When California took its first breath of statehood in 1850, the fledgling state had to quickly find a way to support itself, and myriad new taxes were instituted.

In 1850, there was no federal income tax, and states and local governments managed their own tax programs. Nationally, federal revenue was primarily generated through tariffs on imported goods.

California’s Property Tax Law of 1850 set an annual property tax rate at 50 cents on each $100 worth of taxable property, or 0.5% per annum. In 2025, the state property tax rate is 1%, and other local taxes are added to that number.

By today’s standards, the method used by California and other states to assess property taxes is both interesting and odd. Publicly elected county tax assessors were assigned to physically go to each property and place a value on everything from land to a chicken, to tools, guns, furniture and cash on hand. Even dogs were counted in tax assessments, but their value wasn’t typically taxed.

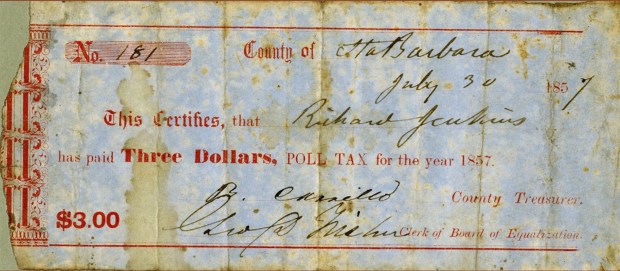

A California Poll Tax Receipt from Santa Barbara County, dated July 30, 1857, is pictured. California instituted a poll tax in 1850, and all White men between 21 and 50 were required to register and pay the tax. This tax allowed the payee to vote in elections, and the funds were used for infrastructure needs such as roads and schools. (Courtesy of the Edson Smith Photo Collection/Santa Barbara Public Library)

A California Poll Tax Receipt from Santa Barbara County, dated July 30, 1857, is pictured. California instituted a poll tax in 1850, and all White men between 21 and 50 were required to register and pay the tax. This tax allowed the payee to vote in elections, and the funds were used for infrastructure needs such as roads and schools. (Courtesy of the Edson Smith Photo Collection/Santa Barbara Public Library)

Like many other states, California instituted a poll tax in addition to its property taxes. The initial poll tax required all White males between 21 and 50 to register and pay a tax that ranged from $2 to $5 in the late 1800s. Payment of this tax allowed male citizens to vote and was considered a civic duty even if they didn’t vote.

In the late 1800s, several states enacted poll tax laws as a device to restrict voting rights. However, the poll tax also generated revenue for state and local needs such as roads, schools and other infrastructure.

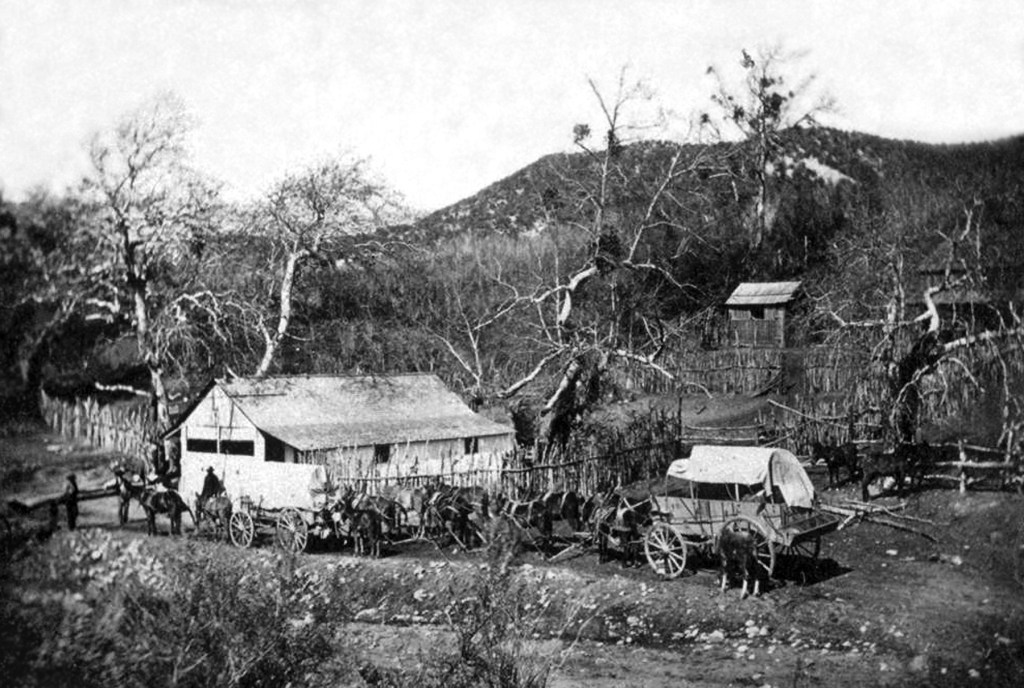

Under Mexican rule, large ranchos were established in Southern California between 1834 and 1846, and their vast acreage was untaxed and poorly mapped. When California became a state, new property taxes and proof of land ownership laws were instituted. Many rancho owners were heavily impacted by the laws, and they were forced to sell off large portions of their land to pay taxes and legal fees.

The arrival of a large party of Mormon settlers in the San Bernardino Valley in 1851 was likely a timely windfall for the Lugo family, owners of Rancho San Bernardino. After a failed attempt to purchase Rancho del Chino, the Mormon leaders made arrangements to buy Rancho San Bernardino and paid $77,500 to the Lugo family.

The Civil War created an immediate need for war funds, and in 1862, the first federal income tax was instituted. The tax rate was progressive, and it ranged from 3% to 10%.

After the Civil War, congress again focused its taxation laws on tariffs, tobacco and distilled spirits, and the federal income tax was eliminated in 1872. The federal income tax made a brief comeback in 1894 and 1895, but the U.S. Supreme Court declared the tax unconstitutional in 1895.

California’s early taxes were disproportionate to population and wealth, and in 1870 the state created the State Board of Equalization to make taxes equitable.

The need for the Board of Equalization was evident when Southern California’s agricultural counties got the shaft from northern mining counties that had larger populations and paid lower taxes.

These inequities were often due to elected county tax assessors undervaluing their voters’ property which lowered their taxes and improved the assessor’s odds of re-election.

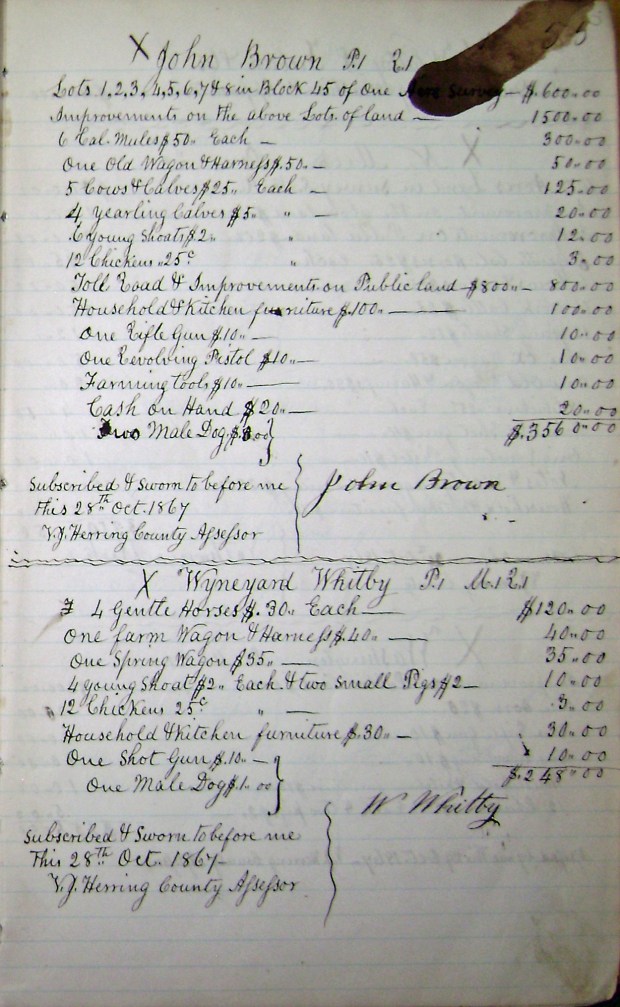

A great example of a county assessors’ valuation of property can be found in the 1867 tax assessment of San Bernardino County’s John Brown Sr., an influential entrepreneur and famous mountain man.

John Brown Sr.’s San Bernardino County tax assessment from 1867 shows a detailed listing and valuation of his properties and personal items. The county tax assessor had to personally go to every home in the county and assess each resident’s property and possessions. (Courtesy of San Bernardino County archives)

John Brown Sr.’s San Bernardino County tax assessment from 1867 shows a detailed listing and valuation of his properties and personal items. The county tax assessor had to personally go to every home in the county and assess each resident’s property and possessions. (Courtesy of San Bernardino County archives)

Brown is also famous for building the first toll road through the Cajon Pass, and the toll road is shown as an asset on his tax record. It’s impossible to tell if the valuation is accurate, but the listing of taxable property is a window into the life and taxes of a well-to-do Southern Californian.

Brown’s assets included such items as: six mules at $50 each, one old wagon and harness at $50, 12 chickens at 25 cents each, toll road and improvements on county land at $800, one revolving pistol at $10 and farming tools at $10. Brown’s total assets were valued at $3,560 in 1867. His neighbor Wyneyard Whitby was assessed at $248.

Another interesting example of tax assessment was that of David N. Smith, founder of the Arrowhead Springs Infirmary and a close associate of Brown.

For the 1874-75 tax year, Smith’s assessment did not include personal property and only included land and improvements to the property that totaled a modest $305. Smith made extensive improvements to the Arrowhead Springs property over the next several years, and his infirmary evolved into the famous Arrowhead Springs Resort.

Major changes to tax laws through the early 1900s included:

1850: California becomes a state and establishes a state constitution that provides for a .5% state property tax. The state poll tax is also created.

1862: The U.S. federal government establishes a temporary federal income tax to fund the Civil War effort. This tax was eliminated in 1872.

1870: The original State Board of Equalization is established to ensure fair taxation across counties. This board was significantly reorganized in 1879.

1913: The 16th Amendment to the Constitution made the federal income tax a permanent fixture in the U.S. tax system.

1946: California eliminates all state poll taxes. The state poll tax was paused between 1914 and 1924.

1950: California abolishes the office of the Franchise Tax Commissioner and creates the Franchise Tax Board as it exists today.

Tax laws and society have changed dramatically since California became a state.

Looking back to the 1850s – 1870s, can you imagine having a tax assessor walk through your house and property, placing a value on all of your belongings?

Mark Landis can be reached at: Historyinca@yahoo.com