In recent days, regional banking stocks came under pressure after peers such as Zions Bancorp and Western Alliance disclosed substantial credit issues, including large loan losses and collateral shortfalls, sparking wider market concern about sector loan quality. This wave of credit anxiety underscores the sensitivity of regional banks like Banc of California to broader industry sentiment, regardless of their direct exposure to the specific loans in question. We’ll explore how heightened market focus on credit quality, highlighted by peer disclosures, might influence Banc of California’s current investment outlook.

Trump’s oil boom is here – pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Banc of California Investment Narrative Recap

To be a shareholder in Banc of California, you need to believe that the bank can continue to benefit from California’s economic growth, digital expansion, and realized merger synergies, while navigating industrywide concerns about credit quality. The recent news of credit losses at peer banks has heightened short-term volatility across regional banking stocks, but has not materially changed the most important catalyst for Banc of California right now: the successful integration and performance uplift from the Pacific Western Bank merger. The biggest risk remains a region-specific downturn or worsening credit conditions impacting commercial real estate and construction loans, which are core to Banc of California’s loan book.

Among recent announcements, Banc of California’s Q2 2025 results are especially relevant in light of sector concerns: the bank reported net charge-offs of US$44.22 million, a year-on-year improvement, but still a sign that loan losses are an area to watch. These impairment updates help put peer credit headwinds in context, highlighting both real improvement and ongoing sensitivity to broader market anxieties. For investors, the focus will stay on whether credit trends and provisioning costs appear contained as Banc of California approaches its next quarterly report on October 22.

In contrast, while peer bank losses highlight systemic risks, it’s the concentration in Southern California real estate loans that investors should be aware of, especially if…

Read the full narrative on Banc of California (it’s free!)

Banc of California’s narrative projects $1.4 billion revenue and $382.6 million earnings by 2028. This requires 15.0% yearly revenue growth and a $274.7 million earnings increase from $107.9 million today.

Uncover how Banc of California’s forecasts yield a $18.82 fair value, a 17% upside to its current price.

Exploring Other Perspectives BANC Community Fair Values as at Oct 2025

BANC Community Fair Values as at Oct 2025

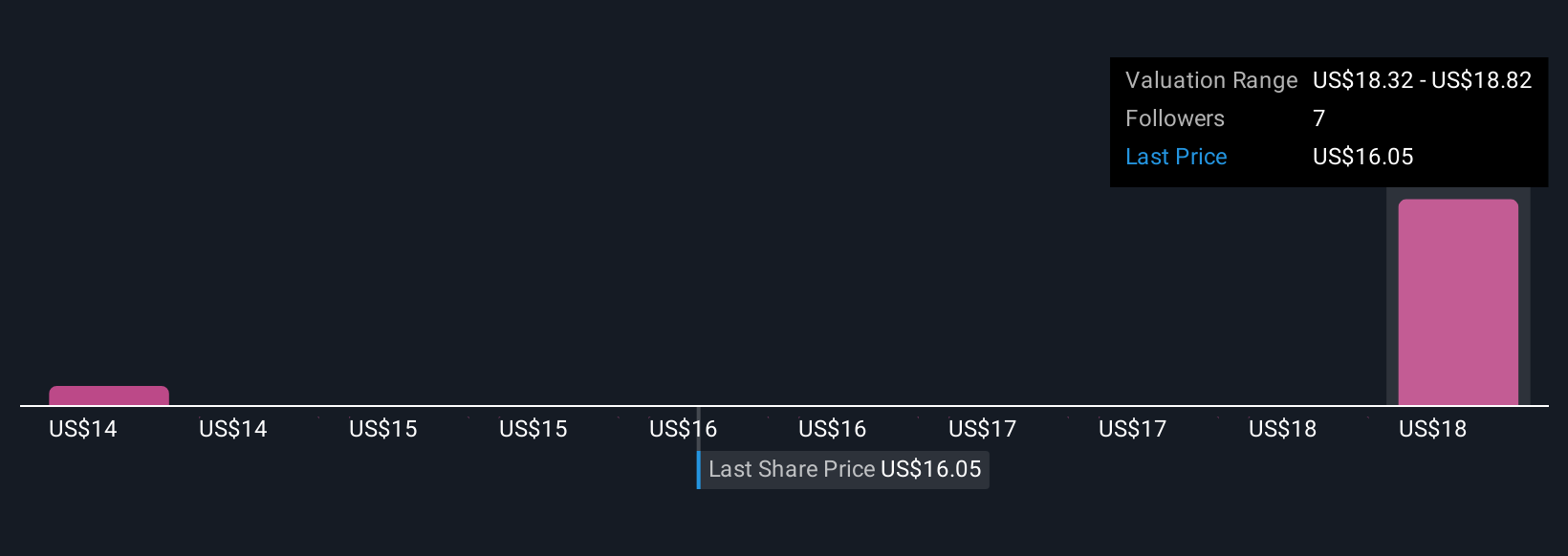

Simply Wall St Community members produced three independent fair value estimates for Banc of California stock, ranging from US$13.85 to US$18.82 per share. Given these varied outlooks, keep in mind that rising credit risk across the sector influences both valuation assumptions and future expectations.

Explore 3 other fair value estimates on Banc of California – why the stock might be worth 14% less than the current price!

Build Your Own Banc of California Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Looking For Alternative Opportunities?

Opportunities like this don’t last. These are today’s most promising picks. Check them out now:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Banc of California might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com