Local executives with decades of experience across industries have discovered a second career at Orange County’s top universities and business schools.

Larry Wilk, Hank Adler, Adam Fingersh and Thomas Sherlock are sharing their real-world experiences in real estate, retail, accounting and corporate turnarounds with students at Chapman University and University of California, Irvine — with the hopes of shaping the future of Orange County’s next top executives.

“You bring experiences and stories, failures and successes. What we did wrong here, what we did right there. So hopefully, that 35 years provides a lot of benefit to the students,” Adler, a 20-year tax partner at Deloitte, told the Business Journal about teaching at Chapman.

Adler picked up teaching immediately after retiring from the daily grind, while others, like Fingersh of Experian PLC, are still going to the office every day while teaching in the evenings.

“We’re preparing the students for what comes next,” former Disney executive Wilk said.

The Business Journal this week has a special report on higher education, beginning on page 15. What follows are the teaching stories of four prominent executives:

The Art of Business Transformation

Adam Fingersh landed at Experian PLC in 2005. Since then, he has spent the last 20 years working his way through multiple sectors at the global data and tech company, such as product managements, fraud solutions and operations.

“I’m helping people meet their financial goals, live out their ambitions to buy a home, put their kids through college, you name it.”

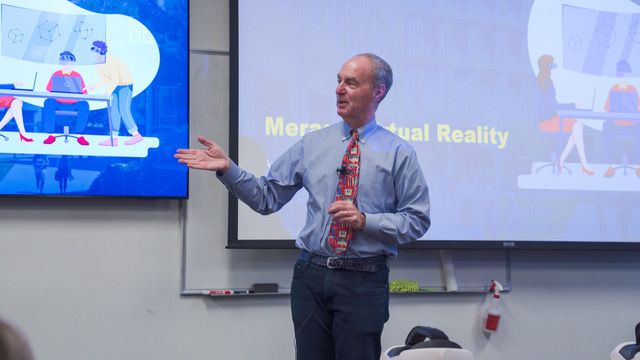

Before being appointed Experian’s executive vice president of North America operations in 2022, he added another responsibility — a teaching gig at UC Irvine Paul Merage School of Business, where Experian is an active corporate partner.

Fingersh, who attended the Merage School for his MBA, was asked six years ago to teach a course for a professor who was retiring. Instead, he pitched a new class that he wished had existed when he was a student.

He wrote up a curriculum where students can analyze financial, brand, cultural, marketing and product “transformations” experienced by companies.

“I have had an interesting vantage point for each of those types of transformations and have had the ability to both be part of those transformations, in some cases, lead them,” Fingersh said.

The class, called Business Transformation, is based on case studies about corporate “transformations” at companies such as IBM, Starbucks or Marvel Entertainment, drawing from current events also.

Fingersh said he uses the Socratic method — a dialogue between teacher and students — during his evening lectures. Last year, students discussed how Starbucks chose Brian Niccol to be its new CEO and the turnaround he previously executed at Newport Beach’s Chipotle Mexican Grill.

“The class requires them to bring some of the knowledge that they’ve had in their finance classes, that they’ve had in their strategy classes, that they’ve had in their marketing classes together in a practical way, as they’re exploring real world changes that companies go through,” he said.

The elective class is available to second-year students at the Merage School once a year during the 10-week winter term.

“All of the materials are practical deliverables that you would deliver in a business setting. So, board presentations, memos to employees, strategy documents, and throughout the course, they work in a team to work on a transformation that a business of their choosing is going through,” he explained.

“Then their final presentation at the end of the course is to present back on the midpoint of that transformation, on the status of that transformation.”

He taught the class for the first time during the pandemic and had only seven students.

Now, 45 to 50 students register for the class each year. This coming winter quarter will be his sixth year teaching the course.

“I always thought that I had wanted to teach and that I would do it after I finished my traditional working career,” Fingersh said. “Having lived through many transformations as both a participant and leader, it gives me a vantage point to share my thoughts and perspectives.”

Translating Real Estate

Thomas Sherlock, co-founding principal of firm Talonvest Capital Inc., counts 25 years in the real estate, finance and investment world of Newport Beach.

Before founding his own firm in 2010, Sherlock was a managing partner at Buchanan Street Partners for 10 years. His long-term career in real estate and financing led Sherlock to join Southern California’s NAIOP, the Commercial Real Estate Development Association.

In 2005, he co-founded a Young Professionals Group within the organization, which was financially backed by real estate colleagues such as John Cushman at Cushman & Wakefield, Robert Brunswick from Buchanan Street Partners, Steve Layton and Phil Belling at LBA Realty and the Irvine Company.

That inaugural YPG class included Starpointe Ventures Chief Executive Patrick Strader. His father Tim Strader Sr., founder and chairman of the real estate consulting firm, decided to recreate the Young Professionals Group in a class format for the MBA program at the University of California, Irvine after his son graduated from the program.

Little did Sherlock know that he would end up teaching that very class based on the program he developed.

Sherlock first connected with UCI when he started a NAIOP-backed scholarship program for MBA students at the university in 2009. He eventually became involved with the university’s center for real estate and was invited to be a guest lecturer for several years.

In 2018, Sherlock was asked to take over a graduate-level course called Management of the Real Estate Enterprise during the 10-week spring quarter. It is a requirement for UCI’s real estate program.

He found out only recently that this class was a replication of the education and leadership development program he began over 20 years ago.

“If I have 40 students—I’ve had as few as 25, as many as 50—but no matter how many I have, there’s some segment of that classroom population that is enormously engaged,” Sherlock said. “They’re so engaged and they’re so enthusiastic that it’s motivating.”

He teaches cash flow analysis and the fundamentals of understanding real estate property; the class also covers how to apply those learnings and develop soft skills such as communication and networking.

He compared the last two decades of his career in the real estate market to Mr. Toad’s Wild Ride, an attraction at Disneyland.

“We went through the great financial crisis in 2008, we’ve gone through the booms of the early 2000s and 2010s and then the craziness with Covid,” Sherlock told the Business Journal. “But that’s what happens when you’ve been in it for a long time.”

An Argyros Invitation

It was George Argyros himself who convinced Hank Adler to start teaching at Chapman University two decades ago.

They met over golf, back when it was much easier to run into people in Orange County, Adler told the Business Journal.

Adler spent 34 years in public accounting, and the last 20 as a partner at Deloitte, overseeing the tax practice. A significant part of his practice was real estate.

“You have to picture Orange County in the 70s, 80s and 90s. It was just a growing phenomenon. There was lots of real estate companies, lots of builders, lots of syndicators, and Deloitte represented a nice percentage of those folks,” Adler said.

He joined Chapman as a full-time faculty member in 2003, the same year he retired from Deloitte.

“There’s obviously a little less pressure to being a college professor than there is to being a partner at Deloitte,” he said.

The first class he taught was the Foundations of Accounting, which he still returns to teaching occasionally. Adler has taught five to six different accounting classes in the last 20 years.

As students reach the upper division classes, the courses are meant to prepare them for taking the CPA exam.

Since Adler joined the Argyros College of Business and Economics, student count and courses have grown. He said the first year he taught, 10 accounting majors graduated.

Nowadays, the program sees between 50 to 70 graduates.

“We just put together what we think is a good program, and the marketplace seems to agree,” Adler said.

“We teach them a lot of technical stuff, but hopefully, we ground them in a fruitful way to understand the ethics of the profession.”