Milk production

Domestic

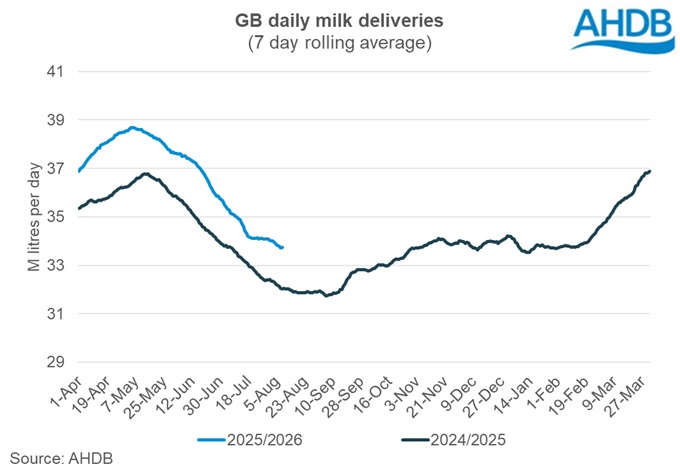

GB milk deliveries totalled 1,069 million litres in July, an increase of 4.4% compared to the same month last year. Daily deliveries averaged 34.48 million litres per day.

Favourable dairy economics have encouraged year-on-year growth in deliveries since September. The milk to feed price ratio (MFPR) remains firmly in the expansion zone.

The latest data from Promar Milkminder dairy costings (May) show that concentrate feed costs had fallen by 5.3% versus levels a year ago. Over the same period, it was recorded that concentrate feed usage increased by 6.1%. This may be due in part to challenging weather conditions for some farmers pressuring forage demand, but also a reflection of a strong MFPR incentivising greater feed use to boost milk yields. As an early harvest is well underway, farmers will be keeping an eye on progress and what that might mean for feed prices and availability come winter.

July was the UK’s fifth warmest on record, according to provisional figures from the Met Office. Grass-growth has been regionally divided depending on rainfall but is a concern for many. Data collected by AHDB Forage for Knowledge showed total recorded grass growth in July was well below the long term average. As the season progresses fears grow in some places for availability of winter forage.

Despite this, the latest BCMS data shows that births to dairy dams in Q2 2025 increased year-on-year by 3.6% to total 309,000 head, the highest number recorded for this period since 2019.

Global

The latest global production data shows global milk flows now picking up. Global milk deliveries averaged 830.5 million litres per day in May, an increase of 9.6 million litres per day (+1.2%) across the selected regions, compared to the same period last year. All regions recorded year-on-year volume increases except for Australia and the EU.

US production was up 1.6% year-on-year, with a bigger herd and better margins. New Zealand deliveries were up by a substantial 2.2 million litres per day (7.6%) supported by better milk prices. Argentina’s production also increased in May, up 3.6 million litres per day (14.1%) year-on-year.

Milk deliveries in the EU averaged 420.4 million litres per day in May, a small decline of 2.3 million litres per day (-0.5%) with year-on-year decline from Italy, down by 62 million litres (-5.4%), Germany, down 49 million litres (-1.8%), year-on-year but Irish milk production up by 76 million litres (6.8%). The short term outlook for the EU is for relative stability at 0.15% growth for 2025 year-on year.

Australia also declined (-3.8%) due to challenging weather conditions.

Longer term, we published the outlook to 2030 for dairy milk supplies globally. This points to high regionality – global milk production is forecast to grow but driven by developing markets. Will this growth be sufficient to meet burgeoning global demand?

Wholesale markets: July

As the summer holiday period kicks in across the UK and Europe, market activity was universally noted to be quiet.

Bulk cream rose by £120/t although saw some easing through the month starting at £2.80/kg to around £2.70/kg. Hot sunny weather and a bumper strawberry crop coinciding with the Wimbledon Tennis Championship helped boost demand for cream.

Butter prices were relatively stable month on month, easing by just £10/t, and remaining within a tight range. Prices in Europe are recorded to be declining, putting some pressure onto UK butter as it now trades at a premium. Trading is being done on a hand to mouth basis with some stock balance still tight.

SMP remained stable, average prices eased just £10, back to where they sat in May. Demand was very quiet in line with the time of year. Some stock is starting to build with production gaining from higher milk solids.

Mild cheddar also saw little change month on month, with the average price easing by just £10/t. Demand was seasonally quiet with little volume traded.

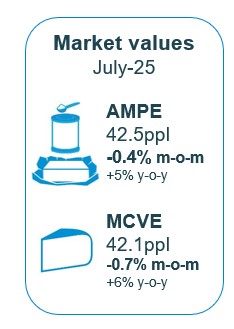

This took AMPE down slightly to 42.5ppl whilst MCVE also reduiced slightly to 42.1ppl. Both remain up year-on-year.

Farmgate milk prices

The Fair Dealing Obligations Milk (FDOM) regulations came into force on 9th July and all milk contracts must be compliant by this date. The Agriculture Supply Chain Adjudicator (ASCA) are the body which has been set up to police the new milk purchase contract rules and have set up a mailbox to raise concerns about milk contracts.

Contact ASCA: asca@defra.gov.uk

The latest published farmgate price was for June with a UK average milk price announced by Defra as being 43.55, up 0.36 pence on the previous month.

Latest announced farmgate prices were fairly steady for August.

Price announcements stabilised for retail aligned liquid contracts by most of the producers. Sainsbury’s saw a decline of 0.13ppl following two months of increases, while M&S have held on to their price for the last four months. Co-op Dairy Group increased their price by 0.01ppl and Tesco have held their price for the last three months.

Non-aligned liquid contracts were also stable overall month-on-month. Crediton Dairy has held steady for the last eight months after continuous increases over the previous year. No changes have been reported for Muller since December last year. Paynes Dairies, Freshways and Yew Tree announced no change to their milk price this month. Pembrokeshire Creamery announced a price decline of 0.04ppl.

Cheese contracts showed stability as all participants on the league table made no change to their price in August (Barbers, First Milk, Saputo, Leprino, Lactalis, Wyke, Wensleydale, Belton Cheese and South Caernarfon Creameries).

Similarly to cheese, manufacturing contracts also remained stable. Pattemores Dairy has held on to their price for the last nine months. UK Arla and Meadow also announced no changes.

Trade

Total export volumes of dairy products from the UK for Q2 2025 increased 9.8% year-on-year at 370,400 tonnes fuelled by cheese, milk and cream, powders, whey and whey products. Total UK dairy export value for Q2 2025 edged up 20.5% year-on-year at £588mn.

Total import volumes increased by 11,800t (3.5%) at 349,400t in Q2 2025 compared to the previous year. The increase was reported from EU nations (12,700t), who are our major providers. Major EU nations contributing to the UK’s increase in imports are Greece (+6,600t), Ireland (+4600t), France (+1900t), Poland (+1800t), Austria (+900t) and Spain (+700t). Increase in imports was capped by decline from Germany and Netherlands. Imports declined from non-EU nations during the period by a marginal 900t. Imports from New Zealand declined year-on-year after seeing a remarkable increase during the last one year. Cheese and curd imports declined by 4,700t at 1,700t in Q2 2025 year-on-year.

Imports of yoghurt saw the biggest increase of 7,300t (9.6%), followed by powders by 2,200t (10.4%). Cheese and curd and milk and cream imports nudged up by 1,700t (1.4%) and 400t (0.5%) respectively. The latest dairy retail data echoes increasing consumer demand for yoghurt, cheese and cream in the domestic market. Whey and whey products in the import basket, witnessed a marginal decline of 500t (-2.4%) during the period compared to year ago levels.

Retail performance

During the 52 weeks ending 12 July 2025, volumes of cows’ dairy declined by 1.2% year-on-year (NIQ Homescan POD, Total GB). Spend on cows’ dairy increased by 4.0% year-on-year, driven by a growth in average prices of 5.3%.

Cows’ milk volumes continued to decrease, seeing a 2.6% year-on-year decline (NIQ, 52 w/e 12 July 2025). Spend also saw a decline (-0.7%), despite seeing a 2.0% increase in average prices paid. Plant based and other animal sourced milk also saw volume declines this period, with plant based seeing steeper average price increases (+3.3%). Whole milk was the only category to see volume growth, up 2.4% (27.4 million litres), driven by an increase in buyers during the period.

Cows’ cheese remained in volume growth, up 2.1% year-on-year, with spend during the period increasing by 2.9% (NIQ, 52 w/e 12 July 2025). Cheddar, which represents 41.5% of all cow cheese volumes, saw a 2.6% (3.7 million kilos) increase in volumes purchased, and combined with strong performance seen by specialty and continental (2.2%) snacking (+0.9%), and other cow cheese (which include cottage cheese, quark and soft white) (+5.8%), offset declines seen by processed, British regionals and stilton and British blue. Overall, cow cheese benefitted from an increase in volumes purchased per shopper, as well as an increase in shopper numbers during the period.

Cows’ butter, at a total level, experienced a 2.6% decline in volume but a 7.0% increase in spend, which was driven by 10.0% increase in average price paid (NIQ, 52 w/e 12 July 2025). Despite this, block butter continued to see volume increases of 5.5% (+3.6 million kilos), driven by an increase in shopper numbers and an increase in shopper frequency of purchase.

Cows’ yoghurt, yoghurt drinks and fromage frais volumes continue to see growth (+6.3%), with spend increasing by 10.0% (NIQ, 52 w/e 12 July 2025), with an increase in buyers and frequency of purchase driving this performance. All products saw volume growth during the period, apart from fromage frais (-9.9%) and standard flavoured yogurts (-3.0%). Cows’ fat free yoghurt saw the greatest actual growth with an additional 14.2 million kilos purchased year-on-year (+9.4%), while cows’ standard plain yoghurt saw the fastest growth of 24.3% year-on-year.

Cows’ cream volumes experienced a 1.4% increase year-on-year and combined with a 6.4% increase in average prices paid, resulted in a 7.8% increase in spend (NIQ, 52 w/e 12 July 2025). Cows’ cream performance was driven by an increase in shopper numbers, as well as an increase in volumes purchased per shopper. Double (+3.4%, equivalent to +1.2 million litres) and sour cream (+4.4%, equivalent to +371 thousand litres) drove the overall category performance, but aerosol (+0.8%) and clotted (+2.8%) also contributed to volume growth.

See the full data and these insights visualised on our GB household dairy purchases retail dashboard.