What could possibly make someone leave Laguna Niguel and Coachella Valley, California for a move to Goodyear, Arizona? According to our latest interview with Barri on Leaving California, California’s highest-in-the-country cost-of-living, and “quality of life.”

Everyone is piling on California these days, and for many valid reasons. California is always ranked as one of the worst states in the country in which to run a business, while many other states are ranked at the top of the chart. People leave because of the exorbitantly high cost of living, leftist politics, and ever encroaching government.

California even ranks as one of the bottom five least free states – a dismal 48th – on CATO Institute’s Freedom in the 50 States ranking. New Hampshire, Florida, South Dakota, Nevada, and Arizona are the five freest states in the country.

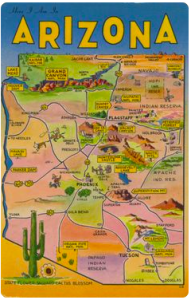

The Globe interviewed Barri, who left California 6 months ago and moved to Goodyear, Arizona, just outside of Phoenix. Barri is a native of Coachella Valley where her agriculture family were growers. She was living in Laguna Niguel when she decided to take the plunge and leave her home state.

Interestingly, we’ve been doing this series since 2019, and will update some of the states’ offerings. Sadly, California still ranks at the bottom on so many of the important categories – income and corporate taxes, regulations, education, right-to-work, unemployment and freedom.

Chief Executive’s annual CEO survey of the best and worst places to do business reflects the impact of transformed global trade environment, changing regulatory frameworks and massive demographic and technological shifts taking place across the nation and they always rank California in an embarrassing last place at 50th. Back in 2019 when we first started this series, Arizona, the Grand Canyon State, ranked number 7, with a booming business environment. It is now ranked at 10th, but notably in the top 10, and still 40 slots above California.

This year, 2025, Chief Executive reports Texas and Florida once again top the list, with Texas retaining its long-held No. 1 position. “Both Texas and Florida are growing states, in people and infrastructure,” said one CEO respondent. “I think the policies there invite business and make it easy to do business.”tax and property taxes, although they are a little less than California.”

“Illinois, New York and California maintain their position as the bottom three states. Despite their economic scale and cultural capital, CEOs continue to cite high taxes, regulatory burdens and rising costs of living as major obstacles.”

“But beyond those mainstays, the 2025 rankings reveal a broader shift taking place across corporate America. Increasingly untethered from traditional urban economic hubs, companies are migrating toward states offering a powerful trifecta: business-friendly environments, skilled workforces and a more affordable, higher quality of life.”

Barri, who left California 6 months ago for Goodyear, AZ, told the Globe that she was just starting to look at different locations for a move, but visited a friend in Goodyear, and the rest is history. She visited Naples, Florida and fell in love, but it was just too far away from her California family. Goodyear is a short hop from Coachella Valley.

Barri said she bought a home in Goodyear and is saving $1,000 a month. She said she started adding up all of the costs – gas, her mortgage, amenities – and she’s saving a significant amount of money.

“People are paying a lot of money for California’s beautiful weather,” Barri said.

In 2019, we reported Steve and his wife left San Diego for Arizona. They bought a large piece of property and said they were building a larger home on it than they had in California. “We got our permits in three months for only $10,400. And we are building a big home on seven acres,” he said. Steve and his wife also had to drill for a well, which he said cost them $16,000, noting in California, well drilling has almost ground to a halt by the state over water issues.

Arizona, According to Chief Executive:

TAXES: 4.9%

AZ’s top corporate income tax is #15 on the Tax Foundation’s State Tax Competitiveness Index

EDUCATION: 89.4% of adults 25 years of age and older graduated high school

33.5% of adults age 25 and older have a bachelor’s degree or higher

UNEMPLOYMENT RATE: 3.5%

RIGHT TO WORK STATE: Yes

QUALITY OF LIFE: #32

POPULATION GROWTH: 3.8% increase between 2020 and 2023

In 2019, Arizona incentivized businesses by offering:

Qualified Facility Tax Credit: Offers a refundable tax credit of the lesser of: 10% of qualified capital investment, $20,000 per net new job or $30 million per taxpayer per year, for location of manufacturing or R&D headquarter facilities.

Quality Jobs Tax Credit: Offers a state income tax of up to $9,000 over a three-year period for each net new quality job.

R&D Tax Credit: Offers a nonrefundable income tax credit for basic research payments made to universities under the jurisdiction of the Arizona Board of Regents.

Arizona Job Training Program:Offers job specific reimbursement of up to 75% of eligible training expense for net new jobs.

In 2025, Arizona incentivizes businesses by offering:

Qualified Facility Tax Credit: Offers a refundable tax credit that promotes the location and expansion of headquarters or manufacturing facilities, including manufacturing-related R&D. (In 2019 AZ offered: 10% of qualified capital investment, $20,000 per net new job or $30 million per taxpayer per year, for location of manufacturing or R&D headquarter facilities)

Quality Jobs Tax Credit: Offers up to $9,000 of Arizona income or premium tax credits spread over a three-year period for each new net qualifying job ($3,000 per year). Mostly the same as 2019.

Research and Development Tax Credit: Provides an Arizona income tax credit for increased research and development activities conducted in the state to encourage Arizona businesses to continue investing in research and development activities.

Sales Tax Exemptions for Manufacturing: Exemptions are available for machinery or equipment used directly in manufacturing, machinery and equipment or transmission lines used directly in producing or transmitting electrical power.

As for comparissons with California, Chief Executive says “While news may focus on the high costs of taxes and regulation in California, the state also has a reputation for offsetting some of it with generous incentives.”

It’s just getting to the point of being able to open a business in California that makes it nearly impossible, except for the very wealthy or those who have secured a substantial amount of capital from investors and/or venture capitalists.

California, According to Chief Executive:

TAXES: 8.84%

CA’s top corporate income tax #48 on the Tax Foundation’s State Tax Competitiveness Index

EDUCATION: 84.8% of adults 25 years of age and older graduated high school

37.5% of adults age 25 and older have a bachelor’s degree or higher

UNEMPLOYMENT RATE: 5.3%

RIGHT TO WORK STATE: No

QUALITY OF LIFE: #37

POPULATION GROWTH: 1.4% decrease between 2020 and 2023