On Kalshi, Polymarket and other sites where people wager “predictions” on real-world events, gamblers lay down millions each month on their picks for AI’s top model.

The AI arms race is playing out in plain sight on social media, ranking sites and obscure corners of the internet where enthusiasts hunt for clues. The constant buzz makes the topic appealing for wagers, though not every scrap of information is meaningful.

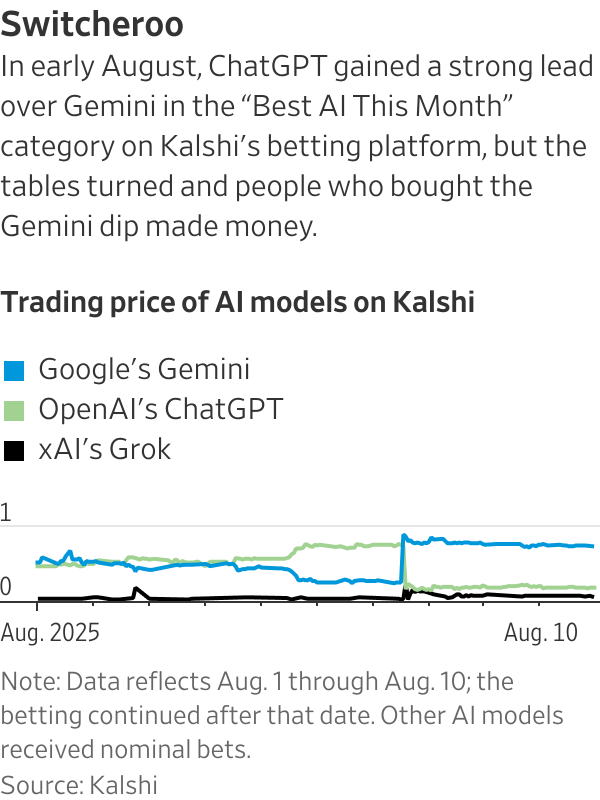

Foster McCoy made $10,000 in a few hours in early August by betting against the success of OpenAI’s GPT-5 release. The 27-year-old day trader noticed people were misreading an online ranking site that appeared to hype GPT-5, so he put $4,500 on its competitor, Google’s Gemini, to be “Best AI This Month.” As more bettors fell in line with his call, he cashed out.

View Full Image

Graphic: WSJ

That’s just another day for McCoy, who has traded $3.2 million on Kalshi since the start of 2025—making $170,000. He’s part of a growing contingent of bettors making hundreds of trades a week on AI markets, on a range of wagers such as “Best AI at the end of 2025,” “AI regulation becomes federal law this year,” and “Will [Chief Executive] Sam Altman be granted an equity stake in OpenAI this year?”

Trading volume across AI prediction markets has surged to around $20 million this month. Kalshi, the only platform currently available in the U.S., is seeing 10 times the volume on AI trades compared with the start of the year, a spokesman says.

Each bet, or “contract,” is priced in cents to reflect the odds: McCoy bought thousands of Gemini contracts at around 40 cents, meaning it had a 40% chance of winning. If the bet had settled and Gemini won, McCoy’s 40 cents would become a dollar. If Gemini lost, McCoy would lose it all.

But much of the action happens before the final outcome. As more people piled into the Gemini bet, the contract price rose. McCoy sold when it had reached 87 cents. It’s like betting on a sports match, only with the option to cash out when the odds rise in favor of your bet.

“You’re just betting against what the other guy knows,” says McCoy, who credits his success to “being chronically online.”

He trades from home on a triple-monitor setup tuned to the holy trinity of AI betting: X, Discord and LMArena, a leaderboard where people rate AI model performance in blind tests.

Social-media beefs can be gold for gamblers. After GPT-5’s debut, a flurry of Elon Musk posts claiming the superiority of his xAI Grok chatbot sent the “Grok to Win” market up more than 500% within hours. Before long, it had fallen nearly all the way back down.

View Full Image

Rishab Jain, a Harvard undergraduate, tracks back-end updates and obscure X posts to anticipate new AI model launches. Photo: Rishab Jain

Bettors end up down rabbit holes hunting for more obscure tidbits. Harvard undergraduate Rishab Jain often scans X accounts of lesser-known researchers. The day before GPT-5’s release, OpenAI’s Sam Altman posted an image of the Death Star from “Star Wars.” When a researcher from Google’s DeepMind replied with an image of the killer globe under attack, Jain read it as a sign of confidence from Gemini’s makers.

Jain also scrapes source files from Google’s apps and monitors public GitHub repositories tied to its products, looking for back-end changes that might signal a soon-to-be-released Gemini model.

“I’m almost obsessively up-to-date with what’s going on in this world,” Jain says. “Google has so many products that need to integrate a new model before it officially launches, and you can see those changes happening in the back end if you know where to look.”

Since starting in June, he has won $3,500.

Strategies vary. Some bet on the big industry players, others buy low on less-known or soon-to-be-updated models. Some compare odds on Kalshi and Polymarket to find arbitrage opportunities in the odds.

As volume for these AI trades continues to grow, the incentive for good information will only increase, and the squeeze on casual bettors will get tighter, says Robin Hanson, a professor of economics at George Mason University.

“When you have better information in these kinds of markets, you can make better decisions,” Hanson says. “If you know a little more, you make more money.”

For now, the markets still draw a mix of sharks like McCoy and Jain along with casual bettors.

“I’m just a dude that likes tech and has some time and money,” says James Cole, a 35-year-old who recently shut down a company he founded. “I’m speculating with mostly instinct and 10 minutes of research.”

He says he’s up for the year…so far.

Write to Ben Raab at ben.raab@wsj.com