Typical of pro cycling, transfer mechanics within the professional peloton are baked in fascinating and odd complexities. Unlike in most sports, talks happen in strict privacy, with salaries and contract conditions relatively unknown to the wider public.

While some sleuths try to dig away at the pros’ salaries, including a rumoured €8 million per year contract for Remco Evenepoel, there are plenty of transfer stats lying in plain view, and we’ve crunched the key figures from the past five transfer windows, from 2021 to 2025.

Let’s start with the basics. The current crop of 18 men’s WorldTour teams have made a total of 682 transfers since the start of the 2021 season. This means teams have signed an average of 37.9 riders over the course of the five transfer windows, averaging out to a yearly intake of 7.6 riders per WorldTour team.

Between all those end-of-season moves, let’s uncover the transfer alliances, trends and strategies from the past five years.

Related questions you can explore with Ask Cyclist, our AI search engine. If you would like to ask your own question you just need to , or subscribe.

If you would like to ask your own question you just need to , or subscribe.

Key takeaways from the past five years

Xavier Pereyron

Xavier Pereyron

Let’s start with the biggest figures first. Which team has signed the most riders since 2021? For that, the crown goes to XDS-Astana, with an astounding 58 transfers. This is almost 20 riders over the WorldTour average, and eight more than their nearest competitor Cofidis’s total.

Indeed, XDS-Astana and Cofidis have had the busiest transfer inbox, but when we factor in third-place Intermarché-Wanty – who have brought on board 45 riders since 2021 – and it becomes clear that the relegation threatened teams have been the most open to making changes.

On the other end of the spectrum, WorldTour mainstays Ineos Grenadiers have made just 29 signings since 2021, an average of 5.8 per year. This is the lowest figure in the WorldTour, but Soudal-QuickStep follow close behind with just 30 incoming riders since 2021. This perhaps reflects a wider discourse on these teams’ budgets, which have been said to be shrinking in recent years.

Most active teams in the 2021-2025 transfer market:

XDS-Astana: 58 (yearly average of 11.6)

Cofidis: 50 (yearly average of 10)

Intermarché-Wanty: 45 (yearly average of 9)

EF Education-EasyPost: 42 (yearly average of 8.4)

Alpecin-Deceunick and Red Bull-Bora-Hansgrohe: 40 (yearly average of 8)

Least active teams in the 2021-2025 transfer market:

Ineos Grenadiers: 29 (yearly average of 5.8)

Soudal-QuickStep: 30 (yearly average of 6)

Arkéa-B&B Hotels, Groupama-FDJ, Lidl-Trek and Movistar: 32 (yearly average of 6.4)

The most common transfers since 2021

Tour de Pologne/Tomasz Śmietana

Tour de Pologne/Tomasz Śmietana

Excluding deals made through in-house development teams (more on that to come), the most common transfer on the WorldTour level over the past five years has been from UAE Team Emirates XRG to XDS-Astana. This pathway has been crossed on five occasions since 2021, with notable examples including Joe Dombrowski and Diego Ulissi. Interestingly, XDS-Astana haven’t reciprocated the deal, with no rider moving from Astana to UAE during this period.

Sharing the accolade of ‘most common transfer’, Astana aren’t the only creatures of habit. Movistar are a repeat offender when it comes to transfers. The Spanish squad have signed five riders from Astana over the past five years and a further five from ProTeam Caja Rural.

Few teams have quite the direct line these guys do, but there are several teams that have signed four riders from the same squad over the past five years. Among their large transfer roster, Red Bull-Bora-Hansgrohe has signed four riders from both Picnic-PostNL and Visma-Lease a Bike. EF Education-EasyPost have also signed four riders from XDS-Astana, while Cofidis have a strong connection to IPT, having signed four of their riders since 2021.

There are just two major transfers that have been consistent over the past three years. The first is the logical domestic move from Groupama-FDJ to Arkéa-B&B Hotels, while the other is between UAE Team Emirates XRG and Tudor Pro Cycling, with the Swiss ProTeam poaching one member of Tadej Pogačar’s fleet each year since 2022.

Transfers that have happened on five occasions

UAE Team Emirates XRG to Astana

XDS-Astana to Movistar

Caja Rural to Movistar

Transfers that have happened on four occasions

XDS-Astana to EF Education-EasyPost

IPT to Cofidis

Visma-Lease a Bike to Red-Bull-Bora-Hansgrohe

Picnic-PostNL to Red-Bull-Bora Hansgrohe

Visma-Lease a Bike to Jayco-AlUla

Transfers that have happened on three occasions

UAE Team Emirates XRG to Tudor Pro Cycling

UAE Team Emirates XRG to Intermarché-Wanty

UAE Team Emirates XRG to Movistar

Groupama-FDJ to Arkéa-B&B Hotels

Intermarché-Wanty to EF Education-EasyPost

Jayco-AlUla to Ineos Grenadiers

Jayco-AlUla to Intermarché-Wanty

Ineos Grenadiers to Visma-Lease a Bike

Ineos Grenadiers to XDS-Astana

Movistar to EF Education-EasyPost

Red Bull-Bora-Hansgrohe to UAE Team Emirates XRG

Transfer friends and partnerships

Xavier Pereyron

Xavier Pereyron

In terms of transfer buddies, some teams have well-established transfer patterns. Movistar and XDS-Astana have shared seven riders between them, while Red Bull-Bora-Hansgrohe and Visma-Lease a Bike have been privy to six transfers since 2021. The third most common trade is between Arkéa-B&B Hotels and Groupama-FDJ, who have sealed five deals between them.

Most teams have swapped a rider over the past five years. That said, some pathways are yet to be trodden. Since 2021, there have been no transfers between Arkéa-B&B Hotels and Bahrain Victorious, Intermarché-Wanty and Ineos Grenadiers, Jayco-AlUla and Arkéa-B&B Hotels, UAE Team Emirates XRG and Cofidis, or between Jayco-AlUla and Groupama-FDJ.

Elsewhere, a mysterious trend seems to emerge among a small contingent of teams. French WorldTour teams love to sign riders from IPT. Yes, in fact 77% of IPT’s WorldTour outgoing riders ended up signing for French teams. The most common of which is Cofidis, who have welcomed four IPT riders since 2021.

Easier to explain, Ineos Grenadiers have also been haemorrhaging resources to UAE Team Emirates and Visma-Lease a Bike over the past five years. Since 2021, these two superteams comprise 25% of Ineos’s outgoing transfers, including headline act Adam Yates, who went on to podium the Tour seven months after leaving Dave Brailsford’s squad. This could be a clear sign of Ineos changing role within the pro peloton, from pole position to past its best.

Strongest WorldTour transfer partnerships since 2021

Movistar and XDS-Astana: 7

Red Bull-Bora-Hansgrohe and Visma-Lease a Bike: 6

Arkéa-B&B Hotels and Groupama-FDJ: 5

Red-Bull-Bora-Hansgrohe and Soudal-QuickStep, Decathlon-AG2R and Cofidis: 4

The big negotiators

Xavier Pereyron

Xavier Pereyron

Let’s look at the teams with the teams that cast the widest net. In other words, which team has signed riders from the widest spread of WorldTour squads?

For that, the team who have done the most dealings around the peloton is Red Bull-Bora-Hansgrohe. The German team has signed a rider from every current WorldTour team except Arkéa-B&B-Hotels, Cofidis and Alpecin-Deceuninck. However, that could change soon, given rumours of a transfer for Alpecin’s Gianni Vermeersch next year.

UAE Team Emirates XRG are a close second, having pulled in riders from every WorldTour team bar EF Education-EasyPost, XDS-Astana, Arkéa-B&B Hotels, Decathlon-AG2R La Mondiale and Jayco-AlUla.

On the other hand, the team with the fewest amount of WorldTour negotiations over the past five years is tied between Arkéa-B&B Hotels and Intermarché-Wanty, who have both only signed riders from eight different WorldTour squads. Unsurprisingly, these are the teams with the smallest WorldTour budgets. Instead, they tend to pool their talent from smaller domestic teams from either Belgium or France.

Recruiting home-grown talent

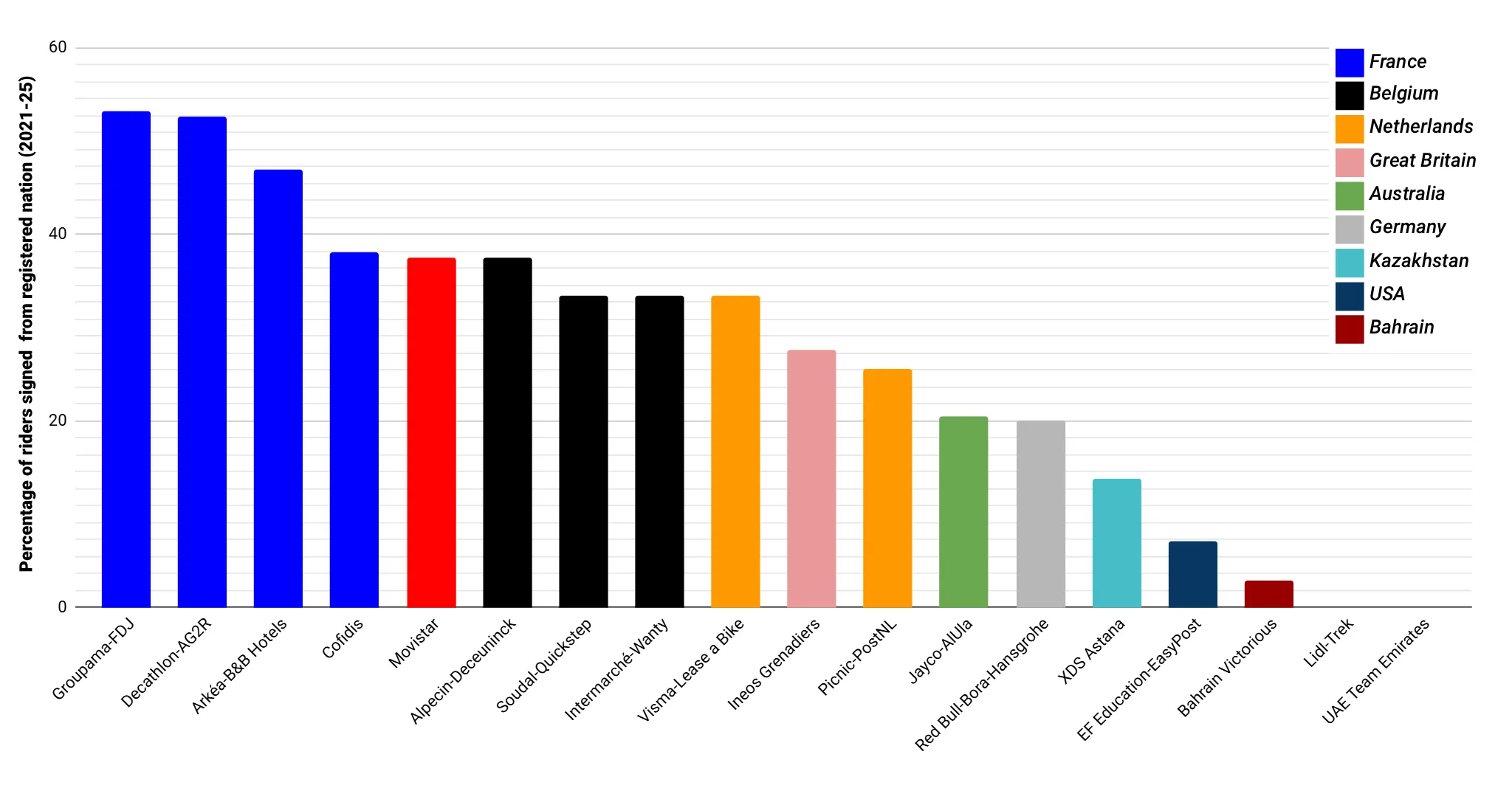

Which team is most likely to sign a rider from its registered nation? As displayed on the chart above, it’s clearly the French. All four French teams top the standings, with over half of Groupama-FDJ and Decathlon-AG2R La Mondiale’s signings since 2021 hailing from France.

On a linguistic front, Movistar is the most likely to recruit riders from not just Spain – which already accounts for 38% – but also Latin America. 62% of their recruits from the past five years are native Spanish-speakers, notably from South America.

Only two teams on the WorldTour level have failed to recruit a rider from the nation in which they are registered. Unsurprisingly, the first is UAE Team Emirates XRG. The second, however, is the American-registered Lidl-Trek, who have not signed a single American rider to its men’s squad since 2021.

Not only is it more likely for teams to sign riders from their home country, but it is by far the most common nationality for incoming riders. All but four WorldTour teams sign riders from their registered country more than any other. The exceptions are XDS-Astana (37.9% Italian), Lidl-Trek (21.9% Italian), Bahrain Victorious (20% Italian), EF Education-EasyPost (14.3% British) and UAE Team Emirates (10.3% Spanish). For the most part though, teams prefer riders from their home countries. Domestic signings account for 27% of all WorldTour transfers since 2021.

Going international

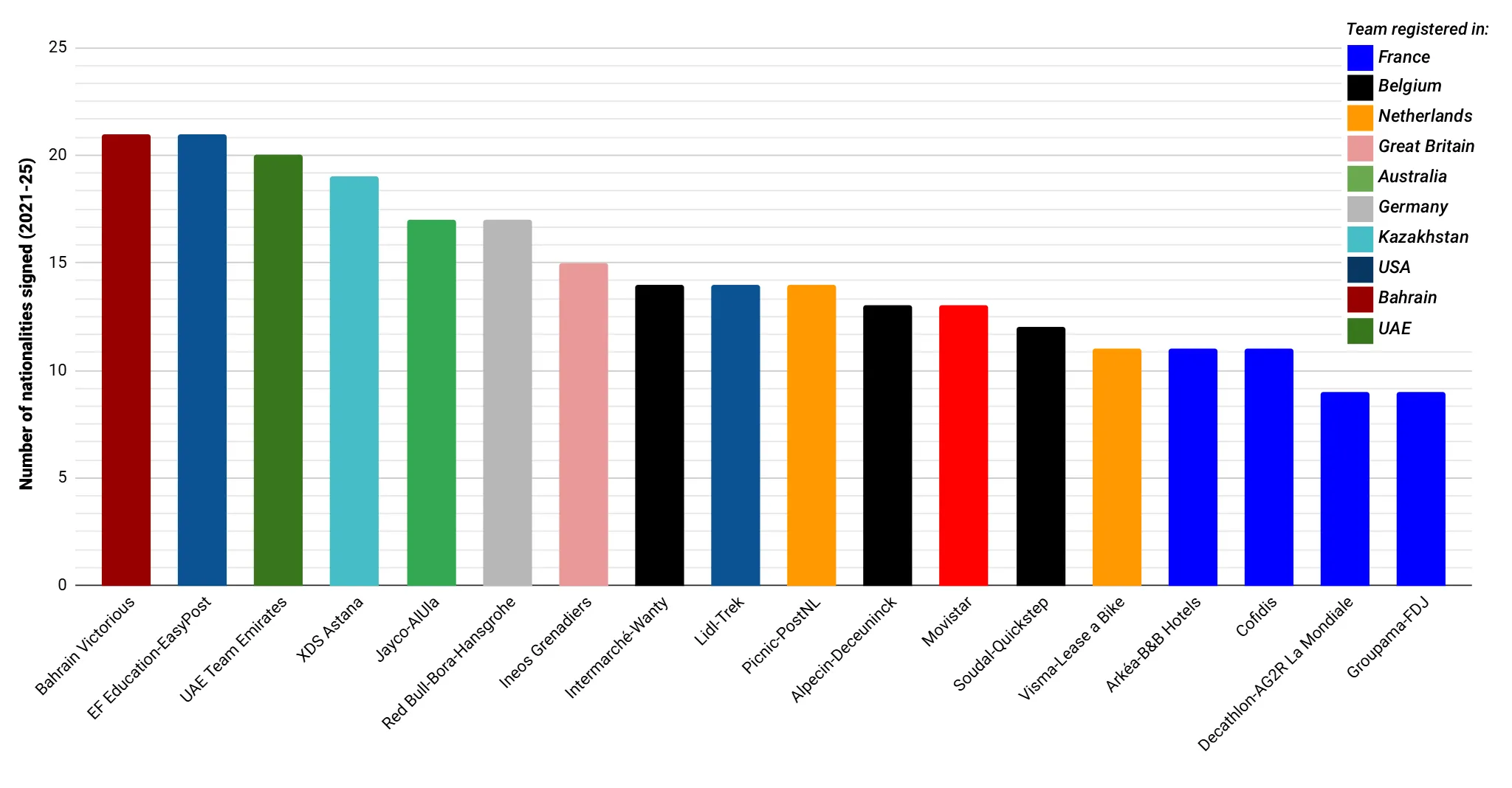

This naturally leads us onto the teams with the most international transfer policy. The chart above almost looks like a complete reversal of the domestic signings graph, with Bahrain Victorious, EF Education-EasyPost and UAE Team Emirates XRG leading the charge in terms of building a worldwide roster. French teams, however, have a particularly insular transfer strategy.

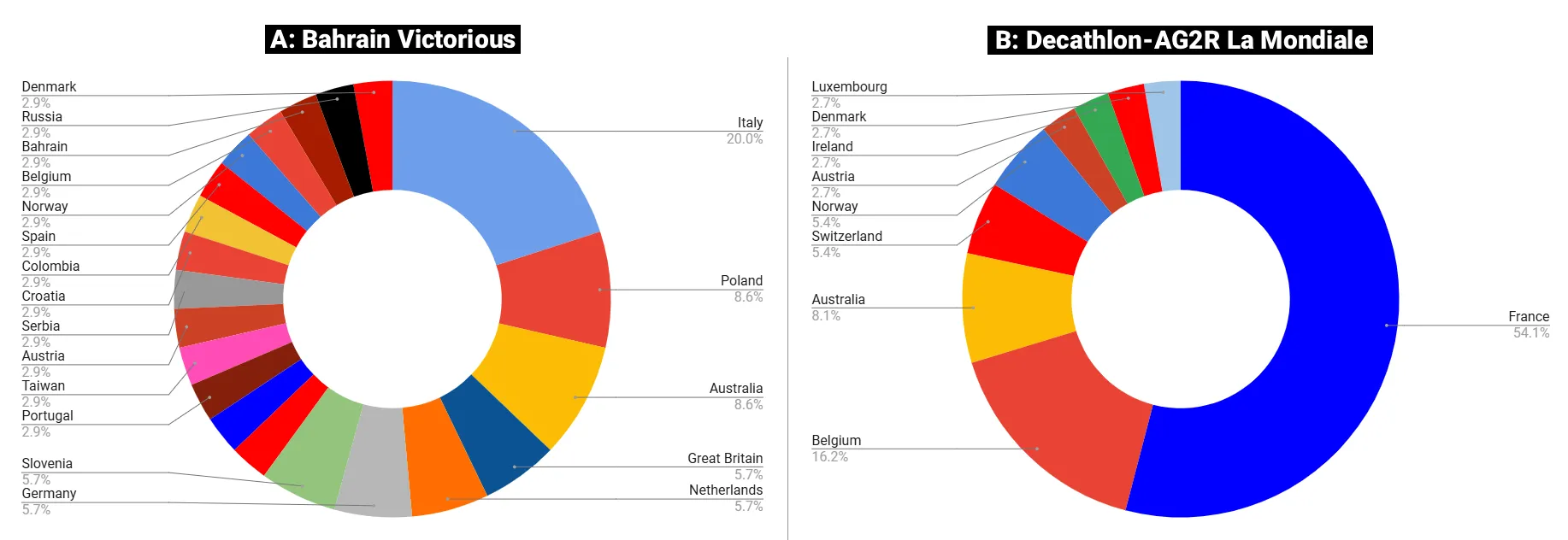

The chart below digs into that, dissecting the teams with both the most international transfer policy (Bahrain Victorious) and the one with the least (Decathlon-AG2R La Mondiale).

Without a strong national identity, Bahrain Victorious appear willing to sign riders from across the globe, with few stand-out nationalities in their ring chart. Decathlon-AG2R La Mondiale, on the other hand, stick to their Francophone guns. They have signed riders from only nine nations since 2021, with France comprising a huge chunk of their incomers. Acknowledging that Belgium and Switzerland are both well-represented, we can see that only eight of their 38 signings originate from non-French-speaking countries (Austria, Norway, Australia, Denmark and Ireland).

They’re not alone in their lack of international signings. Groupama-FDJ have only signed nine nationalities since 2021, with a broader linguistic spread than Decathlon in all fairness, while fellow French teams Arkéa-B&B Hotels and Cofidis have attracted riders from just eleven countries. Perhaps this can be explained by the tough language barrier at French squads. Belgian and Dutch teams are also fairly international-focussed, but not to the same extent as the Anglophone and Middle Eastern-based teams. As a trend, the more common English is in the team environment, the more attractive it is for international signings.

The curious case of the French team

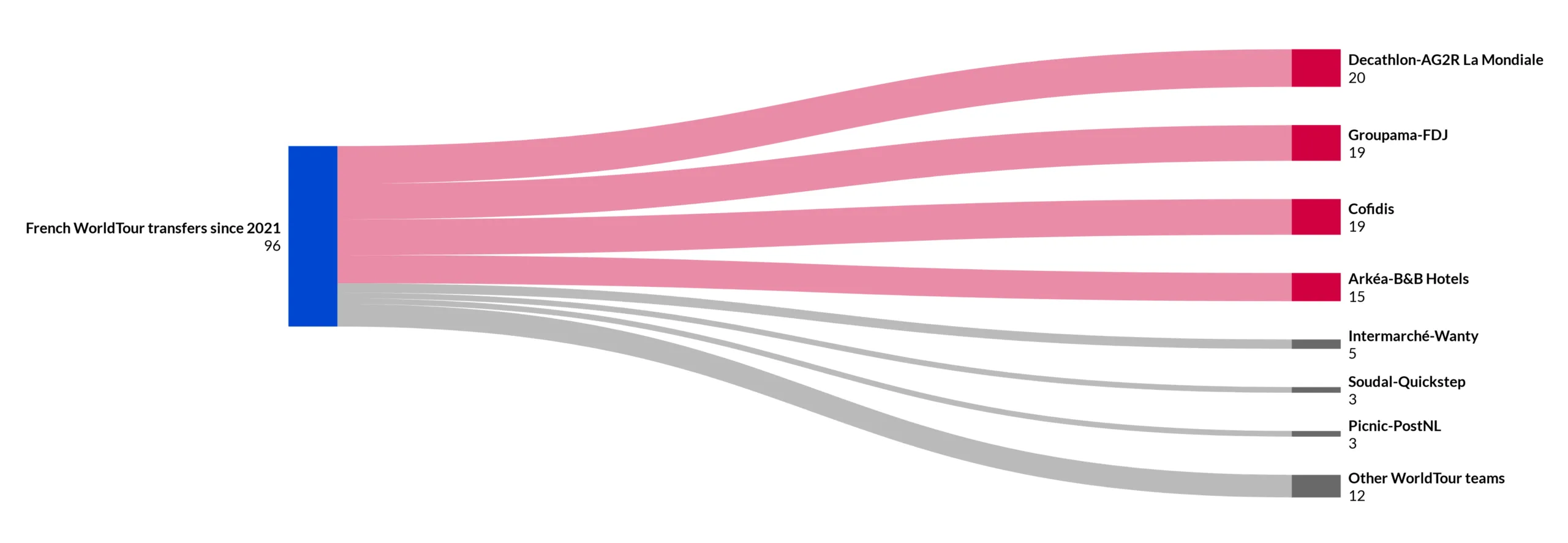

There are currently four French teams on the WorldTour level, meaning that they comprise 22% of the top flight. Despite occupying a small space within the WorldTour, they dominate French signings. Out of the 96 French transfers sealed since 2021, 76% have been poached by this small pool of French teams. This is higher than any other nationality in the WorldTour, bar the small exception of Kazakh riders at XDS-Astana.

There are two well-defined transfer alliances within the French sphere, one between the two Lillois-sponsored teams – Decathlon-AG2R La Mondiale and Cofidis – and the other between the eastern French squads – Arkéa-B&B Hotels and Groupama-FDJ.

In the case of the latter, both have adopted more domestic transfer strategies, focussing on French talent. In fact, both Arkéa and Groupama have made the smallest amount of inter-WorldTour signings since 2021, instead opting for younger talent on the national scene. This is particularly evident with Groupama-FDJ. 75% of Marc Madiot‘s deals have been struck with fellow French teams – two-thirds of which come from his own Groupama-FDJ Development team.

As unpredictable and volatile as the transfer window may seem, there’s one observation that still rings true. The French love riding for their own teams.