Mayor Kevin McCarty’s proposal aims to generate up to $9 million a year for down payment help, rental aid, and tiny homes in Sacramento.

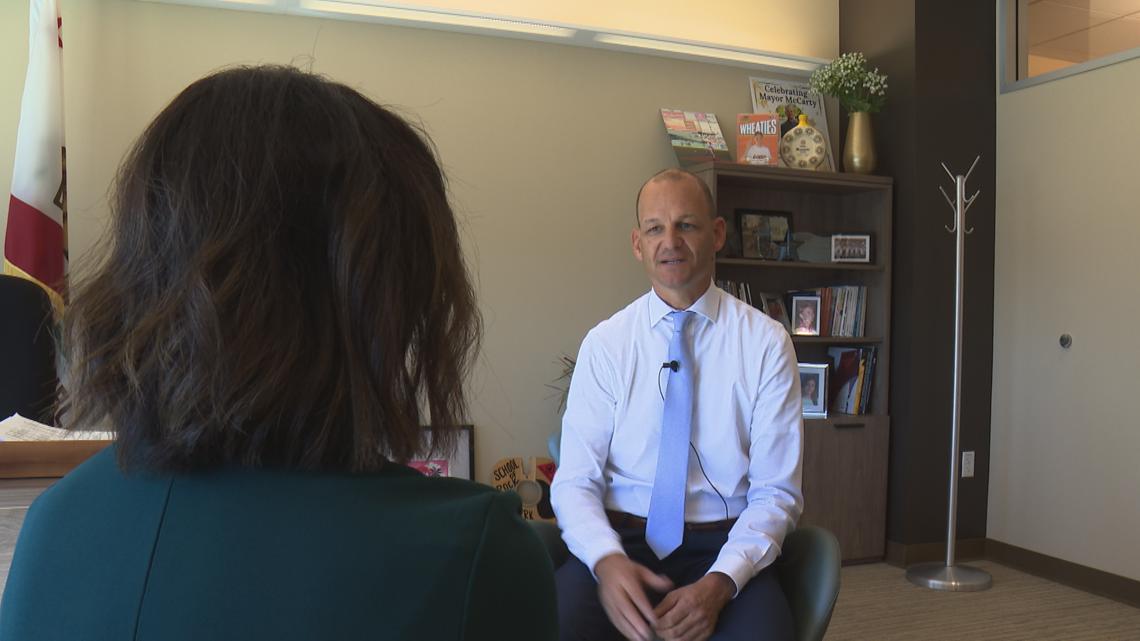

SACRAMENTO, Calif — Sacramento Mayor Kevin McCarty is floating a proposal to raise the city’s real estate transfer tax, a move he says could generate millions of dollars each year to help first-time homebuyers, renters and unhoused residents — without affecting most homeowners.

During his first State of the City address Monday, McCarty said he plans to bring a measure to the City Council for consideration, aiming to get it on the 2026 ballot. The tentative proposal would increase the city’s real estate transfer tax from 0.275% to about 1% — roughly from $2.75 to $10 per $1,000 in property value — but only on high-value transactions, likely targeting properties selling for more than $1 million or $2 million. The mayor said he expects it to help residents locally who are struggling with housing.

“So we’re looking to go to the voters next year and do a ballot measure to help first-time home buyers purchase a home,” McCarty said. “People are getting squeezed out. I’m concerned how this impacts the next generation willing to stay here in Sacramento.”

McCarty’s office estimates the plan could generate up to $9 million annually, funding down payment assistance for first-time buyers, rental support and new tiny home communities.

“Most large cities in America and in California have real estate transfer tax that are far above where we’re at,” McCarty said. “We’re looking at adjusting it to some moderate level for really the high, high-end sales.”

He emphasized that he believes “99% of home sales in Sacramento would not be affected,” saying the intent is to ask the city’s most expensive property deals to help fund housing solutions.

The proposal is still in the planning stages and would need City Council approval before appearing on the November 2026 ballot. It would require a simple majority vote to pass.

Councilmember Mai Vang said she looks forward to reviewing the plan once more details are released.

“Our city’s greatness should be defined by how our most vulnerable communities are doing — and we need to center them in every housing decision we make,” Vang said.

Local real estate appraiser Ryan Lundquist of Lundquist Appraisal Company said properties selling above $1 million make up about 5% of Sacramento’s market. He noted that Los Angeles implemented a 4% “mansion tax” on properties over $5 million back in 2023, and that sales at that price point have slowed significantly since then.

The city said it will continue working with stakeholders and councilmembers over the coming months to determine how the proposal could be structured before it moves forward.

Watch more: The 2025 State of the City Address

ABC10: Watch, Download, Read