Wendy Lennie urges people to take their retirement money sooner rather than later

When he reached the state pension age, Arthur Burgess decided to put off retiring for a few years and carry on working, juggling two jobs.

Arthur thought the extra years of graft would be worth it, as he wanted to enjoy a comfortable life with his wife Anne, once he retired.

And so, along with continuing to work, he delayed collecting his state pension for five years, even though he was eligible to take it.

Delaying receiving the state pension means payments are higher once it is taken and Arthur thought it would help make him more comfortably off once he had left work.

Sadly, though, Arthur never got to fully experience the retirement he dreamed of. He was diagnosed with bowel cancer shortly after retiring at the age of 70 in 2013 and died months later.

New FeatureIn ShortQuick Stories. Same trusted journalism.

His daughter Wendy Lennie, 54, told The i Paper that her family’s experience with losing her dad in such a heartbreaking way has made her strongly believe that people should take their state pension as soon as they can and avoid deferring it for a time that might not ever come.

Wendy, 54, who lives in Fife, said: “When my dad turned 65, I begged him to stop working and spend some time with my mum.

“My dad worked two jobs – as an accountant by day and a shelf stacker at night. He wanted to pay off every debt he had before he retired and he also said he wanted my mum to have a comfortable later life.

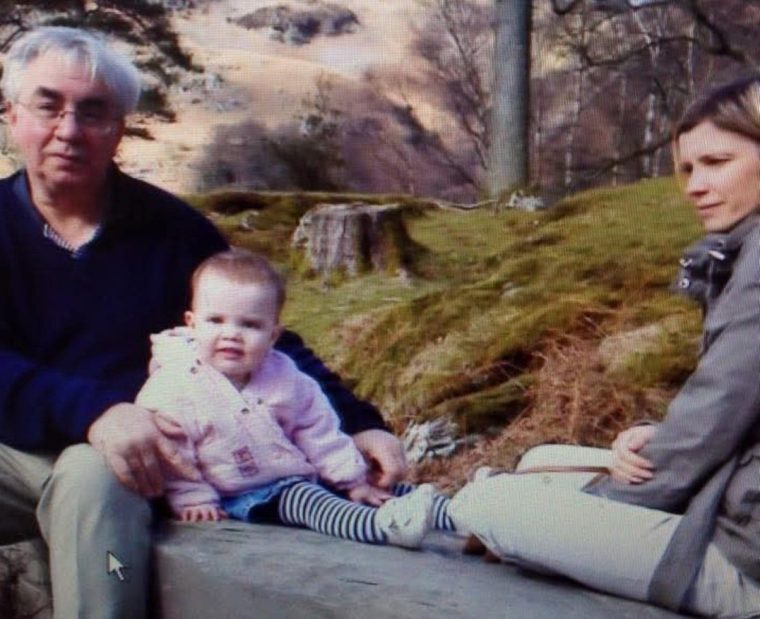

Wendy with her dad Arthur and her youngest daughter Charlotte

Wendy with her dad Arthur and her youngest daughter Charlotte

“My dad was the most unselfish person I have ever known. He was a true gentleman and was the kindest person.

“He used to give lifts to people standing at the local bus stop when it was raining and he was the first at my bedside after I had my kids.”

Wendy’s dad could have taken his state pension at the age of 65. However, he decided to carry on working for another five years, expecting a bigger payment once he did retire.

Arthur, who had two children and three grandchildren, worked until the age of 70 and retired just before Christmas 2013. In April 2014, he was diagnosed with bowel cancer and died in August of that year.

Currently, people who reached state pension age on or after 6 April 2016 receive the new state pension, and can benefit from a 1 per cent increase in their weekly payment for every nine weeks that payments are deferred – equivalent to around 5.8 per cent extra income for every full year deferred.

With the triple lock boosting the new state pension to £230.25 a week this year, those who defer their payments for the 2025/26 financial year will benefit from an extra £13.35 a week – which equates to an additional £694.20 of income every year for life.

However, those who reached state pension age before 6 April 2016 and chose to defer are treated more generously, with an extra 1 per cent income for every five weeks deferred, equal to an annual rise of 10.4 per cent or £954.20, which can be taken either as extra income or a lump sum.

Nearly 42,000 individuals chose to postpone drawing their pension in the 2023/24 financial year, securing higher weekly payments as a result, data obtained by Royal London through a Freedom of Information request recently revealed.

The research showed 41,938 people collected a deferred state pension during the year. However, that figure was down by over a fifth (22 per cent) on the previous year when 54,037 deferred pension claims were made.

People delay claiming their state pension for two reasons: to receive extra income from their state pension when they do claim or to reduce the amount of taxable income they are currently receiving. This means that putting off claiming the state pension can be a better option for someone who is a higher-rate taxpayer.

However, while delaying claiming can lead to significantly higher weekly payments later on, people choosing to delay claiming under the current system may not live long enough to recoup the money they missed out on, especially if they are basic rate taxpayers.

Wendy said it is upsetting to know that after working so hard all his life, her dad did not get to enjoy his retirement with his wife, Anne, whom he had been married to for 48 years when he died.

Wendy believes people should take their state pension as soon as they can and enjoy time with their family

Wendy believes people should take their state pension as soon as they can and enjoy time with their family

Wendy said: “It was such a shock for us all when my dad was diagnosed with cancer and died so soon after.

“He had worked his whole life and never got to enjoy any of his retirement. He was ill most of his last few months.”

Reflecting on her personal experience, Wendy says she would suggest that people take their state pension as soon as they become eligible for it and enjoy time with their family.

“I think my dad would have regretted not having time with us all. It was devastating and none of us will ever get over it. The illness took control so quickly and he ended up so ill,” she said.