Banc of California recently reported third-quarter earnings that surpassed analyst expectations, with revenue up 32.8% year-on-year and earnings per share of US$0.38, bolstered by the repurchase of over 2.1 million shares for US$35.5 million during the quarter. This performance was underpinned by healthy loan production, expanding net interest margins, and stable credit quality, reflecting effective capital management and proactive cost control measures. We’ll consider how Banc of California’s robust quarterly earnings and significant share buyback program may influence its future investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Banc of California Investment Narrative Recap

To own Banc of California, investors need to believe in the bank’s ability to deliver growth through efficient capital returns and disciplined risk management, even as it contends with competitive deposit markets and regional economic concentration. Recent quarterly results and the substantial share buyback suggest positive progress on the bank’s most important short-term catalyst, margin expansion, while the main risk of heightened deposit competition appears largely unchanged by this news event.

Among recent developments, the announcement of 2.1 million shares repurchased for US$35.5 million in Q3 stands out, reinforcing Banc of California’s focus on shareholder returns in tandem with stronger-than-expected earnings. This action is highly relevant as it supports the ongoing margin and earnings growth story seen as central to the near-term thesis for the stock.

On the other hand, investors should be aware that increasing deposit competition in Southern California’s crowded banking market remains a…

Read the full narrative on Banc of California (it’s free!)

Banc of California’s outlook anticipates $1.4 billion in revenue and $382.6 million in earnings by 2028. This projection is based on a 15.0% annual revenue growth rate and a $274.7 million increase in earnings from the current level of $107.9 million.

Uncover how Banc of California’s forecasts yield a $19.45 fair value, a 15% upside to its current price.

Exploring Other Perspectives BANC Community Fair Values as at Oct 2025

BANC Community Fair Values as at Oct 2025

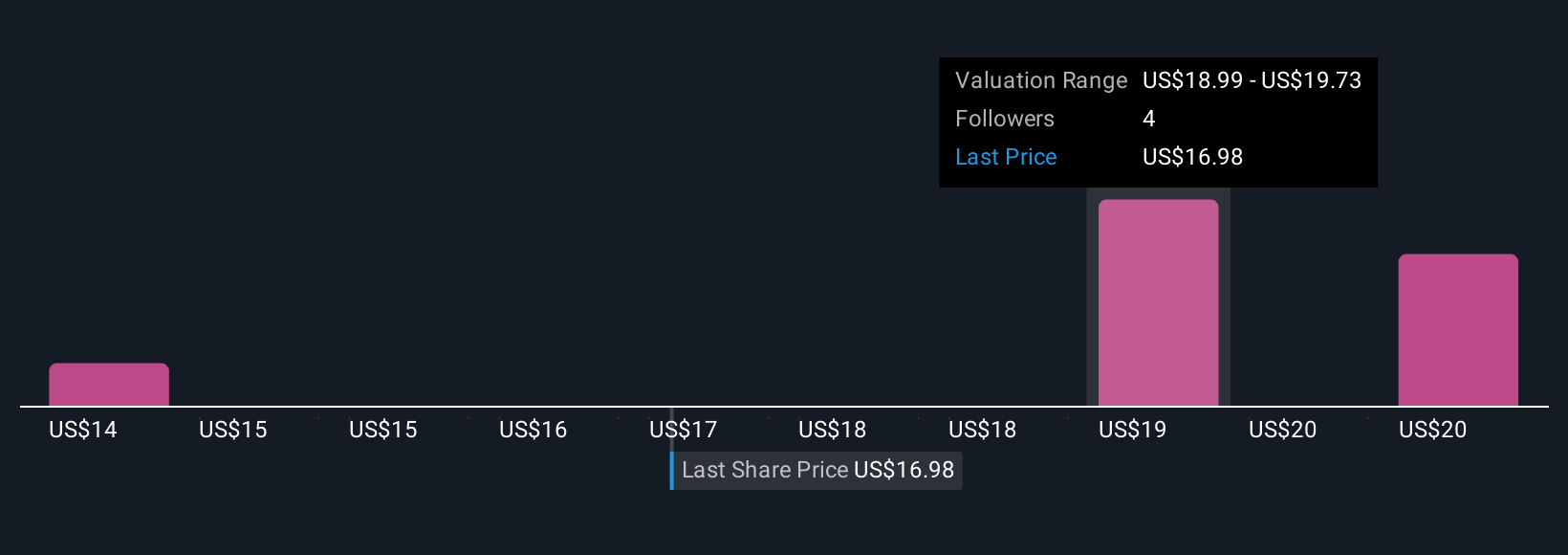

Three members of the Simply Wall St Community have estimated Banc of California’s fair value between US$13.85 and US$21.20 per share. Alongside these differing outlooks, ongoing pressure from deposit competition could influence future performance, so consider the full spectrum of opinions.

Explore 3 other fair value estimates on Banc of California – why the stock might be worth 18% less than the current price!

Build Your Own Banc of California Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Looking For Alternative Opportunities?

Don’t miss your shot at the next 10-bagger. Our latest stock picks just dropped:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Banc of California might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com