FRESNO COUNTY – Looking to fill gaps in revenue, Fresno County may ask voters to approve the implementation of a tax on visitors, called a transient occupancy tax, at the November election.

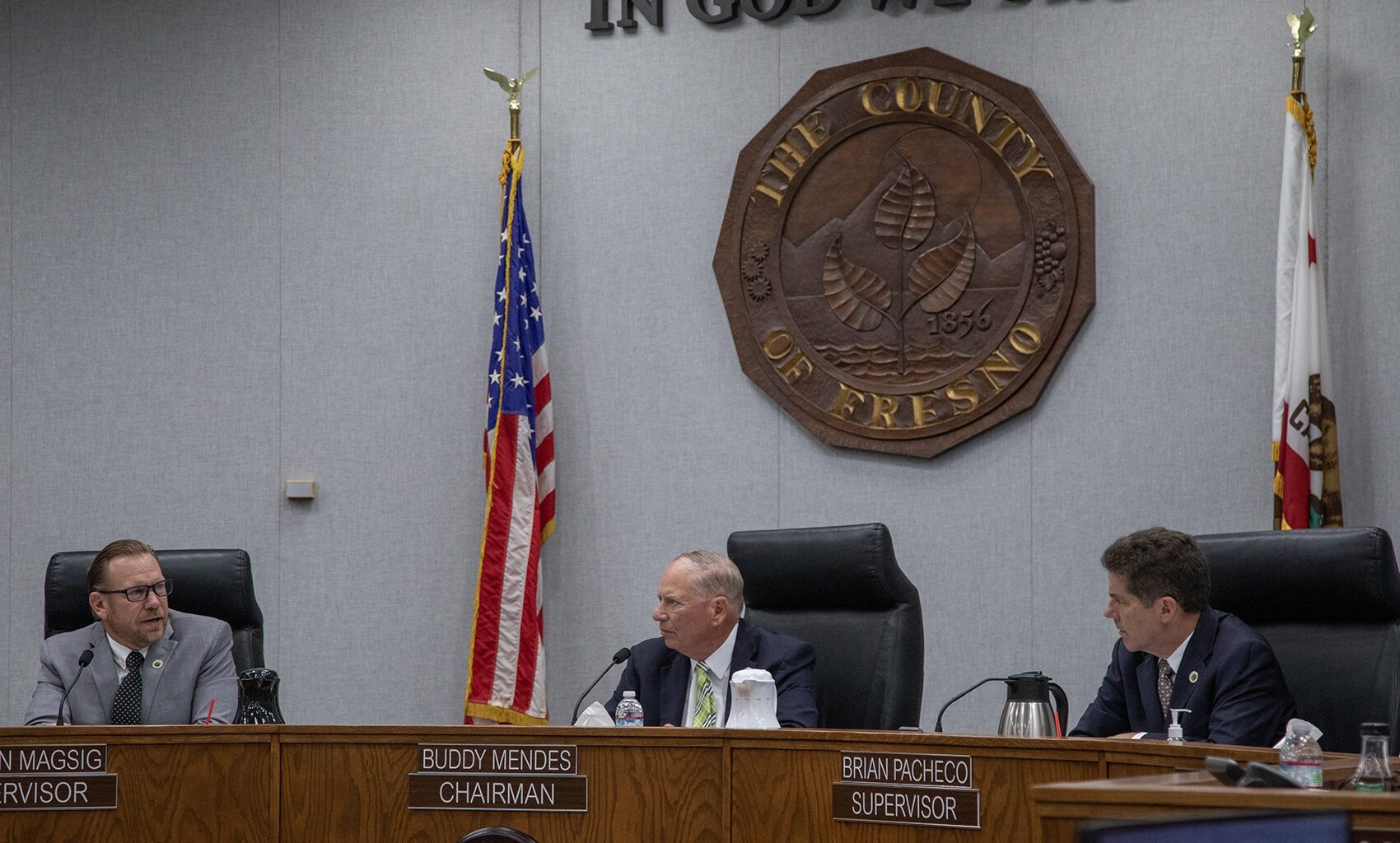

The Fresno County Board of Supervisors voted unanimously on Feb. 10 to pursue a transient occupancy tax despite some concern that it would add to a ballot that may become crowded with local tax measures. Supervisors still supported the idea of the tax, however, because it would help the county fund existing government services.

“As the county looks at its revenue sources and our expanding costs, we’re finding some of our revenue sources are flat — for example, our sales tax revenue — but we’re also seeing rising costs,” County Administrative Officer Paul Nerland said. “In our last budget, we needed to use one-time money to address a shortfall in our budget, which is something that’s not sustainable.”

In the fiscal year 2025-26 budget approved by the board of supervisors, the county’s general fund expenses outpaced revenues by about $15 million.

County Budget Director Paige Benavides provided the board with a brief overview of what a transient occupancy tax would mean for Fresno County.

A transient occupancy tax, or TOT, is placed on guests staying in hotels, motels and other short-term rentals. Under state law, the tax applies to occupancies of 30 days or less, so it is not a tax on county residents in their primary or long-term residences, Benavides said.

“TOT revenues are a common local funding source among California counties and are used to support general governmental services or voter-approved purposes,” Benavides said.

TOTs in place in other counties range from 4% to 14%, with a majority of counties levying 10% or 12%.

Benavides said the county worked with consultant HdL Companies to conduct a preliminary analysis of how many lodging units it has in the unincorporated areas and how much revenue it could generate with a TOT. The county could bring in about $3 million with an 8% tax or up to $5.3 million with a 14% tax.

This is based on projections that the unincorporated areas of the county have around 1,600 lodging units among hotels, motels and campgrounds and 660 short-term rentals through services such as Airbnb and Vrbo, Benavides said. County staff will return to the board with more in-depth revenue projections.

Fresno County is just one of three counties in the state that does not have a TOT in place, Benavides said. Of those three counties, it is the only one with lodging properties in its unincorporated areas.

Visit Fresno County President and CEO Lisa Oliveira said the tourism bureau is supportive of the TOT, having first discovered that the county did not have one in place a few years ago when reviewing a report on visitor spending.

“We’ve very competitive in our office, and we were lower than Kern County, so that was when the red flag started to pick up,” Oliveira said.

Supervisor Nathan Magsig, who represents the foothills on the east side of Fresno County, noted that not having a TOT in place for areas like Shaver Lake hurts the county when it is providing services that are otherwise not being paid for.

“We get a lot of people circulating through, and where there’s calls for service, we’ve got a volunteer fire department up there that responds, sheriff’s department is responding, garbage service is responding, … so I think this could be an opportunity where at least some of the visitors that we’re receiving are paying for a portion of the services that they’re getting,” Magsig said.

Board of Supervisors Chair Garry Bredefeld said he is supportive of the TOT but had an issue with potentially placing multiple competing tax measures on the ballot.

“I’d like to see this pass should we bring it forward, and my only concern is we know there’s a group trying to put a very flawed measure related to Measure C on the ballot, we’re looking at the possibility of a general tax … and then we would have this transient occupancy tax,” Bredefeld said.

Magsig, however, said he believes the county needs to explore the TOT sooner rather than later, especially considering the county’s rising costs and possible need to dip into other discretionary revenue sources. If the county waited until the 2028 election to pursue the TOT, it could be doing so alongside potential bond measures from the tax as well, he said.

“It just really comes down to, as we go through the process, if it looks like something that we do want to put before the voters, we just have to differentiate this particular measure from any other measures that may be on the ballot,” Magsig said.

Just like other forms of taxes, if the TOT is a general tax, meaning its revenue is used for multiple purposes, it would require a simple majority approval from voters to pass. If the county decides to make the TOT a special tax, with revenue going toward a specific purpose, it would require a two-thirds majority.

County staff will return to the board in April for a public hearing on a draft of the ordinance. Nerland said that would be the time for the board to decide if it wants to change course. If not, the board would approve the final ordinance and ballot measure language in June, with the measure going before the voters in the November election.