Quantum Computing Inc. announced it has been awarded a contract from the National Institute of Standards and Technology for the design and fabrication of thin-film lithium niobate photonic integrated circuits, and also received a chip order from a leading Fortune 500 science and technology company. This marks QCi’s first direct government contract for TFLN foundry services and highlights the company’s expanding role as a supplier in mission-critical photonic technologies for both federal and commercial markets. We’ll examine how this government contract win could reshape Quantum Computing Inc.’s investment narrative by broadening its access to high-security sectors.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

What Is Quantum Computing’s Investment Narrative?

With Quantum Computing Inc.’s first direct contract from NIST, it’s tempting to see this as a meaningful turning point. Securing a government contract for TFLN photonic integrated circuits moves QCi closer to being recognized as a specialized supplier for federal and high-security sectors, especially with a parallel commercial chip order from a major science and tech company. These wins could translate into higher near-term revenue visibility and strengthen the company’s credentials, possibly accelerating commercial adoption and reducing customer concentration risks. However, even as revenue is forecast to grow rapidly, the business remains unprofitable and has recently endured significant management turnover and shareholder dilution. The newest contract has sparked fresh interest, but the key challenges still revolve around scaling up revenue meaningfully before additional capital is needed, given ongoing earnings declines and volatility in share price.

But with that optimism, board and management inexperience is a risk that shouldn’t be overlooked.

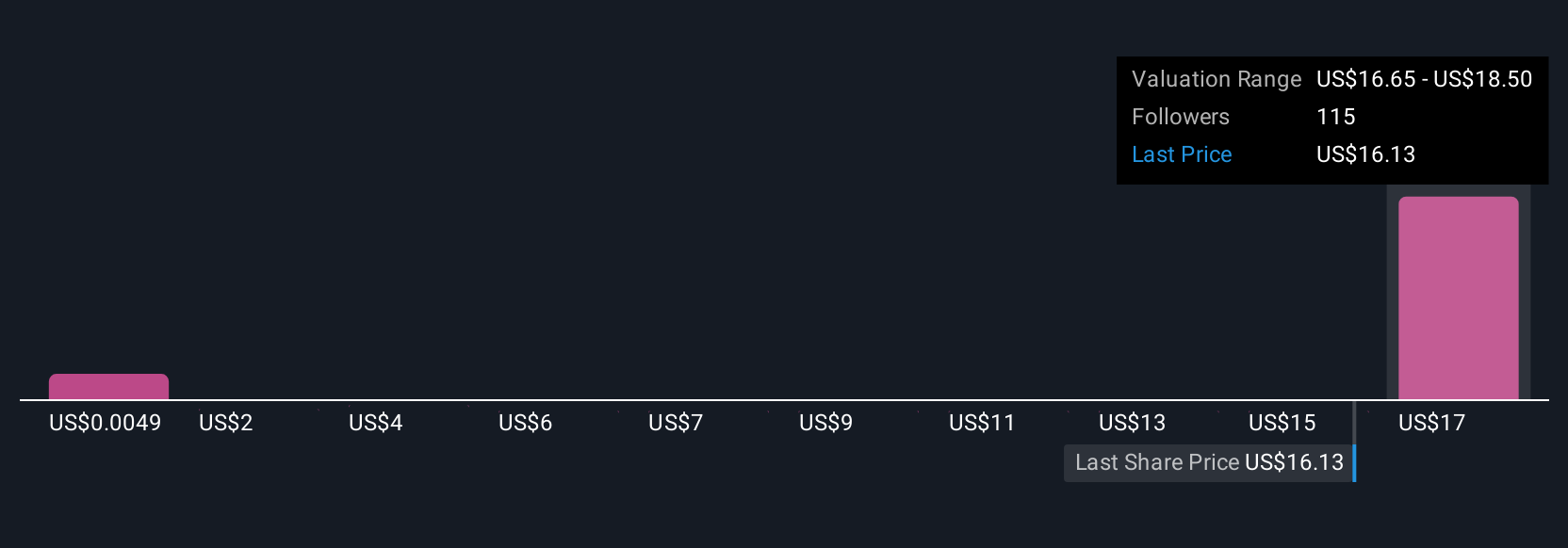

Our valuation report unveils the possibility Quantum Computing’s shares may be trading at a premium.Exploring Other Perspectives QUBT Community Fair Values as at Aug 2025 Among 25 Simply Wall St Community fair value estimates, opinions on QCi’s worth span US$0.005 to US$18.50 per share, showing strong disagreement. While the recent NIST contract improves short-term visibility, persistent unprofitability and management change remain central issues weighing on future performance. Consider exploring these diverse viewpoints for a broader understanding.

QUBT Community Fair Values as at Aug 2025 Among 25 Simply Wall St Community fair value estimates, opinions on QCi’s worth span US$0.005 to US$18.50 per share, showing strong disagreement. While the recent NIST contract improves short-term visibility, persistent unprofitability and management change remain central issues weighing on future performance. Consider exploring these diverse viewpoints for a broader understanding.

Explore 25 other fair value estimates on Quantum Computing – why the stock might be worth less than half the current price!

Build Your Own Quantum Computing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Contemplating Other Strategies?

Don’t miss your shot at the next 10-bagger. Our latest stock picks just dropped:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Quantum Computing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com