SACRAMENTO, Calif. – California’s mid-year cash report revealed an increase in both revenues and spending, according to California State Controller Malia M. Cohen.

The December report showed that General Fund revenues and expenditures surpassed budget estimates, raising concerns about potential future deficits.

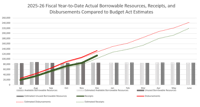

“Our latest cash update shows that receipts for the fiscal year through December exceeded the 2025-26 Budget Act estimate by $11.2 billion, or 10.8 percent,” said Cohen. “At the same time, spending was higher than expected by $5.9 billion, or 4.6 percent which is a reminder that strong revenues alone do not resolve our underlying future year budget gaps.”

Controller Cohen urged budget leaders to adopt a disciplined financial approach. “As the State’s Chief Fiscal Officer, we need to be mindful that any increase in spending on new programs, paired with revenue volatility may increase the size of future deficits,” Cohen said.

Cohen emphasized the importance of rebuilding reserves, limiting borrowing, and prudent spending to position California to handle deficits and future economic challenges.

California State Controller’s Office

The report highlighted that personal income tax receipts for the fiscal year through December were $9 billion, or 15.7 percent, above projections. However, corporation tax collections fell short by $46.7 million, or 0.3 percent, and retail sales and use tax receipts were $55.4 million below expectations.

By the end of December, the state had $86.1 billion in unused borrow-able resources in its special funds. These funds are available for short-term General Fund use to manage cash deficits, but Cohen cautioned against over-reliance on internal borrowing.

Cohen warned that excessive borrowing could increase future liabilities and weaken reserves necessary to avoid deeper cuts during potential economic downturns.