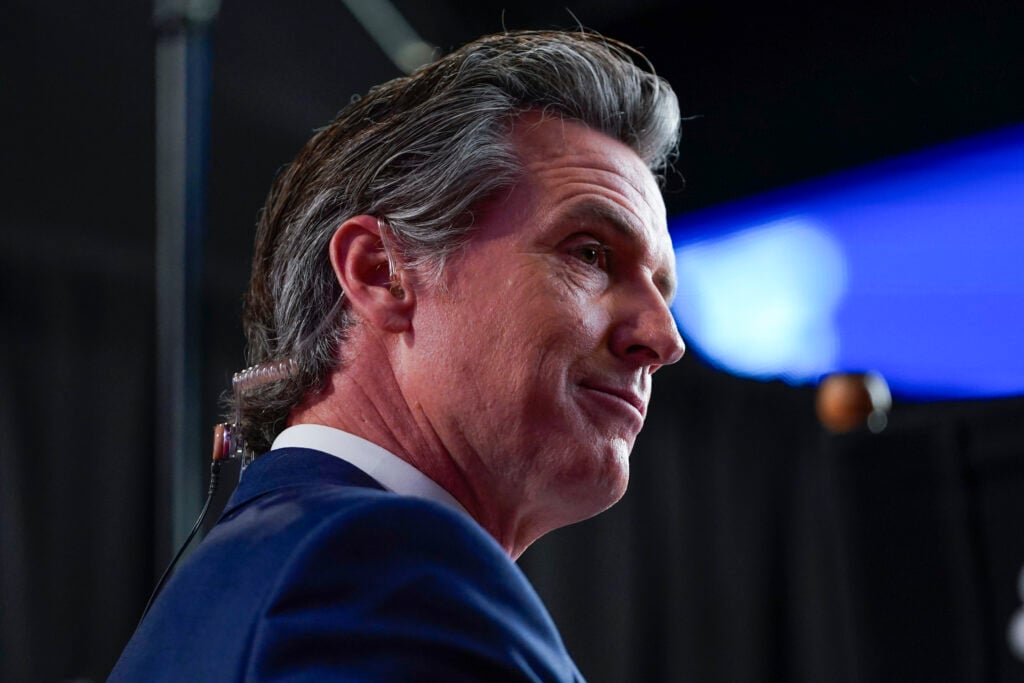

Gavin Newsom’s (D-Calif.) rise from a Getty-backed entrepreneur to California governor now collides with a proposed billionaire wealth tax he calls “bad economics” and has vowed to defeat.

Newsom’s first major business success came in the early 1990s with PlumpJack, a San Francisco wine shop launched with financial backing from Gordon Getty, an oil heir and longtime family friend.

Getty and his family later invested in Newsom’s expanding portfolio of wineries, restaurants and hotels, helping turn him into a multimillionaire before he entered statewide office.

Don’t Miss:

At the same time, after his parents divorced, the governor and his sister were largely raised by their mother, who worked multiple jobs to support the family.

That dual background now frames California’s intensifying debate over the proposed 2026 Billionaire Tax Act, a ballot initiative backed by a powerful health care workers’ union.

The measure would impose a one-time 5% tax on assets exceeding $1 billion for California residents, payable over several years.

Supporters argue the tax could raise tens of billions of dollars for public services while addressing widening inequality.

Critics, including Newsom, warn it could trigger capital flight and destabilize a state budget that already relies heavily on high-income taxpayers.

Newsom has emerged as one of the initiative’s most vocal opponents, arguing that a state-level wealth tax would drive billionaires and businesses out of California.

In an interview with The New York Times, he said the proposal’s mere introduction has already pushed some wealthy residents to relocate.

Bloomberg has reported that at least six billionaires have left the state.

At the same time, tech leaders such as venture capitalist Chamath Palihapitiya and hedge fund manager Bill Ackman have publicly criticized the plan as hostile to innovation.

See Also: Americans With a Financial Plan Can 4X Their Wealth — Get Your Personalized Plan from a CFP Pro

Opposition funding is ramping up. Palantir chairman Peter Thiel has reportedly donated $3 million to a committee fighting the measure, with more contributions expected from Silicon Valley executives.