Quantum Computing Inc. recently completed its Tempe-based photonic chip foundry and commenced customer deliveries, advancing its shift toward in-house chip fabrication and meeting new customer demand. The company also entered high-profile partnerships, including collaborations with NASA and a major therapeutics institute, signaling expanding industry reach and diversified application potential. We’ll explore how in-house photonic chip production shapes Quantum Computing Inc.’s investment narrative and future partnership opportunities.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Quantum Computing’s Investment Narrative?

For anyone considering Quantum Computing Inc., the core bet is on the company’s ability to convert leading-edge innovation in photonics and quantum hardware into meaningful, high-margin sales. The just-completed Tempe chip foundry and successful customer deliveries give the company a credible shot at scaling production and meeting customer demand, which could accelerate near-term revenue and partnership momentum beyond what earlier guidance anticipated. The recent shelf registration could both support growth initiatives and help offset ongoing cost pressures, although it raises the risk of shareholder dilution, a theme that’s played out before. The surge in new commercial orders, government contracts and index inclusions highlights real progress, yet investors still wrestle with fundamental questions: consistently low revenues, a high valuation multiple and the overhang of unresolved litigation and compliance issues. The near-term catalysts may now shift toward monitoring revenue flow from recent contracts and careful tracking of dilution risk.

Yet, potential dilution from new share offerings isn’t the only risk investors should consider.

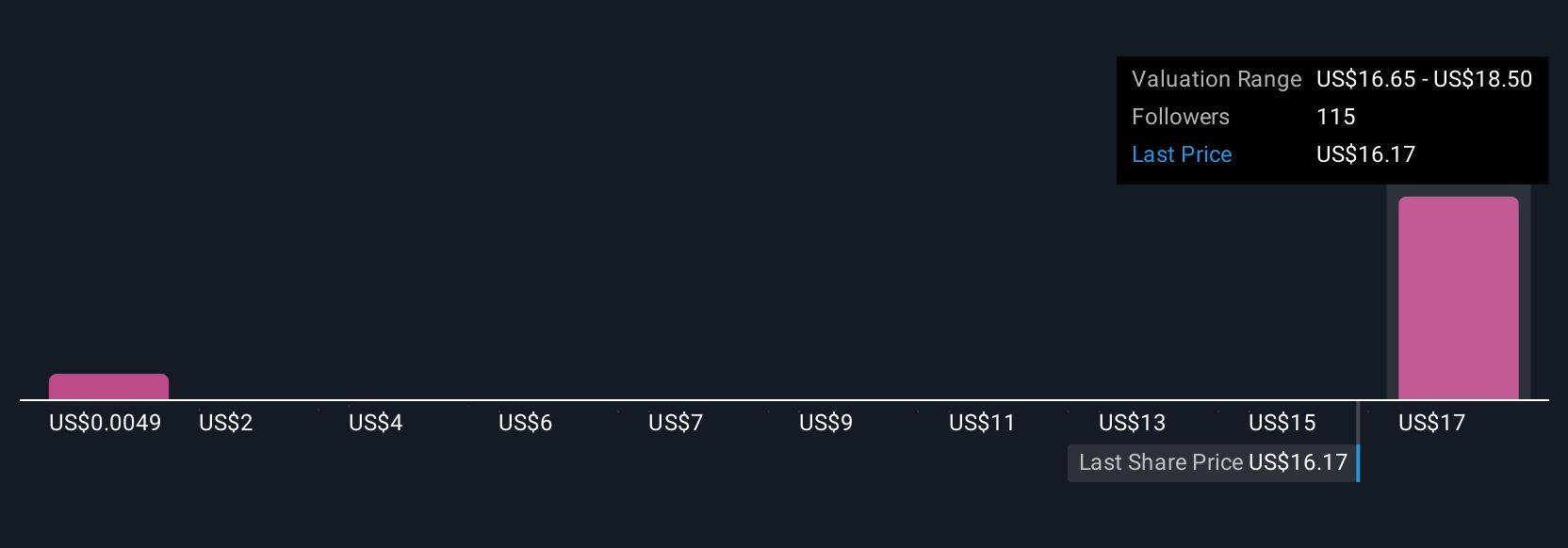

Our expertly prepared valuation report on Quantum Computing implies its share price may be too high.Exploring Other Perspectives QUBT Community Fair Values as at Aug 2025 Across 25 private investor analyses in the Simply Wall St Community, fair value estimates for Quantum Computing Inc. range from just US$0.0049 to US$18.50 per share. This wide spread reflects divided views on future revenue, especially as the company expands in-house chip production. As new contracts trickle in, opinions on both upside and downside risk continue to evolve.

QUBT Community Fair Values as at Aug 2025 Across 25 private investor analyses in the Simply Wall St Community, fair value estimates for Quantum Computing Inc. range from just US$0.0049 to US$18.50 per share. This wide spread reflects divided views on future revenue, especially as the company expands in-house chip production. As new contracts trickle in, opinions on both upside and downside risk continue to evolve.

Explore 25 other fair value estimates on Quantum Computing – why the stock might be worth less than half the current price!

Build Your Own Quantum Computing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

No Opportunity In Quantum Computing?

Right now could be the best entry point. These picks are fresh from our daily scans. Don’t delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Quantum Computing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com