Clint R. Williams

Business Manager

Turner Construction Co.

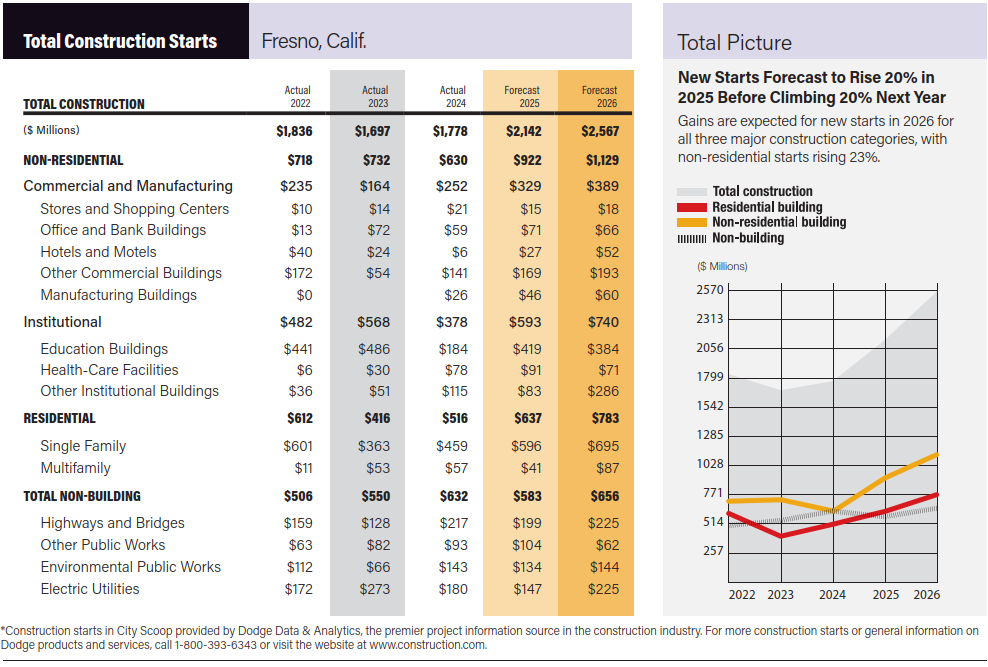

The construction effort in California’s Central Valley is often overlooked due to the sheer amount of activity in the state’s urban centers on the coast. San Francisco, for example, is expected to see more than $16 billion in starts this year versus $2.1 billion for the Fresno area, according to Dodge Data & Analytics.

The difference is that the recent volatility seen elsewhere has mostly been absent in the Central Valley. Fresno is quietly enjoying a boom that is expected to continue. Dodge forecasts new starts to top $2.5 billion in 2026—more than 44% over two years prior.

One key factor, Williams explains, is a robust waiting list of projects such as a large-scale Fresno County justice project planned for 2027.

“The Fresno AEC community is concerned about securing funding for design and construction of priority projects that have been discussed and backlogged for years,” he notes.

Chart by ENR

Non-residential building is expected to fuel the lion’s share of anticipated starts with volume almost doubling between last year and 2026. Also notable are health care projects such as medical outpatient buildings, emergency department expansions and seismic upgrades in excess of $100 million that are planned or just recently completed, Williams notes.

In 2022, Dodge tallied just $6 million in health care starts for the region. That number should surpass $91 million this year.

A good example is the $300-million UC Merced Medical Education Building that Turner is over halfway through constructing via a construction manager at-risk delivery. The facility, expected to be completed next fall—designed by architecture firm ZGF—will feature 203,500 sq ft of instructional, academic office, research and community-facing space and common areas. The building will be part of UC Merced’s medical education pathway program developed in partnership with UCSF and UCSF Fresno.

The education market remains strong with student housing projects at both Fresno State and UC Merced currently under construction and more education projects planned from local bond measures passed in 2024. Private developments of big box warehouse and distribution centers also continue to drive the private-sector construction market throughout the region.

There are also multiple new tribal casino projects—ranging from $200 million to $600 million—planned or under construction as well.

“[The Fresno region] differs from the rest of California, which is often led by technology and a more robust private sector and developer-led market,” Williams says.

The region has stayed steady with selective activity in key public sectors such as large scale heavy civil, highway and road infrastructure, health care, education and the private casino market. As long as the economic outlook remains positive, those sectors are expected to remain robust.

Statewide, the popularity of design-build delivery has been growing, and the boom in major projects in the Central Valley is also pushing the trend into the region, Williams says.

“Public sector owners are now planning or considering delivery of their large and more complex projects through a design-build delivery method,” he says. “This trend is based on past project performance and delays that owners want to mitigate through a single contract design-build entity.”

Yet another commonality with the wider construction industry are the ongoing challenges of supply chain and long-lead procurement times along with material and tariff cost volatility.

“That impact has hurt the private sector more than the public sector as developers pause or even consider canceling projects until market and economic conditions improve,” he says.

Another major question mark is the state’s beleaguered high-speed rail project, which is focused in the Central Valley, where the initial 171-mile-long segment between Merced to Bakersfield is being built.

Earlier this year, the Trump administration axed $4 billion in funding for the effort and is in the process of directing a portion of those funds to other projects. The $35-billion project is now $7 billion underfunded. The state has launched a legal effort to claw back that funding but is also moving to shore up some of the expense with state funds.

Still, construction continues on nearly 70 miles of guideway and about 60 structures.