South Bay leaders back Measure A

South Bay leaders back Measure A

On Wednesday, the mayor of San Jose, along with Santa Clara County leaders announced their support for Measure A. The proposed sales tax increase is on the November ballot and would generate 330-million dollars annually for the next five years. It aims to replace, in part, federal funding that’s being cut.

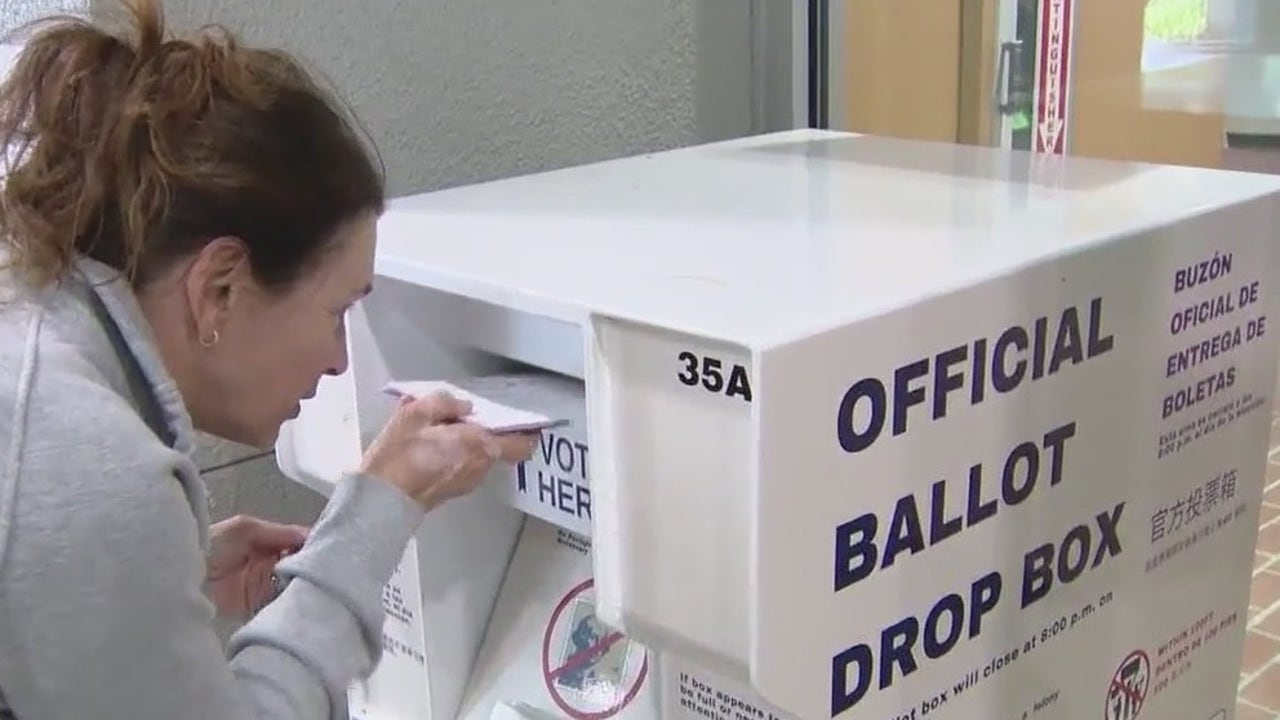

SANTA CLARA COUNTY, Calif. – California voters will have a chance to have their voices heard in a special election on Nov. 4, 2025. Statewide, Californians will decide on Proposition 50, which would re-draw the state’s congressional lines.

In the South Bay, voters will decide on whether to approve Measure A, a new sales tax measure that would expire after five years.

The five-eighths cent sales tax

Santa Clara County’s Measure A is a five-eighths cent (0.625%) general sales tax for five years.

The measure was placed on the ballot to counter federal cuts imposed by the Trump administration and Congress. The revenue generated from the sales tax would amount to $330 million per year that the federal government could not take away. The money from the sales tax would be subject to independent oversight.

The measure would cover local services such as trauma, emergency room, mental health and public safety. It would also reduce the risk of hospital closures at Santa Clara Valley Healthcare.

Background

Dig deeper:

The federal cuts include cuts to Medicaid (Medi-Cal in California) and Supplemental Nutrition Assistance Program (SNAP) (CalFresh in California).

Measure A states that Medicaid is the single largest revenue source for Santa Clara Valley Healthcare’s hospital and clinics.

The County says Measure A would not affect the existing breakdown of tax rates.

7.25% to State of California0.125% to the County1.75% to the Valley Transportation Authority and Caltrain, which are independent agencies not controlled by the County.

A yes vote approves the .0625% sales tax in the county for five years.

A no vote is a vote against the sales tax measure.

When would Measure A take effect?

If approved by voters, Measure A would go into effect on April 1, 2026, and would expire after five years on April 2031.

Who supports Measure A?

The Santa Clara County Board of Supervisors placed this measure on the ballot after unanimously declaring a fiscal emergency.

The Board says the federal cuts stem from H.R. 1, better known as the One Big Beautiful Bill Act, this past July.

The County anticipates cuts from H.R. 1 are expected to be greater than $1 billion in annual lost revenue.

One pro-Measure A group, SaveOurLocalHospitals.com, says local hospitals are in crisis. They say the Trump administration is leaving Santa Clara County with a $1 billion shortfall.

They say Santa Valley Healthcare serves one in four county residents, operates two of only three trauma centers, and provides nearly half of all emergency room visits in Santa Clara County.

In the group’s rebuttal to the argument against Measure A, they say Medi-Cal patients will lose urgent care options and regular doctors and private insurance patients will face longer ER waits. The organization says if the measure does not pass, it would mean fewer hospitals in Santa Clara County, higher premiums and the health care system would be weakened, which is especially problematic in the event of a disaster.

Who’s against Measure A?

Opponents who are against Measure A say the county’s path forward should be efficiency – not higher taxes. One such group is co-signed by the following:

Rishi Kumar, a former Saratoga councilmember, Cupertino Mayor Liangfang Chao, former Palo Alto Mayor Lydia Kou, former Monte Sereno Mayor Liz Lawler, and Kansen Chu, former California Assemblymember.

They say the sales tax measure will hit hardworking families hardest, adding it’s a blank check with no oversight and accountability, despite the measure including stipulations for both oversight and accountability.

They add that the county rushed this through with almost no public notice.

They said they don’t believe this will be temporary. They recall how in the 1990s, a library parcel tax and a half-cent tax measure were extended after they were supposed to expire.

Some analysis

Local perspective:

“Measure A has a chance. Turnout will be low, but it will skew liberal, partly due to the Prop. 50 campaign, but also because labor union volunteers will be working to get supportive votes out,” said Terry Christensen, political science professor emeritus at San Jose State University.

He said he expects the vote to be close, but that it depends on who votes.

“My sense is that voters are getting a bit fed up with taxes, so it will be close at best,” he said.

The potential for low turnout can make it harder to pass tax measures.

“Fewer issues (and candidates) just means fewer contacts with voters to stimulate turnout. Remember, voters will also be choosing a new county tax assessor – but that’s been a pretty low-profile campaign,” the professor said.

Christensen says while opponents are correct in saying this is a regressive tax that will hit middle and lower-income voters harder, that the most likely voters aren’t all that worried about being affected themselves. He added that the opponents of this measure are generally conservative and “anti-tax.” He said their concerns about county spending are legitimate.

“I don’t think voters in (Santa Clara) County are panicked about federal funding cuts yet, but they are predominantly anti-Trump which should help the measure,” he said. “And voters are worried about healthcare overall, so that may help as well.”

The Source: Official Measure A ballot language, interview with Terry Christensen