-highest print for the month since 2016.

Breaking down the inventory by segment reveals that condos applied the downward pressure. Condo apartments represented 15.1k of the units in December, down 10.9% from last year. At the same time, the notoriously scarce single-family units people pay a premium for, surged 19.0% higher to 5.7k units. It was the most single-family inventory since 2015, the end of the Greater Toronto real estate slump that lingered from the financial crisis.

Rising single-family inventory may create more downward pressure for the general market. Relatively weak demand for the most expensive segment of the market tends to have a cascading effect on prices. After all, a typical condo and single-family home are generally comparable for end use, with the price gap being the biggest issue. With rare exception, that means any transmission of downward pressure should trickle down or further erode demand.

Greater Toronto home prices continue to fall, driven by weak demand and oversupply. Even after significant declines, prices remain out of reach for end-user incomes. At the same time, developers have their hands tied, as lofty input costs make price cuts hard to absorb. That leaves new housing developments in real estate purgatory, waiting for buyer incomes to surge or costs to fall.

You Might Also Like