Tk4,600 crore collected in premiums in 9 months, but claims worth Tk2,221 crore settled.

24 January, 2026, 10:30 pm

Last modified: 25 January, 2026, 11:02 am

Illustration: Collected

“>

Illustration: Collected

Bangladesh’s insurance companies paid out less than half of the premiums collected in the first nine months of 2025, raising concerns over mounting unpaid claims and eroding public confidence.

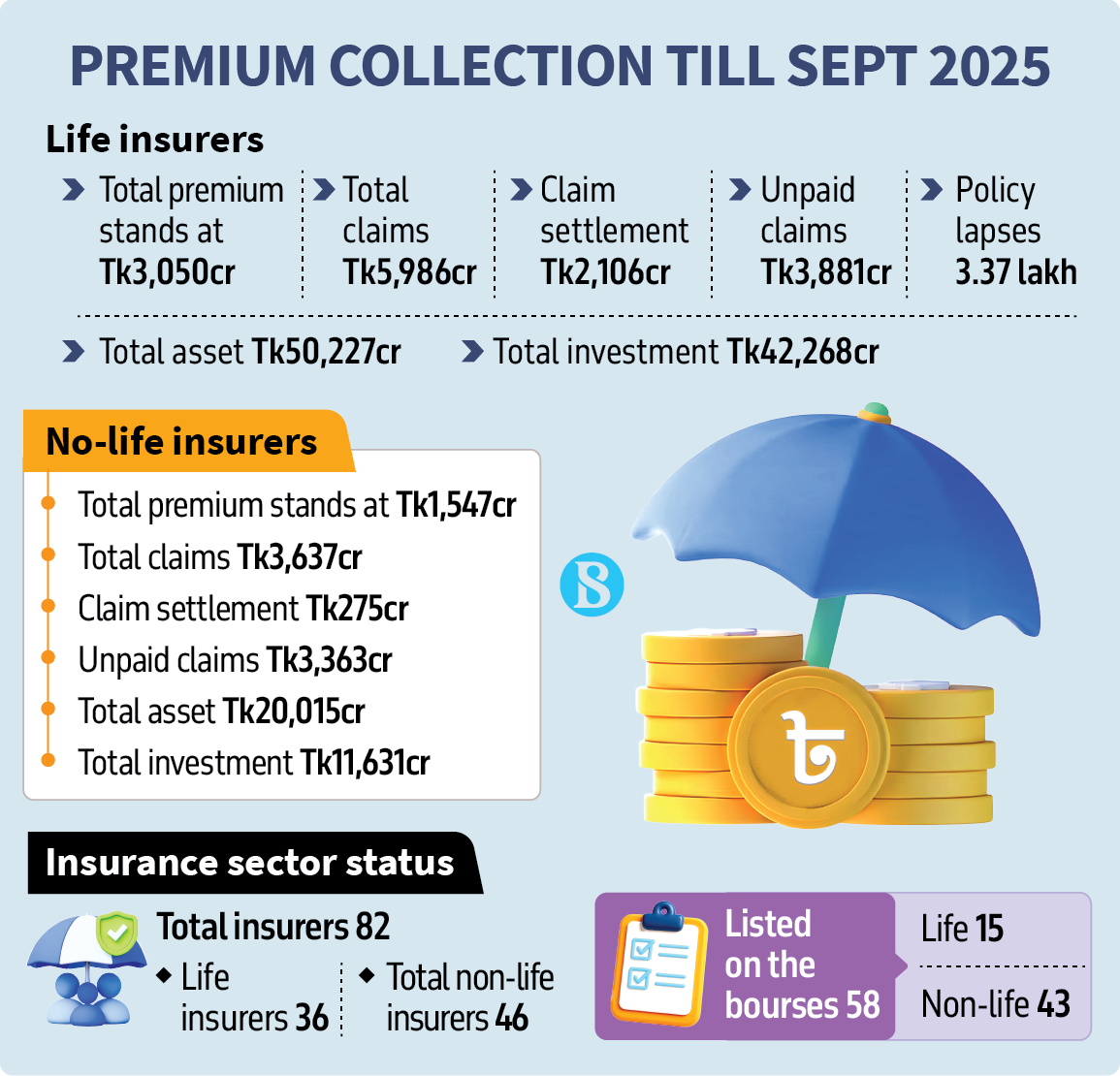

Infograph: TBS

“>

Infograph: TBS

According to official data, between January and September 2025, insurance companies collected approximately Tk4,600 crore in premiums from policyholders. However, during the same period, claims worth only Tk2,221 crore were settled – equivalent to 48% of the total premium income.

At the same time, total outstanding claims across the sector stood at Tk9,624 crore, highlighting a widening gap between premium collection and claims settlement.

Analysis of data from the Insurance Development and Regulatory Authority (Idra) shows that the sector’s average claims settlement rate during the nine-month period was just 23%. In life insurance, the rate stood at 35.18%, while in non-life insurance it was only 7.55%.

Keep updated, follow The Business Standard’s Google news channel

Of the Tk4,600 crore in total premiums collected, life insurers accounted for Tk3,050 crore and paid Tk2,106 crore in claims. Non-life insurers collected Tk1,547 crore but settled claims of only Tk275 crore.

The figures indicate that although policyholders continue to pay premiums regularly, insurers are disbursing significantly less in claims, causing unpaid liabilities to accumulate over time. As a result, the overall claims settlement ratio is declining at an alarming pace.

A key indicator in assessing insurers’ financial health is the Incurred Claim Ratio (ICR), which measures the proportion of claims paid relative to premiums earned within a specific period. For example, if a health insurer collects Tk1 crore in premiums and pays Tk80 lakh in claims, its ICR would be 80%, with the remaining Tk20 lakh typically covering operating expenses and profit.

In the insurance industry, an ICR between 60% and 90% is generally considered healthy, reflecting a balance between customer service and financial sustainability. Companies within this range tend to enjoy higher customer trust and long-term stability.

However, when the ICR falls below 50%, it suggests that an insurer is paying out relatively low claims compared to premium income. While this may boost short-term profitability, it raises serious concerns about service standards and fair settlement practices, potentially undermining public confidence.

Industry insiders note that newly registered insurers often report lower claims ratios in their early years, as most policies have not yet matured. Over time, as policy terms are completed, maturity and death claims rise, naturally putting the ICR at a lower level.

In Bangladesh, particularly in the life insurance segment, several established companies have historically maintained higher claims payouts due to a large number of mature policies. However, sector observers warn that many firms are now deviating from this normal trajectory.

“There appears to be growing reluctance among some insurers to settle claims promptly, even as they aggressively collect premiums,” said a former chief executive officer of an insurance company, speaking on condition of anonymity.

He added that if policyholders’ funds are not paid out in claims, they should ordinarily remain within the company’s life fund or investment portfolio. Yet, in reality, both life funds and investment volumes are reportedly declining.

“This raises legitimate questions about how the collected premiums are being utilised,” he said. “If the funds are invested internally, why are adequate returns not being generated? And if profits are insufficient, why are claims regularly delayed?”

According to him, weak oversight and limited accountability have allowed such practices to persist, leaving policyholders financially distressed and further eroding trust in the sector.

In a recent move aimed at restoring discipline and transparency, Idra suspended licences of individual agents operating in the non-life insurance segment, effective from 1 January. Earlier, acting on a proposal from the Bangladesh Insurance Association, the regulator set the commission rate for individual agents in non-life insurance at 0%.

Sector insiders believe that proper implementation of these reforms could help revive business growth, improve governance standards and ultimately raise claims settlement rates, thereby rebuilding public confidence in the insurance market.