As the United Kingdom’s FTSE 100 index experiences fluctuations amid weak trade data from China, investors are keenly observing how global economic conditions impact domestic markets. In this climate, growth companies with high insider ownership can be particularly appealing due to their potential for strong alignment between management and shareholder interests, making them a notable focus in today’s market landscape.

Name

Insider Ownership

Earnings Growth

SRT Marine Systems (AIM:SRT)

16.3%

57.8%

Quantum Base Holdings (AIM:QUBE)

33.9%

104.9%

Plexus Holdings (AIM:POS)

11.5%

140%

Metals Exploration (AIM:MTL)

10.3%

102.4%

Manolete Partners (AIM:MANO)

34.9%

38.1%

Hochschild Mining (LSE:HOC)

38.4%

33.7%

B90 Holdings (AIM:B90)

10.9%

157.2%

ASA International Group (LSE:ASAI)

30.8%

20.8%

Afentra (AIM:AET)

37.7%

37.1%

ActiveOps (AIM:AOM)

25%

102.9%

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £489.63 million.

Operations: The company’s revenue segments include Real Assets generating £105.67 million, Private Equity contributing £47.43 million, and Foresight Capital Management adding £9.22 million.

Insider Ownership: 34.7%

Earnings Growth Forecast: 18.5% p.a.

Foresight Group Holdings has demonstrated solid growth with earnings rising by 27.4% over the past year and a forecasted annual profit growth of 18.5%, outpacing the UK market average. The company reported a net income increase to £18.39 million for H1 2026, alongside a dividend increase to 8.1 pence per share, reflecting its commitment to shareholder returns. Trading at good value compared to peers, Foresight’s revenue is expected to grow faster than the UK market at 10% annually.

LSE:FSG Earnings and Revenue Growth as at Feb 2026

LSE:FSG Earnings and Revenue Growth as at Feb 2026

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Saga plc, with a market cap of £791.76 million, operates in the United Kingdom offering package and cruise holidays, general insurance, and personal finance products and services through its subsidiaries.

Story Continues

Operations: The company’s revenue segments consist of £475.50 million from travel, £26.70 million from home insurance broking, £54.80 million from motor insurance broking, and £41.40 million from other insurance broking activities.

Insider Ownership: 36.9%

Earnings Growth Forecast: 99.6% p.a.

Saga plc has been added to the FTSE 250 and FTSE 350 indices, reflecting its growing market presence. The company recently launched a significant partnership with Ageas UK, expected to bolster its motor and home insurance business. Despite slower revenue growth than the UK market at 3.5% annually, Saga’s earnings are forecasted to grow significantly by 99.56% per year over three years, indicating potential profitability ahead of market averages without recent insider trading activity noted.

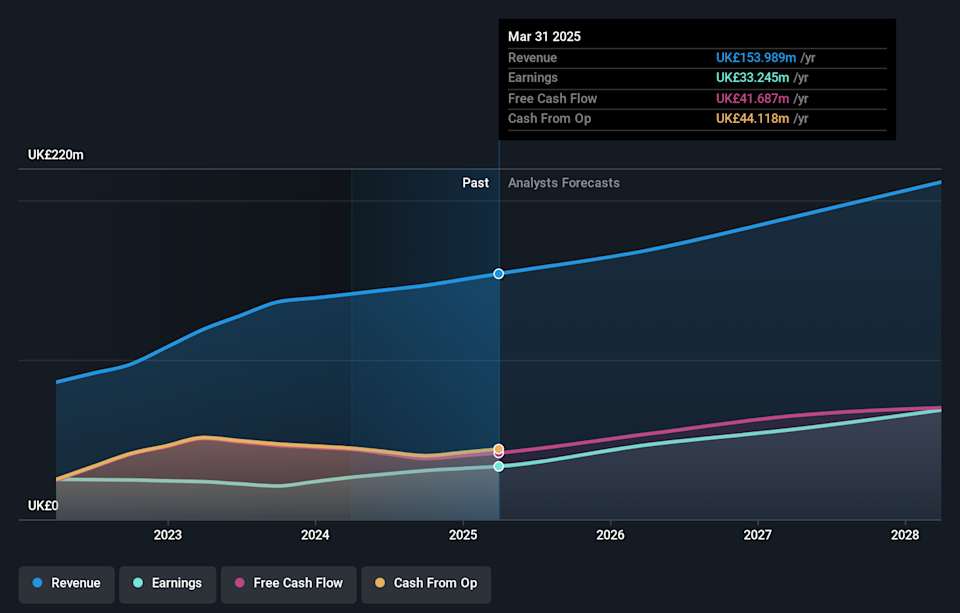

LSE:SAGA Earnings and Revenue Growth as at Feb 2026

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Beauty Tech Group plc is an at-home beauty technology company operating in the United States, Canada, the United Kingdom, the European Union, and Asia with a market cap of £347.60 million.

Operations: The company generates revenue through its operations in the United States, Canada, the United Kingdom, the European Union, and Asia.

Insider Ownership: 19.4%

Earnings Growth Forecast: 56.2% p.a.

Beauty Tech Group, recently added to the FTSE All-Share Index, is experiencing robust insider buying activity with no significant selling. The company forecasts earnings growth of 56.22% annually, outpacing the UK market’s 14.2%. Revenue is projected to grow at 17.7% per year, exceeding market expectations and anticipated to reach at least £136 million for 2025. Trading slightly below estimated fair value, Beauty Tech has become profitable this year despite interest payments not being well covered by earnings.

LSE:TBTG Earnings and Revenue Growth as at Feb 2026

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include LSE:FSG LSE:SAGA and LSE:TBTG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com