Global equity markets experienced their sharpest decline since April after the US Labor Department published much weaker than expected job numbers on Friday.

The S&P 500 tumbled 1.6%, the tech-centric Nasdaq fell 2%.

Amazon fell 8.3% after its cloud computing unit failed to meet expectations.

Apple (-2.2%) was also sold off, despite exceeding expectations in its results, after CEO Tim Cook warned of earning headwinds from US tariffs.

The retreat was even sharper across the Atlantic — the Eurostoxx 50 index fell 2.5%, dragged down, in particular, by German (-2.7%) and French (-2.9%) stocks.

The global MSCI index, which was already looking wobbly after Thursday’s tariff announcements, fell more sharply after the jobs data, to close the day down 1.3%.

Equity markets weren’t the only casualty of the jobs data.

US President Donald Trump wasn’t happy and decided to “shoot the messenger” — figuratively, rather than literally — ordering the termination of the commissioner of the US Bureau of Labor Statistics, Erika McEntarfer, despite hailing her jobs data over much of the year as proof that the economy was firing on all cylinders.

As University of Michigan economics professor Justin Wolfers noted, the move is likely to backfire.

“You can’t bend economic reality, but you can break the trust of markets. And biased data yields worse policy,” Professor Wolfers said.

Putting the politicisation of data to one side, the jobs figures and the downward revisions of previous months’ payrolls were worrying.

The US economy added 73,000 non-farm payrolls last month, below economists’ expectations for 110,000.

June’s job growth was revised sharply lower to 14,000 from 147,000.

It points to jobs growth stalling, in keeping with declining hiring intentions in key business surveys.

The three-month average of 35,000 jobs being created is now roughly at a level not seen since the COVID pandemic recession.

Expectations of “sooner-rather-later” rates from the Fed are firmly back on the table, as is talk of a recession.

“The market is reacting to the possibility of the economy flipping into recession,” Wilmington Trust chief economist Luke Tilley told Reuters.

“The weak jobs data is piling on to weak earnings reports and weak guidance from some corporations.”

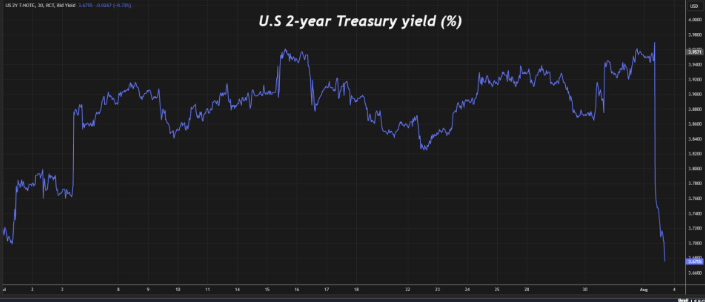

US bond yields tumbled, as did the greenback against most currencies, although the Australian dollar was a bit softer, back under 65 US cents.

US 2year Treasury yields tumble (Reuters)

US 2year Treasury yields tumble (Reuters)

Gold was one beneficiary though, gaining 2.2% on the increased probability of US rate cuts.

Oil fell about $US2/barrel, or almost 3%, on speculation that OPEC+ was about to announce an increase in production.