California billionaires are fighting hard against a controversial wealth tax for the state’s wealthiest residents and have issued a dire warning to its supporters.

A growing number of California billionaires have spoken out against the 2026 Billionaire Tax Act, which would see residents with a net worth of more than $1 billion pay a one-time tax worth five percent of their assets.

The bill has been championed by Democratic Representative Ro Khanna who said in a statement to Daily Mail: ‘We must balance making sure we keep the Silicon Valley miracle and dynamism with ensuring that the working class benefit from the prosperity with healthcare, education, and childcare.

‘Jensen Huang understands this, and I am working with tech and labor leaders on the best way forward.’

Nvidia founder and CEO Huang is one of the standalone billionaires happy to stay put in California and see the wealth tax implemented, despite it being a significant cost to him.

If the bill passes a vote due in November, it would retroactively affect billionaires living in the state beginning January 1, 2026, and would include stocks, art and intellectual property in the calculation.

The movement is an attempt to recoup funds for essential services, such as health care and education, funded by the state’s large population of billionaires.

The Service Employees International Union-United Healthcare Workers West labor union has argued that the bill is necessary to make up for cuts to health care through President Donald Trump’s ‘One Big Beautiful Bill.’

‘We’re calling on California’s billionaires to step up and pay a one-time, emergency 5 percent tax to prevent the collapse of California health care and help fund California public K-14 education and state food assistance programs,’ a spokesperson told Newsweek.

The 2026 Billionaire Tax Act has been championed by Democratic Representative Ro Khanna (pictured) and would tax residents with a net worth of more than $1 billion

The Service Employees International Union-United Healthcare Workers West labor union has argued that the bill is necessary after cuts by President Donald Trump’s ‘Big Beautiful Bill’

‘This would protect health care jobs and ensure working people and families can get the care they need. The tax would be paid only by Californians worth more than $1 billion – which is about 200 people who hold a combined wealth of $2 trillion.’

Suzanne Jimenez, chief of staff at the labor union, told the outlet that the ‘billionaire exodus’ was a ‘myth’ and many billionaires elected to remain in the state despite months of ‘scare tactics.’

‘Californians have long supported asking the wealthiest to pay closer to their fair share. Given the scale of the crisis we face today, it’s no longer a choice – it’s a necessity,’ she said.

California is home to the most billionaires out of any state, with over 80 people featured on the Forbes 400 list in 2025 included in an estimated total of 255 billionaires living there.

But some of those opposing the Act have warned that many wealthy residents would opt to sell large portions of their companies rather than pay, or abandon the state altogether – taking all of their tax dollars with them.

Daily Mail takes a look at what California’s wealthiest residents have said and done in response to the bill.

California is home to the most billionaires out of any state. The beach in Santa Monica is pictured

Google co-founder Larry Page, the seventh richest person in the world, announced his departure from California ahead of the bill’s deadline on January 1

Larry Page

Google co-founder Larry Page, ranked the seventh richest person in the world with a net worth of $144 billion, announced his exit from California ahead of the controversial bill.

Page, who founded Google alongside Sergey Brin in 1998 but stepped down as CEO in 2019, reportedly began relocating out of the state some time ago.

The billionaire moved his California-based businesses in late 2025, just meeting a deadline for the exemption from the impending possible levy.

Recently he also transferred most of his business holdings to Delaware, according to Business Insider.

His family office, Koop, influenza research company, Flu Lab LLC, and his flying car research fund, One Aero, have been listed with brand new Delaware addresses, according to the outlet.

The billionaire’s wife, Lucinda Southworth who is the head of her own marine conservation charity Oceankind, has also moved her interests out of the state.

Google co-founder Sergey Brin joined his former business partner after moving at least 15 limited liability companies based in California, seven of which re-registered in Nevada

Sergey Brin

Page’s Google co-founder has also joined his former business partner in jumping ship, as Sergey Brin was found to have moved a significant portion of his businesses out of the state in the days leading up to Christmas.

That included 15 limited liability companies based in California related to the billionaire’s business interests and investments, The New York Times reported.

Seven of those companies were re-registered in Nevada, including entities linked to the management of a super-yacht and an interest in a private terminal at San Jose International Airport.

Another entity affiliated with Brin also moved its registration to Nevada on Christmas Eve.

Brin is the fourth richest person in the world today and is valued at $248.2 billion, according to Forbes.

He still owns multiple homes in California, according to the Times, but how much time he will spend in the state this year is unknown.

Palmer Luckey, with a net worth of $3.5 billion, lashed out on social media over the bill

Palmer Luckey

Seemingly grounded billionaire Palmer Luckey, the founder of defense startup Anduril, has spoken out against the controversial bill.

The 33-year-old, who recently explained that he still flies coach to set an example for his employees, lashed out over the bill on X.

‘You are fighting to force founders like me to sell huge chunks of our companies to pay for fraud, waste, and political favors for the organizations pushing this ballot initiative,’ he wrote on X.

‘I made my money from my first company, paid hundreds of millions of dollars in taxes on it, used the remainder to start a second company that employs 6,000 people,’ he said. ‘And now me and my cofounders have to somehow come up with billions of dollars in cash.’

Luckey has a net worth valued at $3.5 billion, according to Forbes.

His comments were originally made in October 2022 but resurfaced after he spoke out against the suggested new tax.

Bill Ackman, billionaire hedge fund manager, wants a ‘fairer tax system’ but is against wealth taxes

Bill Ackman

Billionaire hedge fund manager Bill Ackman voiced his opposition to wealth taxes on social media while saying he was still in support of a ‘fairer tax system.’

In late December, Ackman reposted old comments of his on X regarding tax issues and added: ‘On the topic of billionaires and wealth taxes in California, I am opposed to wealth taxes because they effectively represent an expropriation of private property and have many unintended and negative consequences that have occurred in every country that has launched such a tax.

‘I am however strongly in favor of a fairer tax system.

‘To that end, it doesn’t seem fair that someone can build a valuable business, create a billion or more in wealth and pay no personal income taxes by living off loans secured by stock in the company, (and even if the loans are unsecured).’

Ackman said that ‘apparently’ that strategy has been adopted by ‘many super wealthy people,’ and that a ‘small change in the tax code would address this unfairness.

‘One shouldn’t be able to live and spend like a billionaire and pay no tax.’

The Pershing Square Capital Management CEO blamed California’s budget problems on how the money is spent and ‘not a lack of tax revenues.’

Mark Cuban, former Shark Tank investor with a net worth of $6 billion, responded to Ackman’s post with ‘agree.’

Tesla billionaire Elon Musk, named the wealthiest man in the world, defended his wealth status and said on social media all of his riches are tied up in Tesla and SpaceX shares

Elon Musk

SpaceX billionaire Elon Musk, the world’s wealthiest man with a $724 billion fortune, bought a home in Texas in 2020 and moved Tesla to Austin in 2021.

Musk recently reposted a user’s comments on X that defended the billionaire’s wealth status.

‘Elon’s stocks aren’t wealth,’ co-founder of Solana Labs Anatoly Yakovenko wrote. ‘If the number of Tesla shares doubled the world isn’t any richer. If the number of Tesla cars doubled, it’s measurably richer.’

‘Correct,’ Musk responded. ‘My Tesla and SpaceX shares, which are almost all of my “wealth,” only go up in value as a function of how much useful product those companies produce and service.’

‘This mean my “wealth” can only increase due to producing more products and services for the public. Moreover, anyone else who is a shareholder in Tesla and SpaceX, which includes employees, participates in the upside of stock appreciation,’ he continued.

Co-founder of LinkedIn Reid Hoffman said the bill was ‘badly designed’ and would ‘incentivize avoidance, capital flight and distortions that ultimately raise less revenue’

Reid Hoffman

Reid Hoffman, co-founder of LinkedIn, staunchly condemned the bill and took to social media to declare it was ‘badly designed.’

‘The proposed CA wealth tax is badly designed in so many ways that a simple social post cannot cover all of the massive flaws,’ he wrote on X. ‘One well-documented example is the horrendous idea to tax illiquid stock in the proposal.’

‘Poorly designed taxes incentivize avoidance, capital flight, and distortions that ultimately raise less revenue,’ Hoffman argued.

‘It is true that we need to preserve and grow the incredible creation and generativity of Silicon Valley. It is also true that we must figure out how to help people who have not benefited from the wealth, jobs, and company creation engine of Silicon Valley thus far.

‘I, along with many others, have expressed to Rep Khanna that this wealth tax proposal is not the best way to achieve those objectives.’

Hoffman, a current partner at venture capital firm Greylock Partners, sold LinkedIn to Microsoft in 2016 for $26.2 billion and has a current net worth of $2.5 billion, according to Forbes.

Vinod Khosla, with a net worth of $13.4 billion, said Representative Khanna was ‘so wrong’ and that billionaire’s advisors would suggest they relocate to another state

Vinod Khosla

Venture capitalist Vinod Khosla responded to Representative Khanna in a scathing post on X in December, arguing that the bill will lead to a mass exodus of billionaires.

‘You are so wrong Ro,’ Khosla began. ‘Top prospects for generating wealth in the state will almost certainly leave the state.’

‘Every advisor would advise every enterprise that gets big momentum to have key people relocate to another state. Even people who don’t expect this initiative to pass are still planning to leave because there will be another one is the argument.

‘And California will lose its most important tax payers and net off much worse. Long term damage unless legislature bans wealth taxes. Easier to equalize taxes on work income and capital gains at the national level.’

The Khosla Ventures founder’s net worth was valued at $13.4 billion by Forbes.

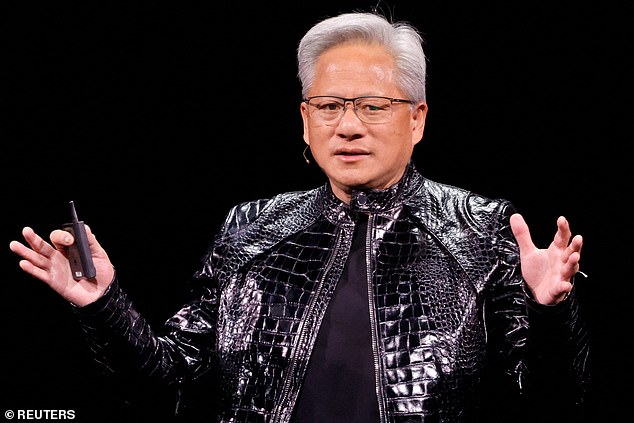

Jensen Huang has a net worth of $157.8 billion has said he is ‘perfectly fine’ with the wealth tax

Jensen Huang

With many billionaires opposing the tax act, and some having already jumped ship, Nvidia founder and CEO Jensen Huang has been a rare standalone wealthy resident happy to stay put.

‘I’ve got to tell you, I have not even thought about it once,’ Huang told Bloomberg.

‘We chose to live in Silicon Valley, and whatever taxes I guess they would like to apply, so be it. I’m perfectly fine with it.’

Huang, with a net worth of $157.8 billion, was ranked as the eighth richest person in the world, according to Forbes.

He said Nvidia, the world’s largest company, worked in Silicon Valley ‘because that’s where the talent pool is.’

Huang would face a significant payment if the measure goes through. He primarily resides in California, where he owns a $44 million, seven-bedroom home in San Francisco.

Nvidia is headquartered in Santa Clara, about 50 miles north of the Bay Area, but also has other offices around the world.

‘Wherever there’s talent, we have offices,’ Huang said.

California Governor Gavin Newsom staunchly opposed the act, and said ‘I’ll do what I have to do to protect the state’

Opposers of the bill also included the likes of California Governor Gavin Newsom, who told Politico that it ‘makes no sense.’

‘It’s really damaging to the state,’ Newsom continued. ‘The evidence is in. The impacts are very real – not just substantive economic impacts in terms of the revenue, but start-ups, the indirect impacts of… people questioning long-term commitments, medium-term.

‘That’s not what we need right now, at a time of so much uncertainty. Quite the contrary.’

Newsom added that he has a ‘very specific agenda’ he is hoping to follow in this final year as governor, and fears that another expensive bill will sidetrack his redistricting ballot measure Proposition 50.

‘The good news is the overwhelming opposition to this by others,’ he continued. ‘I think it will be defeated, because I think people understand what it does versus what it promotes to do.’

The governor, who was been a long opposer to wealth tax proposals, said that a national conversation about wealth taxes is ‘very different’ and could be worth entertaining.

‘This will be defeated – there’s no question in my mind,’ Newsom told the New York Times.

‘I’ll do what I have to do to protect the state.’

Should the proposal reach the necessary signatures of around 900,000 it will be put forward on the state ballot in November.

A representative of the bill told Newsweek that, despite Newsom’s threats, the governor cannot veto a ballot measure ‘once approved by California voters.’