Vino Joy News uncovers the identity behind California’s latest wine world intrigue — and why a biotech magnate is swapping peptides for Pinot in Napa and Sonoma.

A mysterious buyer from China has spent more than US$40 million acquiring two prized vineyard estates: first a 307-acre property in Sonoma, then Napa Valley’s Calmére Estate Winery for US$16.8 million in cash.

At a time when global wine markets are softening, the all-cash acquisitions have raised eyebrows across California’s wine country. Yet U.S. media reports have only referred to the investor as a “mysterious Chinese buyer,” represented by a company called J&S Lee Winery Inc.

A deeper investigation by Vino Joy News, however, reveals the identity of the man behind the purchases: Shawn Lee (李湘) — founder and chairman of Chinese Peptide Co., Ltd., a leading player in China’s biopharmaceutical sector.

Two Estates, One Ambition

According to U.S. property records, the mystery investor paid US$16.8 million in cash for Calmére Estate Winery — a 100-acre estate with 75 acres under vine and 40,000 square feet of winery facilities.

The seller, Peju Winery, had owned the property since 2016. Originally founded in 1979 as Acacia Vineyard & Winery, the site has long been a benchmark for Pinot Noir and Chardonnay. It has changed hands multiple times — including through Diageo and Treasury Wine Estates — before landing in Peju’s portfolio. The latest sale, insiders say, reflects Peju’s shift in strategic direction.

The Napa acquisition follows an earlier purchase: the Alta Vista Ranch vineyard in Sonoma, spanning 307 acres, which the same buyer acquired last year for US$24 million, also in cash.

“Our goal is to be the No. 1 wine and vineyard owner in the Napa and Sonoma area,” said Tony Chan, the buyer’s broker. “This is only the beginning. We plan on buying more.”

Calmere was sold to Chinese biotech billionaire Shawn Lee.

Calmere was sold to Chinese biotech billionaire Shawn Lee.

From Peptides to Pinot Noir

Though Chan has declined to name his client, describing him only as an “overseas Chinese buyer in the manufacturing business,” business filings point clearly to Shawn Lee, a biotech entrepreneur with global reach.

Corporate records show that J&S Lee Winery Inc. owns Calmére Estate, while J&S Lee Vineyard Inc. holds the Sonoma property. Both list Shawn Lee as president.

Documents filed with the U.S. Patent and Trademark Office confirm that Lee serves as president of both companies. Further searches through Biz Profile reveal two principal figures — Ming-tsung Lee, listed as director, and Shawn Lee, serving as director, CEO, CFO, and secretary.

Ming-tsung Lee is associated with three companies: J&S Lee Winery Inc., J&S Lee Vineyard Inc., and Happy Dance Group. Shawn Lee, meanwhile, is linked to 12 entities, including CPC Scientific, Inc., the U.S. arm of Chinese Peptide Co., Ltd., one of the world’s top peptide drug manufacturers.

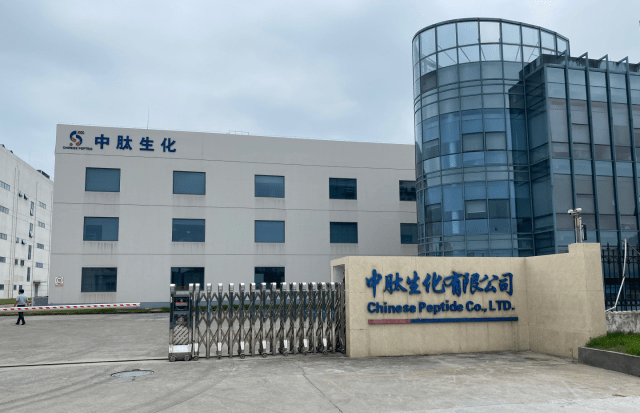

Chinese Peptide is headquartered in Hangzhou, China

Chinese Peptide is headquartered in Hangzhou, China

Founded in 2001, Chinese Peptide is headquartered in Hangzhou, with its international base in California. The company’s English website identifies Shawn Lee as founder and CEO; its Chinese counterpart refers to him as Dr. Li Xiang, a peptide scientist who earned his Ph.D. from the Chinese Academy of Sciences and completed postdoctoral research at the University of California, Berkeley.

In 2015, Guizhou Xinbang Pharmaceutical Co., Ltd. acquired Chinese Peptide, but the company was repurchased in 2020 by Medtide Inc. (浙江泰德医药股份有限公司), another entity controlled by Lee. Medtide went public in Hong Kong in 2025, posting RMB 253.8 million (US$35 million) in first-half revenue. By 2023, it ranked third globally in peptide therapeutics, behind only two Swiss pharmaceutical giants.

Betting on Land, Not Labs

Why would a biotech executive pour millions into vineyards?

According to Chan, the motivation is both strategic and financial. “The U.S. dollar may depreciate in value,” he said. “Holding agricultural land in Napa is a way to hedge against inflation — it’s like owning gold.”

For now, the newly acquired Calmére Estate will operate as a custom-crush facility, producing wines for other labels.

Last year, Lee’s team reportedly made about 300,000 bottles from the Alta Vista Ranch vineyard, destined for China and Southeast Asia. The wine brand name has yet to be announced, but Chan confirmed plans to launch a proprietary label in the near future.

“Long term, we’ll start our own wine brand,” he said.

Building an Empire, One Vineyard at a Time

Chan said the group currently owns about 400 acres across Napa and Sonoma and is actively negotiating more purchases.

“We have a long way to go before becoming the top vineyard owner in Wine Country,” he admitted. “But we’re confident. Just last week, we were looking at another 700-acre property.”

With deep pockets and global ambitions, Shawn Lee appears poised to join the growing ranks of Asian investors reshaping California’s wine landscape — not as a collector, but as a contender.

Like this:

Like Loading…

Discover more from Vino Joy News

Subscribe to get the latest posts sent to your email.

Continue Reading